With the revival of sweeping import tariffs under U.S. President Donald Trump, the global economy is once again in a fragile state. But in a dramatic about-turn just hours after steep new tariffs kicked in, Trump announced a temporary 90-day pause and reduced most tariffs to 10%, while raising duties on Chinese imports to a staggering 125%.

Markets rebounded, but confidence did not. These rapid reversals have sent a clear message: uncertainty is now the norm.

And in the face of such volatility, one market stands out for its consistency and long-term planning—Singapore’s real estate market.

What Are the Tariffs and Who’s Affected?

Trump’s 2025 tariff plan originally aimed to impose sweeping duties on most trading partners. But after global markets plunged and bond yields surged, he reversed course, saying on social media:

“I have authorised a 90-day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10 per cent, also effective immediately.”

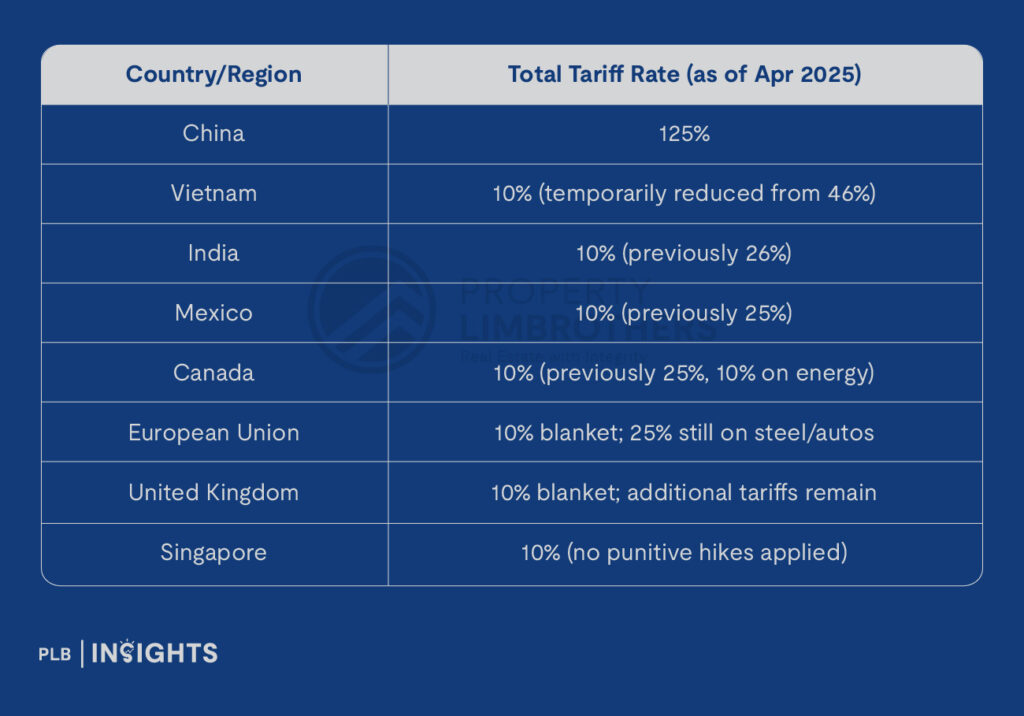

As it stands:

This approach—aggressive, abrupt, and deeply unpredictable—has rattled world leaders and business leaders alike, complicating forecasts and long-term planning.

Singapore is not a direct target of retaliatory measures but still operates within this uncertain global trade climate—and that’s where its strengths begin to show.

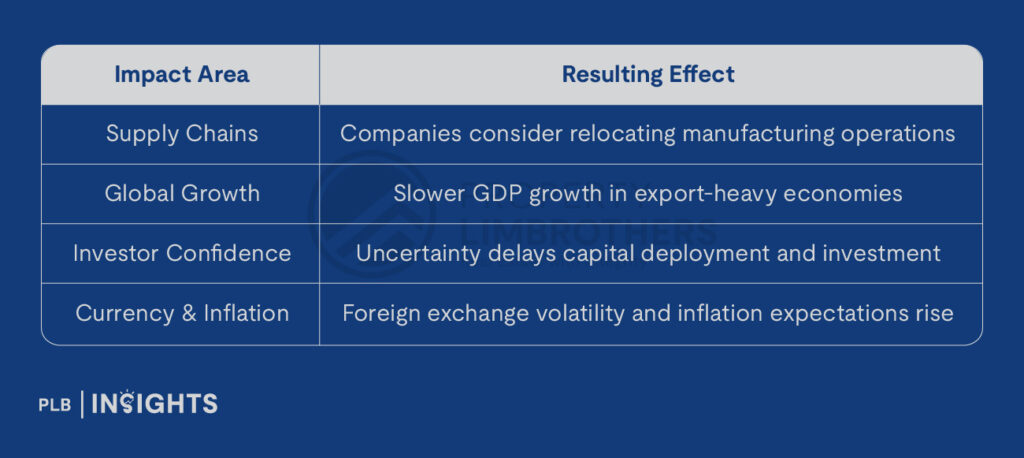

Global Ripple Effects: Why Tariffs Shake the World

Even though tariffs are levied by one country, the effects are felt everywhere:

