However, capital flight may be observed as investors pull money out of stocks and invest in real estate

The United States has sharply escalated its protectionist stance in recent months, marking a dramatic reversal from decades of global trade liberalisation. The Trump administration—amid a renewed pivot toward strategic decoupling—has imposed a blanket 10% tariff on all imports, with targeted duties reaching up to 54% on Chinese goods. In retaliation, China responded with tariffs as high as 84%, amplifying trade tensions across major corridors.

The situation intensified further on 9 April, when President Donald Trump announced a 125% tariff on selected Chinese imports, primarily in the electric vehicle and tech manufacturing sectors, citing “unfair industrial subsidies and national security risks.” This latest escalation sent tremors through global markets and heightened stagflation fears.

Singapore, despite enjoying two decades of free trade with the U.S., was not exempted. The U.S. has included a 10% import tariff on most goods from Singapore, reflecting a broader shift from alliance-based trade to transactional, country-agnostic protectionism.

These moves are not occurring in isolation. President Trump also announced a pause on planned interest rate cuts, citing persistent inflationary risks from imported price shocks. The Federal Reserve, which had previously signaled a dovish pivot, now faces a more complex macroeconomic calculus—one shaped not only by domestic inflation but by tariff-driven global supply distortions.

With the world watching, all eyes are on the day after the 90-days tariffs pause, when the administration is expected to finalise its next round of trade actions and provide forward guidance on monetary policy. The outcome could decisively shape global growth trajectories and set the tone for financial conditions heading into H2 2025.

For a small, open economy like Singapore, these actions reverberate far beyond bilateral trade flows. They pose risks to global supply chains, erode consumer and investor confidence, and threaten to plunge the world into a stagflationary recession—a rare and destabilising combination of slowing growth and rising prices.

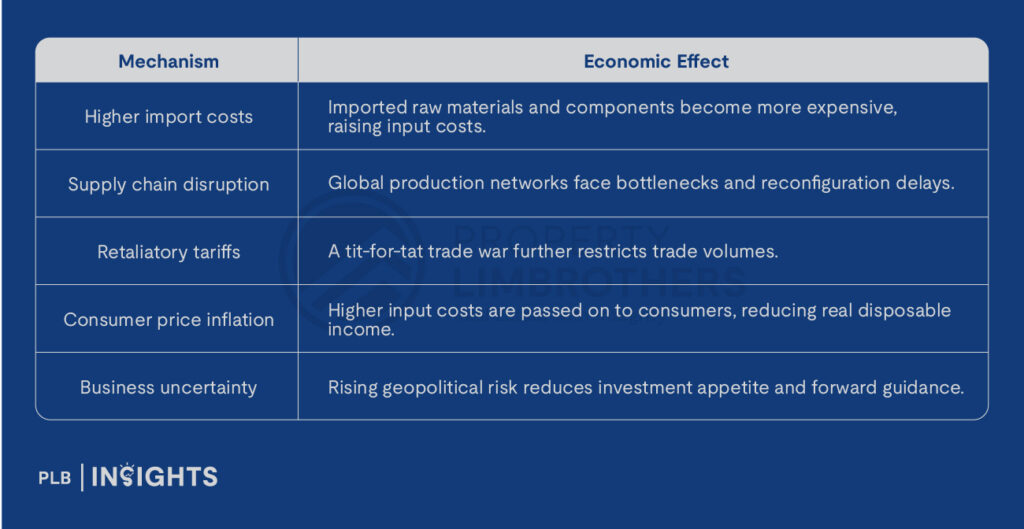

The Mechanics: How Tariffs Trigger a Recession

Tariffs are, by design, a tax on trade. While often politically justified as protective measures, their macroeconomic effects are contractionary:

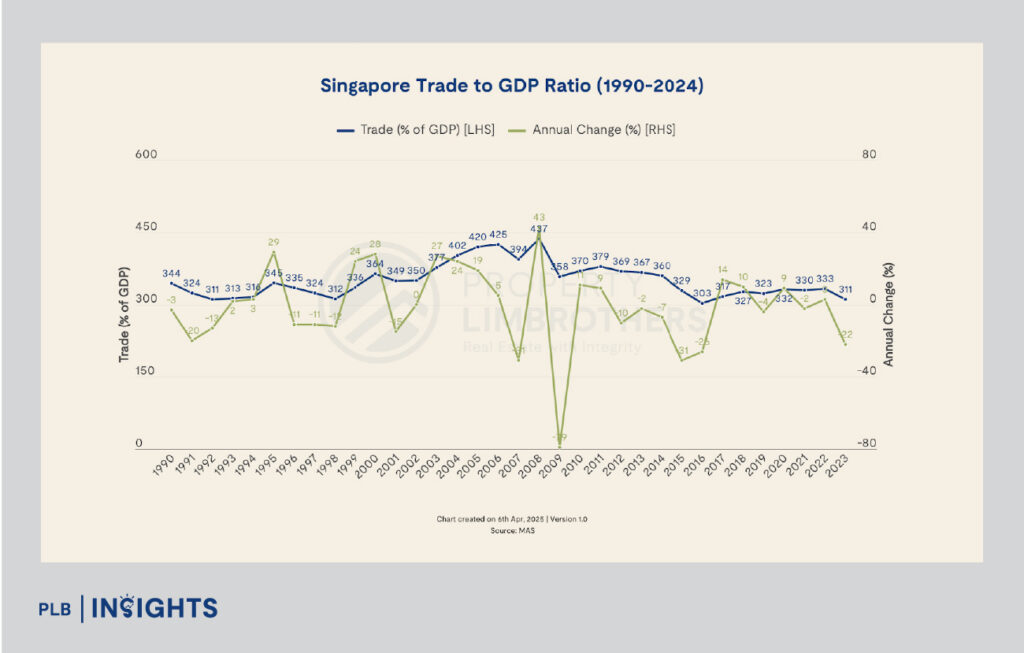

The compounding of these factors tightens global financial conditions and diminishes demand. For Singapore—where total trade accounts for over 300% of GDP—this global slowdown would be deeply consequential.

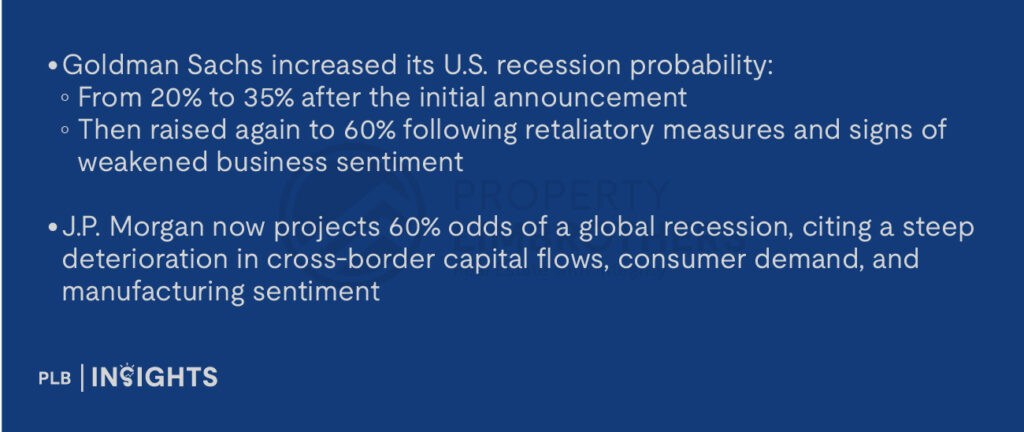

Recession Fears Escalate: Markets React

Major financial institutions have issued stark warnings about the rising risk of a global downturn:

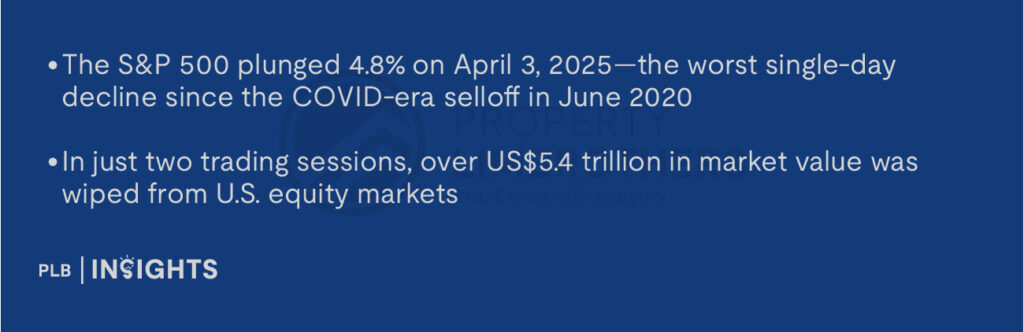

Financial markets were swift and severe in their reaction on 2nd-3rd April 2025:

This erased nearly 6 months’ worth of equity gains in less than 48 hours, underscoring the fragility of investor sentiment in a deglobalising environment.

A Small, Open Economy at Risk: The Singapore Context

Singapore’s growth model is intricately tied to global trade, capital flows, and confidence. When markets tighten and trade contracts, Singapore disproportionately feels the squeeze. Rising import prices from China and the U.S.—two of Singapore’s top trading partners—will increase business costs across construction, manufacturing, and logistics.

