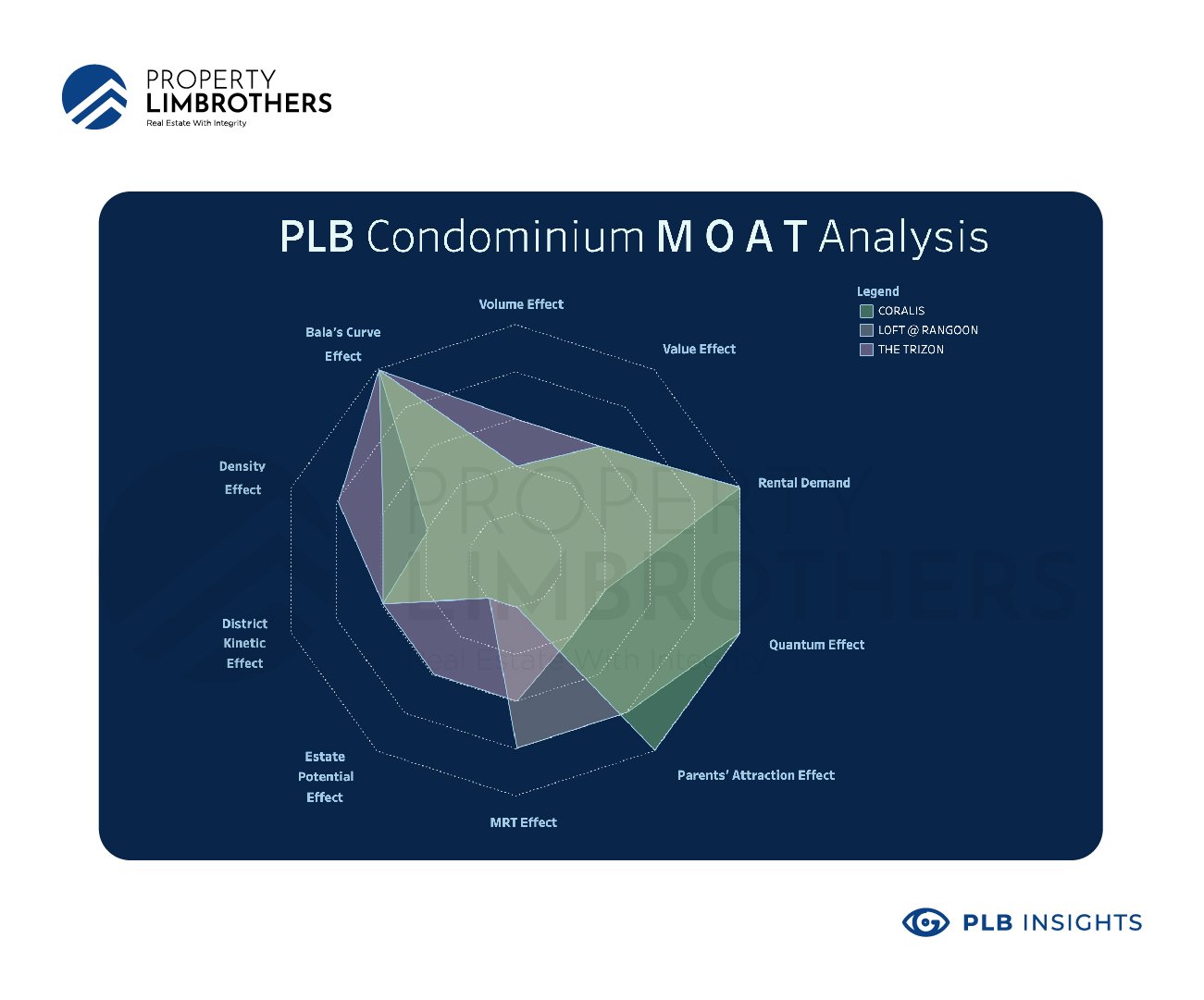

MOAT Analysis is a tool that the PLB Inside Sales Team (IST) uses to help give you a comprehensive bird’s eye view of the factors that will affect the future value of your new home. Our previous introduction gave you a broad overview of the tool and its component factors and how it can be used in different contexts.

In this article, we take a deeper look at the Volume Effect. Why does it matter? And how is Volume being used as a signal? Volume is typically used in conjunction with price action. It also has an intricate relationship with bank valuations, project size, transaction duration, and the profile of the buyers/sellers.

Why does Volume matter?

Most research and analysts in the finance world look to volume as an important signal of trend changes by giving insight on buying or selling behaviour. Volume is important in the property market for more obvious reasons, such as bank valuations. In Singapore, bank valuations are primarily driven by transaction volume and the recency of those transactions. Our MOAT analysis scores properties based on these two important factors.

