District 21 has been one of Singapore’s most reliable profit compounds for patient owners. Using resale evidence by holding period, bedroom mix, and project outcomes, three themes repeat: discipline in holding pays, family-sized layouts monetise best, and a stable set of projects consistently outperform.

What the data says at a glance

So we cleaned and aggregated D21 transactions to focus on signal over noise. Here are the summaries we are basing this on:

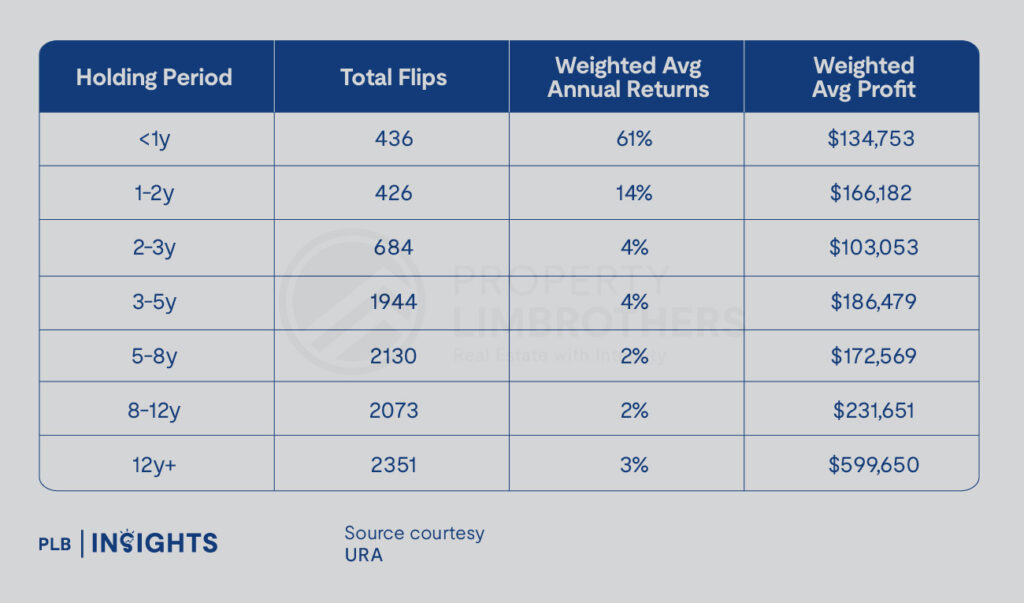

Holding-period performance overview (weighted by number of flips):

