Zyon Grand makes its debut as one of the most prominent launches in District 3 in recent years, setting a new benchmark for integrated, vertical luxury in Singapore’s city-fringe landscape. Developed by City Developments Ltd (CDL) and Mitsui Fudosan, this rare, high-rise mixed-use development offers a lifestyle proposition that blends stature, connectivity, and sophistication — all from a site that directly connects to Havelock MRT.

Comprising 706 units across two 62-storey towers, Zyon Grand is the tallest residential development in D3, located at 3 & 5 Kim Seng Road. The project brings together branded interiors, private lifts (for 4BR+), and a full suite of curated retail and childcare amenities — an offering designed for discerning homeowners, luxury upgraders, and long-term investors alike.

This article presents a comprehensive breakdown of Zyon Grand’s location, pricing, product offering, and market positioning, contextualised within broader RCR and D3 trends, and written with reference data as of October 2025.

Value Proposition: A Rare High-Rise, MRT-Integrated Landmark in the RCR

Zyon Grand presents a vertically integrated lifestyle offering that is almost unmatched in the Rest of Central Region (RCR). Unlike smaller boutique projects or dense suburban launches, Zyon Grand delivers:

Secured via the GLS programme at $1,201 psf ppr, the project benefits from a relatively earlier land acquisition before further construction inflation set in, allowing for competitive pricing relative to its premium attributes.

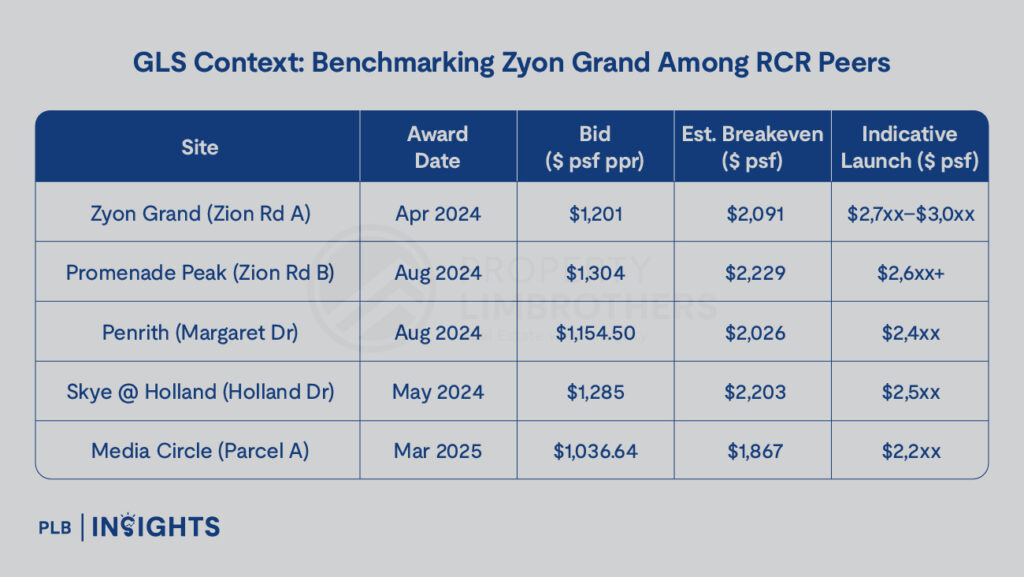

GLS Context: Benchmarking Zyon Grand Among RCR Peers

While Zyon Grand carries a premium over Penrith and Commonwealth-area launches, its integrated nature and architectural scale justify its positioning.

