5 reasons why invest in Singapore real estate versus other investments

“Inflation takes from the ignorant, and gives to the well informed.”

In an age where everyone is always finding an edge to make their money work for them, there is nothing more thrilling than seeing your portfolio in the green. There are many ways for you to invest your hard earned money; such as Stocks, Cryptocurrencies, Bonds, Index Funds, and even the new craze in town – Non Fungible Tokens (NFTs). However, in such unprecedented times and extremely volatile markets, it’s worth taking a closer look at another class of asset: Real Estate (specifically Real Estate in Singapore).

Of course, the distinctions of Real Estate as an investment can get intense, but rewarding too. In this article, we lay it all out with an in-depth analysis as to why you should consider investing in Real Estate over other asset classes.

The first (and sometimes only reason you need) to invest in Real Estate: Low-risk Leverage

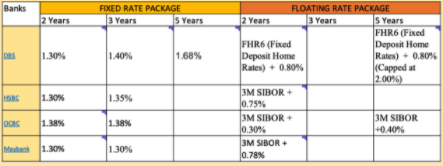

As we have discussed in our other articles, homebuyers are allowed to finance up to 75% of their property. These home loans usually have lower rates as compared to other loans, such as personal loan and business loan etc. Let’s take a look at the various types of loans offered in Singapore:

Mortgage rates:

Mortgage products offered by financial institutions in Singapore are mostly Adjustable Rate Mortgages (ARMs). Adjustable mortgage rates are determined by a reference rate (SIBOR, SOR, or Bank’s Board Rate) plus a spread/margin, and can come with or without any lock-in period (meaning prepayments are not allowed for the duration of ARM’s lock-in period). Investors should note that even though Fixed Rate Mortgage (FRM) packages are offered, these are usually disguised as ARMs, with fixed rates in the beginning 2-3 years, then becoming an adjustable rate thereafter.

Personal Loan rates:

It is common practice for individuals to take out a personal loan for deployment into other investment opportunities; such as to start a business, to invest in the stock market, or for other personal needs.

Business Loan rates:

Business loans can run anywhere from 1% to 13%, depending on the nature of the business and terms of individual banks.

As we can observe from the tables above, mortgage products have a much lower cost of borrowing as compared to leveraging for other investments. This plays a huge role in the overall profitability of an investment. Since home loans require mortgagors to put up their property as collateral, there is limited liability when leveraging for Real Estate investment because you are only forced to sell your investment home in cases of defaults. Seldom can you borrow money to invest at such a low rate and low risk. While investors are still able to utilise leverage for other asset classes in the form of margin accounts, these usually confer far greater risks, considering the volatile nature of equities and other asset classes like cryptocurrencies.

Buying on margin involves borrowing money from a broker to purchase securities, which allows for a higher profit potential, but also amplifies downside risks. Investors therefore face the imminent risk of a margin call in the case when an investment goes south. This requires buyers to liquidate their positions, or inject their margin accounts with more capital in order to keep their investments. Furthermore, unlike Real Estate, you don’t get to enjoy the usage of a tangible asset after paying down your loans. This is definitely much riskier as compared to taking out a mortgage to finance a Real Estate investment!

Tangible benefits of Low-risk leverage

The robustness of properties in Singapore as an asset makes it a low-risk collateral for banks, which allows home loan rates in Singapore to be significantly lower than that in other countries. This further caters to the low risk appetite of Real Estate investors locally.

The mortgage rate in Singapore has an average of slightly less than 2%. Home Loan rates abroad, especially India, however are considerably much higher, possibly due to the unique market structure and economic conditions in India; such as high corporate tax rate, high inflation rate, and even corruption.

With leverage, your gains can outpace other assets. By gearing up, your returns can be amplified when your rate of return on the investment is higher than the interest you’re paying on the mortgage. By only putting 25% (depending on the mortgagor’s financial situation) of the money down and borrowing the rest, the buyer is essentially only forking out a small percentage of the purchase price with their own money.

