In 2023, the real estate market in Singapore is set to welcome a number of new condominium developments. These new properties offer a range of options for potential buyers and investors, with a varying levels of focus on luxury, design, amenities, and affordability. The condominiums come in different sizes and styles, ranging from high-rise buildings with city views, to low-rise developments surrounded by greenery.

With the Temporary Occupancy Permit (TOP) coming to these new condominiums, these properties will soon be ready for immediate move-in. This article provides an overview of some of the new condominiums that TOP by 2023 in Singapore. Some notable new condominiums that TOP in 2022 will be included as they present opportunities for buyers. This article will cover the top 10 affordable TOP properties, the top 10 leasehold properties by take-up rate, and the top 10 freehold properties by take-up rate.

Overview of TOP Properties by 2023

We have a total of 38 properties on our TOP watchlist, but we will be covering the ones which caught our attention based on their affordability and take-up rate by lease type. These are properties that the market is watching since they have done well during the launches, indicating strong market demand for these properties. With higher property prices on the watch, relatively affordable TOP properties will also catch the attention of home buyers this season.

Our TOP list indicates a total of 16,684 residential units would have reached their TOP by the end of 2023. In terms of actual supply, we expect a ballpark number of 800 to 1,000 units to be sold from these TOP properties in 2023. The estimated average asking psf for all these properties comes to around $2,700 psf. This is quite a high number due to the number of properties located in the Core Central Region (CCR) and are of freehold status. After adjusting for the number of units for each of these properties, we have an estimated average asking psf of $2,200 psf, which is a much more believable number.

As for the breakdown of the 16,684 residential units that will TOP by 2023, approximately 80% of these units are leasehold and 20% are freehold. The leasehold units in the OCR tend to be the larger developments with more units and affordable pricing. Freehold units are mostly located in the central region or the city fringe and are usually found in small to medium sized developments. The average take-up rate for these properties is 77%, which is relatively high. Many of these projects actually managed to hit a 100% take-up rate. We will take a closer look at those properties in our top 10 lists.

Top 10 Affordable TOP Properties

Affordability is a hot topic now in Singapore’s real estate market. We are not here to debate what exactly “affordable” means for TOP properties in relation to the income of Singaporeans. Instead, this list collates the top 10 properties with the lowest estimated asking psf. Based on this list, the estimated average asking psf after adjusting for the number of units is $1,793 psf. Considering that the new launch estimated average psf is around $2,100 psf, these TOP properties are definitely worth looking at.

There are a total of 9,568 residential units among these 10 properties, with an estimated 450 to 650 units that might be sold in 2023. This list represents 57.3% of units from our 2023 TOP list. This fact is thanks to the large developments that span more than 1,000 units. Half of the properties on this list fall into that category, most of them are found in the Outside Central Region (OCR).

The top affordable properties are Treasure at Tampines and Riverfront Residences coming in at an estimated average asking price of $1,600. Coming in next, we have Mont Botanik Residence (the only freehold property on this list) and The Florence Residences which are estimated to have an average asking psf of $1,800 psf.

Many home buyers in 2023 will find this category palatable, especially if they are looking for a larger sized home for their multi-generational family. On this list, a 1,200 square foot home would have a quantum range of around $1,920,000 to $2,400,000. This is a great price range relative to other new launches and TOP properties out on the market. Take note that we are talking about a unit that likely doesn’t have a previous occupant. This is something that Singaporeans do like when it comes to real estate. Being the first occupant of a property gives it a special feeling of exclusivity.

