Introduction

Singapore’s housing market is one of the sectors that prove to be resilient despite the pandemic. We observed healthy sales for landed homes within the private segment and public housing market. We offer a preview of how the property market space here may fare this year, and the key trends particularly the landed homes to keep an eye on.

The Current Property Scene in Singapore

Source: URA

Based on Q1 2021 Property data published by the URA website, the price index for private home price rose 3.3%, from 157.0 in Q4 2020 to 162.2 in first quarter of 2021. Conversely, the price index increases for non-landed property from 153.3 to 157.1 increased by only 2.5% in first quarter of 2021. Hence, the overall price index increase was largely driven by landed properties segment.

To get a glimpse of actual prices and volume, let us take a look at landed properties transactions, over the past 48 months:

According to the data from Square foot research, May 2021 see an average price 1400psf for landed housing as compared to an average price at 1311psf in May 2020, went up by 6.8%.

The total landed sales transacted in May 2021 was 276 units as compared to 334 units in April 2021. However, the drop in sales volume was not as drastic as a year earlier during the circuit breaker period with total sales transacted of 48 units.

The relatively low volume recorded from March to July 2020 is due to the Circuit Breaker. We also observed the significant drop in the total landed property sold of 48 units in May 2020 was record low. However, since August 2020, the landed property sales transaction has been on the upside and have also reached a four-year high with 334 transactions on April 2021.

With COVID-19 restrictions ease, Singapore now is in Phase 3 at Heightened Alert, sales is expected to pick up again. There is potential for sales in June to meet May’s numbers as the relaxed COVID-19 measures may see pent-up demand.

What’s happening to the landed property scene in Singapore?

The landed property market saw a strong pick up in Q4 2020. It is expected that the Singapore’s economy to see a strong rebound this year which will in turn lift buyer sentiment and drive the buoyancy in the property market. According to the CBRE, it noted that to date, private property prices in Singapore rose by 6 per cent since Q1 2020. The gains was mainly due to growing demand and cheap mortgages.

The performance of the private residential market has certainly exceeded expectations in 2020 and the main drivers that have boosted sales and supported prices last year continued to spur the property market in the first quarter this year.

It is evidenced by the pace of price growth, particularly in the last two quarters which will draw the government’s attention and may raise the odds of new cooling measures being introduced in the future. The overall price increase was a 6.7 per cent surge for landed properties segment in the first quarter 2021 as compared to the 1.6 per cent decline in last quarter 2020.

June 2011 – May 2021 Detached Landed Home Prices over 10 years

Detached Landed Home Prices on a Quarterly Basis

In terms of the detached property sales, March 2021 also saw 48 transactions recorded. It is the highest transaction volume for detached houses in 10 years, although the number fell back to 38 in May.

Prices for detached homes now average $1,372 psf, up from $1,307 at the same time last year. This is up slightly at 5 per cent.

Semi-Detached Houses Transactions:

Source: URA Realis accurate as of 17 June 2021

Overall, the prices for semi-detached homes in May 2021 average $1,398 psf, up from $1,097 at the same time last year. This is up approximately 27 per cent. In general, we observed that the prices has been trending up since October 2020 for semi-detached property. Meanwhile, semi-detached properties were sold for $4.48 million on average in Q1 2021. Semi-detached property also saw their highest transaction volume in around 10 years, reaching 103 transactions in April 2021.

Terraces houses Transactions:

Prices for terraces houses on May 2021 average $1,407 psf, decline from $1,431 at the same time last year. This is down marginally at 1.68 per cent.

Evidently, we can see that landed homes particularly semi-detached and terraces houses have been the highlight of the year. We predict private landed home prices to rise further, with low mortgage rates and a recovering economy. The demand for landed home in particular the semi-detached and terraces houses will be strong until 2022.

Also, the increased sales of such homes with higher price tags may boost the overall residential price index in the next few quarters. It is also noted that the future price growth may come from cost pressures in the slowdown construction sector due to the pandemic.

Is it likely to see the trend for landed home continue their momentum?

In terms of landed properties, we observed that the transaction volume for semi-detached and terraces houses has been comparatively high this year.

Also, rental saw stronger growth in the first quarter of the year, rising by 2.2 per cent, beating the previous quarter’s increase of 0.1 per cent. It came after a dip seen in the second and third quarters of last year. It was largely due to low supply of homes that have been available for lease in recent months, with more Singaporeans returning to the country and foreign tenants staying put amid travel restrictions. Thus, this reduced stock has raised the rents.

