What do you think of when a person mentions “doctor” or “medicine”? Most Singaporeans would immediately associate it with status, wealth, intelligence, exclusiveness, prestige. If we go a bit further, people will think about how healthcare is a necessity. A way through which lives could be saved, or at least extended for a while more.

What does healthcare have to do with property? Most people would think that healthcare facilities belong to the government, or big private companies. That they are out of reach of individuals. Surprisingly, not many articles cover Medical Suites as a way to dip your hands into real estate in the healthcare industry.

In this short feature article, we discuss more about medical suites. What are they? How could you get your hands on one? And how are they performing on the market? We cover these questions and more as we explore this special class of commercial real estate, deemed as the “Landed” of commercial properties.

What are Medical Suites?

Image courtesy Thomson Medical

Medical suites are commercial property in Singapore that are specifically designated for health and medical care use. Typically, they are found in clusters such as in Novena, or Farrer Park. There is a limited supply of medical suites on the commercial real estate market. That means a much lower number of transactions.

You will typically encounter medical suites if you are looking for healthcare and medical consultants that have set up their own private practice. Specialists who venture out from the public system might join a private practice or start their own. They often cluster together with other specialists of the same expertise to rent a medical suite together. It is also possible that the doctors join hands (and wallets) to buy the commercial property under a company rather than an individual.

Inevitably, the low number of units and transactions of medical suites translated to a lack of information and certainty regarding the transaction process. It is a topic that most real estate agents would be unfamiliar with. And at best, would be assumed to be like the retail or industrial type of commercial real estate.

In some sense, medical suites are the same as other forms of commercial real estate. There is no Additional Buyer’s Stamp Duty (ABSD) on commercial real estate but the regular Buyer’s Stamp Duty (BSD) will still apply. Seller’s Stamp Duty (SSD) applies to r industrial properties such as factories, but does not include retail, office, and medical commercial spaces. So if you already have a solid residential property portfolio but are still looking to go deeper into the real estate market, you can consider investing in commercial properties.

What sets Medical Suites apart from other commercial property is that medical clinics and private healthcare practices are stable tenants who usually sign a longer lease. These long term contracts help ensure a stable stream of rental income for your commercial property investments. On top of that, some of these rental contracts might include floating rates. Which means that rental would be adjusted to market rate on the agreed periodic review.

Image courtesy Thompson Reuters

An important thing to note about commercial property is that you are venturing into two industries at the same time. First, you are invested in real estate. Second, you are invested in either the retail, office (corporate), industrial (manufacturing or processing), or medical industry. Your choice to invest in commercial property must be strategic.

Take for example, the Covid Pandemic. Retail activities plummeted, hurting businesses who eventually decided to close or go virtual. Demand for rental and ownership of retail spaces likewise corresponded, and fell. The lesson to be learned is to make sure that your decisions have considered worst-case scenarios and contingencies if rental income is cut off abruptly, putting you on a cash crunch.

The healthcare industry in Singapore is robust. If anything, it is suffering from a lack of skilled labour in the form of healthcare providers. This form of demand is hard to disrupt. When health is considered a necessity and the population is considerably wealthy enough to afford and prefer private healthcare, it shows that the industry is rather resilient.

The risks posed to investing in Medical Suites would mostly be macro-concerns. For instance, the regulatory risk of governments changing the rules on private ownership of healthcare spaces. Or the sudden brain drain of medical expertise from the country. Both of these examples are rather unlikely. The ageing population in Singapore would likely only heighten the demand for healthcare services. A possible concern would be that we would not have enough doctors to serve this population or to take up the supply of medical suites on the market.

All these factors considered, Medical Suites still pose as an interesting commercial property class to invest in to diversify your property portfolio. Alternatively, if you are a medical practitioner looking to save on rent in the long term, buying a Medical Suite might be a good financial move depending on the situation.

How could you get your hands on one?

Image courtesy Thomson Medical

Investors who are not medical practitioners can actually buy Medical Suites in specific locations such as Novena Medical Centre. Other medical suites such as Gleneagles or Mount Elizabeth Novena would require the buyers to be medical practitioners themselves. Perhaps this is a way to protect practitioners from being crowded out by non-practitioner investors. And it does make sense to some degree to do so.

However, not all medical practitioners would want to spend that amount of capital on the commercial space. Medical suites like Novena Medical Centre give the outside world an option to invest in medical commercial spaces. Given the strength of the healthcare industry and favourable rental arrangements, this seems like a more attractive option than retail or office space.

There are a few important notes on commercial property that you should know. Especially if you are new to commercial real estate. First, if you are buying the commercial property from a GST registered entity, you will be required to pay GST for the commercial property purchase. This is a significant sum, and will be an important consideration when making the buying decision. GST rising by 1% in 2023 and 2024 would only make this cost factor grow in importance. A caveat here would be that you may submit a claim application to IRAS for the remission of GST if you are eligible.

Unlike residential property, you would not be able to use your personal CPF savings for the purchase of commercial property. This would make it difficult for the everyday person to delve into this property class. Typically, business owners or HNW investors are the ones considering the commercial property investment. That being said, the process of getting a loan is also different from residential properties. The table below illustrates some differences between residential and commercial properties.