Project Overview

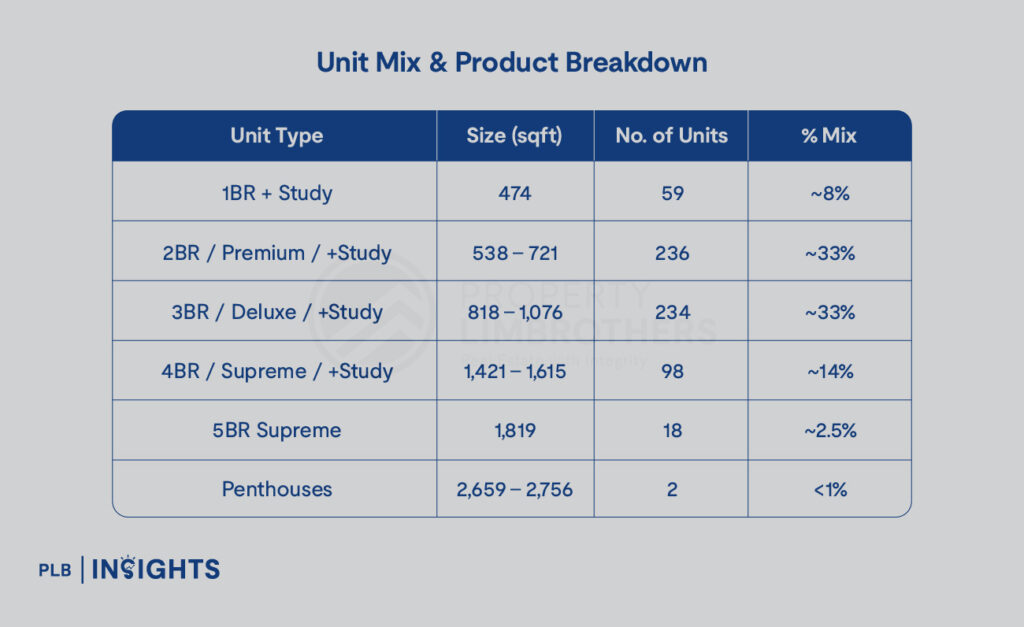

Unit Mix & Product Breakdown

Notable highlights:

- Private lifts for 4BR and above

- Branded fittings: V-Zug appliances, Laufen, De Dietrich

- High ceiling heights (3.05m typical, 3.6m for select stacks)

- Smart home features and concierge services

Location Advantage: Transport-Integrated, City-Fringe Convenience

Zyon Grand’s direct link to Havelock MRT (TEL) creates a highly desirable connectivity profile:

- 2 stops to Orchard

- 4 stops to Marina Bay

- 6 stops to Shenton Way (CBD core)

This connectivity appeals strongly to professionals, expatriates, and investors alike. The surrounding area also benefits from:

- Walkable access to Great World City, Zion Riverside Food Centre, Singapore River

- Proximity to green connectors and park network (Fort Canning, Kim Seng Park)

- Urban yet livable — surrounded by low-rise enclaves and riverfront trails

Amenity & Educational Catchment

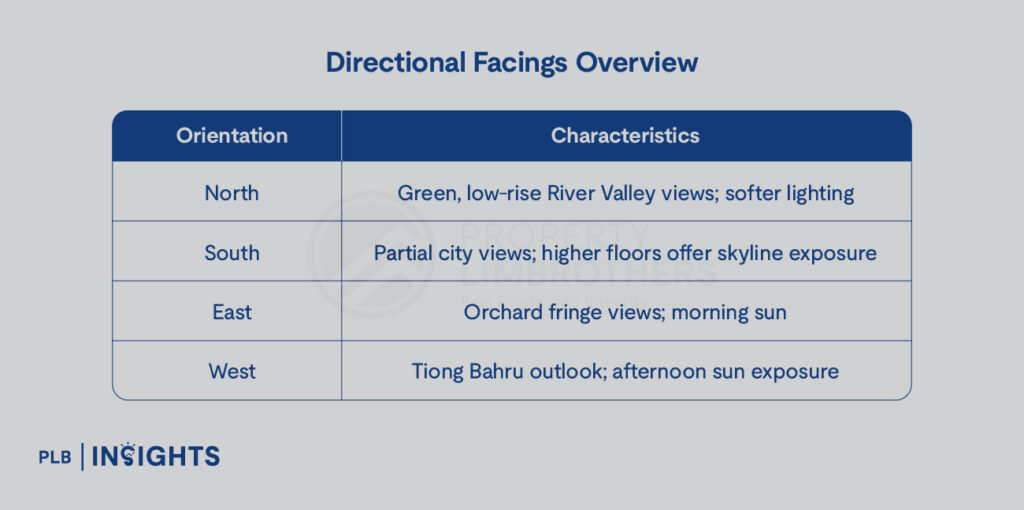

Directional Facings Overview

District 3 Price Disparity Analysis

Zyon Grand’s indicative pricing of $2,700–$2,950 psf places it in the upper quartile of D3, but not at the top end of the wider RCR or CCR fringe. Here’s how it compares:

