The pandemic changed many things from wearing masks all day everyday to local haunts like Robinsons closing down. It has also redefined the personal value of a home. Once COVID-19 hit, the Singapore government introduced new regulations to contain the spread of the virus including compulsory work-from-home arrangements during Circuit Breaker and Safe-Distancing measures. These different regulations limit the time we spend outside and our houses have had to evolve to fit many functions — an office on most days and a diner or gym on others, while still remaining inviting and restful.

To meet this new challenge, some are considering moving to a new house to secure their own private space or upgrading to a larger house that allows spatial differentiation for these different functions. In this article, we highlight the advantages and disadvantages of the Core Central Region (CCR) and Rest of Central Region (RCR) and discuss how the pandemic has affected them.

Defining CCR and RCR

Singapore is divided into three main sections by the Urban Development Authority (URA) for urban planning purposes. These regions consist the CCR, RCR and Outside Core Region (OCR) and are based on their proximity to the city centre. Together, CCR and RCR make up the central region as seen in the map below.

Map of Central Region Courtesy URA.

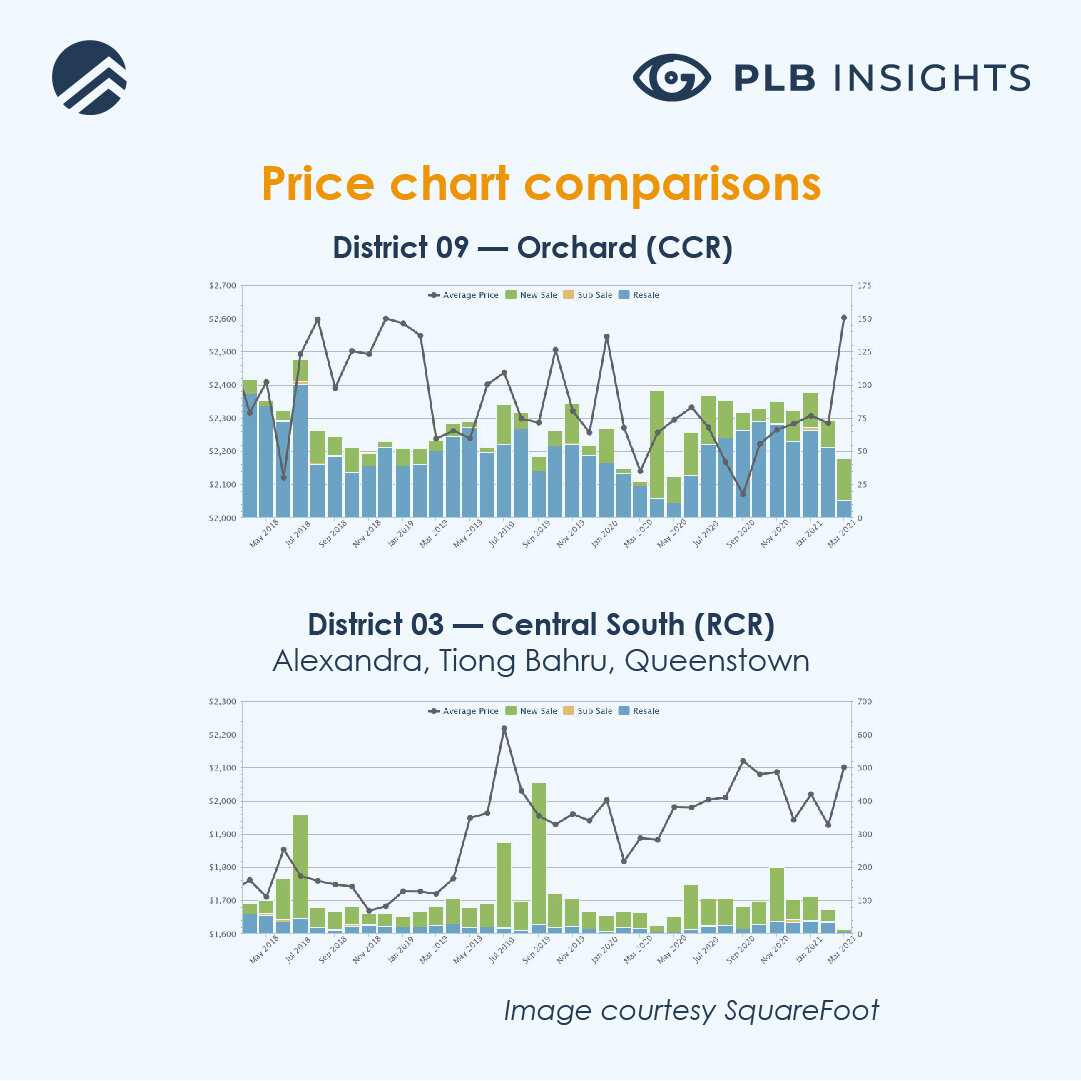

CCR consists of postal districts 9, 10 and 11 and the Downtown Core Planning Area. This includes places like Orchard, Bukit Timah, Central Business District, Tanjong Pagar and Marina Financial District to name a few. CCR houses many high-value properties such as Wallich Residence at Tanjong Pagar, Leedon Green located within Bukit Timah, Kopar at Newton among others. Properties within these regions usually carry premium price tags. For example, the average PSF of condos in District 9 in March 2021 was approximately $2,600.

District 9 Price Chart Apr 2018 to Mar 2021 Courtesy SquareFoot.

Contrarily, RCR refers to the area sandwiched between CCR and OCR. Consisting areas such as Little India, Tiong Bahru, Queenstown, parts of Balestier and Telok Blangah. It serves as a middle ground between high-value properties in CCR and mass market properties within the OCR (More about landed home prices in Singapore can be found here). It supposedly offers mid-tier or intermediate properties such as the recently launched Midtown Modern located above Bugis MRT station, One Normanton Park at Kent Ridge Park, The Atelier located along Makeway View and more. Though currently less expensive, the gap between CCR and RCR properties have been closing with the average price of condos reaching $2,100 PSF in March this year.