Image courtesy Smart Nation Singapore

While the bank still goes through a similar process of valuation and offering their loan terms. PropertyGuru has recently done a great article highlighting the differences between residential and commercial property loans. To cut to the chase, each business loan is unique to the financial standing of the company, with varying interest rates. It is possible to get a LTV of up to 80%. What is most important here is the financial history of the company.

In order to be qualified for a business loan, your business would need to have at least 2-3 years of financial history. This includes the ACRA profile, bank statements, profit/loss statements and balance sheets. It is very likely that they would ask for a credit report of all the directors of the company as well. Some loans might have a minimum requirement for Singaporean ownership of the company.

An interesting note on the valuation aspect of the commercial property loan would be that it is subjective. More so than residential property. Because the number of past transactions are limited, some banks might have a more flexible approach to commercial property valuation. If substantial information is provided to the banks, you might be able to obtain more favourable terms for the loan.

To summarise, the transaction process for Medical Suites is complex. Most real estate agents are often inexperienced in this specific class of commercial property. We hope that this article helps in illuminating some parts of the process. The deals are often owner-led with brokers simply acting on the instructions of the owner. If you wish to know more about the processes for Medical Suite transactions, you may reach out to our experts on commercial real estate here.

How do Medical Suites Perform relative to other Commercial Properties?

Singapore has around 1,400 to 1,600 medical suites. Approximately 1,000 of such medical suites are located within hospital-supported environments, which would require a medical practitioner licence to purchase such suites. This leaves around 400 to 600 units on the open market. Such a small number of units is the reason why the number of transactions in the market annually hovers around 20-30.

The good news for this particular segment in commercial real estate is Singapore’s ageing population. Demand for healthcare services would likely increase beyond what public infrastructure can support. When it comes to that, private practices will play a bigger role in accommodating the incoming surge in demand for healthcare services. The need for these services translates into the requirement for more space designated for health and medical uses.

