A Step-By-Step Guide To Navigating HDB Appointments

The latest BTO ballot results have been released, and if you’ve successfully secured a queue number – congratulations! This is an exciting step in your homeownership journey. However, navigating the next stages might seem overwhelming. Not to worry – here’s an updated guide, fully aligned with the latest 2025 policies, including the new HDB Flat Eligibility (HFE) process that has replaced the HLE.

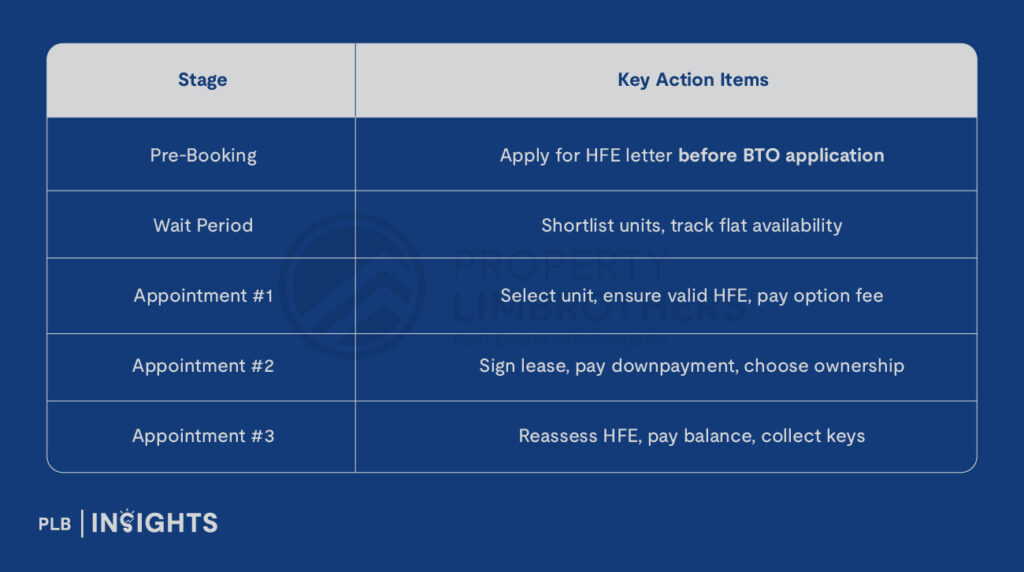

Step 1: Apply for HFE Letter (New Requirement since May 2023)

Before you can even apply for a BTO flat, you must complete the HDB Flat Eligibility (HFE) letter application. This replaces the old HLE letter system.

The HFE application is submitted via the HDB Flat Portal. It assesses your eligibility for purchasing a flat, receiving CPF Housing Grants, and obtaining a housing loan from HDB or banks. The process is digital, using MyInfo to retrieve your data from CPF, IRAS, and participating financial institutions.

The estimated processing time for the HFE application is around 21 working days, so be sure to plan ahead.

Important: You must complete your HFE application and obtain the HFE letter before applying for a BTO flat. Your application will not be considered otherwise.

Also, before your flat selection appointment, ensure that your HFE letter is still valid and not expired. If it has expired, you will need to reapply in order to proceed with selecting your unit.

Step 2: Wait for Your Flat Selection Appointment

Once your queue number is confirmed, it might take a few months for your turn, especially if your queue number is further back.

During the wait, monitor unit availability on the HDB Flat Portal. This will help you shortlist preferred flats based on factors such as floor level, direction, and proximity to amenities. You should also take this time to decide whether to opt into the Optional Component Scheme (OCS), which includes pre-installed fittings such as flooring, internal doors, and bathroom fixtures.

Note on Forfeiting: If you forfeit your queue number, any additional ballot chances gained from past unsuccessful applications will reset. Two consecutive rejections will result in your first-timer privileges being suspended for one year.

Step 3: Appointment #1 – Flat Selection Day

Bring along your NRICs, a valid HFE letter (check the expiry date), and the Appointment Letter issued by HDB.