District 3 Price Chart Apr 2018 to Mar 2021 Courtesy SquareFoot.

Key difference between CCR and RCR

Besides pricing, the key difference between CCR and RCR would be their proximity to the city centre where Singapore’s financial and shopping districts are concentrated. How would the pandemic affect these regions given the shifts in working arrangements and attitudes and regulations regarding shopping and entertainment?

Whatever it is, the way you tell your story online can make all the difference.

Prior to the pandemic, one of the Singaporean government’s key strategies for future urban planning was to decentralise the Central Business District (CBD). This StraitsTimes article explains two main reasons for this shift. Firstly, the concentration of offices within CBD results in an influx of workers to CBD during peak hours, putting pressure on the infrastructure like trains and expressways. The article claims that it “takes billions of dollars to cater to these three to four hours of peak usage per day, resulting in a gross underutilisation over the remaining 20 hours.”. Secondly, once people leave the CBD for their homes after office hours, the business district becomes a ghost town with few people around, underscoring the inefficient use of space.

To decentralise CBD, the state intends to create a supply of office spaces within the RCR and OCR. This includes but is not limited to the development of Paya Lebar Central, Bishan Sub-Regional Centre, Jurong Lake District (JLD) and one-north. Some major firms have also come on board this move. For example, Google moved its office out of Asia Square 1 located at Marina Financial District into city-fringe Mapletree Business City II at Pasir Panjang located within the RCR.

By creating more office spaces outside of CBD, the state aims to drive down rental in these areas to increase the difference between CBD office spaces and RCR, OCR office spaces. With the lower rental, companies would relocate to these regional spaces since it makes better economical sense. This in turn could drive down the pressure on public transportation and redistribute the population, for more efficient land usage.

The virus outbreak and the Circuit Breaker expedited this decentralisation when non-essential workers, including white-collar workers who make up most of the populace that frequent CBD, were made to work-from-home. Through the forced telecommuting arrangement, businesses realised that some functions of the office can operate remotely, from home.

