Inter-terrace homes consistently make up the largest share of landed transactions in Singapore. Their appeal lies in accessibility and liquidity — the preferred choice for many families upgrading from condos or HDB flats while staying within a manageable budget.

But with today’s market dynamics and rising PSF levels across the island, one question continues to surface: what’s the safest price point to enter the landed market through an inter-terrace home?

The Heart of Landed Transactions

Within the broader landed landscape, inter-terraces form the foundation of demand. These homes often sit on land sizes ranging from 1,600 to 2,200 sqft, making them more attainable for upgraders transitioning from condominiums or HDB flats. Their relative affordability also means that resale liquidity — or the ease of selling in the future — remains one of the strongest in the pure landed category.

In District 19, for instance, inter-terrace homes are the backbone of landed transactions. Out of roughly 200 landed sales recorded in a given year, nearly half typically fall within the $4–$6 million range. This has become the “sweet spot” for upgraders, striking a balance between budget, land size, and address.

The appeal is straightforward: for many families, this price range allows them to enjoy the landed lifestyle — a sense of ownership, privacy, and space — without crossing into the higher financial commitments of semi-detached homes.

The Safest Price Point: The $4M–$6M Sweet Spot

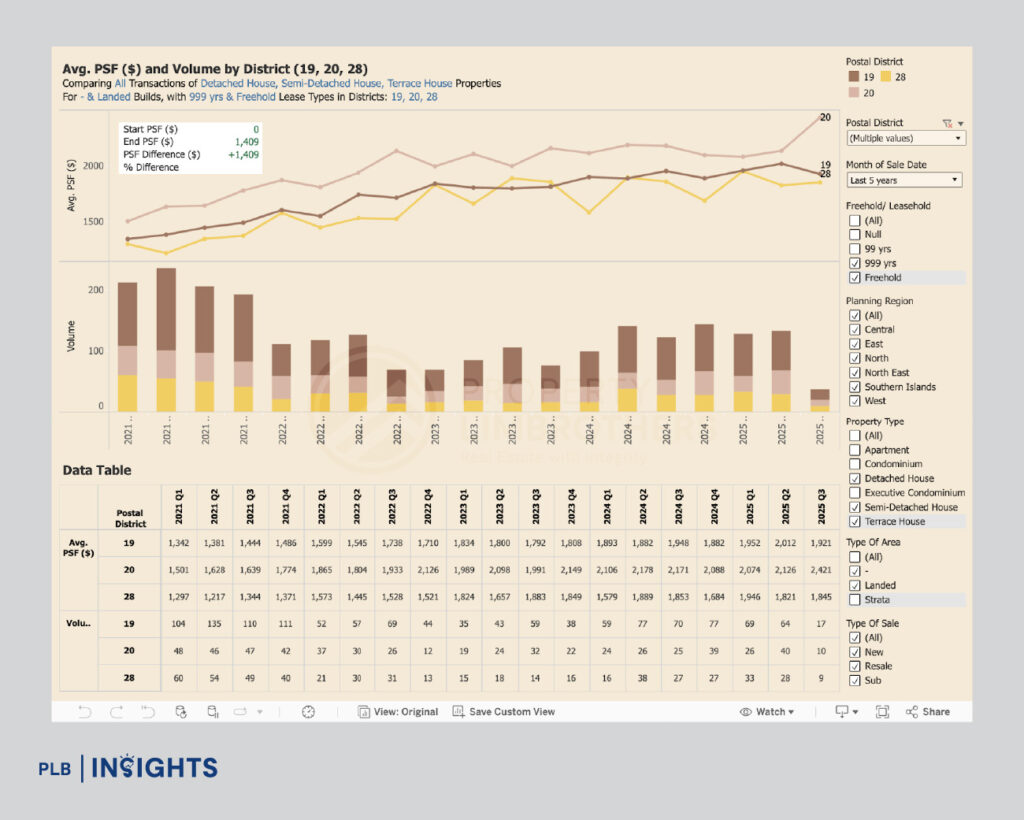

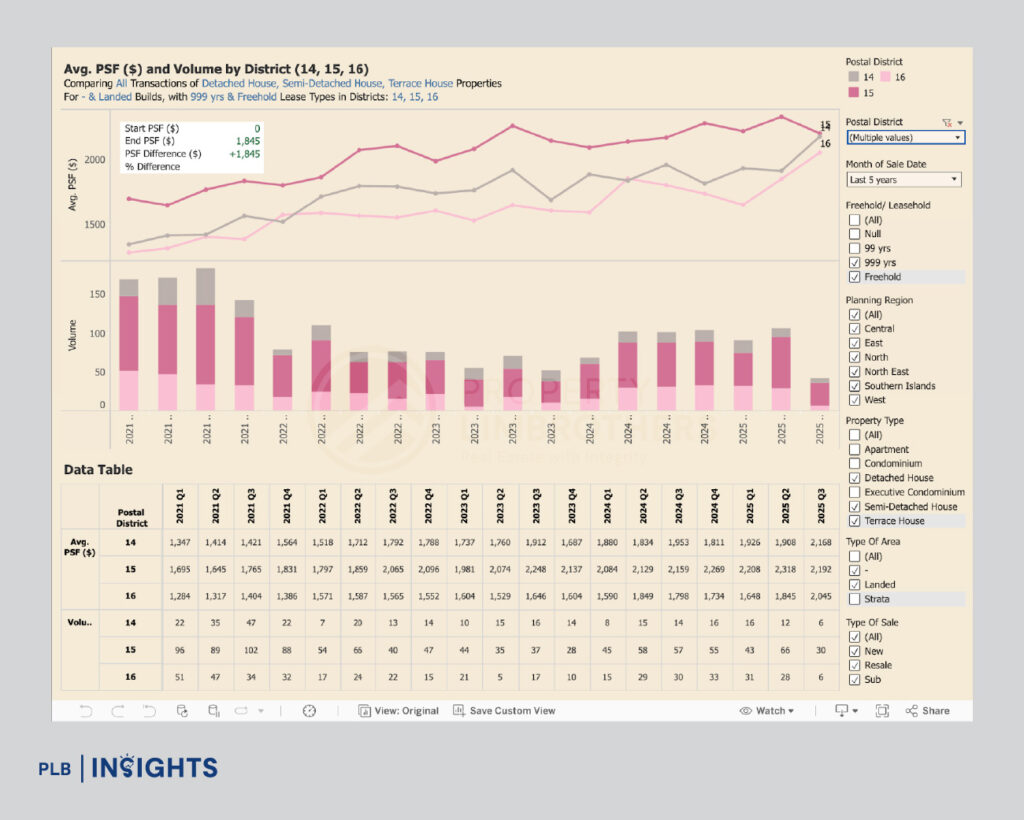

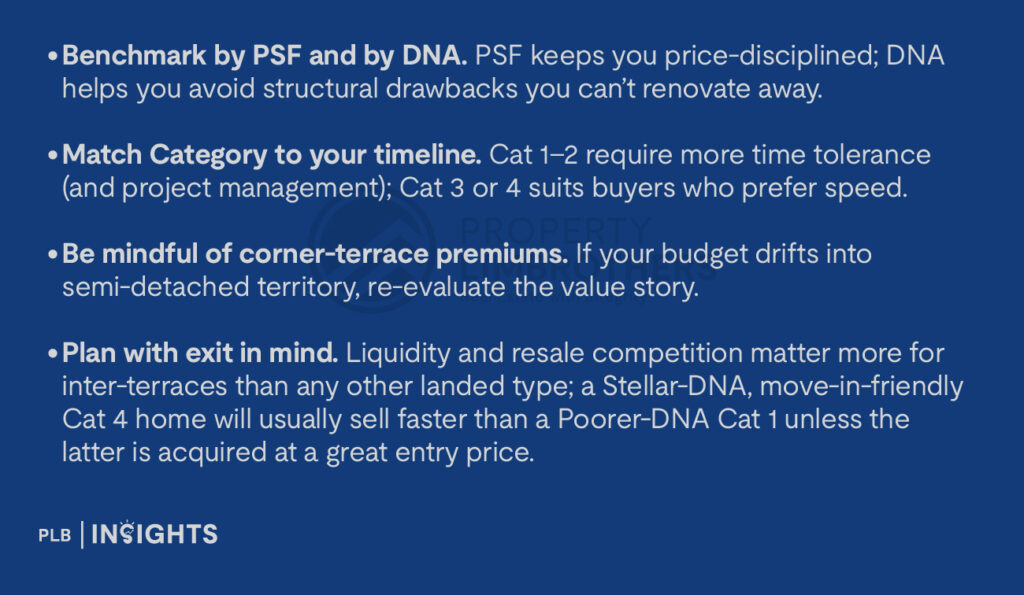

Analysing transactions across Districts 19, 20, and 28, as well as 14, 15, and 16, the data shows that average PSFs for terrace homes range between $1,800 and $2,200 in recent quarters.

In the North-East region (D19, D20, D28), PSFs have held steady between $1,800–$2,400, with D20 leading at ~$2,421 PSF as of 2025 Q3.

In the East region (D14, D15, D16), prices have similarly risen, with D15 crossing ~$2,200 PSF in 2025.

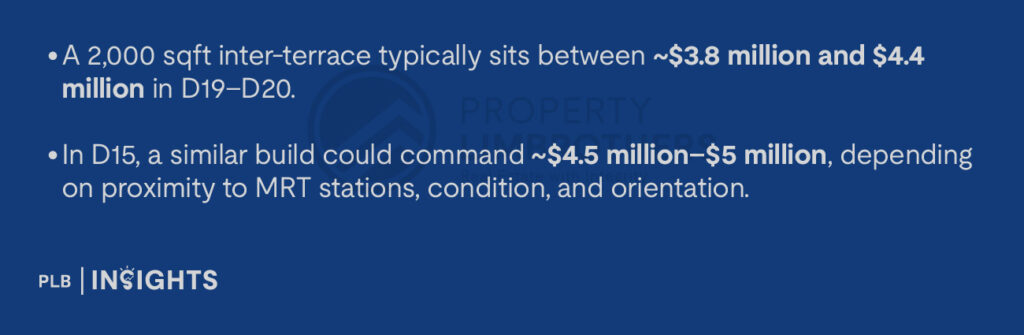

Translated to total quantum, this means:

At this quantum, inter-terraces remain the most liquid and “defensible” entry point in the landed hierarchy. They attract the broadest buyer base — upgraders from HDBs and condos who see landed ownership as the next logical step.

Why Demand Is Strong — But Also Price Sensitive

Unlike detached or semi-detached homes, where buyer pools tend to be smaller and more affluent, inter-terrace homes attract a wide yet price-sensitive audience. Buyers here are often stretching their budgets and are more likely to be affected by financing limits or rising interest rates.

This creates a unique dynamic:

In practice, this means that entry price matters greatly — both at the point of purchase and resale. A home priced even $300,000 above comparable listings may sit longer on the market, as buyers in this segment compare options closely.

That’s why inter-terrace homes are often seen as a safe but not speculative entry into the landed market. The investment upside lies not in exponential capital appreciation, but in the speed and certainty of resale, provided the home is well-priced and well-maintained.

The Investment Lens: Liquidity and Longevity

From an investment standpoint, inter-terrace homes present one of the most balanced risk-reward profiles.

However, inter-terrace homeowners must recognise one critical trade-off — competition. Because inter-terraces form the bulk of landed supply, buyers will often compare your home against several similar listings in the same vicinity.