Let’s assume a private property bought for $1 million appreciates by 10% over 5 years ($100,000 capital gain). This is still considered a conservative approach as even the S&P500 generates a yearly return of 10-30%. However, with leverage, the $100,000 capital gain on the private property was achieved with a total cash outlay of less than $100,000, consisting of a $50,000 cash downpayment outlay with Buyer’s Stamp Duty and miscellaneous fees. The rest of the downpayment and mortgage repayments can be serviced by CPF Ordinary Account monies, which you cannot otherwise touch prior to reaching 55 years old. So technically speaking, the property buyer in this instance has just doubled his $50,000 in 5 years, whereas it would require you an annual yield of 15% to generate the same kind of returns in 5 years in the financial markets

Furthermore, with interest rates for home loans near an all-time low due to the low interest rate environment globally, this is an opportune time for property buyers to lock-in low rates for 3 to 5 years. In a high but falling interest rate environment, homebuyers and owners can also take on floating rate loans.

Three letters: CPF

Many Singaporeans have a considerably large reservoir of savings in their CPF Ordinary Account. Other than earning a fixed yearly interest, the only time when they can be fully utilised is when being used to buy a property or to service the monthly mortgage repayments. Coupled with the fact that rental yields of an investment residential property can exceed the 2.5% interest rate paid out by the CPF Ordinary Account, it is no wonder Singaporeans are utilising their CPF accounts to its full potential to pay off their investment properties.

Let’s take a look at an example below to see why CPF plays an influential role in the financing of an investment property. Let’s say a couple (decoupled to avoid paying ABSD) buys a new launch condo Affinity @ Serangoon at an asking price of $1.5m under the name of the wife. Details of the wife are as such:

Age: 46 Years old

Monthly Salary: $12,000

CPF OA account balance: $530,000

Cash Savings: $300,000

Mortgage loan:

-

25 years

-

2% interest rate (assuming it stays constant)

-

Monthly payment and fully amortised

To purchase the new launch investment property, the wife can finance up to 55% of the purchase price through a mortgage loan, and has to put down a 10% cash down payment. She can then finance the remaining 35% of the purchase price through her CPF OA account. In doing so, she would have to pay in total $530,000 in CPF monies, $195,000 in cash, and take out a bank loan of $825,000 with monthly repayment of $3496.80 ($1140 from monthly CPF contribution and $2356.80). Given the current positive market sentiments for private non-landed residential properties, let’s say the property appreciates by 20% in 5 years (or a 4% growth annually), she would be able to sell off the property at $1,800,000.

To put this in simpler terms, she would stand to make at least 6.5% cash on cash return annually if she could rent out the unit at a rate of $2356.80/mth, which is considered way below market rental price considering its premium pricing and location. (Review of Affinity @ Serangoon, Affinity at Serangoon Cluster House Strata Landed Singapore New Launch Review | PropertyLimBrothers, Ep 1 Pt 1 | Affinity@Serangoon Location & Site Review).

From the ROI on this investment opportunity, we can see why it is much more profitable to utilise your CPF OA account for a residential investment project, as compared to leaving your hard earned money sitting in the CPF OA account accruing a measly 2.5% return.

Buyers should however be aware that during the time of reversion, it is mandatory for them to return the CPF savings that was withdrawn, which includes the total of lump sum and monthly usage as well as the accrued interest, back into the CPF OA account.

Feel free to speak to any of our agents to find out more!

The best way to outperform Singapore’s robust economy

Because of the stability and periodic government intervention in the form of cooling measures, investing in the domestic Real Estate markets could potentially be the best way to outperform Singapore’s robust economy. Let’s take a look at how the property markets performed alongside the Straits Times Index (STI).

As robust and efficient as Singapore’s economy can be, it is still very much susceptible to macro global trends and events. For example, Singapore’s economy was badly hit by the 1997 Asian Financial crisis, and was affected even more by the 2008 Sub-Prime Mortgage Crisis. Also not forgetting the recent pandemic that sent shockwaves through Singapore’s economy, affecting the way we work, play and live. These events have adversely affected many investor’s returns in such volatile financial markets, and have become a motivating factor for many investors to look elsewhere for more stable returns.