A Climate of Uncertainty, Not Just Cost

Trump’s unpredictable approach has left even seasoned businesses scrambling. Today’s tariff may be tomorrow’s tweet. This on-again, off-again trade policy affects more than cost—it disrupts confidence, continuity, and capital flows.

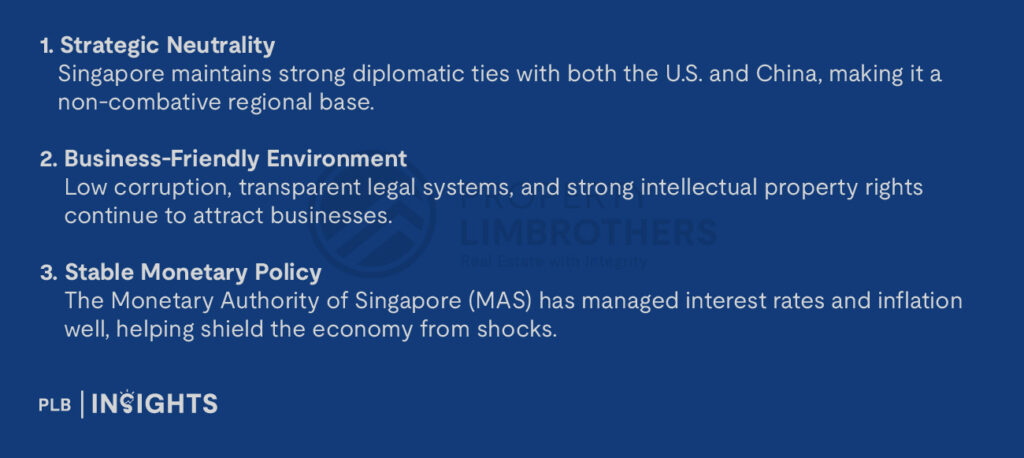

For companies seeking stable operational bases in Asia, Singapore may not offer the lowest cost—but it offers something far more valuable: predictability.