In addition, the growing demand for the landed property segment is likely to be driven by a number of these factors:

1.Fear of new cooling measures

Some buyers will feel pressured to act now before new cooling measures introduced. In the last round of cooling measures which happened in July 2018 after landed property transactions reported to stay above 200 units for several consecutive months in 2018.

2. Lower interest rates

At present, home loan rates are at relatively low in the market. This is due to the US lowering rates at home, to boost their economy.

As such, it is expected to see low interest rates for the next few years. From the investors; perspective, an interest rate lower than the risk-free of CPF rate of 2.5 per cent.

3. A safe-haven form of investment.

In 2007- 2008, investors who have liquidated other assets such as their stock funds, are not always eager to leave it with the bank. With interest rates being near zero, they need to find something else to invest in.

While there are a range of alternatives for example stocks, gold, bond funds, Singapore real estate is one of the most safe form of investment. This is especially the case for Singaporean investors, who have perceived property as their significant part of retirement planning when they are looking to invest in properties, particularly in the landed homes.

Landed homes are seen as a lucrative asset, since new condos and flats launches are being constructed all the time. Yet landed houses are so rare with about five per cent of current housing supply.

4. Elderly retired landed homeowners form a ready pool of sellers

Elderly retired landed home owners find themselves to profit and downgrade as they grow older, even as the cost to own such properties is high. As landed home supply is not likely to increase significantly in the future due to the scarcity of the lands in Singapore, these homes are an ideal asset.

Driven by strong desire for private home ownership and the influx of foreign investment demand has in part driven home prices higher in the last quarter. Also, low supply of homes were available for lease in recent months which in turn helped raise the rent prices, is deemed attractive for investors. Yet, demand may also have gone up as more Singaporeans, PRs, and long term pass holders return to the state from abroad due to the Covid19.

5. Landed Properties is Perceived as more “value for money”

The concern about rising home prices in particular, the condominium segment has made landed properties more “value for money” in the sense. In terms of rents, the rise in the rents of private homes which is attributed to the gain of 2.2 per cent quarter on quarter as compared to the 0.1 per cent increase previously.

Strata landed house vs Non-strata landed house

Strata Landed vs Pure landed

In contrast to the conventional landed housings, owners of strata landed do not own the land title but rather the strata title of their landed units. Individual land title property refers to the private landed homes whereby each property has its individual land title. According to the Urban Redevelopment Authority, strata landed property is defined as low-rise or low density residential developments with strata-titled arrangements.

These strata‐titled cluster houses offer buyers the option to combine a landed housing lifestyle with communal facilities and greenery by paying a fee monthly. Another key difference is that a landed unit can be rebuilt whereas a strata‐titled landed unit cannot be rebuilt on its own.

Certainly, the appeal of Singapore as one of the best places to be in during this pandemic is attracting ultra-high-net-worth individuals to move to Singapore. We should also see more purchases by this segments once the borders are opened again.

Foreigners are generally not allowed to own landed properties with two main exceptions. Approval is not required when purchasing a strata‐titled landed unit within a development with Condominium status. However, this measure has been tightened in 2012 after URA announced that it will no longer grant condominium status to these new developments that comprise strata‐landed units, thus restricting the number of such developments available. Foreigners who are interested to buy landed properties beyond the two exceptions can obtain approval from the Singapore Land Dealings Unit if they are permanent residents. The applicant would need to pass a stringent screening process and meet the criteria such as having significant contributions to Singapore’s economy. Successful candidates are then allowed to purchase only 1 landed home in Singapore entitled for their own residency.

Both individual land title houses and strata‐titled cluster house can be categorised into three types: detached houses or bungalows, semi-detached houses, and terraced houses.

Owning a landed home is a lifelong dream for many Singaporeans. Hence, most buyers would generally exercise caution in their property purchase decisions. A common question that often arises is whether a strata landed house or an individual land title house which is called a non-strata landed house would be a better investment decision.

When the Covid 19 hit, the world is affected from the economic effects of the pandemic, the property market was expected to plummet. After all, with homeowners tightening their belts, buyers would have been more cautious about committing to a purchase.

But amid the pandemic, the property market proved surprisingly resilient, recovered strongly after a short slump at the beginning of the pandemic, primarily due to strong demand for private property.