Many employers have also broadened their perspectives on telecommunication. Some companies such as confectionery giant Mondelez International have adopted WFH solutions except for a small team working in the laboratories and running their cocoa processing plant. Twitter has also famously offered employees the option to WFH indefinitely. In addition, UOB will also be providing its employees with two days of optional WFH for their employees’ mental health.

WFH becoming the new norm.

Human Resources (HR) technology start-up EngageRocket, the Institute for Human Resources Professionals and the Singapore Human Resources Institute surveyed 2,700 respondents in April 2020 regarding workplace sentiments. They found that 8 in 10 respondents wished to continue working from home despite concerns about their productivity. While younger respondents between the ages of 21 to 30 were less likely to have their productivity affected, 40% of them still reported lower productivity due to working longer hours, practical constraints from inadequate private space and appropriate equipment, and an inability to gain access to resources and tools that they would otherwise have in the office.

These responses from employers and employees alike suggests that WFH is likely to become a lasting feature of the post-covid working environment. This leaves us wondering what would become of CBD once COVID-19 restrictions are lifted.

Shopping and Entertainment

Orchard Road Courtesy AFP/Roslan Rahman.

The other key draw of the CCR would be its proximity to Orchard shopping district and the Quays for some nightlife and entertainment. However much like what happened with offices, during Circuit Breaker, many discovered and cemented their love for shopping remotely. This has resulted in many retail outlets shuttering physical stores and moving online. Aforementioned, Robinsons had to close down their last two stores at The Heeren and Raffles City due to weak demand. Topshop and Topman also announced the closure of their last store at VivoCity last year and their move to go online.

Additionally, shopping has been further decentralised to the many malls within the RCR. Popular brands such as H&M, Uniqlo, Isetan and more have set up their stores within heartland malls and malls within the RCR to ensure even those outside the CCR would have access to these large brands.

Clubbing in Singapore Courtesy Zouk.

Finally, nightlife and entertainment. Once again, COVID-19 put abrupt brakes on the nightlife scene in Singapore since they were considered high-risk establishments. At the end of last year, with our move to Phase 3, the state also announced a small-scale pilot programme for the reopening of nightlife and entertainment establishments. Accordingly, bars and nightclubs were required to enforce stringent safe-distancing measures which involved heavy investments to purchase sanitary equipment.

However, in mid-January, the state put the pilot on hold due to a rise in community cases, leaving those who signed up in the dark. For example, Mr Poon, the managing partner of Cash Studio Family Karaoke in Clarke Quay explained how scary it was to operate a karaoke joint amidst the uncertainty. He also expressed his disappointment in the postponement since he had invested about $12,000 to $15,000 to get ready for the pilot.

While these articles present how the pandemic has seemingly decimated the advantages of CCR, if we look further, we can see how there is still hope.

Hope for CCR

Vaccination Infographic Courtesy Gov.sg.

While Singapore has managed to get the virus mostly under control through stringent safe-distancing measures and extensive testing, the state is also offering nationwide vaccination beginning with seniors and high-risk groups. With more Singaporeans getting vaccinated, the state has expressed their optimism regarding the reopening of borders which could rejuvenate the economy and more. In general, widespread vaccination is expected to alleviate some of the pressures caused by the pandemic.

Offices

Moreover, while WFH arrangement might suit for some, it may not work out for others. According to a survey from Forrester 46% of those polled in late-April said they prefer telecommuting, a drop from 60 per cent in an earlier survey done more than a month ago. On the other hand, more people said they could not wait to go back to the office, an increase from 34 per cent to 50 per cent. The different results highlight how there are diverse perceptions of WFH arrangements, making it difficult to conclusively claim that WFH arrangements should be the sole working configuration.

Furthermore, in a CNA article, Dr Sam Yam, assistant professor of management and organisation at the National University of Singapore (NUS) Business School, said: “People who say offices are no longer important are coming from a business operation perspective. From a psychological perspective, the social interaction you get from going to an office is what humans require to be functional and psychologically well.”, suggesting the importance of maintaining office spaces.

Hybrid Working Arrangements Courtesy Raconteur.