With the lockdown and various safety regulations put in place by the government to curb the spread of COVID-19, Real Estate markets globally faced much uncertainty, and there was low confidence among investors. The property market in Singapore was surprisingly catapulted further, as we have mentioned in our other article, ”A macro look at the Singapore property market in 2021. Is now the time to buy?”, signally positive market sentiments and high confidence among investors.

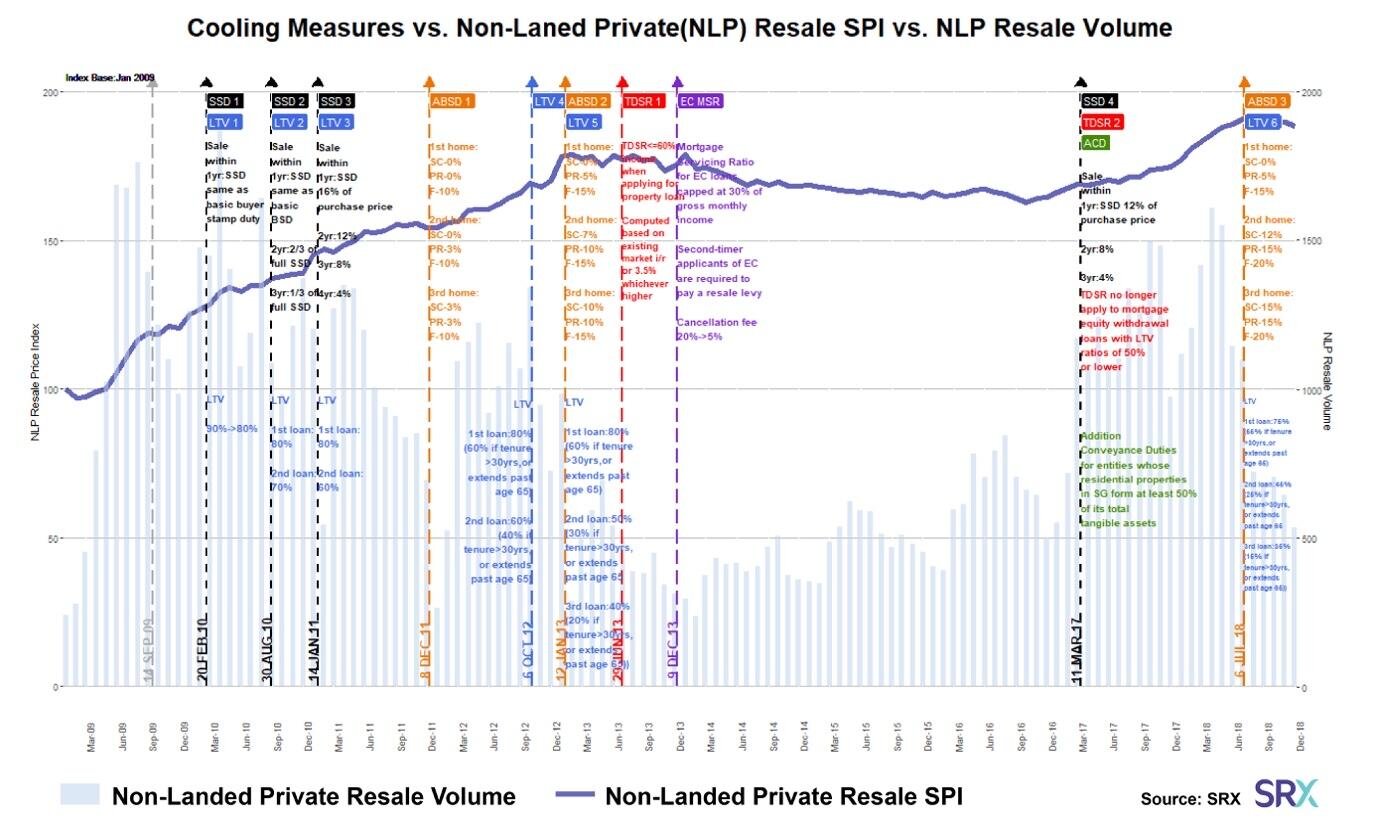

However, the property market in Singapore has seen steady growth over the years, even in times of financial instability. That said, the performance of the domestic property market is very much dependent on the supply and demand of housing in Singapore. This is where our Government truly excels, as they are able to bring in cooling measures whenever necessary, giving them the ammunition to curb the oversupply of housing, while mitigating potential downsides in the property market. These in general have ensured the stability of the property market in Singapore because cooling measures such as the Total Debt Servicing Ratio and Mortgage Servicing Ratio forces buyers to be more judicious when taking up loans and purchasing property, thus reducing mortgage default rates.

If you can recall, the government raised the Additional Buyer’s Stamp Duty (ABSD) rates and tightened the Loan-to-Value (LTV) limits for all housing loans granted by financial institutions in 2018. This was in response to the fact that the property market then was overextended, and moving “ahead of economic fundamentals”. With the current property market mirroring that of 2018, coupled by the fact that interest rates are near all-time lows, it proved to be a favorable environment for existing homeowners and potential new home buyers, and even those looking to refinance their mortgage loans.

As such, the government has been taking a measured approach to increase housing supply by launching a carefully calibrated GLS Programme in the first half of 2021, taking into account the effects of the pandemic and macroeconomic situation. Despite the low interest rates offered by banks, Singapore’s economy is still en route to recovery and it is uncertain that Singaporeans would have the financial ability to sustain the demand for private residences. Hence, the government needs to be careful to create an oversupply of private residences, which could send prices crashing. This has sparked rumors over when and how the next round of property cooling measures would be rolled out.

We have done an in-depth analysis of cooling measures, do check them out here:

https://www.propertylimbrothers.com/insights-posts/when-property-cooling-measures-come-2021

All in all, unlike the almost unpredictable nature of the financial markets, the government has the ability to control and stabilise the Real Estate market to a certain extent. This makes Real Estate an even more attractive investment option because the ability to mitigate downside risks of the property market gives investors more assurance and confidence.

Property hedges best against inflation