Differentiation becomes key: thoughtful renovations, efficient internal layouts, and tasteful A&A works can significantly impact both resale value and buyer perception.

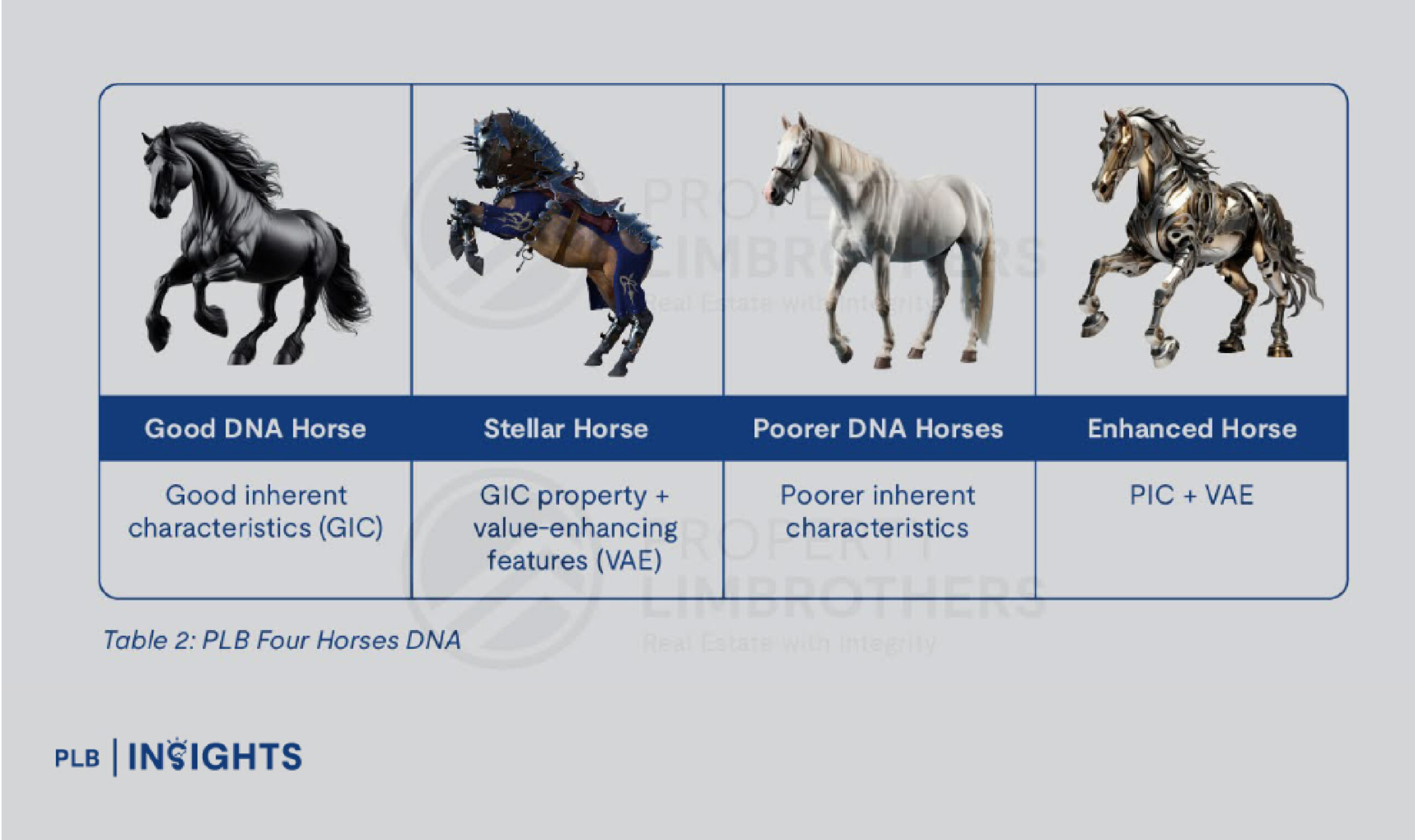

Reading a Home’s “DNA”: The Four Horses Framework

Beyond price and quantum, the inherent characteristics of a landed home — its “DNA” — play a major role in long-term desirability and value. Using PLB’s Four Horses Framework:

