To say Singapore is a land-scarce nation is an understatement. As a country that is quite literally a dot on the world map, land for the little red dot is one of, if not the most desired resource.

But did you know that Singapore has been growing in size since the nation’s independence? Wait, Whatttttt?

Singapore has been putting TLC (Tender, Loving, Care) into reclaiming back land, growing by almost a full quarter; from 581.5 square kilometres at its independence to 733.1 square kilometres by the end of 2021. By 2030, the government has plans for Singapore to have a total land area of nearly 776.9 square kilometres.

But hold your horses. That doesn’t mean Singapore has found an infinite land hack. At some point, land reclamation will no longer be a feasible solution, which begets the question for us homeowners. Does size really matter?

Bigger is better?

It’s not new news that the COVID-19 pandemic set Singaporeans and Foreigners alike in Singapore into a home-buying frenzy. As outlined in our previous article – there was a huge surge in condominiums measuring above 1,200 sq ft. But were they getting bang for their buck? Should you be following suit in this craze?

When and Why do we think it matters?

How property size affects Price Per Square Foot (PSF)

The common notion – smaller units have a higher Price per Sq Ft (PSF) holds true (to a certain extent). When looking at resale condos, a resale Studio’s Average PSF is almost double that of a resale 4-Bedder’s Average PSF across the past five years.

Similarly, an Executive HDB Resale flat’s average PSF is 14% greater than that of a 2 Room HDB Resale Flat (We have used a 2 Room HDB for comparison as 1 Room HDBs are no longer being made).

Generally, HDBs suffered from a slight dip from 2017 to 2019, before inflecting upwards during the pandemic season of 2019 to 2021.

Wait a minute…

However, if you were to inspect the data a little closer, 3-room and Multi-generational flats seemingly do not fully subscribe to the notion mentioned above (that smaller units have a higher Price per Sq Ft (PSF), and vice versa).

