Singapore is set to introduce more than 80,000 new public and private homes across over ten locations islandwide under the Urban Redevelopment Authority’s (URA) Draft Master Plan 2025, unveiled on 25 June. This forward-looking blueprint charts out key residential and infrastructure developments that will shape the city-state’s urban fabric over the next 10 to 15 years.

Key new housing precincts include Dover–Medway, Newton, Paterson, Defu, Kranji, and future phases of the Greater Southern Waterfront. These sites will feature a mix of public and private housing, community amenities, green corridors, and improved mobility, with an emphasis on “10-minute towns” that enhance liveability and reduce commute times.

New Residential Precincts Across the Island

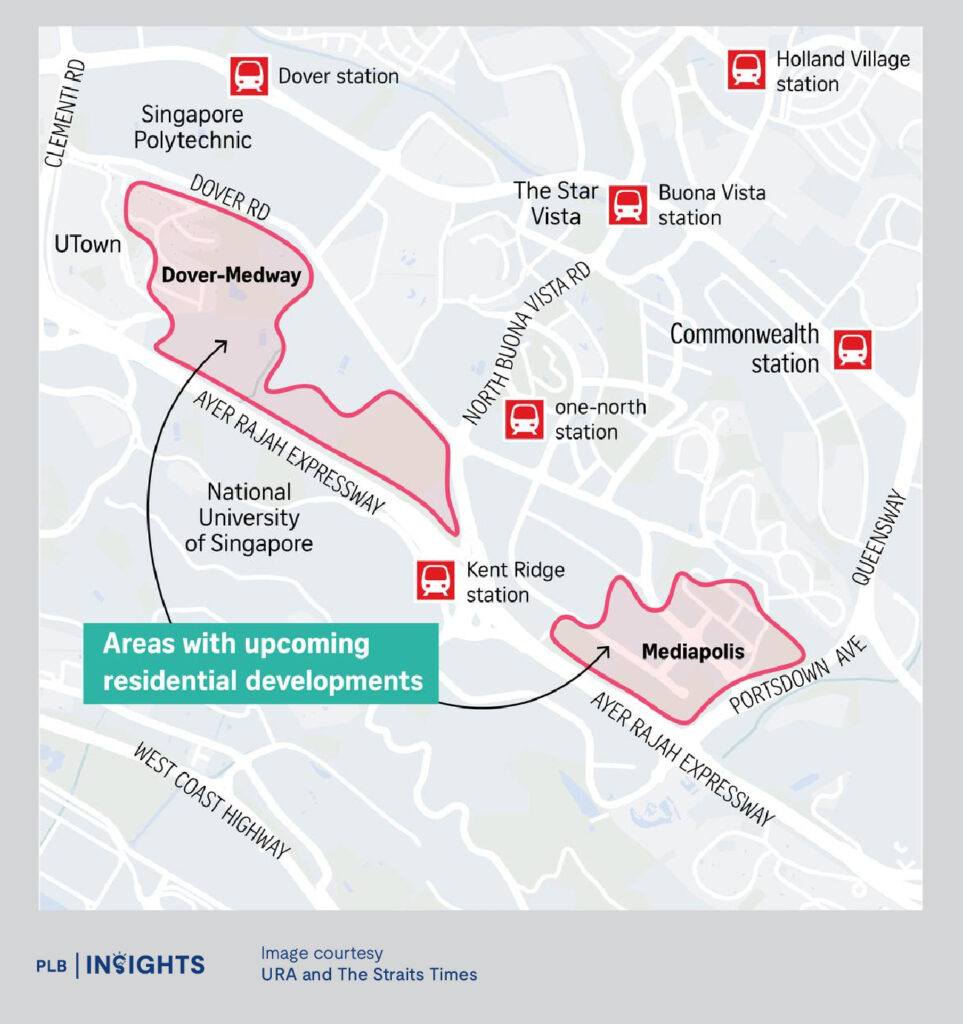

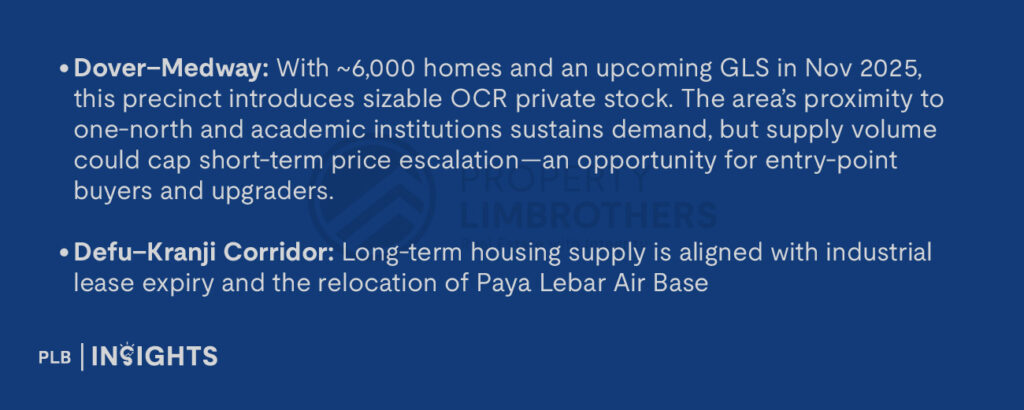

Dover–Medway: Around 6,000 homes will be built near one-north, NUS, and Singapore Polytechnic. The first phase begins in November 2025 with a Government Land Sales (GLS) site at Dover Road yielding 625 private units. Parks and amenities will accompany this transit-linked precinct.

