Many Singapore property investors think:

“My rental yield is 4%, my loan rate is 3.5%… confirm profitable!” On paper, that sounds logical.

In reality, it’s often very wrong.

The problem: Gross rental yield looks nice in a listing, but it hides the true cashflow, especially in today’s higher interest rate environment.

Let’s break this down properly.

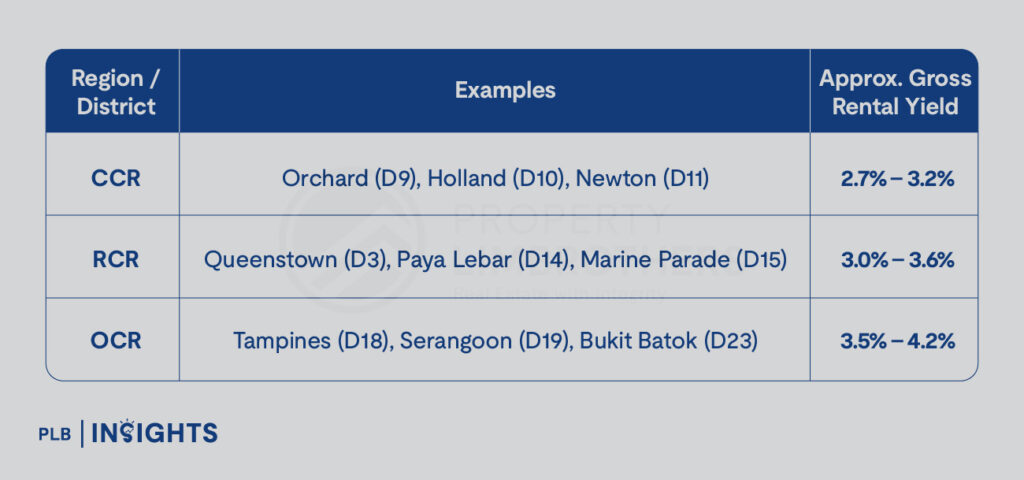

Singapore’s Gross Rental Yields by District

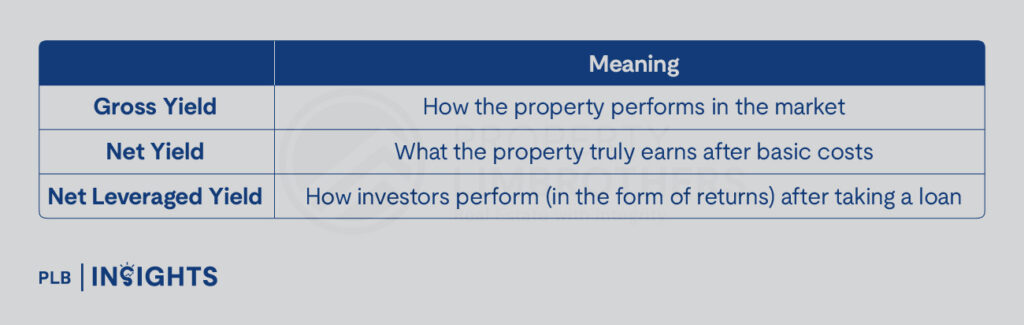

Gross rental yield indicates how the property performs in the rental market, not how much profit you pocket.

So if you see a 4%+ rental yield in OCR, it feels “good”.

But even with a 4% gross yield, your actual cashflow can still be negative once you factor in real-world costs and your mortgage.

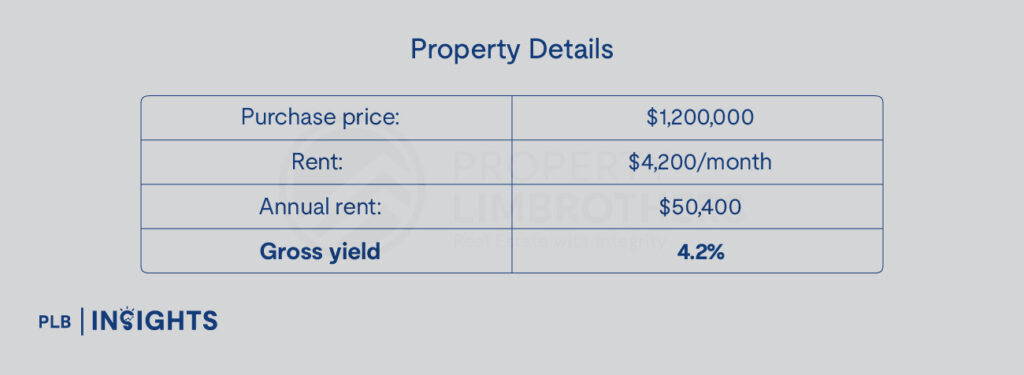

A Realistic Example: District 19 (Serangoon / Hougang)

Property details:

On paper:

You’ve got a 4.2% gross yield. Looks healthy.

Now let’s see what you actually take home.