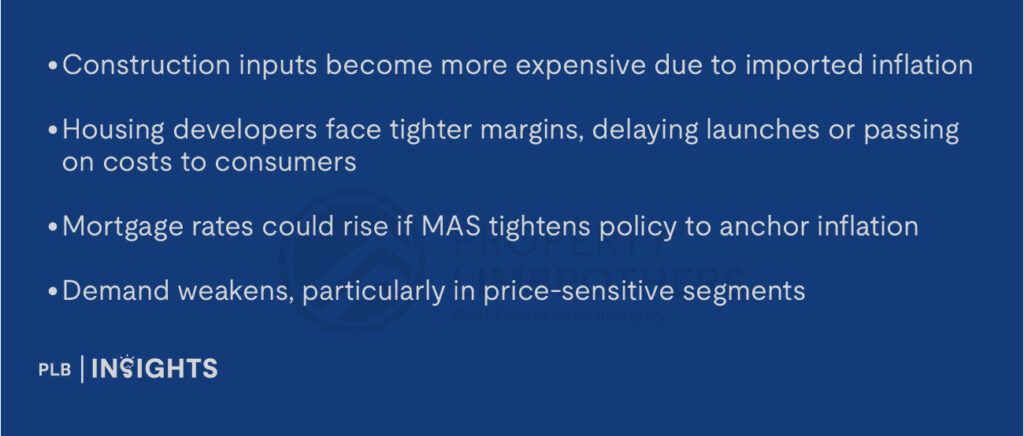

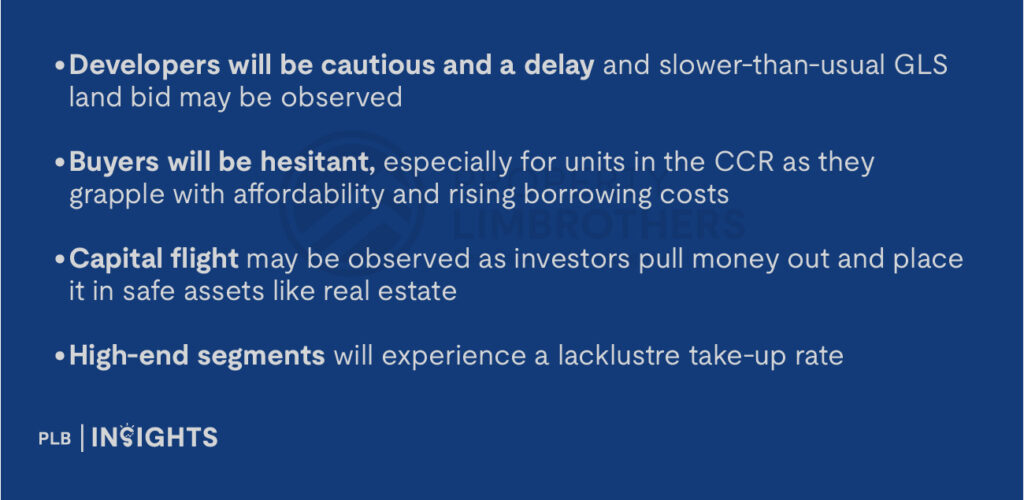

Coupled with this are rising risks in the property market:

The outcome? A potential decline in transaction volumes, particularly in both the private and resale segments, as affordability constraints and financing hurdles deter prospective buyers. A softening of resale markets may manifest through longer time-on-market durations, or higher absorption ratios, and modest price corrections in both the private and HDB segments.

In addition, growing uncertainty in the investment-grade residential sector (such as those in the Core Central Region) could arise from shifting foreign buyer sentiment, delayed project launches, and recalibrated developer strategies in response to higher construction costs and financing risks.

This uncertainty may extend to en bloc prospects and high-end developments, where risk appetite is more sensitive to macroeconomic volatility.

A Higher Construction Costs Affecting the Housing Market

Singapore’s robust trade infrastructure may cushion direct tariff impacts, but industry sources warn of indirect price pressures. As U.S. firms localise procurement to avoid higher import costs, global demand for foreign construction inputs may drop, prompting production cuts overseas. This contraction could reduce global supply, lifting prices.

Suppliers are unlikely to risk oversupply; many would pivot to other sectors or geographies to maintain price levels. These shifts, layered on top of the baseline 4%–5% increase in construction material costs projected for 2025 by Linesight, could further erode developer margins and heighten affordability risks, particularly in cost-sensitive segments.

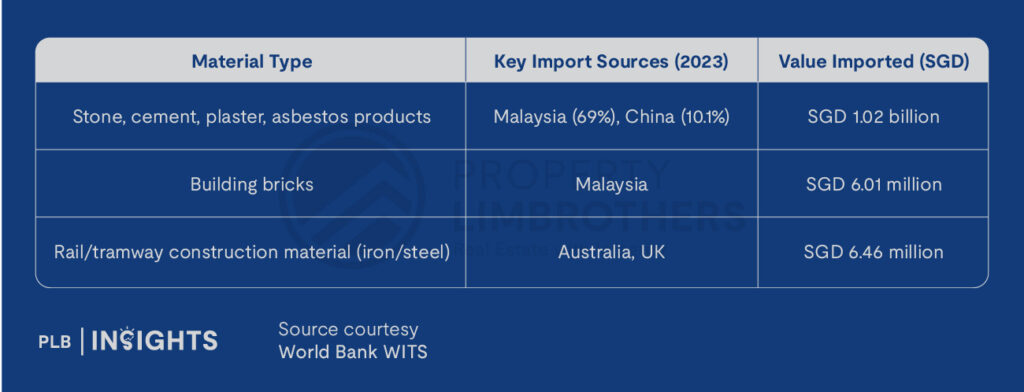

Singapore relies heavily on imported construction materials, making the sector acutely vulnerable to global trade tensions:

Higher tariffs and retaliatory measures risk raising the cost of these imports, because tariffs function as a tax on goods entering the country, effectively inflating the base cost of the products.

When applied to key construction inputs such as cement, steel, and bricks, the additional costs are passed through the supply chain, ultimately borne by contractors, developers, and end-consumers. This leads to higher construction and development costs, which may deter new project launches, reduce housing affordability, and slow down the pace of private sector investment in real estate.