Volume matters as bank valuations determine whether the property is affordable. This is arguably the most important reason for looking at the volume of transactions. If the bank is not going to give you a sufficiently large loan to purchase the property, you would have to fork out a larger chunk of your savings in cash for the property. This Cash-Over-Valuation factor is what might price out buyers from the market.

The time aspect of transactions is vital to banks. This refers to the recency of transactions. Even if there were tons of transactions (but 5 years ago), the banks would tend to look at the transactions that took place in recent years. Past transactions will do little to improve the valuation that the bank gives the property. It is mostly led by recent transacted amounts. For example, new launches tend to have a bulk of their transactions happen in the first few years of launch. Subsequently, the volume of transactions shrinks due to the SSD period where people typically avoid selling during this period. The valuation of units in such new launches tends to gradually increase again once the project passes TOP and gets resold into the open market.

The Importance of Project Size

That being said, transaction volume itself is not a standalone variable. Second to the transaction volume itself is the size of the project. The project size basically puts a cap on the number of transactions that can occur. If the property only has 150 units, the number of transactions is capped from the beginning. To complicate matters, the TOP and SSD rules would encourage people to hold on to their properties rather than sell it. This coupled with the maximum number of units in the property might reduce the number of transactions within the year to a very low number.

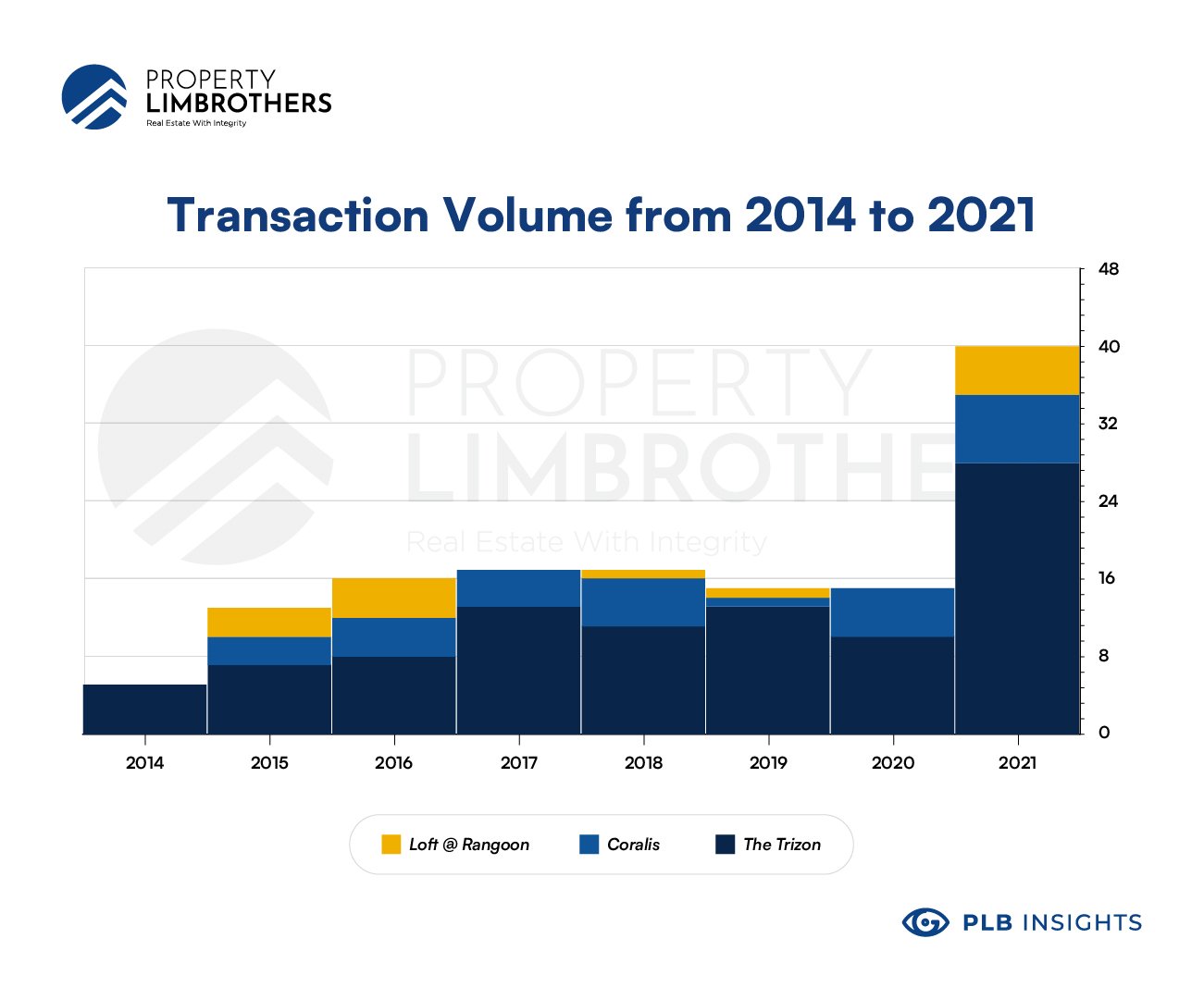

For instance, take a simple look at freehold projects with different numbers of units. Loft @ Rangoon was completed in 2014 with 27 units. Coralis was also completed in 2014 with 127 units. The Trizon was completed in 2013 with 289 units. While each of them have different locations and advantages, we look at just volume for now to explore those differences.

Notice that for Loft @ Rangoon, the number of transactions a year typically ranges from 1 to 3. As opposed to around 10 for medium sized projects like The Trizon. The transaction turnover rate per year seems to be around 5% to 10% as a rough estimate. For project size translating to higher transaction volume, it’s basically just a numbers game. The more units available in the project, the more likely there’ll be a higher number of transactions.

These two factors are reflected in our MOAT scores as follows. Coralis and Loft @ Rangoon score 2 points on Volume Effect (12 o’clock) for its relatively small unit size. The Trizon scores 3 points on Volume Effect as a mid-sized project in terms of units. This is just a simple exercise. Every project is unique, as you can see here. Each project has its own advantages and disadvantages. We will cover the other parts of the MOAT system in the coming weeks.

Transaction Duration & Liquidity

The volume effect shouldn’t be analysed and used in isolation. As mentioned earlier, volume makes the most sense in conjunction with other considerations. The volume effect might be more pronounced in real estate transactions than in other financial instruments like stock and bond due to the transaction duration and liquidity.