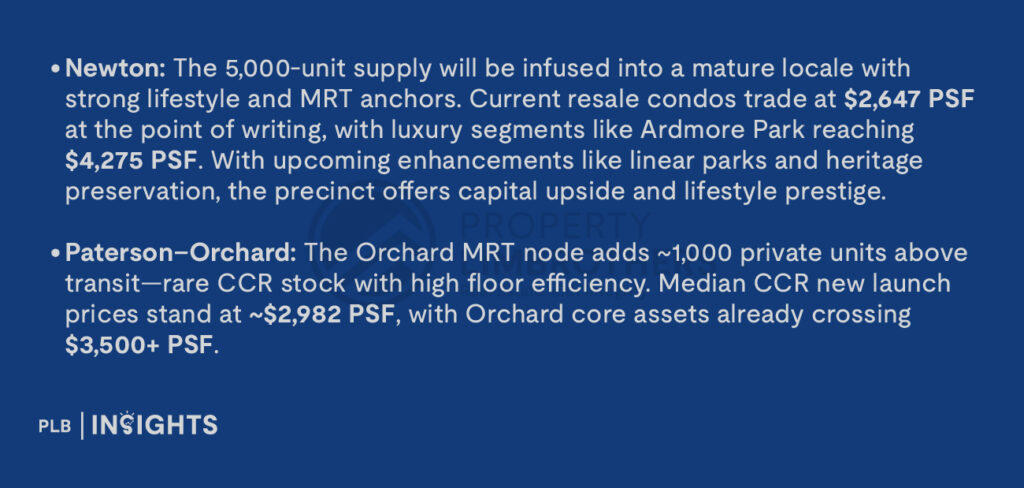

Newton: A new mixed-use neighbourhood with 5,000 private homes will emerge near Newton MRT and Newton Food Centre. Monk’s Hill Road will be transformed into a linear park, with heritage trees and structures integrated into the precinct design.

Paterson (Orchard MRT Node): About 1,000 new private units will be built above Orchard MRT station as part of a high-density mixed-use hub with retail and office components.

