In this episode of our investors series, we dive into calculating the breakeven price of your property and the steps you can take to reduce your breakeven price!

So … What is Breakeven Price ?

The Breakeven price refers to the price that you can sell your property for that equals to the total sunken cost in purchasing that specific property.

Let us use the following example as a way to illustrate this concept.

Assuming that you are currently 35 years old and intend to purchase your first property, with a purchase price of $1.2 Million. You intend to own this property until it is fully paid off. A thirty-year tenure mortgage will be taken against the property. At age 65 the property would have been fully paid off.

We will exclude the management cost and property tax paid for. The reason for exclusion is because of the idea that we are consuming the property, enjoying its facilities and that property tax is a definite cost that everybody has to incur.

The example is summarised as follows:

Breakeven Price Formula

From the above illustration, we have shown that we can take that the formula for the breakeven price is as follows:

The illustration also shows that the overall cost of a property often largely differs from the “price tag” – the initial purchase price of a property. This is due to the fact that buyers will have to pay for the stamp duty and the mortgage loan (Principal + Interest of Loan)

Can the property appreciate to the level of breakeven?

Hence something to consider when selecting a property is whether the value of the property can appreciate to the level of breakeven price. Should the property be able to appreciate to the level of breakeven price, there would theoretically be no cost incurred over the 30 years of stay in the property.

If the value of the property appreciates further, you would have made money back through appreciation over the years should you choose to sell the property.

However if the property is unable to appreciate over the years of stay, one would have to consider if they are willing to incur the difference between the purchase price and breakeven price as a cost of staying in the property for the 30 year.

Although property appreciation is something that is determined by external factors and cannot be controlled by you. What we can aim to do is to reduce the breakeven price.

How can you reduce your breakeven price?

1. Refinance Home Loan to a lower interest rate

By refinancing your home loan, you can get a lower interest rate and thus lower your monthly mortgage instalments and thus overall breakeven price.

Pro tip! Your refinancing window starts 4 months before your existing home loan renews. Banks often require a 3-month notice before you refinance and switch to another bank, hence it is important to know when your lock-in period will end in order to plan ahead and prepare for the refinancing process.

