If you thought 2021 was a year of new launches, 2022 might surprise you. In 2021 alone, we saw 27 new launch projects, but this year, we might be seeing a number close to 40. Some notable new launches that have drummed up much interest are Piccadilly Grand that was just launched in late April, Ang Mo Kio Avenue 1 slated to be launched sometime in June, as well as the Lentor Central parcel to kickoff the entire Lentor transformation.

And what usually follows the excitement of new launches is also the lamenting of often record-breaking prices for new launches. Perhaps due to their confidence in market sentiment, and their diminishing land bank, these developers have been setting high bids for land parcels.

GuocoLand made the news last year by winning the tender for a land parcel at Lentor Central. The winning bid was $784.1 million, which roughly translates to $1,204 per sqft per plot ratio. This is 4.5% more than the second highest bid of $750 million. This cost is then passed on to the buyers via the eventual sale price, which we expect to easily reach the $2000 psf mark, on average.

But all that does not deter hopeful buyers. New launch sales are expected to still go strong, and we see that evident in the throngs of people who turned up for the preview of Piccadilly Grand in late April.

So if you are thinking of getting into this scene, you will probably want to get a good deal. And if the property purchase has an investment angle to it, every dollar counts, so the biggest discounts you can get will go a long way in driving up your capital gain.

That leads us to the question – when is the best time to buy into a new launch? Are the best prices given early in the launch, or later in the launch when the developer is trying to clear units?

The early bird catches the worm

If you speak to any real estate agent, chances are that they would tell you that early buyers of a new launch tend to get the best discounts and lock in the lowest prices. This is generally true to some extent. Here’s why.

Developers often adopt a loss leader marketing strategy whereby they price the initial units at discounted prices. These attractively priced units are usually the loss-makers, used to lure in customers, and generate hype about the project. The more buzz about the project, the more traffic this will bring to their showflat, which then results in sales.

There is also the construction loan, that is typically disbursed to the developers once they have sold around 30% of their units. Before this, these developers were digging into their coffers to support the construction costs. It is thus important for developers to get the disbursement of the loan as quickly as they can to relieve the financial burden they have. And to do so, they price their first 30% (varies across projects) attractively so as to generate enough sales to meet the criteria for loan disbursement.

Developers, being business entities, have the sole objective of driving profits. Once the construction loan is secured, they will start prioritising profits, and will generally increase prices of the subsequent units.

One example of such a project is Normanton Park. The average launch prices were hovering at the $1700 psf mark, but in a year from then, the prices have steadily increased to around $1900 psf.

Irwell Hill Residences is also another project that showed the same general incline in price transactions. The average launch prices started at the $2500 psf mark, and slowly rose to $2900 psf at its peak in a matter of 5-6 months.

But there’s also the other camp

As with all arguments, there is always the other camp of supporters, who believe that waiting out the initial hype of the project will get you better prices later on in the launch. And these arguments are not without merit.

Developers tend to drop prices in 2 instances:

Situation 1: Introduction of cooling measures

Price drops for new launch sales are a common trend observed whenever a new round of cooling measures is announced. These price cuts are used to cushion the impact of the measures on buyers, and also to reflect a downturn market sentiment.

A famous example is Sky Habitat. Launched in 2012, it was lauded for its iconic design, but also created buzz for the prices. At that time, it was the most expensive condominium project in the RCR/OCR, with launch prices averaging around $1600 psf. This was due to the high bid price that the developer paid for the land.

Unfortunately, the project was plagued with some of the hardest hitting cooling measures – the Total Debt Servicing Ratio (TDSR). A year later after Sky Habitat’s launch, TDSR was introduced, and that turned the market on its head. TDSR was particularly effective in dampening demand because it was not a gradual cap on the maximum debt you can take on, but a sharp 60% limit that was slapped on to buyers.

For a development that was priced that expensive at launch meant that many potential buyers could no longer sustain that loan, and demand dropped drastically. As a result, the developer had to drop their prices to as low as $12xx psf to clear their leftover units.

And to make matters worse – Sky Vue, a development right next to Sky Habitat, also by the same developer was launched a year later, with prices at $14xx psf. Because of that, the prices for new units at Sky Habitat languished for a few years between $14xx to $16xx psf. Those that entered Sky Habitat in late 2013 and 2014 would have already made a gain on the early buyers that bought at $16xx psf.