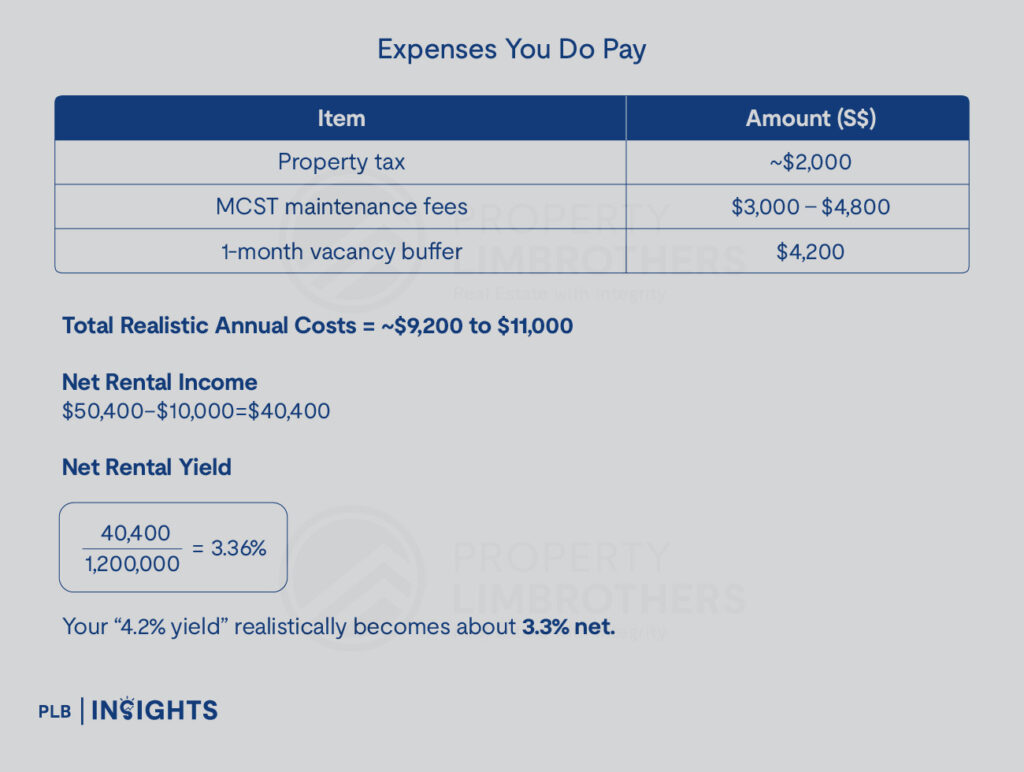

Strip Out Realistic Annual Expenses

Let’s ignore “nice-to-have” costs and focus on what most Singapore landlords almost definitely pay.

