New launches in 2022 have hit the market with gusto. With the consumer sentiment for new launches still remaining strong and hot, the demand and price for new condominium and apartment launches have enjoyed substantial growth. Where does Lentor Modern stand among the new launches in 2022? Is Lentor Modern for you? Does it make sense to buy despite rising inflation, interest rates, and a possible recession?

The new launch segment for condominium and apartments have been one of the fastest growing segments in residential real estate. Boasting over a 10% annual growth rate since the pandemic, the new launch segment far surpasses the growth rate of resale condominiums and apartments. While this story is largely driven by rising land, materials, and labour costs, it still remains that demand is sufficiently strong for new projects in popular locations.

In this opinion piece, we look at where Lentor Modern falls among a series of exciting new launches in 2022. We situate the buying decision in the context of a worrisome macroeconomic backdrop and attempt to discover which demographic this project is most suited for. This article hopes to give you insight and uncover some blindspots you might have missed if you are considering buying Lentor Modern for your own stay or for investment purposes.

How Special is Lentor Modern among 2022 New Launches?

Among other notable recent launches such as AMO Residence, Liv@MB, Piccadilly Grand, and Cape Royale, what is so special about the Lentor Modern launch? Typically, when people compare new launches, it is mostly the question of location and price. If both of these are to the liking of buyers, they will try their luck in balloting for a good queue number. While the matter of location and price are the key reasons for choice, there are plenty of important considerations that should not be overlooked.

The development of a plot of land for a residential project is an extremely expensive and capital-intensive enterprise. With so much money at stake, developers spend plenty of time researching what is the appropriate unit mix (bedrooms), size, and perks of the location with a specific target resident in mind. We will cover later on what this mysterious target resident might be, but first we look at the unique selling points that developers have set given what they know about the land plot and future development plans of the area.