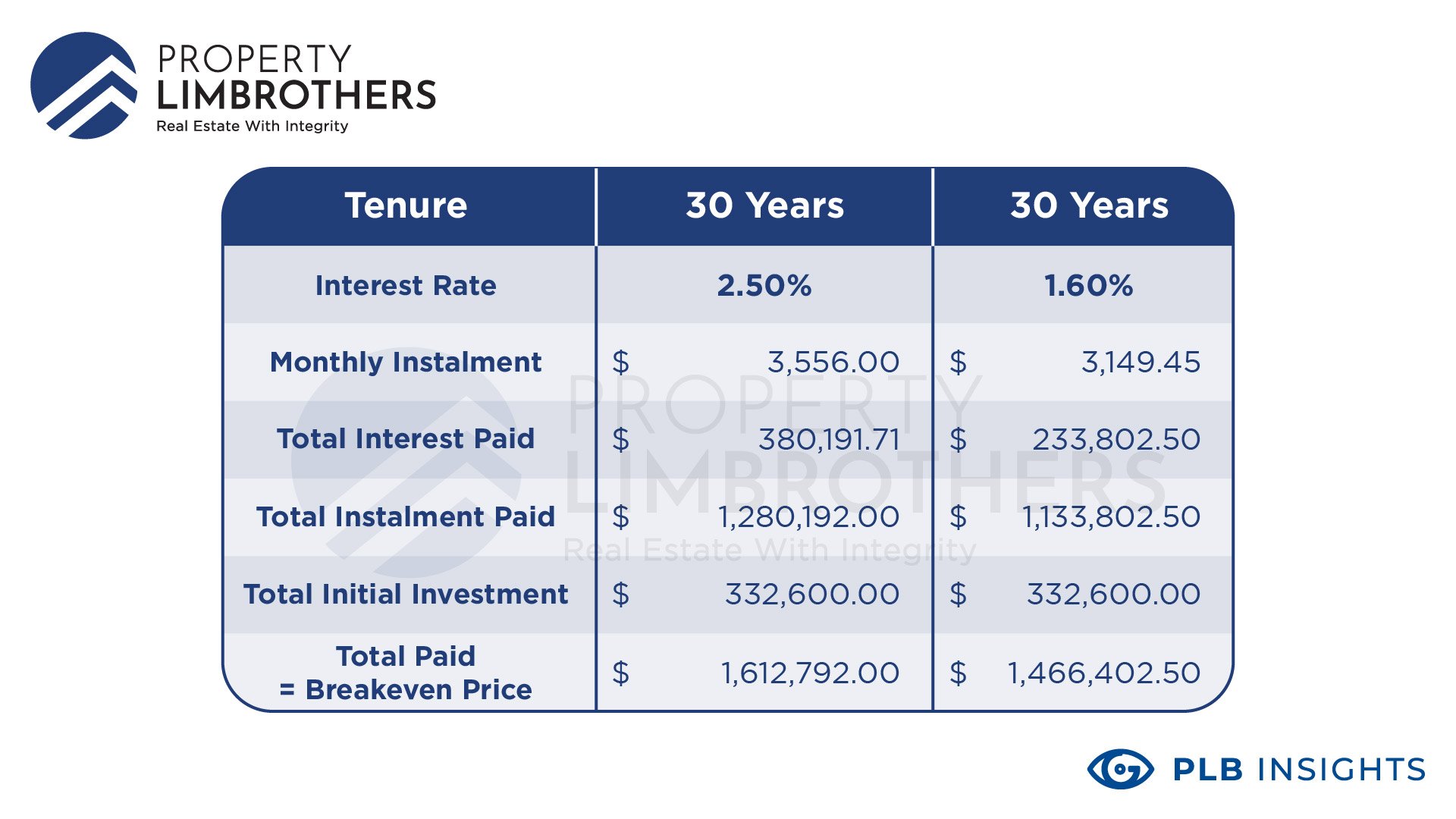

In the following example, we take a look at what would happen if you were to be able to refinance your mortgage interest rate from 2.5% to 1.6% based on recent interest rates that have been available due to the COVID-19 situation.

As seen from the 2 graphs above, the Singapore Interbank Offered Rate (SIBOR) which is the benchmark interest rate for lending has been falling in recent years. Thus by converting from a fixed interest rate to a floating interest rate (vice versa), one would be able to secure a loan with better interest rates.

A fixed interest rate package has its interest rate locked in for a certain period. Although it is more stable, the interest rate is slightly higher compared to a floating rate package.

Hence changing to a floating rate home loan which has its interest rate pegged to the SIBOR could benefit you in terms of paying less interest.

However, those tied to a floating rate may want to change to a fixed rate package to better plan and manage their long-term finances. Those who have also done research on SIBOR rates can switch to a fixed rate if they expect the benchmark to inflate in the near future to lock in lower interest rates.

2. Shortening Loan period

If your financial status allows you to afford a higher monthly instalment, you could take advantage of it by taking a lower loan tenure which would result in paying less interest on the mortgage.

To summarise, the idea of reducing your breakeven price follows the principle of lowering the amount of money spent on interest paid on mortgage loans.

Conclusion

Understanding the breakeven price and ways you can reduce it will provide a deeper perspective to conclude whether to stay for 30 years or to sell in a shorter period and restructure your property investment portfolio.

Sometimes a lot of property buyers often do not consider the overall cost involved when purchasing a property. Hopefully, this article has been informative and brings to light what are the overall costs involved in purchasing a property to help you when selecting your next property.

Considering the breakeven price of a property is a part of our property planning for our clients that is used in conjunction with other different points of view so that we can structure the property investments to cover a wide range of angles for the overall plan itself. Not forgetting that this method of calculating breakeven price has yet to factor in inflation which could help with the value of your assets. If you want to find out more about inflation and how it affects your property investments, check you “Do not invest in Properties if you have not watched this! | Investors S2 Ep 03”

Need more guidance? Feel free to reach out to our PropertyLimBrothers Buyers’ Consult team. Click here to contact us now!

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.

Ps: Place this hashtag #InvestorsSeries in front of any questions you might have for us in our comments section below, or feel free to email us at [email protected]. We would love to answer your queries surrounding property investing in Singapore!

Interested in finding out the key factors in considering your property’s monthly instalment? We delve into that in our insights article here!

Curious to find out the key factors in considering if you should buy a property to rent out? We delve into that in our insights article here!

To check out our Investors Series Season 1 click here!

And for Investors Series Season 2 click here!