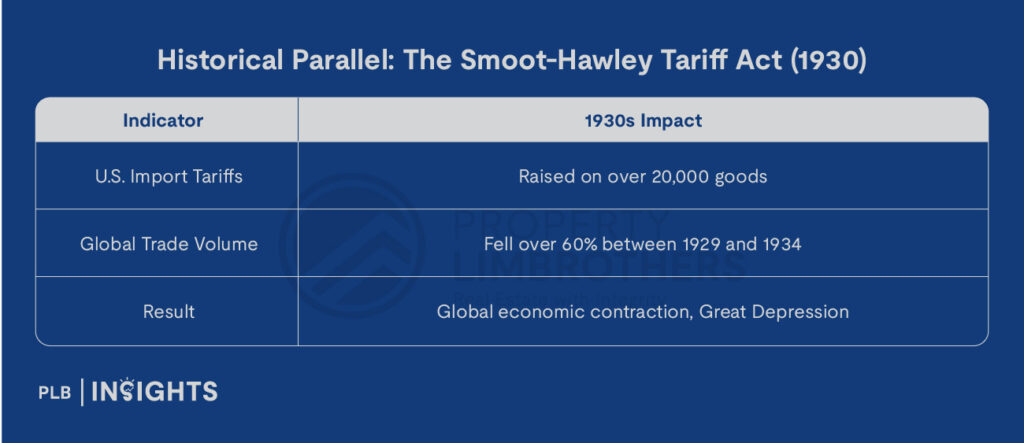

The End of Globalisation? Lessons from the Great Depression

The move toward tariffs marks not just a shift in policy—but a historic reversal in economic ideology. For the past 70 years, globalisation has been the dominant paradigm, lifting hundreds of millions out of poverty and underpinning Singapore’s prosperity.

But with the U.S. retreating from free trade, and global supply chains fragmenting, we are witnessing a return to protectionism and strategic economic nationalism.

And this is likened to what happened before the Great Depression in the 1930s.

The World Trade Organization (WTO) warns that “geoeconomic fragmentation” could shave up to 5% off global GDP in the long run. For Singapore, which depends on external demand, the stakes could be higher.

This looming slowdown invites us to reflect on the past: how have previous global and regional recessions impacted Singapore’s housing market?

Understanding historical responses to economic downturns is crucial, particularly when assessing the resilience and vulnerabilities of residential property in times of crisis. In the following section, we examine key recessionary episodes and their effects on home prices, transaction volumes, and buyer sentiment in Singapore.