Why Singapore Is Built to Withstand Global Trade Shocks

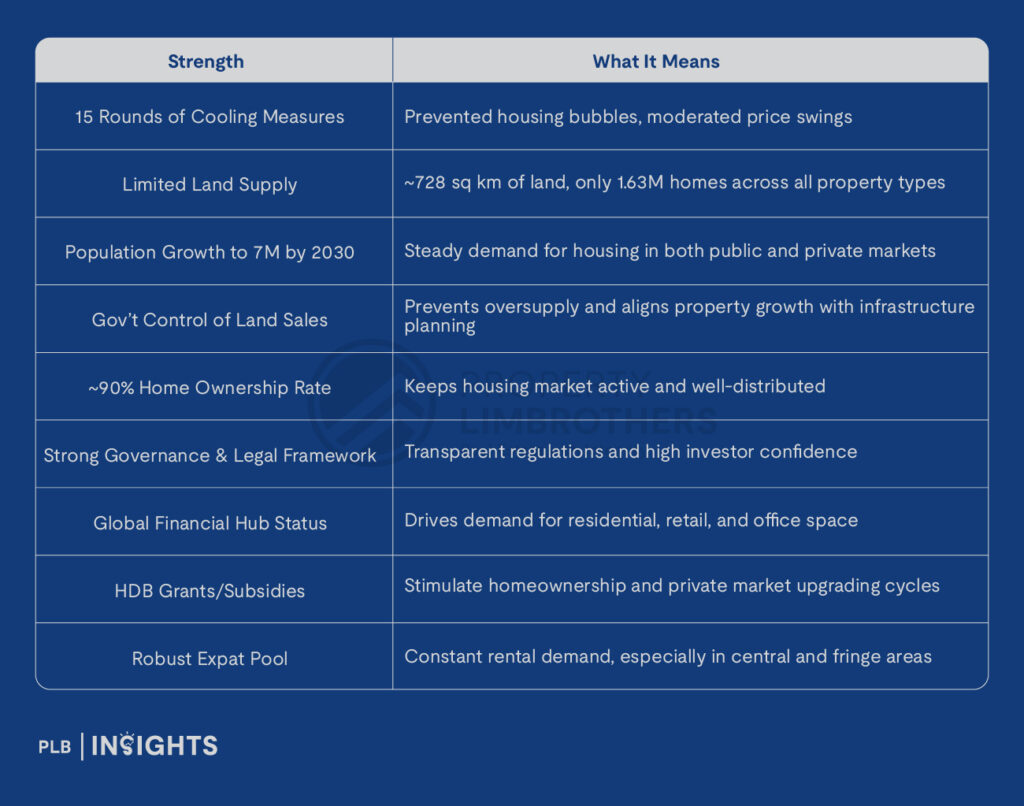

Despite the chaos in global markets, Singapore continues to project consistency and long-term viability. Here’s why:

Real Estate Implications: What This Could Mean on the Ground

As firms reassess their Asia-Pacific strategies, Singapore’s real estate market may experience measured shifts in demand, but reactions will likely be cautious and calculated.

Commercial Real Estate

Companies seeking stability in logistics or HQ placement may increasingly consider Singapore. While not a sudden flood, gradual increases in demand for office space, data centres, and logistics facilities are likely over time.

Residential Real Estate

If more expats are relocated due to regional shifts, this could support rental demand, especially in city fringe and central areas. However, growth will likely be moderate and tied to long-term restructuring, not short-term moves.

Singapore’s political stability and asset protection laws may still appeal to long-term foreign investors—though landed homes remain strictly for Singapore citizens due to ownership restrictions.

Why Singapore’s Property Market Is More Resilient Than Most

The real estate market isn’t just surviving uncertainty—it’s engineered to withstand it. Here’s how:

Evidence of Stability: Singapore’s Cooling Measures in Action

One of the strongest testaments to Singapore’s real estate resilience lies in its long history of disciplined policy intervention.

From the global financial crisis in 2008 to COVID-19, and now the uncertainty of a fragmented global trade landscape, Singapore has not only stayed afloat—it has done so without the extreme price swings or housing bubbles seen in other developed markets.

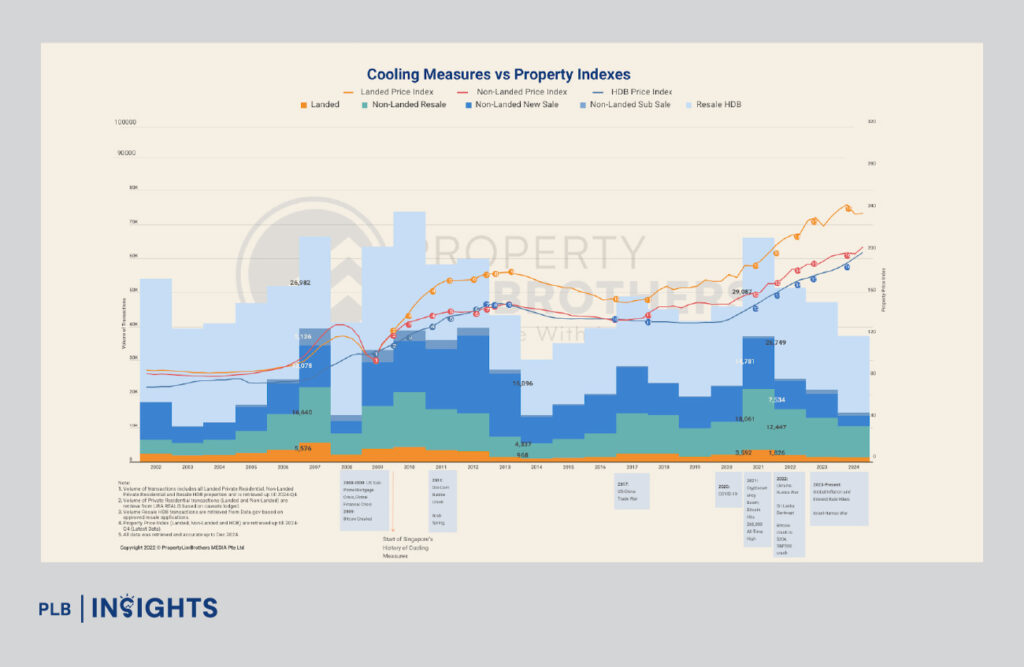

Cooling Measures vs Property Indexes (2002–2024)

This chart shows how transaction volumes and price trends across landed, non-landed, and HDB properties have responded to each phase of market intervention. Despite fluctuations caused by macroeconomic shocks—from the 2008 financial crisis to global inflation in 2023—prices have shown long-term upward stability. Notably, none of the measures triggered steep market crashes, reflecting the government’s finely tuned balance between affordability and growth.