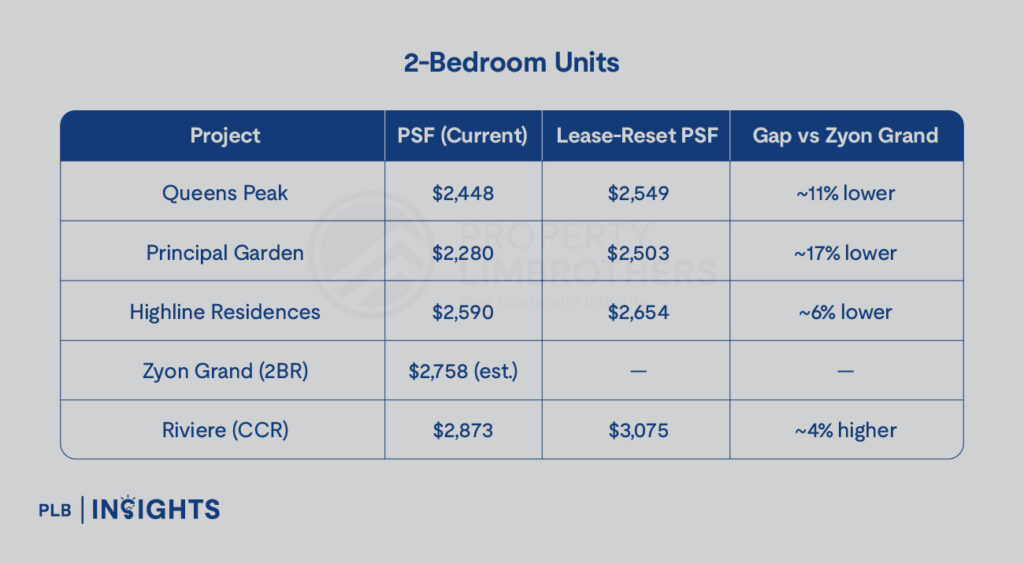

2-Bedroom Units

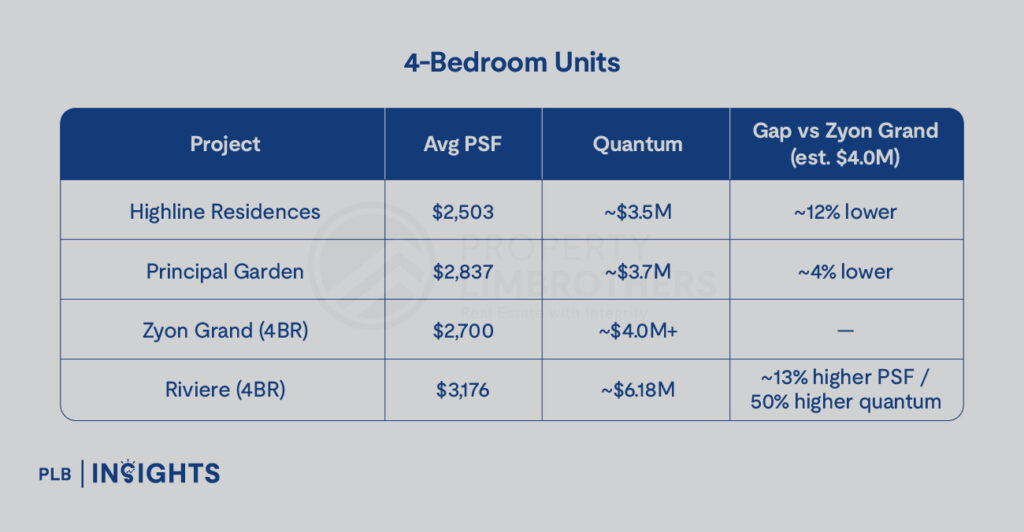

4-Bedroom Units

Zyon Grand holds a 10–15% premium over resale D3 condos, but remains competitively priced compared to RCR but CCR fringe launches like Riviere and One Pearl Bank.