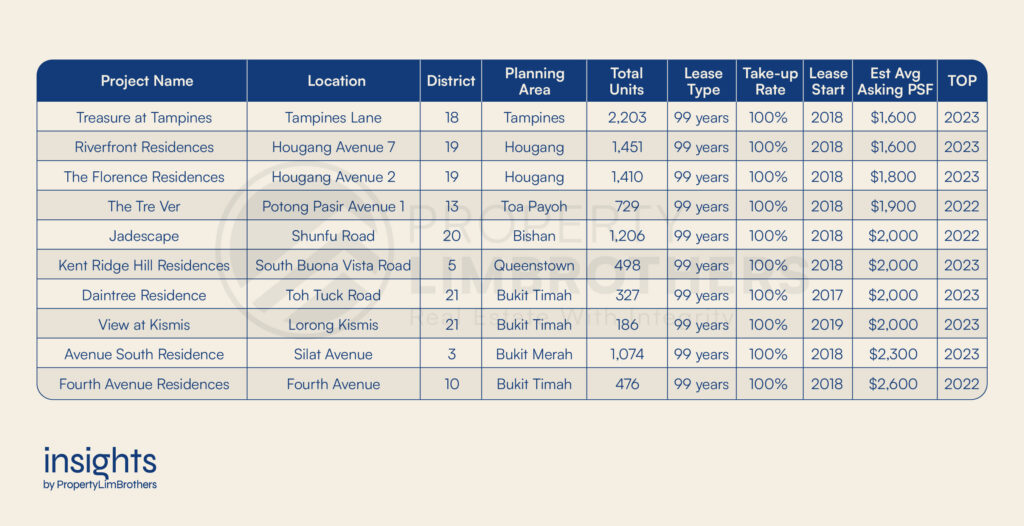

Top 10 Leasehold TOP Properties by Take-up Rate

Now we take a look at the top 10 leasehold properties by their take-up rate. The data on take-up rate is accurate as of December 2022. We use the take-up rate as an indicator of the property’s desirability in terms of its location and price. The key assumption is that those properties with a high take-up rate signal a high demand for that particular property, and that this demand persists because of the attractiveness of the property’s characteristics. For properties with a 100% take-up rate, it may even be possible that the project has more demand than can be fulfilled.

Do note that the lists might have some overlapping properties. These properties that turn up multiple times might be worth exploring. The estimated average asking psf after adjusting for the number of units is $1,874 psf. This list has a few interesting options near the city centre. Kent Ridge Hill Residences and Avenue South Residence might be good upmarket properties for home buyers looking for a more central location. This will of course come at a higher price.

This list has quite a bit of an overlap with the top 10 affordable TOP properties by 2023. Mont Botanik Residence and Parc Clematis are not on this list. Instead we have Avenue South Residence and Fourth Avenue Residences, which are upmarket options which have a 100% take-up rate. Another important note is that a few of these properties have already TOP-ed. The Tre Ver, Jadescape, and Fourth Avenue Residences had their TOP in 2022 and are on this list because of the relative recency and notability of the projects.

These properties have a total of 9,560 residential units between them and are expected to do well in 2023. With a larger volume of transactions to help move prices, we might see some of these asking prices inch up over the year if the market continues to heat up.

Top 10 Freehold TOP Properties by Take-up Rate

Our final list looks at the top 10 freehold TOP properties by take-up rate. The average take-up rate for this category is 96%, which is pretty good considering that freehold options tend to be pricier. The estimated average asking psf is $2,853 psf. This is markedly higher than leasehold options (by almost $1,000 psf), but it is also due to the fact that most of these freehold options are found in the city fringe or core central area. Thus, the premium is for both the freehold status and the central location of these properties. These 10 properties sporting a high take-up rate indicate their desirability despite the higher price levels.

There are a total of 2006 units between these 10 properties. We expect a ballpark figure of 400-600 units entering the market upon TOP in 2023. Among these properties, 1953 has already hit its TOP date in 2022. The rest of the properties will TOP in 2023.

The important thing about these lists is that they appeal to different audiences who might look out for different things when they are going through the home-buying process. With a limited number of freehold properties in the central areas, investors looking for a legacy property or a conveniently located family home would have their eyes on these properties which TOP in 2023.

Join our Mailing List to get our Complete TOP List!

This article gives you a sneak peek into our TOP list for 2023. If you wish to have the complete TOP list along with our very own PLB MOAT Analysis scores for each and every one of those properties, sign up for our mailing list here!