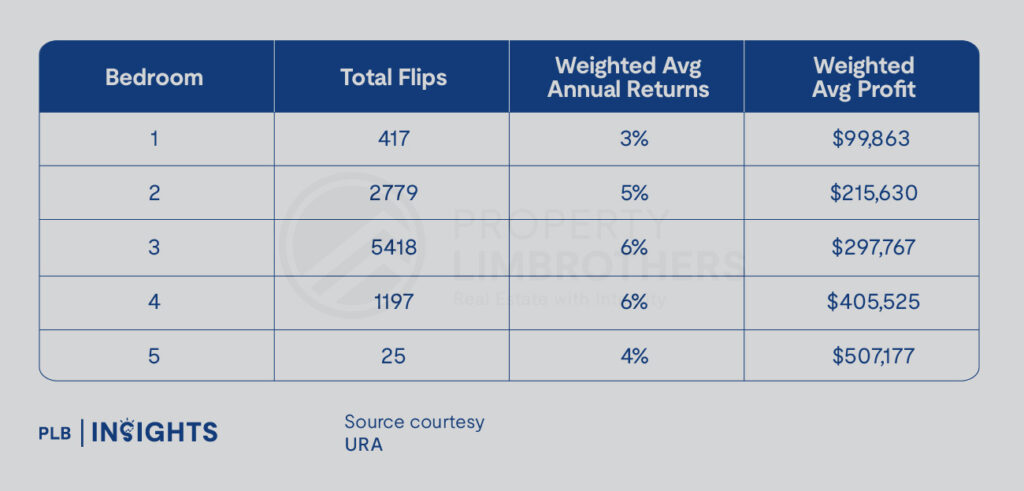

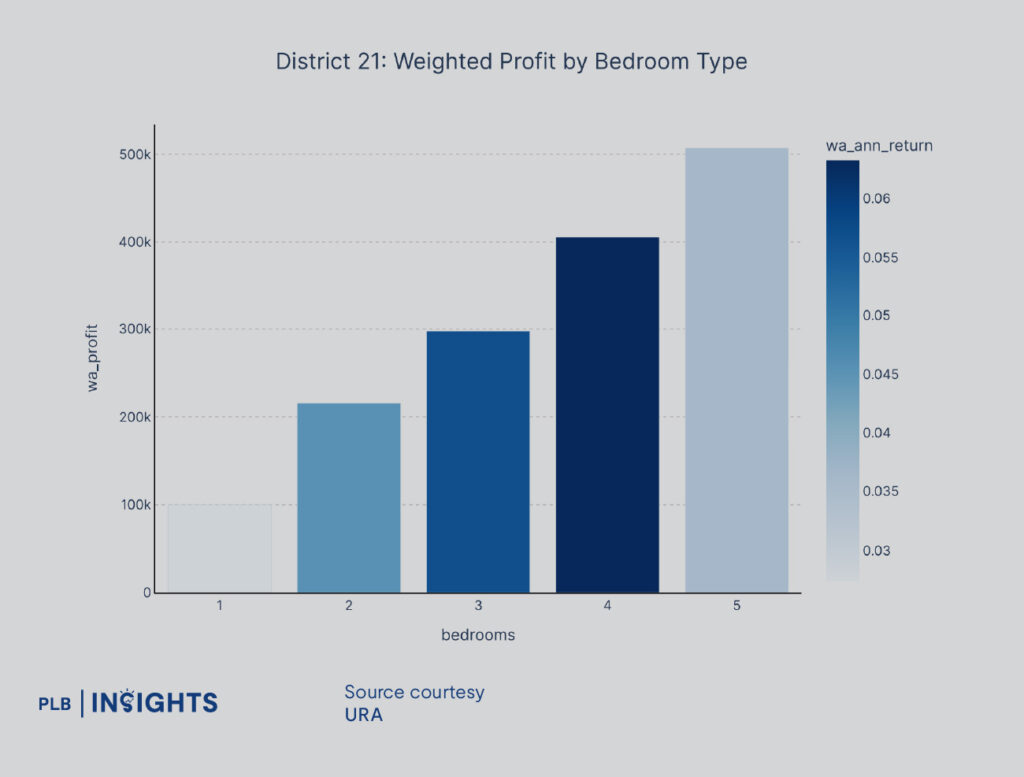

Bedroom segment performance overview (weighted):