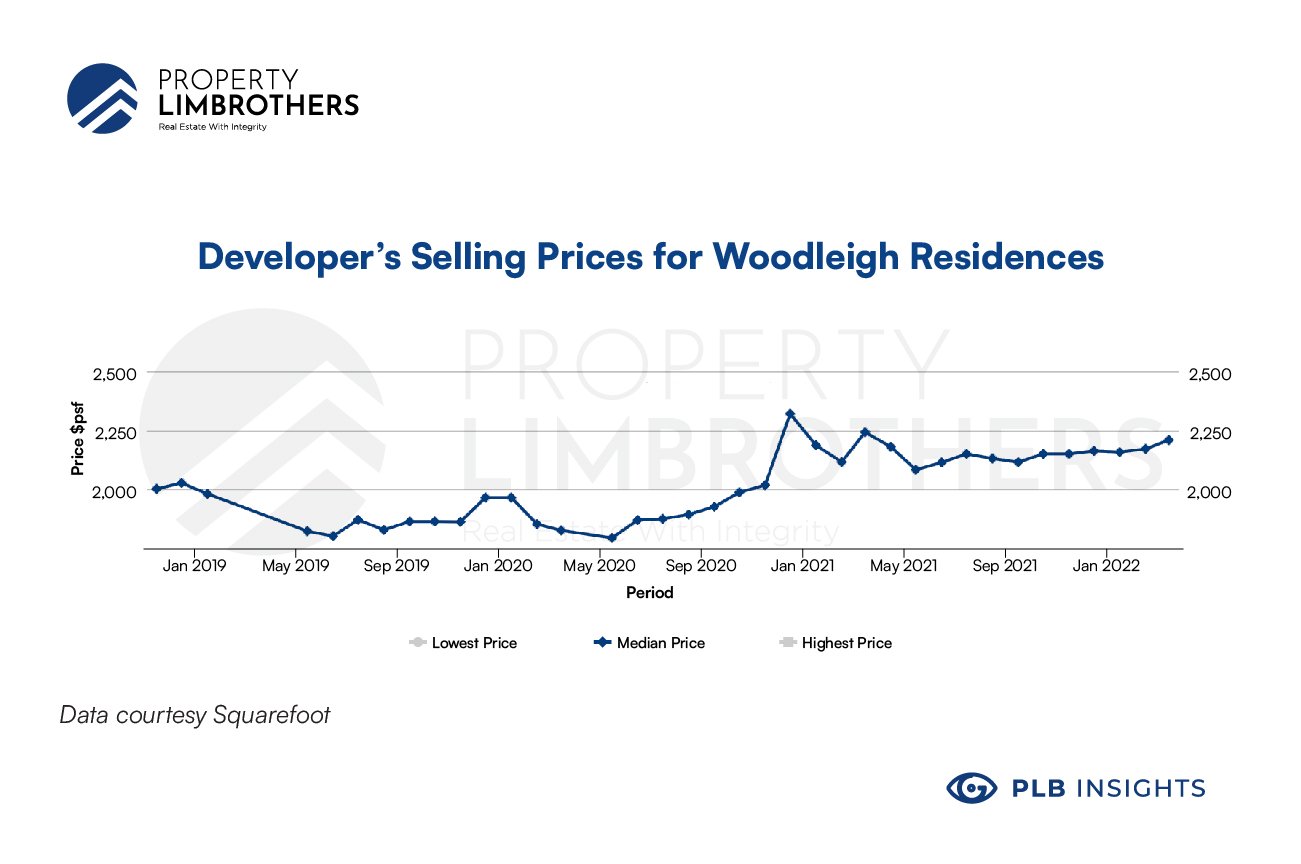

A more recent example is the raising of Additional Buyer’s Stamp Duty (ABSD) and tightening of Loan-to-Value (LTV) limits in 2018. Buyers became more cautious, and Woodleigh Residences, also launched in 2018 suffered as a result.

It launched at an average of $19xx psf, but was relaunched again in mid 2020 at $17xx psf. It has since climbed up as the market sentiment was overwhelmingly positive in the pandemic years, but those that bought into the development from late 2019 to early 2020 were the winners.