Even though investments in equities produce periodic income in the form of dividends (subject to terms of different companies), and sometimes generating healthy enough returns to beat inflation, it is often very volatile and carries a higher level of risk. Rental income from Real Estate however provides a more sizeable and steady stream of cash flow for investors, because it is a tangible asset that allows investors to control all aspects of their investment (they can decide when to renovate, whether to increase/decrease rent etc), the government can stabilise the property market by intervening through various cooling measures, and most importantly, there is always demand for housing because it is a necessity for people to have a shelter over their head.

For example, the average rental price of a 3-Bedroom unit at The Poiz Residences is around $3,800 per month. On the contrary, Coca Cola, also known as 1 of the 30 dividend kings who has been raising dividend rates for more than 50 years consecutively, pays shareholders a dividend rate of $0.41 per share Quarterly. To put this into context, it would require an investor to own approximately USD$509,756 (data correct as at date of publication) worth of Coca Cola shares to earn an equivalent amount of dividend Quarterly! This is assuming the best case risk profile where the investor owns every single share with their own capital, and did not utilise a margin account.

On top of that, investors can also choose to refinance their current mortgage arrangement, allowing them to repay their mortgage obligations at a lower interest rate/cost of borrowing, which could be fully/partially paid off with the rental income generated by their investment property. Moreover, investors would be able to profit off their investment property through price appreciation when they decide to sell a few years later. So essentially, they are enjoying healthy returns off their property over time without doing much work.

Let’s take a further look at Real Estate versus other asset classes:

Real Estate vs Stocks:

Historically, stocks tend to increase in dividends and price over time as evident from the S&P 500 chart. Information on public companies is widely available and coupled with the fact that there are many different sectors in the financial market, investors can diversify their risk and potentially increase their profitability if they know what they are doing and are able to perform proper due diligence. However, it is a known fact that stocks are unpredictable, and the volatile nature of the stock market can cause prices to fluctuate dramatically. Moreover, investing in the financial market requires a vast amount of knowledge and years of experience to get started, let alone becoming profitable. This might seem perfectly acceptable for financially savvy individuals, but it is a big barrie

r to entry for many individuals who are unfamiliar with the complex inner workings of the financial market. Sure, individuals can put all their money in the hands of mutual funds, their trusted financial advisors, or any other forms of money managers, but their returns will be greatly reduced after taking into account commission and management fees.