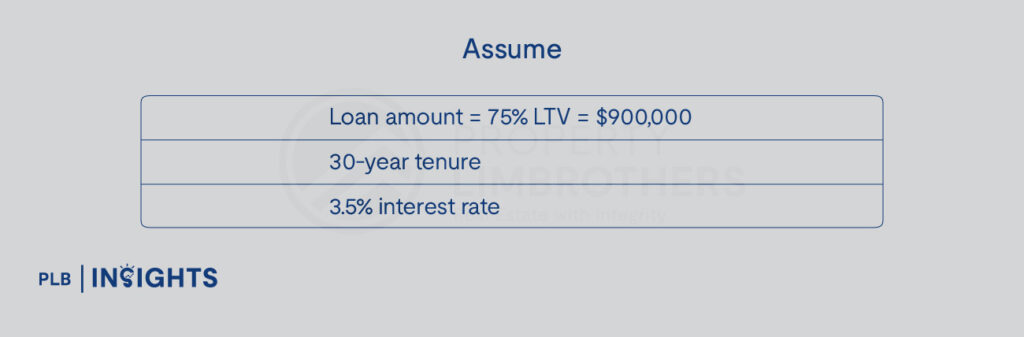

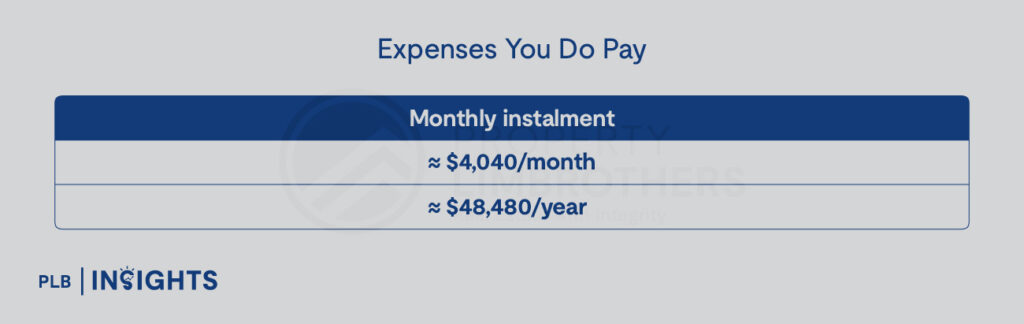

The True Cost: Mortgage Instalments

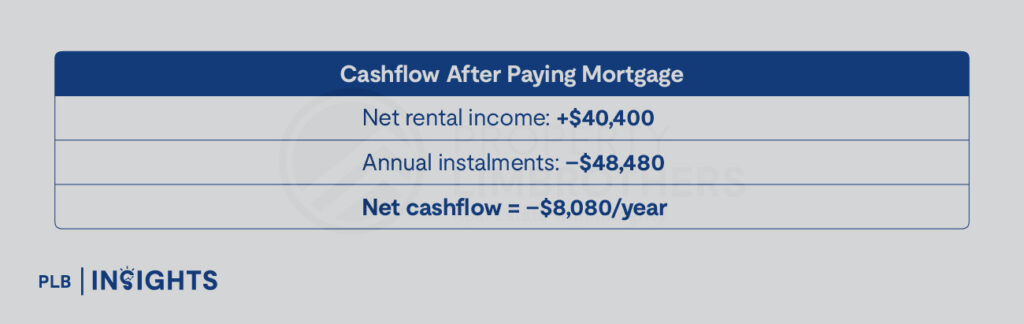

That means you are topping up:

≈ $670/month out of pocket

even though the rental yield looks like a “healthy” 4%.

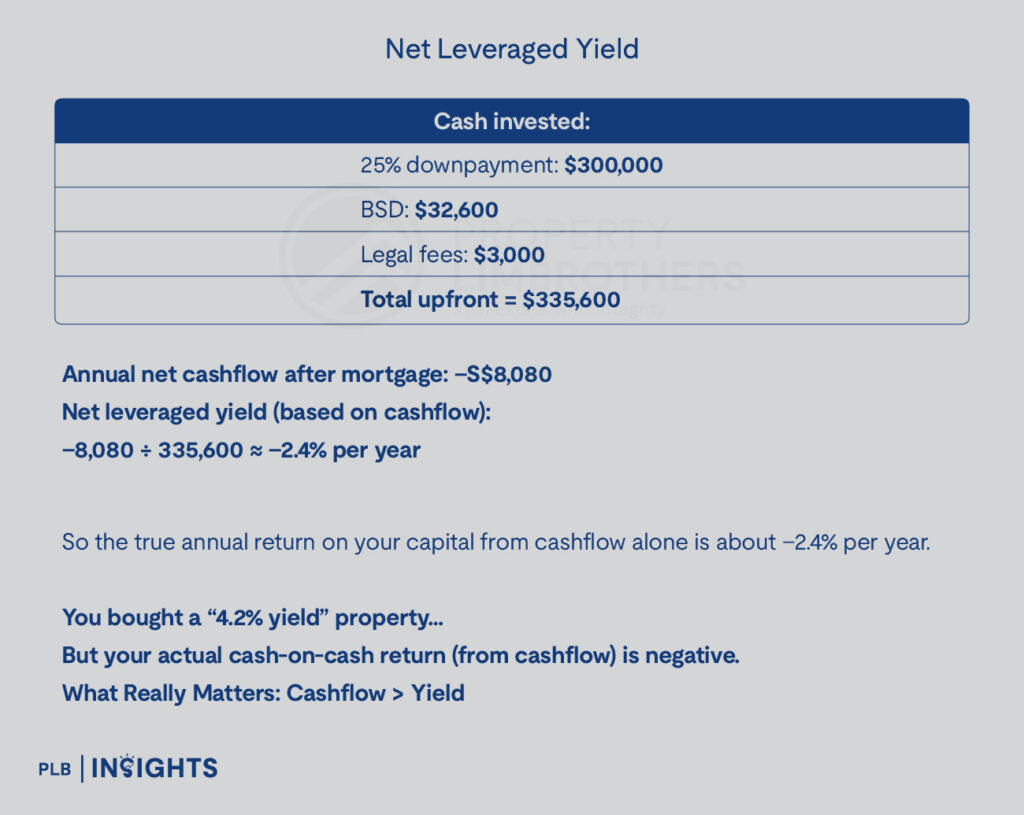

Net Leveraged Yield: What You Actually Earn

To simplify:

But the most important metric: Monthly CASHFLOW — the money you keep each month

Because only cashflow keeps you alive in a high-mortgage environment.

Capital appreciation helps you five to ten years later, cashflow determines whether you can survive until then.

Singapore Rule of Thumb

A good rental investment hits this balance:

If this holds, you’re:

And always keep: 3–6 months of mortgage instalments as a safety buffer for vacancies or unexpected issues.

Conclusion

Even in Singapore’s strong rental market, “4% yield” usually doesn’t mean profit.

Once you factor in property tax, maintenance fees, and mortgage payments, landlords may still see negative cashflow, especially with higher interest rates.

A good Singapore property investment isn’t defined by yield. It’s defined by sustainable cashflow that keeps you afloat until the property is truly yours.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!