Situation 2: Looming ABSD deadline

Yes, developers have got to pay Additional Buyer’s Stamp Duty (ABSD) as well, but they have this neat advantage of being granted remission if they meet certain criteria.

The ABSD for developers was first introduced in 2011 as a way to regulate developers and prevent them from buying land at record prices, and passing the cost onwards to the buyers. It also held them accountable in developing the properties at a fair pace, and pricing them competitively.

In December 2021, the ABSD for developers framework was again revised upwards to now 40%, of which 35% ABSD may be remitted once the developers have met the required criteria.

This criteria include a 5 year timeline for developers to develop and sell all units. If the developer fails to sell all units, and is left with even just 1 unit, they have to pay the full 35% of ABSD on the land price.

As you can imagine, this 35% ABSD is a hefty amount to pay, and that is also why you will see developers giving heavy discounts for their remaining units when they are reaching their ABSD deadline.

New launch developments that will reach their ABSD deadline in 2022 include the following projects: Normanton Park and Amber Park, both of which were sold in 2017. At the time of writing, Normanton Park has about 63 units (3%) left, and Amber Park with 31 units (5%).

Not that easy to time entry into a new launch project

But there are two downsides to this strategy, one being leftover units tend to be those that are not as favourable due to factors like facing or floor level. Waiting to the later phases of a new launch will therefore limit your choices, and you may end up choosing units that you may have a harder time exiting. So even though you have saved money in terms of getting better discounts, chances are that the unit would transact at a lower sale price as compared to the premium facing units that were bought at a higher price.

Additionally, it is hard to predict whether developments can sell well or not. Some projects have managed to sell really well without further discounts due to a combination of factors such as prime location, future growth in the area or even famous architectural design. For example, Canninghill Piers dominated the news with its distinctive design and prized location, and ended up selling over 77% of its units at its previous launch. Those who decided a wait and see approach were relegated to the last few units in just one weekend.

So yes, while there are some benefits to waiting out the initial hype of the project, it is never with certainty that you would enjoy a lower price if you buy in later.

What if we buy at a higher price, can we get a refund?

Developers are not legally required to refund the difference in price to early-bird buyers, so it is quite rare for them to offer full compensation or a partial rebate to these buyers.

There are certain instances when developers have given some form of compensation as a form of “goodwill”. For example, in 2001, CapitaLand gave a rebate of about 5% to some of the early buyers for the condominium project, Tanamera Crest. Launch prices were around $5xx psf, but was relaunched later that year at $4xx. However, we have not seen such behaviour in the past few years.

But oftentimes, as developers tend to give early buyers promotional prices or loss-making prices to stimulate sales, it can be difficult for the developer to cough out extra cash to compensate these buyers. This is especially so if the developer’s profit margins are thin, and they have barely broken even on the rest of their units.

Unless the developer had explicitly stated, in writing, that “this would be the lowest price ever”, it would thus be difficult to prove a claim of misrepresentation, and buyers have little legal recourse.

So what can we do to avoid getting the short end of the stick in both scenarios?

While it is impossible to predict with 100% accuracy how developers would price the units at launch or later on, there are a few factors we can analyse to determine the possibility of the price moving upwards or downwards.

Factor 1: Developer’s profit margin

A key consideration as to whether the developer will drop prices later on would be its profit margin.

The profit margin is calculated by taking into account land and construction costs, which are fixed overheads. The difference between the costs and sale price would be the developer’s profit margin.

If we understand the breakdown price for the developers, we could then figure out the lowest price point they are willing to drop to. If the sale price is far from the breakeven price, we can conclude that the developer has built in a significant buffer for price movements in between. This may result in the developer giving big discounts in the later launches if the project is not selling as well as expected.

In contrast, if the developer’s sale price is very close to its breakeven price, it is unlikely that the developer will be cutting its prices massively.

A general way to estimate the breakeven price of a development is as follows:

But in today’s market, it is not as common to see developments with a large profit margin. There are 2 reasons for this – the land costs which have been transacting at new benchmark prices, as well as the stiff competition from other new launch developments.