Specifically, what might take you less than a minute to buy or sell your stock would take you around 6 months if you were transacting property. The different legal documents required as well as the lengthier process and negotiations all factor into a longer transaction duration. Furthermore, the illiquidity of property as an asset class gives more meaning to volume signals.

A spike in volume can refer to a climax in buying or selling transactions. Since volume only indicates the number of transactions, it needs to be coupled with price action to give clues on where the market is heading. From technical analysis, when prices are typically at its low with high volume, it signals a climax in selling and a potential reversal. Of course, this works with a higher probability in conjunction with multiple other signals. In the stock market, the effects can be seen in weeks if not months. For the real estate market, this effect takes years to observe due to the SSD rules which limits speculative buying and selling.

Following a volume climax in the real estate market, if subsequent years have much lower supply and growing demand, you will see prices rise quickly even when the following years exhibit lower volume than the climax. This is because of the relatively larger pool of players vying for the lower supply. The previously transacted properties are “locked-in” for at least 3 years, and will likely see higher prices upon exit.

Profile of the buyers/sellers

Looking at just the transaction volume masks a lot of information about the transaction itself. The profile of buyers and sellers in transactions is important, but hard to obtain. Such information is not readily available in URA data banks or other sources online. However, the people on the ground have the best access to such information. The transacting parties and agents would know what kind of profile fits the property or development the most. The needs of the buying party ultimately decides the reason for the purchase (unless the seller lets go at an incredible discount).

The needs of the buyer needs to be highlighted again and again in our MOAT Analysis articles because it determines what factors of the analysis would matter to you the most. In this article, the volume effect would matter most in the bank valuation exercise and the ease of selling your property when you exit. If the trend persists, the same could be said for the next buyer of the same property.

There is a home for every audience. Scoring well on the MOAT Analysis means that the audience is broader. Since Volume Effect is one of the fundamental forces driving property movements, it matters a lot in expanding the audience group that your property would appeal to when you exit. And it also gives you a stronger motive to go for that particular project.

Accessing PLB’s MOAT Analysis

PLB’s IST are experts in the use of the MOAT Analysis tool to help you to discover the best property that suits your needs. It is most helpful when you already have a handful of shortlisted properties that you are interested in. With the MOAT Analysis, you can compare these properties all on the same page, without the back-and-forth madness if you were to do it manually on your own. What’s more, our experts can help guide you through the entire process, and highlight blindspots in your search and evaluation of projects which you might not have considered.

You may reach out to your favourite IST member or contact us here to get more information on the MOAT Analysis and how it can help your property buying journey.