1. There is a much smaller sample size of data for Multi-Generational HDB Flats transactions within the past 5 years

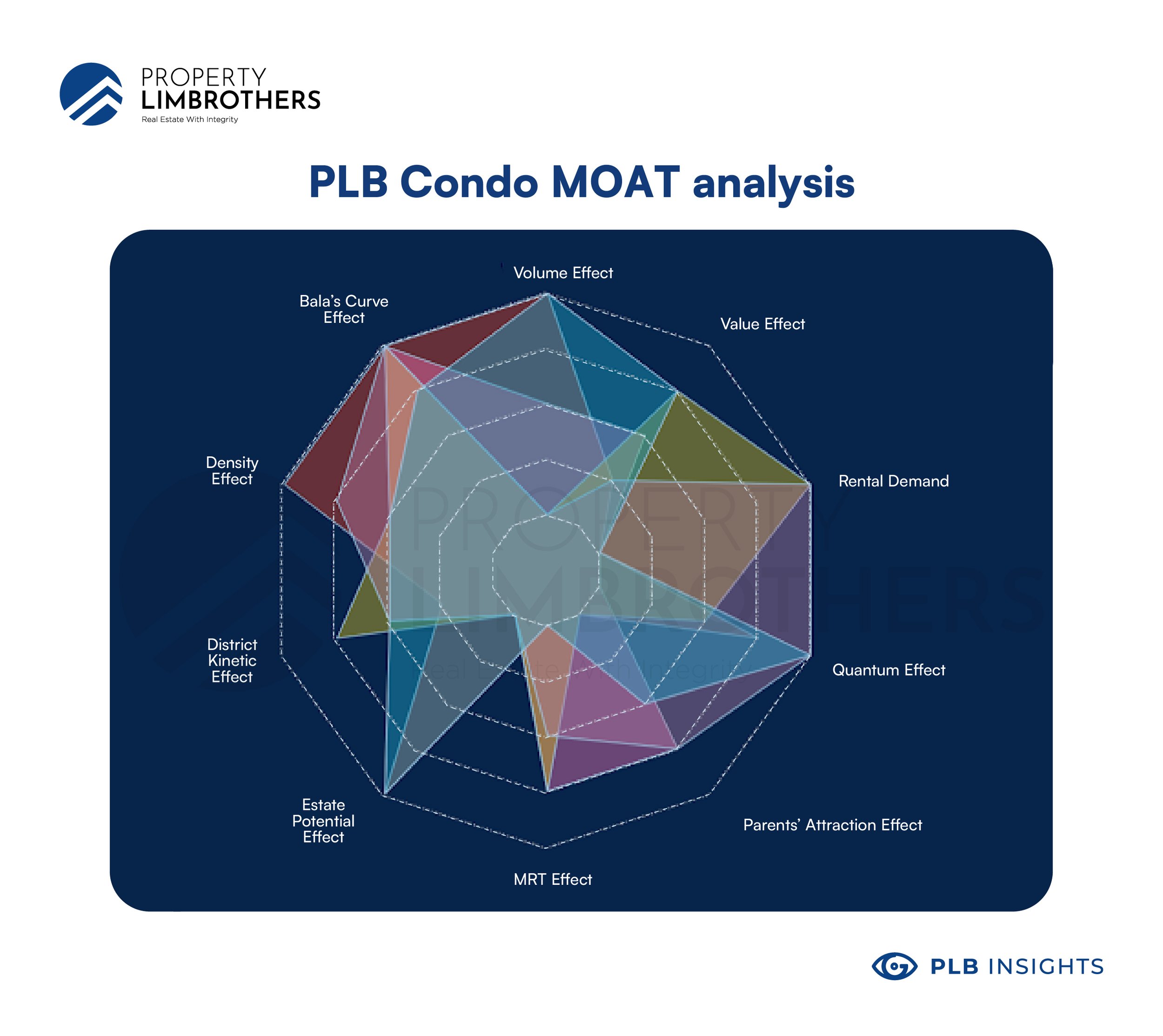

2. The remaining lease of Multi-generational HDB Flats transacted in the past five years is much lesser than 2 Room, 4 Room, 5 Room, and Executive Flats, hence is subjected to Bala’s Curve to a greater extent. (To find out more about Bala’s Curve, head onto your MOAT analysis article, where we explain the proprietary algorithm tool that we use for our Buyer’s Consultation.)

Note on data sample:

Transaction Data from REALIS does not make readily available the actual Condominium type, hence we have grouped the transactions by unit size, estimating through the total condominium size into their respective estimated type. We have decided to exclude units larger than 1600 sq ft, as these units are typically ground floor units and penthouse units that have external living spaces, which would not give a fair comparison against typical condominium units.

Bigger Units, Kings and Queens of Price efficiency

As seen from both Condo and HDB flats’ average PSF data over the last 5 years, it is undoubtedly true that larger units are significantly more price efficient than their smaller counterparts.

However being more price efficient does not necessarily mean larger units are more affordable. With larger units, it is the quantum price that prevents most from attaining.

Then what about its effects on Capital Appreciation?

While there are articles out there correlating size with capital appreciation, we believe that correlation does not mean causation

When accounting for factors for capital appreciation, size is only one of the potential contributing factors. There are other areas of consideration such as remaining lease, distance to primary schools, MRTs and many more!

When and Why we think it doesn’t really matter

Layout Efficiency

Bay Windows and Planter Boxes

While the listed square foot does give an indication of the size of the house, the number is unable to convey the efficiency of the layout. Especially since in the past, bay windows and planter boxes were exempted from Gross Floor Area calculations which were subjected to development charges.

This loophole was unfortunately an irresistible exploitation used by most developers, if not all to include bay windows and planter boxes which they could then charge buyers for these areas, but do not incur additional cost of development as these additions were not taxed and were constructed for cheap.

Another consideration for how “efficient” your layout could be is your household or bombshelters. Household shelters which are more affectionately recognised as the unofficial storeroom, have been mandatory for quite some time now. The bigger these rooms are in your house, means a smaller actual living space!

Eccentric Layouts

There will definitely be some layouts that are a little less than desirable as developers seek to maximise the land available to build on. While this has given rise to layouts that are quirky, eccentric and bold. They are however, a hate it or love it.

Investment Properties

Why we think smaller units makes for better investment properties

In our PLB Insights 2022 Q1 Report | PropertyLimBrothers, we outlined that unless interest rate falls or inflation gears down, we will continue to receive higher rentals and rising property prices, and we do expect for property to outperform other asset classes in an inflationary environment. One specific inherent characteristic of real estate is the ability to leverage when purchasing properties.

We outlined that rising inflationary environments and interest could potentially pose a threat to rental yields and those overleveraged individuals. Hence, a smaller (about 700 sq ft) investment unit seems to be the sweet spot of being able to leverage on mortgage loans, without being overstretched on the financial obligations of paying interest rates and run the risk of insolvency.

