Imagine this. At 35 years of age, you purchase a property, and when you have fully paid off the mortgage after 30 years, at age 65, you might think of selling off this property and downgrading, since your children would have all grown up, purchased their own properties and move out of yours. What is your break-even price?

Let’s put in some numbers to illustrate this scenario.

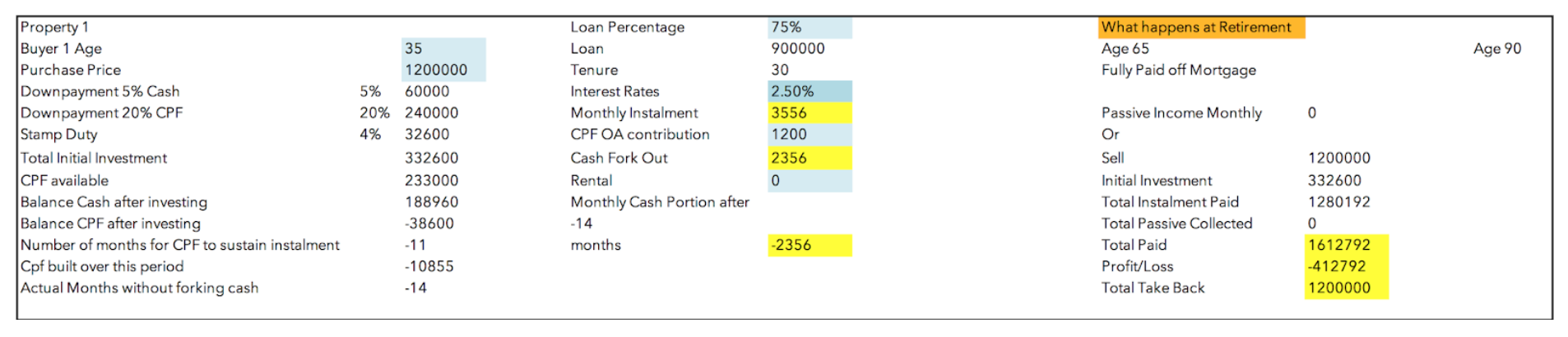

The property is purchased for $1.2 million. You pay a 5% down payment in cash (=$60k), a 20% (=$240k) from CPF, and stamp duty of $32,600. You take up a maximum 75% loan (=$900k) with a 30-year mortgage tenure. For illustration purposes, let’s take interest rate to be at 2.5% throughout. The monthly instalments will work out to be at $3556. Of course, if you are currently working for an employer and drawing a stable salary, CPF contributions to your OA will definitely help you offset some of the costs. Notice that to keep it simple, we have also excluded monthly management fees and sinking funds, and annual property tax.

What would be my cost, after 30 years, if I need to sell it off and breakeven just for the bank interest? $332,600 would be the initial investment that you have pumped into the property. The 25% down payment (5% cash, 20% from CPF) + stamp duty + total instalments you would have to pay over the next 30 years, altogether amounts to $1.28 million. Without taking into account your MCST and property tax, you need to sell your property at about $1.612 million to get back the amount of money you would have put in — this would be your gross breakeven price point you would be aiming to achieve.

Your property was purchased at $1.2 million. 30 years later, it has to be sold at $1.612 million. Do you think your property has the potential to achieve that appreciation effect and allow you to breakeven? If you can only manage to sell your property at your initial purchase price of $1.2 million, will you be able to carry this cost of $412k — roughly $13,759 a year, or approximately $1k a month? Further, if inclusive of the MCST and property tax costs, monthly losses will all amount to about $1.5k to $1.6k – not inclusive of any agent representation fees to sell the property.

Many people do not consider such costs, and whether the property has the potential to appreciate to a level that allows you to breakeven (especially if you plan to sell off in the future). It really depends on which group of property buyers you belong to — if you plan to sell your property, or if you just plan to hold the property and enjoy it all the way.

Hence, it is important that we understand what type of buyers our clients are so that we can appropriately structure their property portfolio plans accordingly.

Cheers,

Marc Chan