Further Insights:

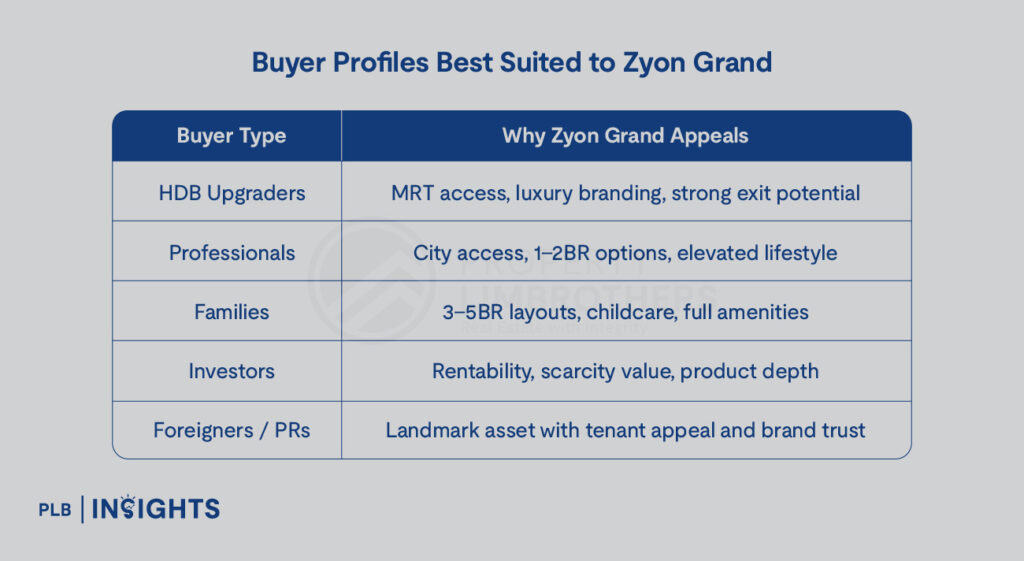

Buyer Profiles Best Suited to Zyon Grand

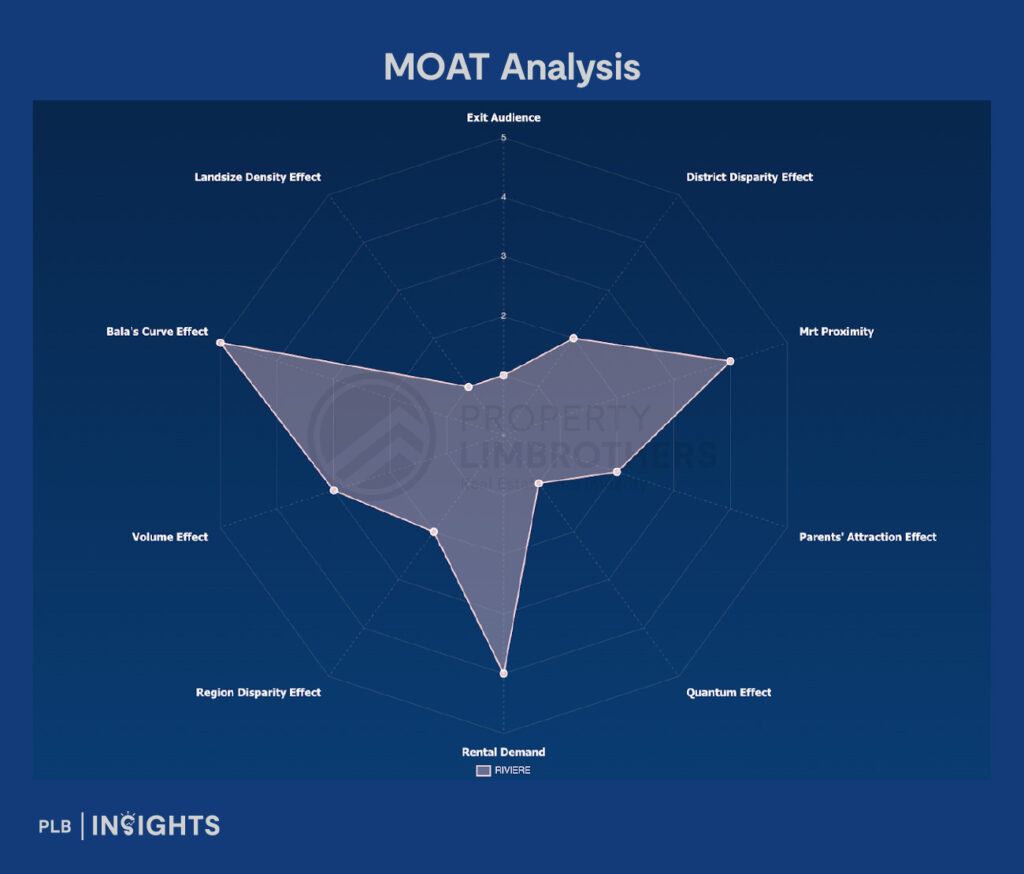

PLB MOAT Analysis – Zyon Grand vs Riviere

A comparative framework to assess strategic investment value in D3

Overview

Zyon Grand enters the District 3 landscape as a flagship MRT-integrated development with scale, height, and product depth. To assess its investment defensibility, we compare it against Riviere — a luxury D3 benchmark launched in 2019, completed in 2023, and occupying a similar river-adjacent city-fringe profile.