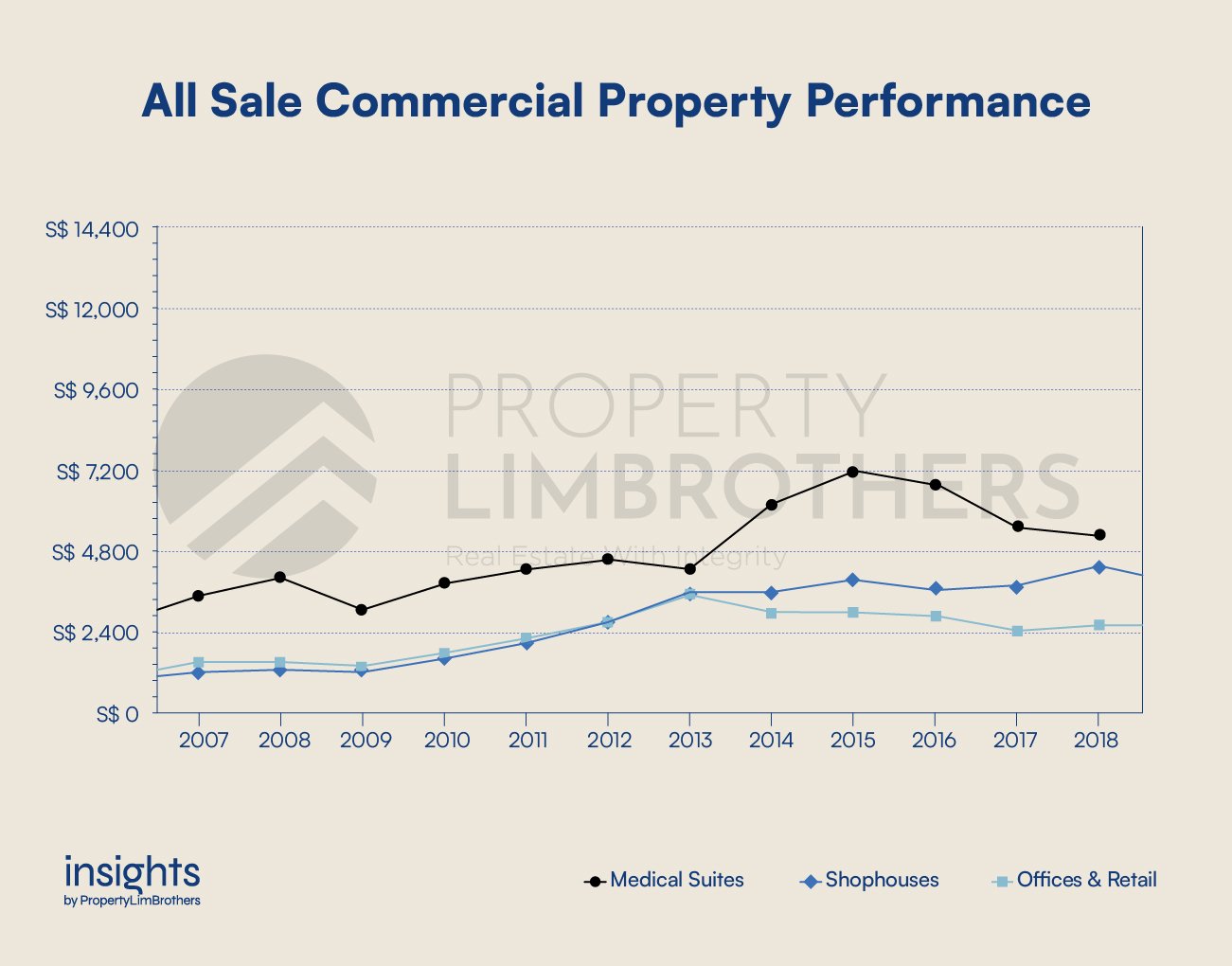

Thus, it would not come as a surprise for the government to eventually set aside more private and public space for the development of hospitals and private healthcare facilities. As seen from the chart above, medical suites prices have grown 52% from 2007 to 2018. Because no caveats were lodged between 2019 to present, there is no performance data to work with thereafter. Looking at the sales volume, new sales in the launch of new private medical spaces dwarfs the resale activity in the market. When it comes to the launch of new medical suites in the future, one can expect demand to be very hot when the supply hits the market.

In addition, Singapore’s medical insurance frameworks are considerably robust. There are many insurers that provide a comprehensive array of private insurance. With the number of individuals being covered by these policies increasing over time, we will have this as a push factor for people seeking private healthcare services over public alternatives. A large number of private medical practitioners belong to the medical panel of these insurance providers as well. This gives the private health sector more stability in demand and subsequently drives the need for private real estate space for such forms of commercial activity.

Looking at the price performance of the different types of sales among medical suites, new sales are prices the highest. This is intuitive as inflation of material and labour costs factor in most for newer developments. The price growth is the highest for sub sales. This signals the opportunity for good deals if you have the luck of encountering such listings on the market. To qualify the information that we present, these numbers are driven by a very small amount of transactions. The high variance or volatility that we see might be a reflection of the type of medical suites being sold rather than the true price trend.

This is, however, the challenge of appropriately estimating the value and price of low volume assets. It is scarce, and hence hard to ascertain the value of such commercial property. Nonetheless, the unique combination of real estate and healthcare industries still make this class of commercial property an appealing and special investment.

In a bid to respond to the future demands for healthcare services due to changing demographics, the government would likely invest more and set aside more land for the purposes of healthcare. Future growth in medical hubs is therefore very likely. Areas such as Novena Health City would likely benefit the most when it comes to a nation-wide approach to improving our healthcare infrastructure.

Looking at the performance by district for medical suites reveals that District 11 (Thomson, Watten Estate, Novena, Newton) does indeed grow at a much faster pace (98% from 2007-2018) as compared to the rest of Singapore (24% from 2007-2018). Although the transaction volume is small, we can interpret this as a stable market with few to no sellers. Most buyers of medical suites can be described to have invested in it for their own business-use or for rental yield. Selling for capital gains is very rare in this specific segment, based on historical data.

When we compare Medical Suites (Orange) to other commercial real estate such as Shophouses (Blue) or Offices & Retail (Dark Blue) in the chart below, Medical suites typically transact at a higher psf. In terms of growth, it is harder to compare as there is no transaction data from 2019 to present for medical suites. The spike in Offices and Retail in 2021 is largely due to an anomalous transaction for Maxwell House as shown below. This might be due to the recent en bloc for Maxwell House.

As mentioned earlier, Medical Suites are usually purchased for the purposes of own business-use or rental yield. Thus, a comparison on the capital appreciation alone does not reflect the actual performance of the asset. Nevertheless, medical suites have done acceptably well from 2007-2018 with a 52% growth. While this may be lower than other types of commercial property, we can interpret medical suites as a lower volatility choice for stable rental yield that is sheltered from most forms of economic disruption.

Medical suites have some air of exclusivity about it. The high average psf reflects some sense of the rarity and scarcity of this class of commercial property. Moving into the longer-term future, we expect more space to be designated for health and medical care use. This might mean more available suites for sale in the new future. We do not know what exactly the future holds, but we do know that health is a necessity. And we can expect the medical industry to continue to be resilient in the coming years.

Closing Thoughts

To summarise our discussion in this article, medical suites make for an interesting alternative if you are considering an investment into commercial real estate. As an industry, health and medical care has proven itself to be more resilient than retail and office spaces. At the end of the day, it is a necessity that people still need. And if they can afford it, most would opt for the best possible service they can get.

Even if you do not have a medical licence, you may still invest in some medical suites, such as the one in Novena Medical Centre. While the capital appreciation of medical suites are not as extravagant as shophouses, it is a class of commercial real estate that has stable tenants and favourable rental arrangements for the landlords.

If you want to learn more about this class of commercial property, reach out to our experts here. They can share more information with you to expand your knowledge on the topic and to see if it makes sense to your property portfolio. We hope this article has been interesting and helpful to you!