The property market serves as a more stable investment environment for those who do not wish to participate in the risker financial market. This is especially crucial in such unprecedented times where the pandemic has sent the financial markets into panic mode, causing the stock market to be extremely unpredictable, while real estate investors are consistently generating steady streams of rental income.

Real Estate vs Bonds and CPF:

As we all know, CPF is a savings scheme introduced by the government to provide retirement benefits for Singaporeans. Singaporeans can make monthly contributions to their CPF accounts, which would accrue interest at 2.5% for the Ordinary Account, and 4% for the Special and Medisave accounts. Upon reaching the age of 65 years old, individuals can enjoy a monthly payout of $1,350 -$1,450 should they fulfill the Full Retirement Sum (FRS). Similarly, bonds like the Singapore Savings Bond (SSB) allows investors to earn revenue through interest upon the date of maturity.

It offers a gradual step-up of interest rate from 0.38% in Year 1 to 3.22% in Year 10, which is much more profitable than leaving your money in a regular savings account in a bank! This means that the longer you hold, the more profitable you will be. However, with inflation rate standing at 1.5% in Singapore, investors are essentially losing out money to inflation in the first 5 years of the bond period!

Even though Bonds and the CPF serve as a very low risk investment option, it comes with low returns. Furthermore, Singaporeans are not allowed to touch the monies in their CPF account until the age of 55. While the SSB allows investors to pull money as they wish, investors would stand to lose out on the higher interest rate in the later years.

Therefore, the opportunity cost is way too high, and investors would be much better off putting their hard earned money to work in Real Estate investments which could generate steady streams of cash flow, offering higher liquidity for investors to potentially create more income generating assets.

Moreover, investment properties can serve as a tax shelter through reduction of taxable rental income. When filing for income taxes, investors can exclude the cost and fees related to the upkeep of the property. These fees can include anything from interests on mortgages and travel costs to sign contracts, to depreciation & repairs, insurance, and legal & professional fees. Investors can take advantage of this tax shelter to maximise their rental income, making their investment more profitable.

Real Estate vs Gold and other commodities:

Gold is often hailed as a hedge against inflation, as it increases in value as the purchasing power of fiat currencies declines. However, the value of gold is subjected to volatility, and there is also a need to consider the storage and logistical complexities of gold ownership. Furthermore, investing in gold involves a very long-term horizon as investors cannot do anything to influence the value of gold. They could only wait and hope to sell it off at an opportune moment, so it is truly a waiting game. However, investment properties allow investors to enjoy monthly rental income while waiting for the asset to appreciate in value, giving investors much more cash flow in general.

Final Verdict:

Savvy investors often have Real Estate as part of their portfolio. Afterall, some of the richest billionaires in the world made their fortune through Real Estate! With the property assets in Singapore having a clear superiority over other asset classes and Real Estate in other parts of the world, investors, especially those with sufficient CPF monies, should perhaps merit a bigger portion of their portfolio into exploring various investment properties.

The fact is that Real Estate in Singapore is an investor’s dream come true: a low-risk, low volatility asset class that is potentially high-yielding especially over the long-term. That said, we still have to consider the various trade-offs between investing in Real Estate as opposed to other asset classes:

Undoubtedly, Real Estate in Singapore is truly in a league of its own as an investment asset. With such high costs of living in Singapore, it is almost impossible to live off just one source of income. That said, Real estate investment in Singapore allows investors to tap into the latent advantage of low-risk leverage and usage of CPF monies to finance their investment properties, giving them an edge to beat out inflation and outdo their compatriots in the financial markets.

Speak with us to find out how you can uncover the latest opportunities out there in the market today!