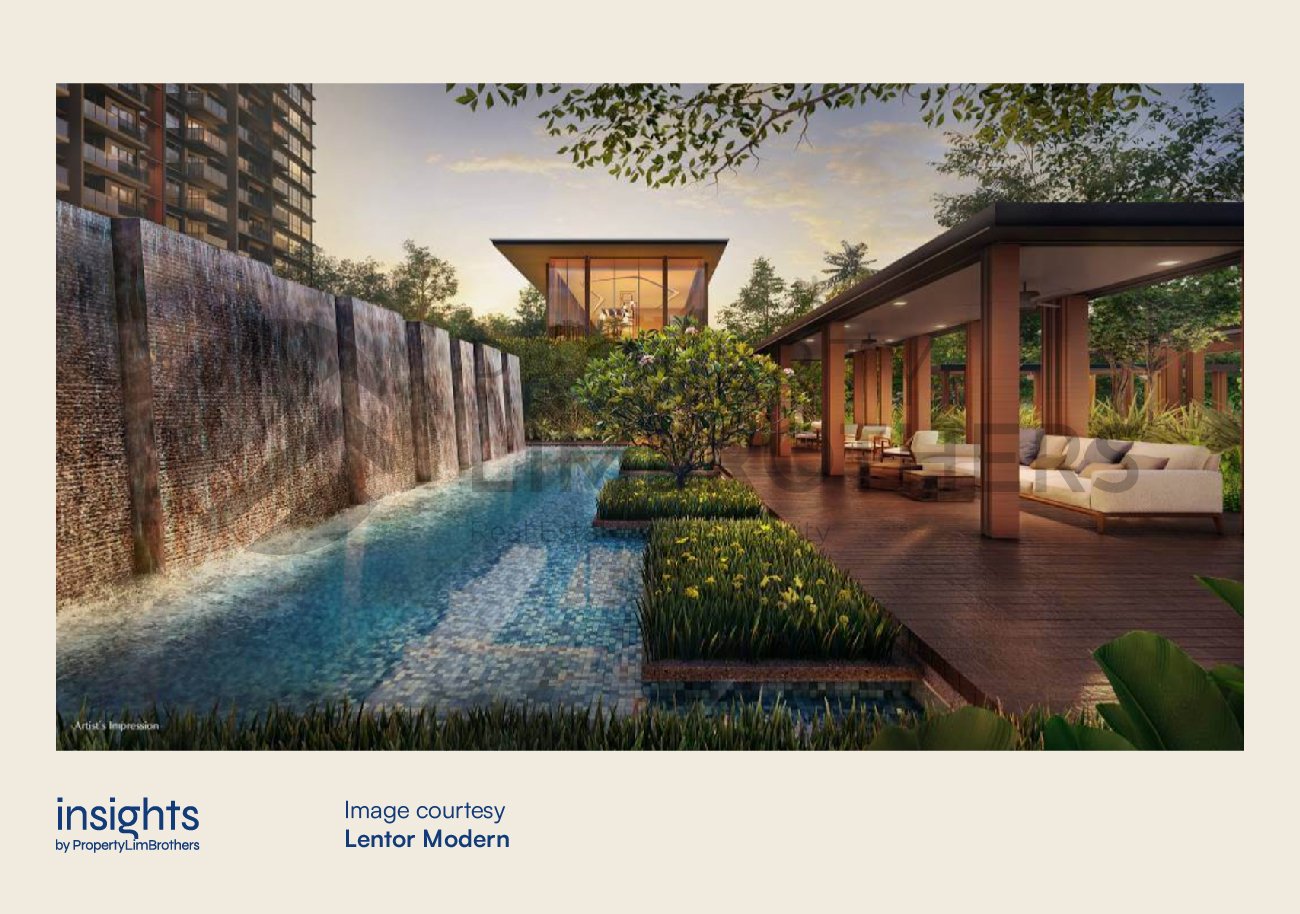

The key signature of the “Modern” series of new launches by GuocoLand (see Midtown Modern) is that the new launch is directly connected to an MRT as an upscale mixed-use development. Lentor Modern is the OCR reflection of the more exclusive Midtown Modern in the CCR (average psf of $2,800). The unique selling point is definitely centred upon lifestyle, convenience, and connectivity. This is in line with the URA’s plans of developing more integrated towns with multiple mixed-use spaces.

Another key highlight of Lentor Modern can be attributed to the overwhelming success of the AMO Residence launch, which almost sold out on the first day of launch (98% sold). For reference, other comparable leasehold new launches sell over 75% on the first day (Piccadilly Grand, Liv@MB). The success of the AMO launch spells out clearly that the demand for housing in the general Ang Mo Kio area along the Thomson line stretch is very hot. Lentor Modern is located approximately 2km north of AMO Residence, situated around the Yio Chu Kang – Ang Mo Kio area.

Despite this close proximity to AMO, Lentor Modern still falls short in terms of the primary schools found nearby (Anderson Primary, CHIJ St Nicholas Girls’ School). But is still relatively close to other educational institutions (Presbyterian High School, Anderson Secondary, Anderson Serangoon JC, Nanyang Polytechnic, and ITE College Central). Even though the benefit of the primary school ballot is not as obvious, it still provides a good location for the long-game educational trajectory for children.

AMO Residence performed exceptionally well with intense oversubscription of interest in buying. Local forums are speculating that more than 1,400 cheques were collected in interest of buying with only a supply of 372 units. It is thus not far-fetched to believe that the spillover demand from AMO Residence might dramatically aid the performance of Lentor Modern of 605 units. Whether it is simply high demand or exuberant speculation, it remains that Lentor Modern is a highly anticipated launch in mid-September with its location alone.

While the price guides have not been released as at the time of writing (28 July 2022), the land sale price gives a generic suggestion as to the possible price range of Lentor Modern. With the current land cost, estimated development costs and profit margins, the expected average psf range from $2,200 to $2,600. Its 1-bedders are estimated to go for $1.25 million to $1.3 million for a 500 sqft apartment. 700 sqft 2-bedders are estimated to go for $1.68 to $1.82 million. 1,000 sqft 3-bedders might be around the $2.3 to $2.6 million price range. And finally, the 4-bedders would probably be around $3.3 to $3.9 million range depending on the facing and layouts. Given that the AMO Residence sold for an average of approximately $2,100 psf, Lentor Modern is a comparable alternative with closer proximity to an MRT with commercial spaces on level one.

Lentor Modern is also one of the first new Condo developments in the Lentor neighbourhood. There is an already existing Landed estate on the north side of Lentor Modern, and an upcoming residential development on the south side. Some consider Lentor Modern to be a first-mover among a wave of new residential developments in the area. It is possible that this might translate into better capital appreciation, provided that upcoming developments are priced higher. Given the inflationary environment, that story seems reasonable to believe in.

On the URA Master Plan, Lentor Hillock Park will have upcoming residential development in a circular format around the park. Lentor Modern is the first one, north of the park. Subsequently, the Lentor Central project acquired a land parcel across the road from Lentor Modern. Other parcels of land around the park are awaiting the results. And another development, Lentor Gardens is on the reserve list. Lentor Modern would indeed be one of the first new developments in this estate, giving it a slight advantage.

Is Lentor Modern special? Well, yes when we are looking at the odds of a successful launch. Even though the pricing of Lentor Modern resembles that of an RCR condo more, the region might be more of a label than an indicator of demand. AMO Residence is a proof of how buyers are willing to pay RCR prices for a well-located OCR condominium. Lentor Modern may be the next in line to show how some OCR developments can be exceptional if they are well and centrally located.

Does it Make Sense to Buy a New Launch in the Current Economic Situation?

Even if Lentor Modern is the “right” new launch to buy. Is it the right timing to do so? There are many reasons to be cautious in today’s world. Central banks are increasing interest rates at a tremendous pace. The U.S. Fed just recently announced its second consecutive 75 basis point hike to bring the interest rate to a benchmark of 2.25 to 2.5%. Interest rates would likely continue to rise so long as inflation is elevated above 4%. Central banks in Europe and around the world are following suit to defend their currencies and fight local inflation. Even Singapore is moving fast to tighten monetary policy to defend the Singapore Dollar and keep inflation under control.