Why this matters for inter-terraces: in a segment where many homes look similar on paper, DNA explains why two houses on the same street can perform differently at resale. Prioritise Good/Stellar DNA where possible; if you’re considering an “Enhanced” or “Poorer DNA” home, your entry price must reflect those limitations.

A Note on Corner-Terrace Entry Prices

While corner-terraces share many similarities with inter-terraces, buyers should be mindful of the entry quantum. The additional land often commands a premium, but that premium can blur the line between choices.

For example, a corner-terrace transacting at ~$6.5–$7 million may encroach on budgets where larger semi-detached options become viable. When that happens, ask if the same budget could deliver better DNA (wider frontage, more natural light, two-car parking), or a clearer long-term value story, with a semi-detached home.

In short, be careful not to overpay for a corner-terrace when the next landed tier may offer a different value proposition for a similar outlay.

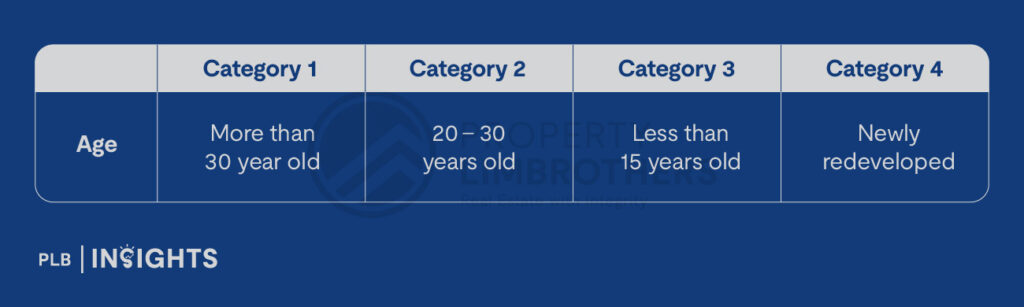

Where Inter-Terraces Sit Among Cat 1–4 Homes

Within Singapore’s landed landscape, inter-terraces commonly span Cat 1 to Cat 3 homes.

Cat 1 homes tend to be older and suitable for rebuilding, Cat 2 for major A&A works, and Cat 3 for minor improvements or light touch-ups before moving in.

This range makes the inter-terrace an incredibly versatile segment — one that allows buyers to choose between rebuilding from scratch, revitalising an existing structure, or purchasing something move-in ready.

Selecting the right “category” often depends on your lifestyle goals and project appetite: whether you want to create a fully customised home or simply secure a well-kept property with good DNA that can serve your family immediately.

Navigating the Market with Foresight

With landed homes now commanding higher absolute prices, strategic entry is key. Inter-terraces offer a compelling blend of affordability, liquidity, and familiarity — but not all purchases are equal.

Your decision checklist:

For upgraders and families seeking stability, the inter-terrace remains one of the safest ways to enter the landed market — the ideal starting point that balances practicality with potential.

Conclusion

Inter-terrace homes represent the pulse of Singapore’s landed property market — resilient, in-demand, and deeply entrenched in upgrader aspirations. Their strength lies not in flash or grandeur, but in reliability: a product type with enduring resale liquidity, steady appreciation, and a buyer base that renews itself with every generation.

When you combine price discipline (PSF and quantum) with DNA awareness (Four Horses) and a clear understanding of Cat 1–4 (age and works), you’ll position yourself to buy the right inter-terrace — one that fits your timeline today and tells a compelling resale story tomorrow.

Ready to find your ideal inter-terrace home? Speak with our sales consultants today and make a confident move into the landed market.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.