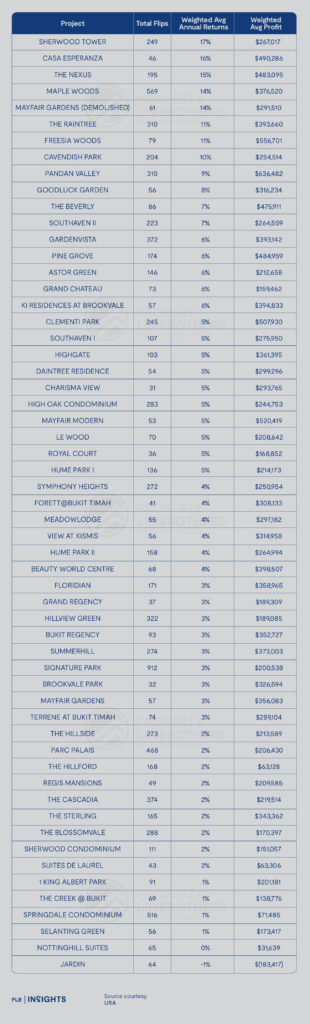

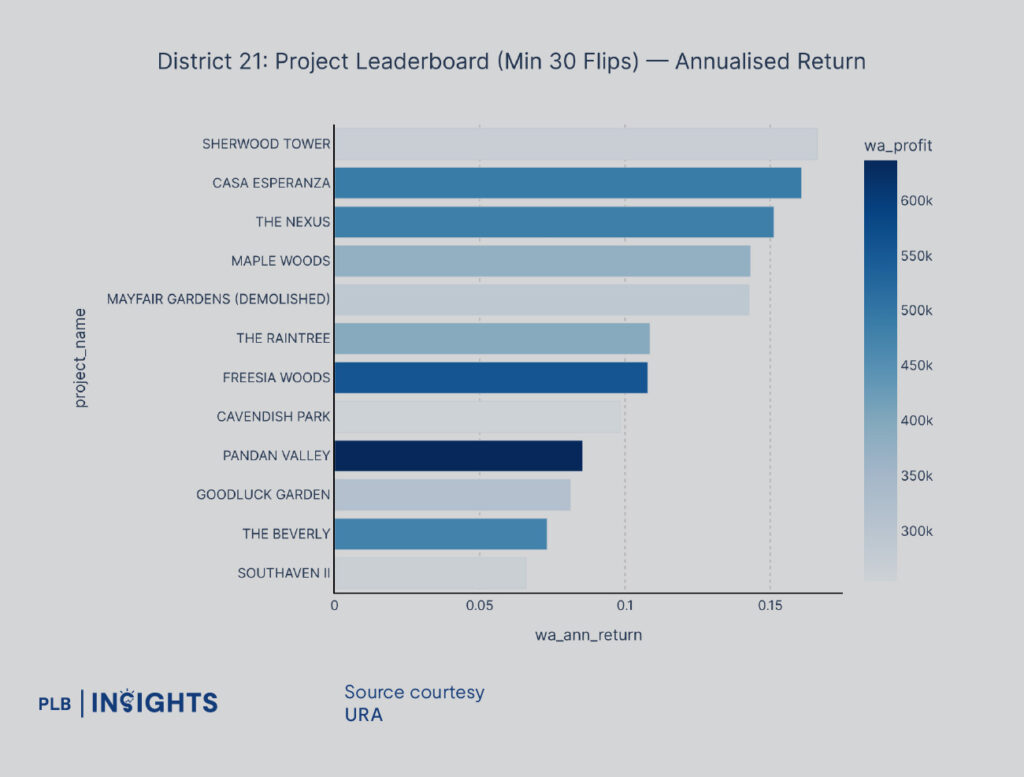

Project leaderboard, filtered for trade depth (min. 30 flips):