What does this mean for people considering buying a unit at Lentor Modern? You will need to be aware of rising interest rates as it affects your mortgage payable. We did a sample calculation in this other article on how rising interest rates can impact the affordability of housing. As rates are slated to increase, likely into 2023, it might be a good idea to consider short-term fixed rate mortgages. This would allow buyers to hedge against short-term rise in interest rates, and subsequently allow them to refinance their loans should the monetary tightening end in 2024 and beyond.

Another important shift to be aware of is the potential of a recession in Singapore in 2023. The U.S. is likely in a recession (two quarters of negative GDP growth). Once the Q2 data is announced, this will be a given fact. While political manoeuvres might aim to change the technical definition of what a recession is, it won’t change the fact that the American economy isn’t doing well. On the other hand, China is facing a property crisis with some developers and consumers not being able to or refusing to meet debt obligations. If not handled appropriately, the crisis could potentially escalate into a full-blown financial crisis.

Spillover effects and spooked investors will be harmful for the global economy and growth prospects. Being the small and well-connected economy that it is, Singapore would likely suffer negative impacts from a global economic slowdown. The silver lining is that it takes time for the recession to unfold and for the ripples to eventually reach Singapore. By the time a recession is officially announced in Singapore (if it even happens at all), it would likely be 2023.

Prospective buyers and investors of Lentor Modern (or any property for that matter) should be cautious about their emergency cash holdings and job security as we enter economically uncertain times. If you are in tune with the news, you would have heard of recent hiring freezes and layoffs made by companies. This is just the beginning of a potentially larger wave of retrenchment. If the negative growth persists in the economy and unemployed individuals are not able to find new jobs, the chances of a housing loan default is on the table. Before making a huge financial commitment to buy a house, make sure you have solid savings for rainy days and job security even after the property purchase.

Another plausible black swan for buyers is the introduction of more cooling measures in 2022 and beyond. This would affect the ease of selling the property and the capital gains from selling. Additional cooling measures will affect the affordability of higher priced properties, and push consumers towards more affordable housing in the form of resale HDBs, ECs, or less central OCR Condos. Lentor Modern might have a risk of a price correction if new cooling measures strongly affect future buyers.

Given how residential property and rental indices are rising despite the December 2021 cooling measures, the chances that more policy moves to cool the property market are definitely possible. Seeing also how new launches in 2022 are able to sustain the current price growth levels, new cooling measures might still be insufficient to deal with the inflation of new property developments.

Now might not be the “best” time to buy a new launch, but it is still alright to do so. Provided that the individual exercises financial prudence, great cash flow management, and has confidence in their job security. If prospective buyers and investors are on the fence about buying a new launch at this time, they should hold back or seriously take stock of their ability to afford the property purchase comfortably.

Who is the Main Target Audience for Lentor Modern?

After all is said and done, who is this mysterious “target customer” that GuocoLand has in mind for Lentor Modern? The Lentor estate is definitely one that is closely resembling the URA Long-Term Plan Model of integrated and inclusive spaces. This means having more mixed-use spaces, such as Lentor Modern itself, which will have commercial space on level one. It is also a neighbourhood with a mix of public and private housing (landed, condo, HDB) and the shared amenities to support it.

Likewise, the target audience of Lentor Modern is more diverse than AMO Residence. While lifestyle, convenience, and connectivity are key areas of focus, the project is also family-friendly with a good range of educational institutions and support for multi-generational living (geriatric community hospital in the neighbourhood). An important thing to note is also that it is not a mature estate. So, there are fewer amenities and food options as opposed to more mature or central estates. Lentor Modern will also be more beneficial for families who intend to go car-lite to take advantage of the direct connection to Lentor MRT Station.

Lentor Modern can be summarised as a modern home for families that currently or will have to meet multi-generational needs. It is also a premium entry for property investors that want exposure to estates with a higher growth potential. We expect the unit size distribution for Lentor Modern to reflect the intended audiences they are catering to. The spread should be diverse, with a focus on two and four bedders as more affordable options for small and larger families. As the floor plans and unit size distribution are not released yet, what we put forth in this article is speculatory.

It will be interesting to see if Lentor Modern has a more affordable OCR version of the sky bungalows introduced in the Midtown Modern project. It would be exciting to see Lentor Modern offer some limited luxury units that are like “landed property” with a view of the landed estate to the north of the new project. This is definitely a feature to look forward to mid-September, especially for high net worth investors looking for a signature OCR piece.

Closing Thoughts

This opinion piece hopes to give readers a primer on what to expect and the basic rundown based on the limited information we have on the new launch as at the time of writing. We will be doing another proper review of the new launch once more information is released by the developer on the unit floor plans and size distribution.

Until then, if you have any questions or would like to discuss more about the state of new launches and Singapore’s property market, please feel free to contact us here! We look forward to bringing you more content on Lentor Modern and upcoming new launches in Singapore.