Why Landed Homes are gaining popularity amidst this current pandemic?

Optimistic among Affluent Buyers

Amid the COVID-19 pandemic, many affluent residents have emerged relatively unscathed.

There is likely to be a large pool of affluent buyers, and it is likely to be these people who purchased private properties over the past year.

With the arrival of vaccines and a strong recovery expected for the economy, many affluent buyers are feeling optimistic and the sentiment has been positive. In this period of time, it has been a great time to purchase a new home or an investment property at a cheaper price before the economy rebound.

Demand For More Space

The COVID-19 pandemic has had Singapore residents spending more time at home. With an increase time spent working from home and the announcement by the Ministry of Education that home-based learning will be continued even after the pandemic, having a spacious home is deemed attractive.

Thus, Singapore residents now have a stronger demand for personal space. More spacious common rooms and a garden are now even more appealing as they are seen as beneficial to the mental health.

Less Concern about Accessibility to the City

Lack of accessibility via public transport, which has been one of the main drawbacks for landed property owner, is now less important due to the reduced need for commuting.

This suggests that Singapore buyers may be increasingly less concerned about proximity to the central region, because of the rise of working from home culture.

Desire for Privacy

Thanks to work from home policy and safe distancing measures, our work and life spaces have aligned. This introduces the trend of buyers who stay with their parents, now wanting to purchase or rent a studio or a one-bedroom apartment for more privacy.

Also, with increasingly bigger condo developments housing thousands of people, city dwellers are forced to come into contact with many people daily. For example, during the rush hour, it is inevitable that crowds are packed in like sardines in the common lift and areas such as the gyms, swimming pools. Particularly, the concerns about hygiene are more critical these days. Hence, the privacy in living in landed homes is greatly desired by those who wish to avoid minimal contact with others.

Less Affected by COVID-19 Restrictions

Mask wearing is still required in common areas at condos, and condo residents are risked being reported to the police by other residents.

On contrary, landed property residents are less affected as they are free to use their gardens and enjoy facilities without having to wear a mask at home.

The Prime Time to Buy Landed Property

With the scarcity of land supply in Singapore, landed homes have been perceived as one of the most attractive assets in the local private residential space.

The supply of landed homes has been limited. It is reported that from Q4 2008 to Q2 2018, the total supply of landed homes rose 6.4 per cent, from 68,761 units to 73,150 units. Yet, the total stock of non-landed homes rose by about 70 per cent from 172,443 units to 293,593 units in the same period.