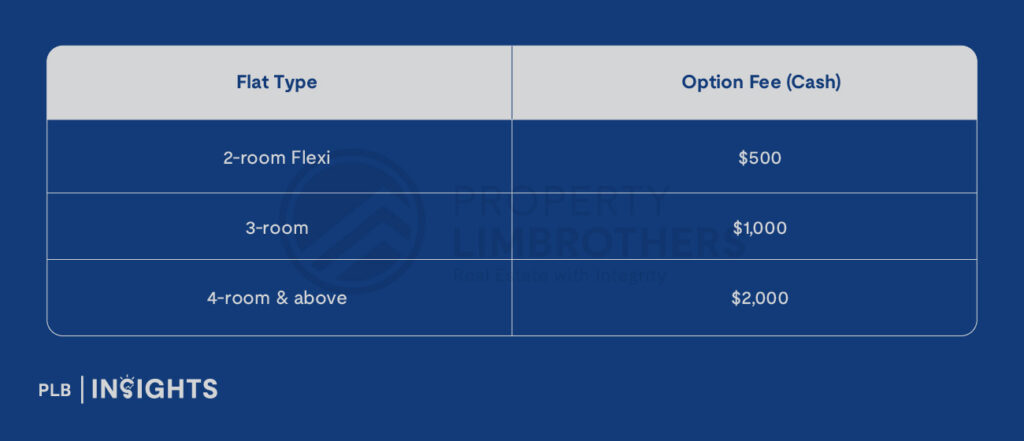

At HDB Hub, you will select your unit. Your grant and loan eligibility will be verified using your HFE letter. Once your selection is confirmed, you’ll need to pay the Option Fee:

This fee will be applied toward your flat’s downpayment.

Don’t forget to take a commemorative photo at the MyNiceHome photo wall!

Step 4: Appointment #2 – Lease Signing & Downpayment

Several months after selecting your flat, HDB will invite you to sign the Agreement for Lease. By this stage, your CPF Housing Grants (if not deferred) would have been credited to your CPF OA.

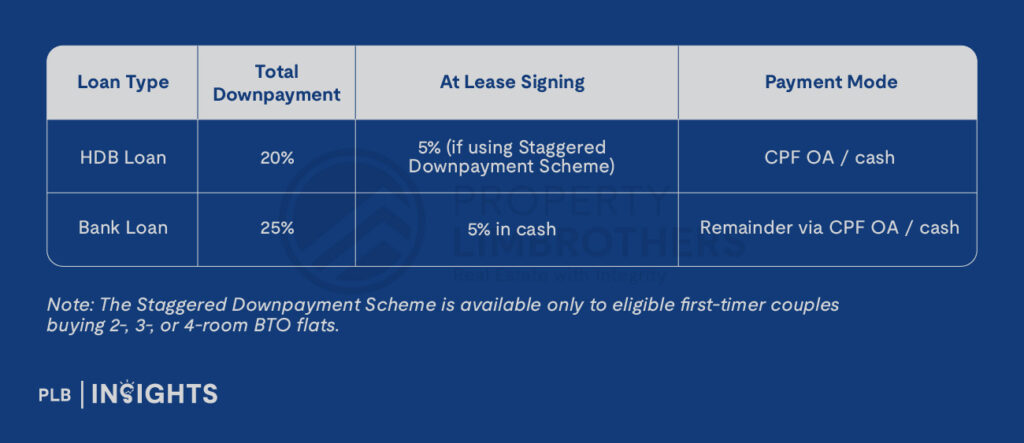

Downpayment Requirements (2025 rules):

You’ll also need to decide on your ownership structure: either Joint Tenancy (equal interest) or Tenancy-in-Common (specific ownership shares).

Step 5: Appointment #3 – Key Collection

Fast forward 2 to 4 years later – your flat is ready!

Before collecting your keys, you must reapply for the HFE letter. HDB will reassess your loan eligibility based on your updated income.

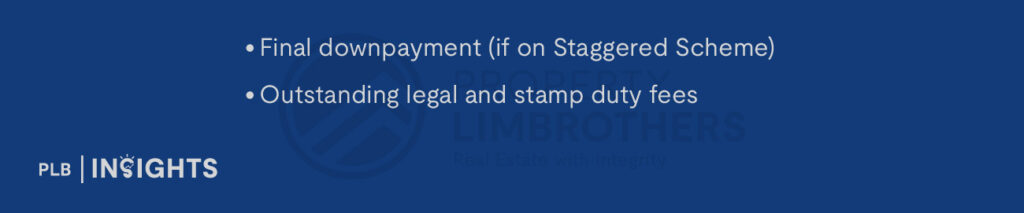

At this stage, you’ll make any remaining payments, including:

These can be paid using CPF OA, cash, or a combination of both.

After completing these steps, you will receive your keys – the final milestone in your BTO journey.

Celebrate with a photo at HDB Hub, and consider observing the popular tradition of rolling a pineapple into your new home to usher in good fortune.

Need Interim Housing?

If your flat isn’t ready and you need temporary accommodation:

- Parenthood Provisional Housing Scheme (PPHS): Apply to rent a flat from HDB while waiting for your BTO

- Alternatively, consider open market rentals

Summary Checklist

Final Thoughts

Buying your first home is a major life event – and while the process may seem long and complex, having the right information makes it more manageable. With this updated 2025 guide, we hope you’re feeling more confident about what’s ahead.

For those who didn’t manage to get a queue number this time, do not lose hope! If you have more enquiries or want a second opinion about your property options, do not hesitate to contact us. See you in the next one.