Factor 2: Demand and supply of units in the area

The demand and supply of units in the area has a huge impact on the interest and take-up rate of new launch units. Let us illustrate with 1 example:

In 2019 and early 2020, many buyers were trying to time the market, and were hoping for the property market to dip. When the pandemic hit, most expected the property market to start showing signs of a decline, but as we have all seen, the property market for both resale and new launch units flourished in the last two years.

Although some new launch projects gave discounts, most other projects had very successful launches. Contrary to expectations, prices for new launch units in the Rest of Central Region (RCR) and Outside Central Region (OCR) region were on an upwards trajectory. Some examples of OCR projects that made the news were Pasir Ris 8, and the Watergardens at Canberra.

One of the key reasons that led to this phenomenon was the changing demand appetite of local buyers, and their willingness to pay higher prices for units in the RCR and OCR.

Traditionally, new launches in the Core Central Region (CCR) attracted many foreign buyers, but with the pause in travel and prevalent work from home arrangements, the foreign demand dipped. At the same time, local buyers were also looking for bigger sized units to accommodate work from home arrangements.

And this supply of these larger units is more commonly found in the RCR and OCR, where the quantum may also be more affordable for these buyers. As such, this led to an increase in demand for projects in the RCR and OCR region, and a drop in demand for CCR projects.

These popular projects in the RCR and OCR would have seen prices continue to increase at the later stages of the launch. Take for example Pasir Ris 8, prices started at around $1600 psf, and swiftly rose to $2000 psf at the tail end of the launch. The lower psf in January 2022 onwards is due to the 5 leftover units of the development, or otherwise known as “star-buys” that were also some of the larger units. If you were an early buyer for this project, you would have enjoyed a paper gain, as the later units all transacted at a higher psf than your purchase price.

But that is not to say RCR and OCR new launch projects are the way to go moving forward. In previous years, the price disparity between CCR and the rest was a reason why buyers looked to the RCR and OCR areas. However, due to the increased demand and transactions, psf prices of units in the RCR and OCR have been steadily climbing, whereas the psf prices in CCR have not risen as fast.

This means that as the price gap continues to close, buyers would naturally be more compelled to consider CCR projects. With time, this would nudge both demand and prices in the CCR upwards, and the cycle continues. And that is also why we think projects in the CCR may be the next hotspot for buyers to invest in. You can read more here as well.

In summary, it is important to understand the changing trends of demand and supply before investing into a new launch. If the project has strong demand, the developer is likely to continue increasing prices, and as an early buyer, you would have already made a paper gain in a few months.

Factor 3: Developer’s reputation

Generally, developers only revise their prices downwards by means of discount/rebates as a last resort because of situations like a looming ABSD deadline, or they are clearing the last few “star buy” units that are hard to move because of unfavourable facing/layout etc.

But when developers offer discounts on a significant number of units, industry watchers will sit up and take notice. There will be speculations about the state of the developer’s finances, as well as criticisms of their marketing strategy. Ultimately, the developer’s reputation will take a hit, and buyers would lose confidence in the upcoming projects by the developer. Buyers would think twice before buying a unit from that developer as they do not want to suffer the same fate.

As such, developers with deep pockets will try not to go down this path, and they may take the units off the market in the meantime, and launch them again when the market sentiment has improved. Additionally, these experienced developers have also done tons of market research on sentiment and price, and they are likely to price their units fairly to avoid being caught in this situation. In such developments, you will expect to see price transactions moving upwards, with later buyers paying a premium for their units.

Bottom line is: do your research

While there are instances where late buyers get a better deal than early buyers of a new launch, these are dependent on many external factors like the announcement of cooling measures, that are oftentimes not within our control and therefore, hard to predict. The wait-and-see approach has its benefits, but we feel that the risks of getting leftover units that may not be as preferred, or having to fork out a greater premium, greatly outweigh the potential savings buyers may get.

We feel that it is generally best to enter new launches early to grab the better deals and have your choice of units, but that is not to say you should blindly rush into any new launch that pops up. Your best bet should still be to always do your research, compare the new launch with its competitors, and run the numbers.

And if you need an expert opinion, we would love to get in touch. Come speak to us here and we will be happy to discuss in greater detail with you.