Managing these different approaches would require innovation and diversification starting with a “hybrid” model that strikes a balance between well-being and work productivity. In the same CNA article, Mr Armstrong thinks companies will likely have split teams – one working remotely and the other being based in the office, or in some cases a hybrid group that will split time between the office and home.

He explains that there are two main office strategies to facilitate this, with one being a “hub-and-spoke” model whereby the company will have a client-facing office and another office where the support departments would operate from. Alternatively, companies could adopt a “core-and-flex” model where the main team heads to a permanent office and teams that are more mobile, such as sales, report to co-working spaces when required.

CBD Downtown Use Courtesy URA.

Our government had also anticipated and prepared for this when they implemented the CBD Incentive Scheme in 2019. The scheme promotes a broader mix of uses for CBD so that it’s “not only a place to work, but also a vibrant place to live and play”, says National Development Minister Lawrence Wong. It offers developers an increase in gross plot ratio (the gross area they can build in a particular site) so that they have more room to work with to integrate other functions within the development. In the URA Master Plan, they also expressed their desire to increase housing within CBD to ensure that it doesn’t become a ghost town after working hours. Through these initiatives, they hope to revitalise CBD and transform it into a space beyond just the epicentre of offices.

Midtown Bay Courtesy Guocoland.

Midtown Bay is one such development that has taken the cue and integrated multiple functions with the development. It comprises a 33-storey residential building located next to a 30-storey office building – comprising Grade A office spaces, shops and FnB outlets. It’s located along Beach Road, within the CCR.

Beyond building multiple functions into the development, they also offer a “core and flex” leasing scheme that will give tenants flexible and adaptable spaces to expand or contract their teams without having to move or renovate their main offices. Cheng Hsing Yao, group managing director of GuocoLand Singapore explained that they incorporate flexibility into their leases and offer facilities to achieve different purposes thus, going further than a simple residential property to a home that is conducive for work or entertainment. This reiterates the need for diversification and innovation in a post-covid world.

Shopping and Entertainment

Continuing the theme of diversification, we can see how while the pandemic has severely disrupted the shopping and entertainment aspect of CCR, through innovation and staying creative, disruption will not equate to the end of CCR.

Orchard Shopping district and CCR are still integral in Singapore’s wider shopping landscape since they’re the only places in Singapore that host luxury brands such as Louis Vuitton and Gucci. In the short-term, these businesses have definitely suffered its fair share of losses. However, when Singapore opens its borders (preferably by the end of the year), and tourists start coming in, these luxury brands would attract the wealthy looking for a holiday home, contributing to your tenant pool.

Moreover, the state is also planning to rejuvenate the district to resemble a “green oasis in the city centre” or an innovation district, where start-ups and social entrepreneurs could use the precinct as a “living lab” to test out ideas for new retail concepts, urban logistics and environmental sustainability.

Spin Classes at Zouk Courtesy StraitsTimes.

Entertainment establishments had to find alternative ways they could use their facilities while they wait out the industry downturn. For example, prominent club Zouk transformed its dance floor into a spin studio during the day and cinema by night. Their partnership with Absolute Cycle is mutually beneficial since it offers Zouk an efficient alternative for their facilities and Absolute Cycle is able to meet the demand for spin classes while maintaining safe-distancing measures through the use of the larger venue.

Some clubs have also had to pivot to other business models such as F&B. This comes with its own set of problems such as the investment required to make the switch and worries of not being able to revert to their original activity after pivoting.

To aid in this transition, the government had in place several initiatives, one of which is the URA One-Year Temporary Conversion initiative. It allowed nightlife establishments that chose to pivot to F&B from now till 31 March 2021 to revert to their original activity, provided such uses are permitted to operate under the prevailing COVID-19 regulations, and that the premises are not located in selected exclusion areas where this temporary conversion does not apply. Additionally, they’ll provide a grant of up to $50,000 from Enterprise Singapore (ESG) to help defray the costs that would be incurred in efforts to pivot approved businesses. Establishments exiting the industry will be given an ex gratia one-off payment of $30,000 to help with costs of winding up the business. In this way, those who manage to stick it out will be able to reopen their establishments after COVID-19.