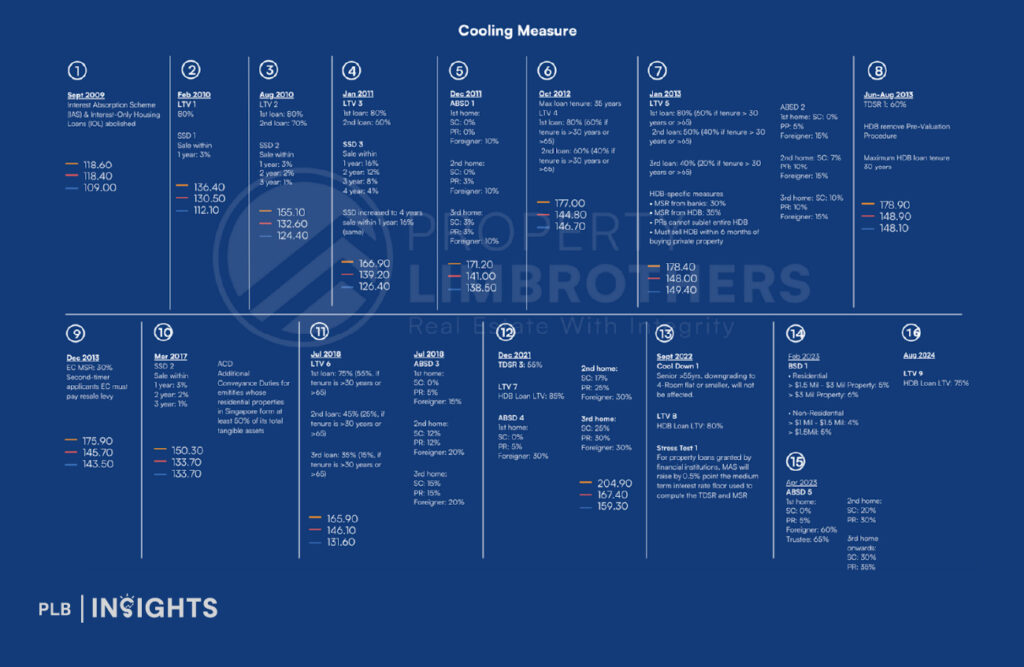

Timeline of Singapore’s Cooling Measures

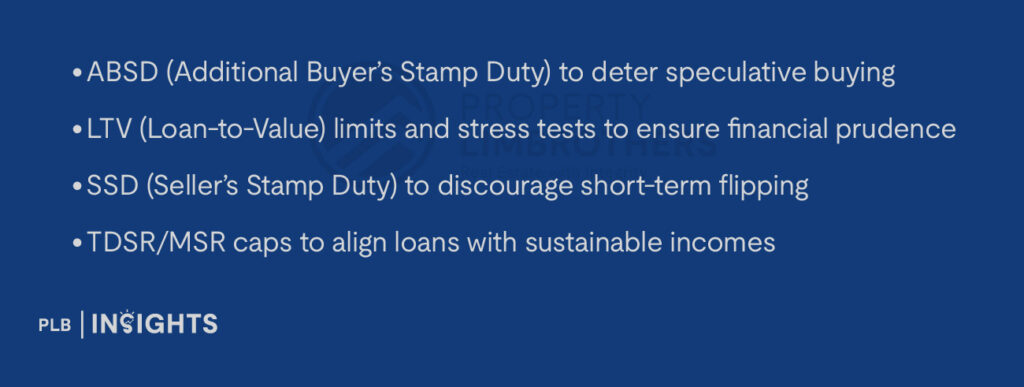

To understand how this was achieved, this timeline lays out all 15 rounds of cooling measures introduced since 2009, including:

Each measure was carefully timed and calibrated based on market conditions, ensuring stability even as global forces created volatility elsewhere.

Final Thoughts: Stability Is the Real Strength

Trump’s tariffs may rise or fall—but the uncertainty they bring is the real constant. And in that environment, Singapore’s calm, measured approach is its competitive advantage.

While global trade tensions could moderate short-term activity, they also shine a spotlight on markets with genuine staying power. Singapore’s real estate—especially in tightly regulated and supply-constrained segments—offers just that.

No one can predict the next twist in U.S. trade policy. But as the world pivots, investors and companies alike will look for safe ground to plant long-term roots.

And Singapore, more than ever, is proving it’s built for exactly that.

Looking to better understand how global shifts like these could impact your property journey? Whether you’re an investor assessing long-term opportunities or a homeowner planning your next move, our consultants are here to help you navigate with clarity and confidence. Reach out to our sales consultant here to start a conversation tailored to your goals.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice or any buy or sell recommendations.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.