Using the proprietary PLB MOAT framework (Moats of Asymmetric Advantage & Timelessness), we evaluate each project across 10 core defensibility metrics — combining locational, pricing, product, and demographic factors to derive comparative edge.

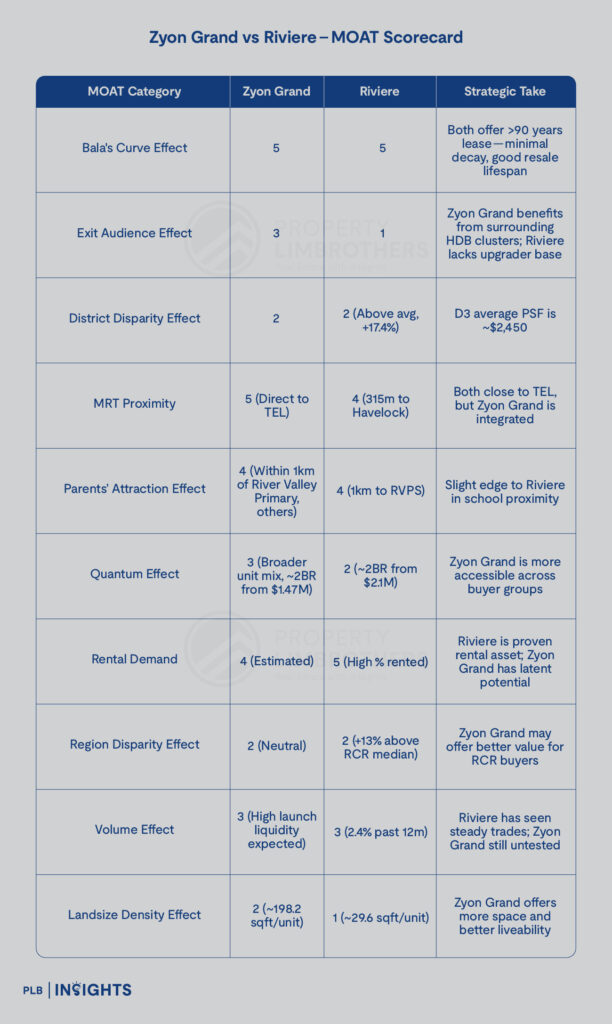

Zyon Grand vs Riviere – MOAT Scorecard

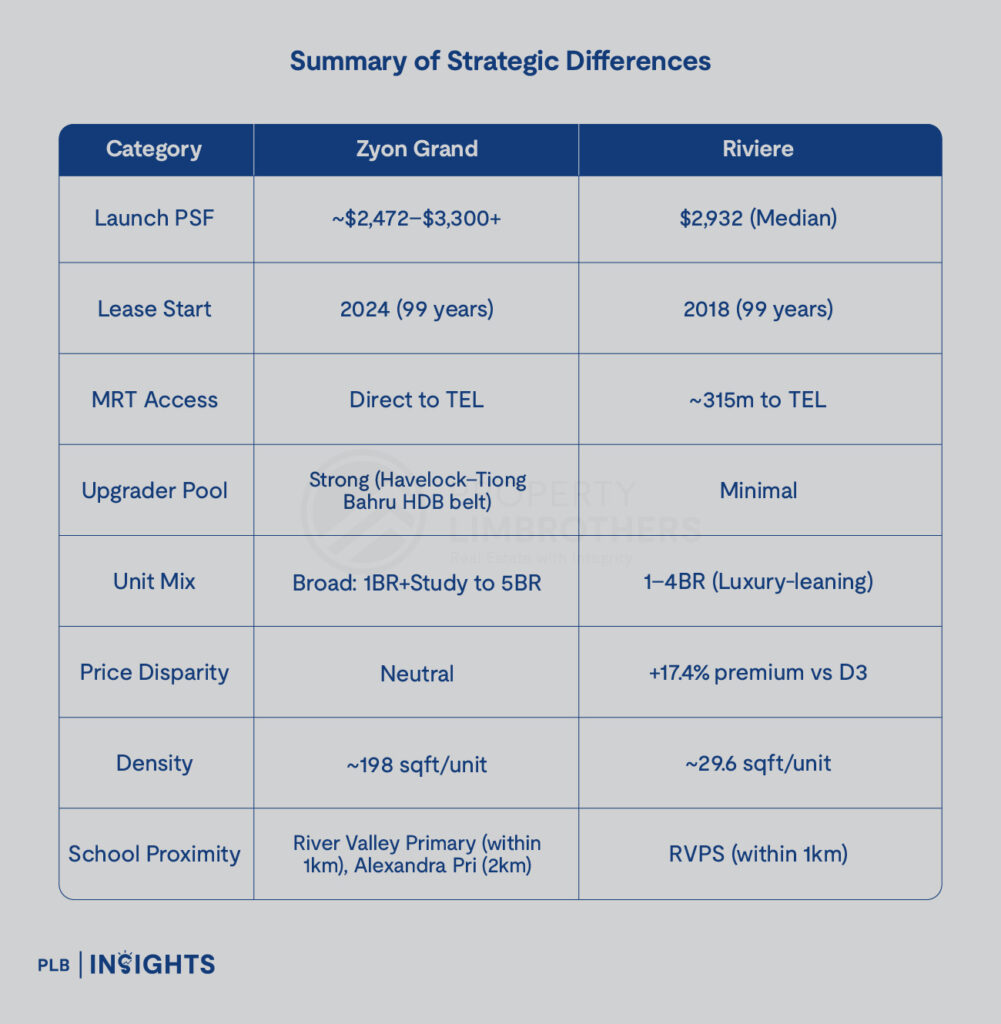

Summary of Strategic Differences

Key Insights: Why Zyon Grand Shows Stronger Long-Term MOATs

Better Pricing Corridor for Growth

While Riviere is already transacting at ~$2,932 psf, Zyon Grand launches at a lower base (~$2,472 psf) — giving it room to rise as nearby projects like One Pearl Bank and Promenade Peak push $2,900+.

Zyon Grand sits closer to the D3 median, reducing entry risk and enhancing capital appreciation prospects.

Integrated MRT & Retail – Long-Term Differentiator

Zyon Grand’s direct TEL basement access surpasses Riviere’s walkable 315m proximity. It also features curated retail podiums and childcare — offering full-stack convenience and increasing daily footfall.

In the long run, lifestyle integration becomes a magnet for both tenants and families — a key reason why MRT-linked developments command resilience.

Stronger Exit Audience Moat

Unlike Riviere (Exit Audience Score: 1), Zyon Grand taps into the large HDB upgrader population from Tiong Bahru, Havelock, and Delta precincts — a sustainable exit base with purchasing power.

This matters when resale liquidity and demand-side resilience are considered post-MOP.

Greater Density & Lifestyle Comfort