Ultimately, even in a post-COVID world, CCR will probably still appeal to the crème de la crème in Singapore because it caters to a luxurious lifestyle. With landmark buildings, luxury shopping and world-class entertainment in close proximity, CCR is bound to retain its prestigious appeal.

Hope for RCR

URA Master Plan

Nonetheless, RCR also stands to gain from URA’s Master Plan whereby they intend to transform the RCR into a space that celebrates our Arts, Culture and Heritage. For example, part of Armenian Street is to be transformed into an urban botanic garden, extending the greenery down from Fort Canning. Moreover, with more space for events and activities, visitors, students and more will be able to enjoy picnic lunches, music performances, art strolls in the park.

Furthermore, there are plans to create a Bugis – Bras Basah Arts Belt with wider sidewalks with student-designed street furniture that create more space for people to walk, socialise and linger. Sidewalk enhancements and the upcoming Singapore Art Museum expansion will also create new staging grounds for arts and cultural events. Finally, streetscape improvements will make walking a delight, with more public spaces for arts and cultural activities to spill out onto the street.

The Master Plan for RCR also aims to enhance our historical links to the space especially at places like Fort Canning Park and Little India.

Fort Canning History Courtesy URA.

Little India History Courtesy URA.

Revitalisation plans include creating more family friendly spaces, and social spaces that provide a stage for arts and cultural performances and experiences.

Prices

As mentioned above, the price difference between CCR and RCR properties have been fast closing in recent years. However, RCR still stands lower than CCR properties. Using District 9 as an example of CCR and District 3 as an example of RCR, we use data from SquareFoot for this comparison.

Price comparisons between District 09 and 03, relative to the price differences between CCR and RCR in Singapore.

Rental yield comparisons between District 09 and 03, relative to the price differences between CCR and RCR in Singapore.

Price-wise, CCR is still more expensive compared to RCR. In March 2021, the average price of Condos in District 9 was at $2,554 PSF while RCR’s average PSF was lower at $2,019. Dissimilarly, CCR had a lower rental yield. In August 2020, the average monthly rent for District 09 was $4.12 PSF compared to District 03’s $4.25 PSF. Thus, it would currently make more economic sense to purchase RCR properties for investment purposes since you pay a lower quantum but earn a higher return.

Office spaces

Moreover, as previously discussed, URA plans to decentralise CBD which means building more office spaces in the RCR, such as at Pasir Panjang, Bishan and Paya Lebar. Therefore, RCR properties have easy access not just to office spaces in CBD and the city centre but also within their immediate region which gives RCR investors a wider tenant pool.

Family-oriented Units

Finally, RCR properties are generally more family friendly, with wider unit configurations. For example, Guoco Midtown has two components – Midtown Bay and Midtown Modern.

Midtown Bay is located within the CCR, with 1- and 2-bedders making up approximately 60% of units offered. The largest configurations they offer are 3-bedders at 1,324 sq ft. Conversely, at Midtown Modern located in Bugis (RCR), 45% of units offered are 3-bedders or larger. They range up to 1,808 sq ft for 4-bedder premium configurations and penthouses are even larger at a maximum of 3,520 sq ft.

Taken together with the URA Master Plan to create a bustling, family friendly space, RCR would be best suited for families with professional breadwinners even in the long-run.

Our thoughts?

The gap between RCR and CCR will definitely be closing in the near future especially as the pandemic continues its vagary on tourism and the F&B industry. Additionally, decentralisation plans could further narrow the gap as CCR loses its key advantage of proximity to the city-centre. Nonetheless, a narrow gap need not be a cause for worry since both RCR and CCR have their own merits.

Finally, the different regions in Singapore have different merits so it’s important to first ask yourself why you’re purchasing a property. Is it an investment option? Your forever home? For those who are able and willing to purchase a property, now might be the time for investing in RCR properties, before the gap closes further. If you need some help or more information, our team would be happy to help you out if you reach out to us here. See you in the next one!