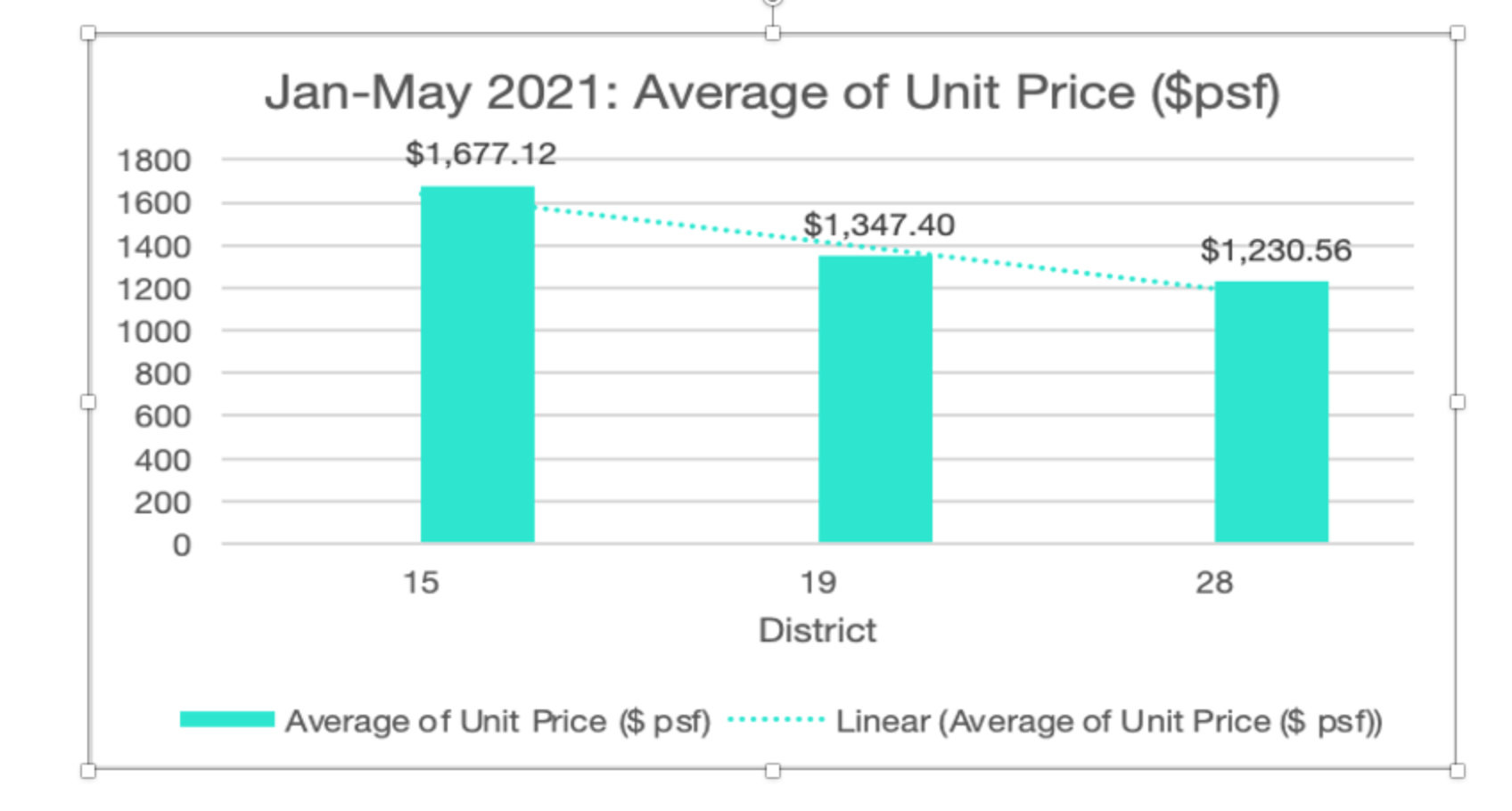

With a lack of a strong supply of landed homes, it is observed that prices of landed homes tend to rise more than prices of non-landed homes during an uptrend in prices. According to the Urban Redevelopment Authority, the residential price index for landed homes rose 87.7 per cent during the upswing from Q2 2009 to Q3 2013, while prices of non-landed homes appreciated 56.2 per cent over the same period. Let us have a look at the landed homes transaction specifically in District 15, 19, 28.

Jan – May 2021 Landed Housing Transactions

Based on URA data published on the volume of landed housing transactions in the first five months of this year 2021, we see District 19 (Serangoon Garden, Hougang and Punggol) recorded the highest number of deals of 209, followed by District 15 (Katong, Joo Chiat and Amber Road) with 155 deals transacted. District 28 saw 93 deals transacted in the first five months.

Source: URA Realis accurate as of 17 June 2021

Specifically, we see the prices for landed homes in District 15, 19, 28 in the first five months of this year 2021 average $1,677psf, 1,347psf, 1,230psf respectively.

In general, amongst transactions of terrace homes and semi-detached homes, District 19 similarly topped the charts with District 15 being the next with 155 units. Private landed housing enclaves in both Districts 15 and 19 have benefited from heightened interest in non-landed projects and the prospect of new developments in the area. Landed homes in Serangoon Garden, for example, are among those that have benefited from the growth of the Bidadari area in the vicinity.

Investors seeking to purchase landed home should focus on potential upside in terms of capital gains, rather than yields, which are pretty low. This creates opportunities for younger buyers desiring to own a landed home to enter this segment, which has a more limited supply. Prices continue to be sustained by limited supply. Indeed, locational attributes, tenure, condition and timing will still play an important role in the purchase decisions for buyers.

Landed Market Outlook

The boom in the private resale market also extends to landed homes. According to the URA data, 1Q2021 saw landed homes segment prices increase 6.7% quarter on quarter, and exceeded the 2.5% increase for non-landed homes segment. Landed home segment also saw close to double in transaction volume in the first quarter of 2021 compared to first quarter last year. The robust rebound for landed home prices in Q1 2021 is mainly attributed to the high demand for landed housing and Good Class Bungalows driving prices higher.