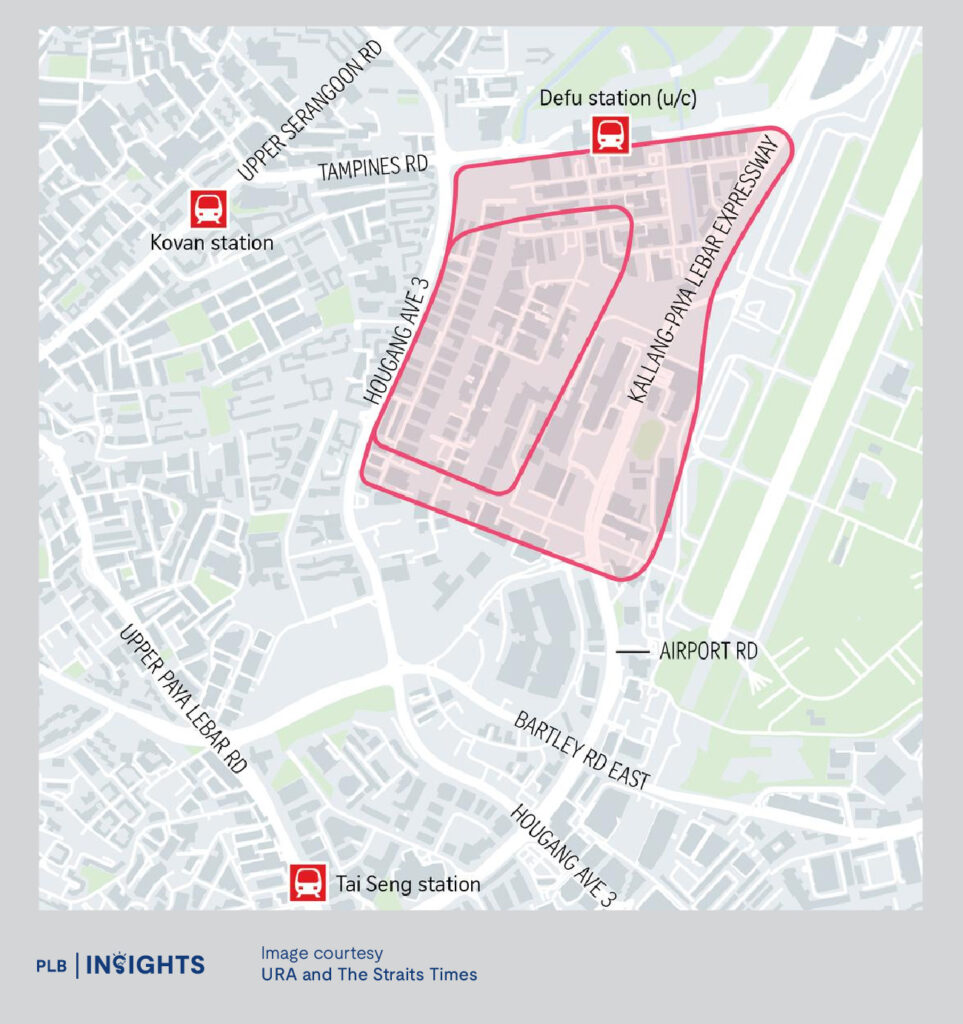

Defu: A brand-new public-private township will be developed at the Defu industrial area following the relocation of Paya Lebar Air Base in the 2030s. Residential planning will begin once industrial leases expire.

Kranji and Sembawang Shipyard: These areas—where industrial and recreational uses are being phased out—are also earmarked for future housing estates.

Further Integrated Developments and Urban Enhancements

URA also outlined complementary projects that will support residential growth and decentralisation.

Bishan will be developed as a sub-regional centre with new office and retail space, a polyclinic, a hawker centre, and a revamped transport hub.

Greater Southern Waterfront will enter its next phase, with new homes planned at Keppel Distripark and Keppel Terminal. The first public flats in this area will be launched in October 2025.

Elevated pedestrian bridges will be constructed to link Dhoby Ghaut to Fort Canning, and Marina Centre to Bay East Garden, enhancing walkability and green connectivity.

New community hubs—inspired by Our Tampines Hub—will be introduced in Sengkang, Woodlands North, and Yio Chu Kang.

Potential Impact on Residential Housing

Supply-Led Price Stabilisation in Growth Nodes

The infusion of housing in Dover, Defu, Paterson, and Kranji may bring about an easing pressure in both the HDB and private resale markets. This is particularly significant in a high-demand context where limited inventory has driven price spikes in recent years.

These emerging towns offer affordability without sacrificing urban planning quality. One may expect price stability in the near term, followed by gradual value appreciation as community amenities and transport infrastructure are completed.

In addition, buyers are also provided with more choices in these growth nodes.

Premium Market Consolidation in Core Central Region

New launches in Newton and Paterson are aimed squarely at the mid- to high-end market, reflecting an intentional densification of existing high-value enclaves.

These precincts will appeal to buyers seeking quality locations with future-proof desirability. Despite high entry costs, the location (MRT, retail, green space) and undervalued CCR today will likely push values upward.

Proximity to Hubs Translates to Price Premiums

Integrated hubs enhance neighbourhood convenience and utility, and this proximity has a quantifiable impact on property values.

A study by the Centre for Liveable Cities a decade ago found that public housing within walking distance to Integrated Transport Hubs (ITHs)—such as Bukit Panjang—enjoyed a 12.6% resale premium compared to comparable flats further away. In addition, this was at a time where the Singapore housing market experienced an influx of supply, resulting in property price index softening.

Even in such times, the price differential was significant – suggesting that accessibility, convenience, and concentrated amenities have an upward effect on housing prices.

Case Study: Our Tampines Hub

Launched in 2017, Our Tampines Hub (OTH) is Singapore’s flagship integrated development, offering a library, indoor sports halls, swimming pools, clinics, a hawker centre, and public services—all adjacent to Tampines MRT and bus interchange.

Private condo prices in Tampines surged from $450 PSF in 2004 to $1,532 PSF in 1Q 2024, representing a >3x increase over 20 years.

HDB prices in the region similarly rose from $243 PSF to $575 PSF in the same period.

These gains outpaced the national average and were sustained even during market slowdowns—underscoring the resilience conferred by lifestyle integration.

Hubs Support Rental Demand and Investment Value

Integrated hubs expand the appeal of a precinct across all buyer and tenant segments—families, young professionals, seniors, and even short-term renters. This drives:

Homes near integrated hubs usually can command 5–15% price premiums, depending on accessibility and maturity of the hub.

Strategic Implications for Buyers and Investors

For Homeowners:

Proximity to an integrated hub offers day-to-day lifestyle advantages—from healthcare to recreation—without the need for extended travel.

This enhances the non-monetary value of a home, contributing to satisfaction and community rootedness.

For Investors:

These hubs act as demand anchors, supporting rental performance, price stability, and stronger resale prospects.

Precincts like Sengkang, Woodlands North, and Yio Chu Kang offer first-mover pricing advantages, with value likely to appreciate as hub development matures.

In Summary

Integrated hubs are more than infrastructure—they represent a holistic shift toward people-centric urban living. Their development enhances not only lifestyle quality but also capital resilience, making them a cornerstone of future-ready real estate investment.

Stay Updated and Let’s Get In Touch

Our goal is to provide you with transparent real estate information. Do not hesitate to reach out to us!