However, the flip side of buying a smaller investment unit could be the ease of exit. Hence, this is why our Inside Sales Team preaches to avoid getting 1 Bedroom units and to try to at least attain a 2 Bedroom for investment purposes. This gives the option to exit should you feel that, over time, the gains in capital appreciation outweighs the rental profits.

Apart from targeting smaller investment properties to reduce risk of insolvency, we believe that there are remorse substantiating reasons to go for smaller units for investment purposes over which we list below!

Falling Household Size and Increasing Foreign Workers in Singapore

The average household size among Singapore resident households has also been steadily declining over the years, dropping from an average of 4.9 people in a household to 3.2 people in a household.

Additionally, there is a Sizeable pool of foreigners who would look into renting smaller HDB apartments and Condominiums while working in Singapore

Current Pass Type Definitions by Ministry of Manpower:

-

Employment Pass (EP)

-

The Employment Pass allows foreign professionals, managers and executives to work in Singapore. Candidates need to earn at least $4,500 a month and have acceptable qualifications. Employers must also demonstrate that they have fairly considered all jobseekers.

-

-

S Pass

-

The S Pass allows mid-level skilled staff to work in Singapore. Candidates need to earn at least $2,500 a month and have the relevant qualifications and work experience.

-

In fact, the minimum qualifying salary for new Employment Pass and S Pass applicants will each rise by $500. This bring the new qualifying salary for an Employment Pass and S pass to $5,000 and

Additionally, EP applicants in the financial services industry will have to meet salaries of $5,500 and over. While S pass applicants will need to meet the higher

While the number of foreigners on an Employment Pass (EP) and S pass in Singapore has dipped considerably when the pandemic hit, if we were to refer to the trend prior to COVID-19. The pool of foreigners on an EP in Singapore remained relatively stable at around 190,000, while the number of S pass holders increased significantly from around 180,000 to 200,000.

As Singapore opens up the economy Employers are moving to tackle labour crunch as border curbs ease, we can look forward to seeing these numbers return back to pre-COVID levels or even rise to new highs. Adding to the pool of rental market entrants, which is already rather heated in recent times.

Food for Thought: Size of Non-Landed Private Developments

While most discussion surrounding the size of a property is more concerned with the living area of a property, another area for consideration for potential HDB upgraders and Landed “right-sizers” is the development size of a condominium.

While Condominiums have been loosely used to represent Non-Landed Private Properties in Singapore, there are actually two different categories of Non-Landed Private Properties in Singapore – Condominiums and Apartments.

Condominiums vs Apartments

The difference between apartments and condos is very minute. While typically people refer to non-landed private residential properties as condos, apartments also fall under that category.

So what is the difference?!

1. Apartments have a minimum site area of 1,000 sqm. Condos have a minimum site area of 4,000 sqm.

2. Apartments have lower common boundary setbacks. (i.e condos that do not meet the requirement setbacks “fail” and become apartments)

To reiterate, the status has nothing to do with the size of the project or number of units. Bartley residences (704 units) and Kingsford Waterbay are examples of large apartment projects.

While these technicalities may affect living qualities such as population density and noise experienced within the development. Our general census is that these definitions have either little to no impact on investment potential.

Large vs Small Condominium Developments

We believe that veteran property investors have been onto something, being mindful about the development size. We believe that the development size confounded with the number of units results in differing volumes in transactions and thus price action.

The size of condominium units also results in qualitative differences that could affect price action and rental demand.

Potential Impacts of Size of Development are as follows:

-

Unit Average Quantum Price

-

MCST Management fees

-

Rental Yield

-

Capital Appreciation

-

En-bloc Potential

-

Population Density / Noise

Final Thoughts

According to the Pareto Principle, or alternatively known as the 80/20 rule – 20% of your financial decisions will have an exponential impact on your financial obligations.

Property purchase remains to be one of the biggest financial undertakings most will go through, and falls under this 20% of financial decisions. The potential opportunity cost of making a “wrong” purchase or sale is likely much more than the commissions paid out to an agent.

At PropertyLimBrothers, we deal Real Estate with Integrity! As the only real estate company with a full backend team supporting our Inside Sales Team, you can rest assured that your decisions are backed by data and insights. With proprietary tools, algorithms, in depth data research and analysis, you can rest assured that your real estate journey is in good hands!