Riviere’s 455 units on just ~13,476 sqft results in a dense 29.6 sqft/unit — among the lowest across D3. In contrast, Zyon Grand enjoys a larger footprint (~139,931 sqft) for 706 units, offering ~198 sqft/unit.

The difference translates into more landscape, amenity spacing, and long-term living satisfaction.

Affordability & Quantum Accessibility

Zyon Grand’s broader mix of 1BR+Study (~$1.29M) to 5BR (~$5.99M) allows multiple entry points across demographics. Riviere’s high base quantum makes it less attainable for first-time buyers or dual-income families.

Final Verdict: Zyon Grand s the Future-Proof Play

While Riviere enjoys an established luxury presence and high rental appeal, Zyon Grand offers stronger long-term defensive moats — especially in the exit audience, MRT integration, pricing upside, and density comfort.

For buyers entering at sub-$2,500 psf in a rapidly appreciating RCR landscape, Zyon Grand represents a more value-laden, future-facing option — combining the right blend of investment fundamentals and livability advantages.

Takeaway

Zyon Grand delivers a flagship-level proposition that sets it apart in a competitive RCR market. Its combination of height, integration, branded luxury, and central access makes it a standout choice for buyers seeking a long-term asset, both in lifestyle and investment value.

While priced at a premium to most D3 projects, its attributes justify the corridor, especially when compared against core-central or CCR launches.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!