This is affirmed to the growth of the affluent population in Singapore and their preference for landed properties which reflects prestige. Landed homes are a highly sought-after real estate asset that many Singaporeans dream to own, and competition for available houses has intensified considering the limited supply of landed homes in the market.

Aside from the low interest rates environment, buyers are gravitating towards landed property as prices look more appealing based on a psf. There are some freehold landed properties on the market that are priced at $1,300 psf to $1,500 psf currently.

With the desire for more space and exclusivity given the work-from-home culture, more people are looking at upgrading from condominiums to landed property. Hence, It is widely expected that the current level of buying interest to sustain.

However, the strong performance of the resale market over the past year has raised concerns that the government could step in to stabilise the market with a fresh round of property cooling measures. The last time it happened was in July 2018 when the property prices had increased by 9% over the preceding 12 months.

The government has been apparent that cooling measures are not unfavourably introduced but are executed to achieve the goal of sustainable price growth in the residential property market. Having said that, it does not benefit any party when private home price growth increase at a faster rate than wage growth, the affordability gap for private homes could further widen for most Singaporeans. Let us now have a glimpse of the different types of development that one can make on the landed homes.

The different types of development on your landed property

The following are the different types of development you can make on your landed property:

● New construction

● Reconstruction

● Additions and Alterations

1. New construction

A new construction mean you’re going to construct everything from scratch. A new construction simply means you are going to demolish your landed property, and build a new house. This is costly, but may be necessary for extremely old houses. It might also be a lucrative investment decision, if the current property doesn’t take full advantage of the available land space.

Working out what you can build in terms of height, Gross Floor Area, so this is where your architect, contractor, engineers are going to work with you.

2. Reconstruction

This means you make some changes while maintaining the existing structure. The requirements are as follows: The increase in Gross Floor Area (GFA) exceeds half (50 per cent) of the current GFA, to be considered reconstruction. Any change in elevation also cannot exceed 50 per cent of the current height.

While you can add storeys to the existing structure, you cannot add an attic. Adding another storey is not the same as adding an attic as regulated by URA standards, such as a roof-to-floor height capped at five metres, etc.

For reconstruction, you’ll need to write to Singapore Civil Defence Force for approval not building the household shelter.

3. Additions and Alterations

You must retain the existing structure, GFA and elevation increases cannot exceed 50 per cent.

You’ll need to seek the necessary approvals from BCA and URA and the main contractor you engage comes into play.

One main consideration is URA’s Envelope Control Guidelines. Some of the important requirements are:

● Landed property cannot exceed the two-storey or three-storey height control. For example. you can’t build a five-storey house to block your neighbours’ views, in an area where every other home is two-storeys.

● Mezzanine floors have height limitations for example, 12 metres for a designated two-storey housing estate, and 15.5 metres for a designated three-storey housing estate.

● Any overhanging basements can’t infringe past limits in the Road Line Plan.

Essentially, it is determined by the house zoning restrictions for your area. The Road Line Plan and the road reserves allow your landed property doesn’t obstruct the future road works. If you infringe too far onto the space that is reserved for future road works, then you need to get rid of any.

Finally, you’ll need to engage a topographical surveyor to work out the buildable size of your property.

How much is this going to cost in total typically?

Please consult the experts before you make your decision to purchase

You may have a chat with an architect, contractor or engineer before you decide whether you want to purchase, to get a picture of how much everything will cost; most of them are happy to help. Necessary A&A or reconstruction is advisable for investors who see a high rental or resale gains in some old properties.

If you need to totally reconstruct the landed homes, this is best for genuine home buyers who are not concerned about future gains or rental yields. For investors, the cost is generally high, and you won’t be able to rent out the property while it’s being constructed.

Conclusion

All in, landed properties may not be the best asset to invest in if a quick return is expected. Due to its relatively higher price, rental yield is generally low when compared with the realised return. Also, as this segment sees low transaction volume, average prices can fluctuate in the short to medium term, should the market conditions turn unfavourable quickly. However, with the increasing land scarcity, we believe the segment remains as a fundamentally attractive asset to invest in.

With diminishing home supply in the market and the improvements in the economy outlook, the chances of home prices falling this year is not high. Having said that, we expect the landed segment, especially the semi-detached and terrace houses, to perform well in the next few quarters. We hope you find this article useful. Stay tuned for the next PLB insights article! For those who are interested in finding out more or would like to start planning for your property portfolio, you may contact our PropertyLimBrothers team!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.