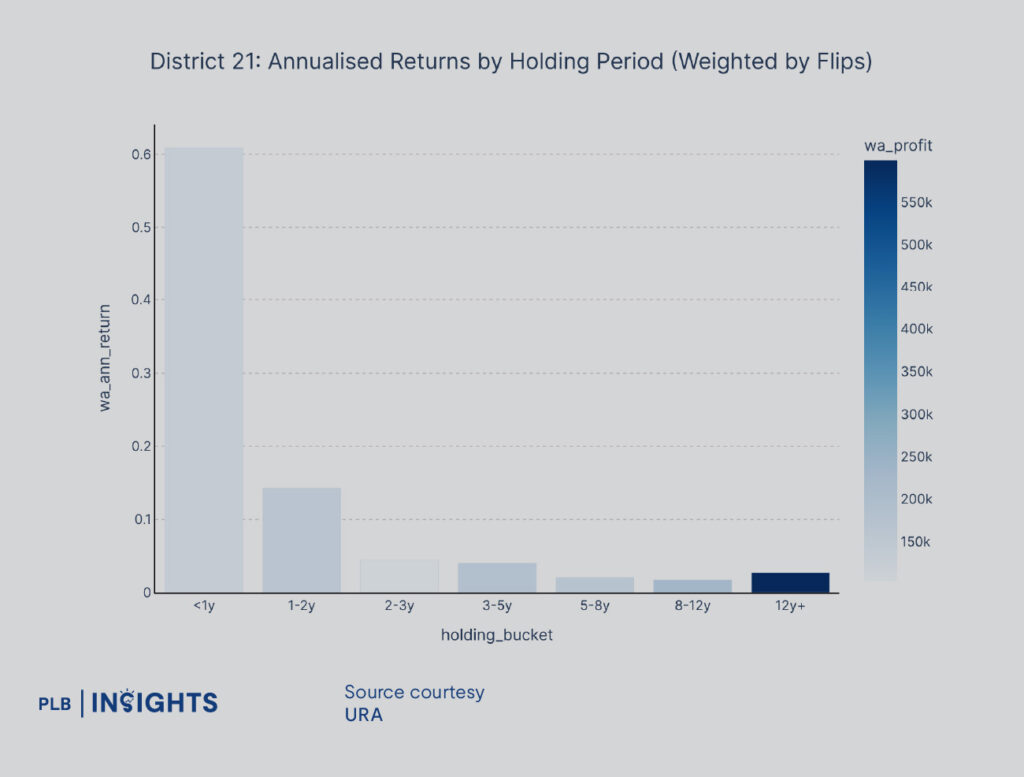

And here are the charts that visualise the same tables:

D21 Insights

Holding periods: patience out-monetises noise

Short flips can show extraordinary annualised returns, but the durable absolute dollars accrue to mid-to-long holds. In D21, the 8–12 year window posts the strongest weighted profits, while 12y+ holds demonstrate the district’s compounding power in absolute terms. The trade-off you see in the chart is classic: early trades can spike rate of return, but consistent, large outcomes come from time-in-asset rather than timing the asset.

What makes that work here:

Bedroom strategy: follow the upgrader wallet

The bedroom view is unambiguous: absolute profits rise markedly from 2- to 4-bedrooms, and annualised returns improve through the 3- and 4-bed segments. This reflects D21’s buyer base — families who value school adjacency, greenery, and functional layouts.

The implication for buyers:

If you want to optimise exit depth and dollars, 3- and 4-bedders are the sweet spot.

One-bedders are niche in this district; they move, but the big money is family-format led.

Five-bedders are rare and can show high profits in dollars, but sample depth is thin and liquidity can be episodic.

Project leaders: where product-market fit meets liquidity

When we filter to projects with meaningful trade depth (min. 30 flips), a pattern emerges: well-situated, family-oriented estates with connectivity and greenery consistently post strong annualised returns and solid absolute profits.

The leaderboard reinforces that a handful of District 21 mainstays have the right ingredients — scale for price discovery, liveability, and catchment appeal for future upgraders.

How will the upcoming new launch – The Sen – fit in?

If District 21’s resale data tells us one thing, it’s that discipline, family formats, and liveable design win out over hype. The Sen, a 347-unit development by SL Capital, H10 Holdings and Greatview Development, fit into D21 advantages.

Product-Market Fit: Family First, Not Flipper First

The Sen’s architecture — five 10-storey blocks with tiered greenery and a 50-metre lap pool — speaks to the “livability premium” that data already rewards in D21.

Its inclusion of a childcare centre, rooftop wellness deck, and dual kitchen layouts in larger units signals a long-hold orientation. This design DNA resonates with the district’s historical buyer base: families anchored by nearby schools like Pei Hwa Presbyterian and Bukit Timah Primary, and owner-occupiers seeking stability rather than churn.

Stay Updated and Let’s Get In Touch

Our goal is to provide independent and comprehensive insights. For any questions, do not hesitate to reach out to us!