Historical Trends of Recession and Singapore Housing Market

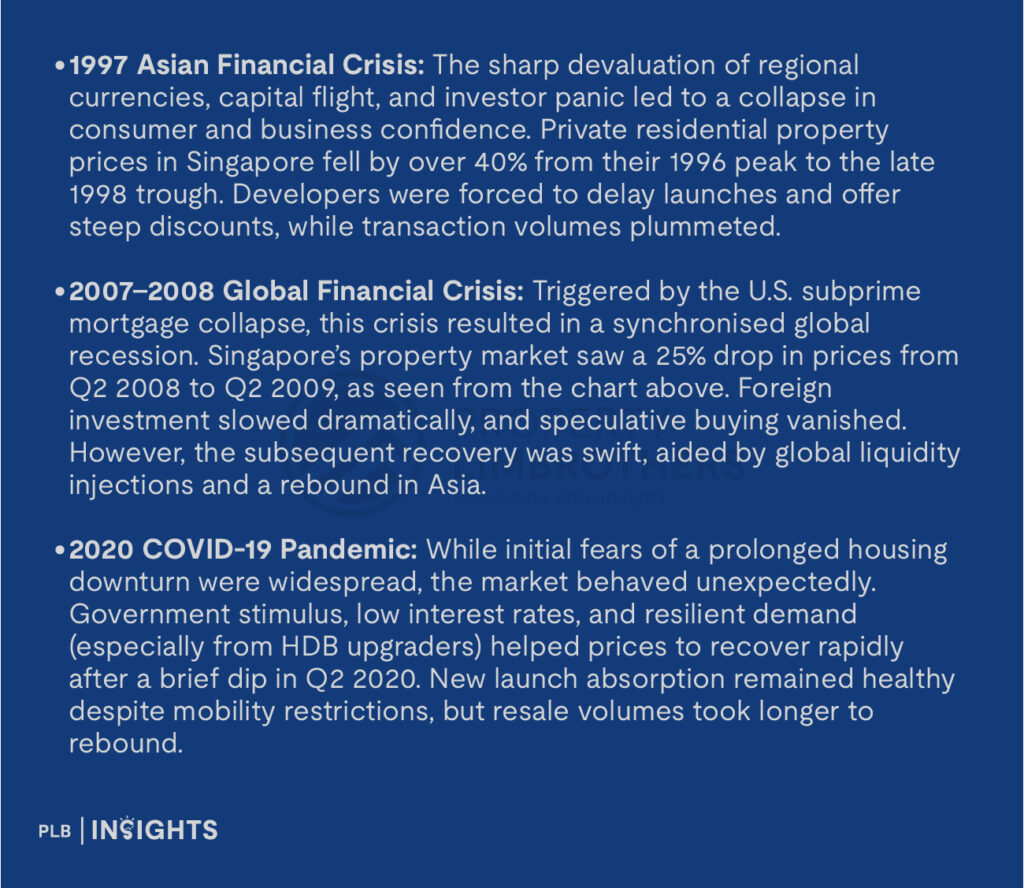

Singapore’s housing market has experienced significant corrections during major global and regional economic downturns.

Understanding how home prices, buyer sentiment, and transaction volumes responded to past recessions offers valuable insight into how the market might behave amid the current tariff-driven global risks.

These three events underscore the sensitivity of Singapore’s property market to external shocks, while also highlighting its capacity for swift recovery when supported by coordinated policy interventions and macroeconomic stabilisation.

However, the current environment—characterised by protectionism, supply-side inflation, and tighter monetary conditions—presents a more complex risk landscape.

Unlike previous recessions triggered by demand-side or financial shocks, the confluence of geopolitical fragmentation and cost-push inflation could result in a more prolonged and uneven recovery across property segments.

That said, one pattern remains consistent: recessions have historically been accompanied by downward adjustments in housing prices, making this a key trend to monitor as macroeconomic pressures intensify. The current environment, marked by protectionism and monetary tightening, presents a different challenge—where recovery could be slower and more uneven across segments.

Implications for New Launches

Compounding this is the issue of elevated mortgage rates. Unlike previous downturns where central banks were able to lower interest rates quickly, today’s inflationary backdrop has kept borrowing costs high. And this is worsened by rising stagflation risks.

Singapore’s mortgage rates, closely linked to U.S. interest rate movements through the SORA benchmark, remain elevated. This has eroded affordability for many prospective homebuyers, particularly first-time buyers and HDB upgraders, leading to greater caution in large financial commitments such as new private home purchases.

Additionally, the global demand environment remains weak. Foreign buyer sentiment has softened considerably, especially in the CCR, where high quantum projects are most vulnerable to pullbacks in investment appetite. The market is already observing this. For instance, Aurea, a residential tower in Beach Road, sold 23 units on its launch weekend in February this year, representing only 12.2% of the 188 available units.

Wealth preservation remains a priority, but risk aversion is curtailing appetite for high-value residential properties amid global uncertainty and market volatility.

Unlike the Global Financial Crisis or the COVID-19 pandemic, policymakers now face more limited flexibility. The current downturn is supply-driven, rather than demand-led, meaning that traditional fiscal and monetary stimulus measures may not be as effective or as politically feasible. Without aggressive interest rate cuts or broad-based government support packages, the housing market is unlikely to see the same swift recovery witnessed in earlier recessions.

Lastly, buyer sentiment has become increasingly cautious. Many first-time buyers and upgraders will adopt a wait-and-see approach, concerned about job security, interest rate trajectories, and downside risks to property values.

Resilience Factors: Cooling Measures and Investor Behaviour

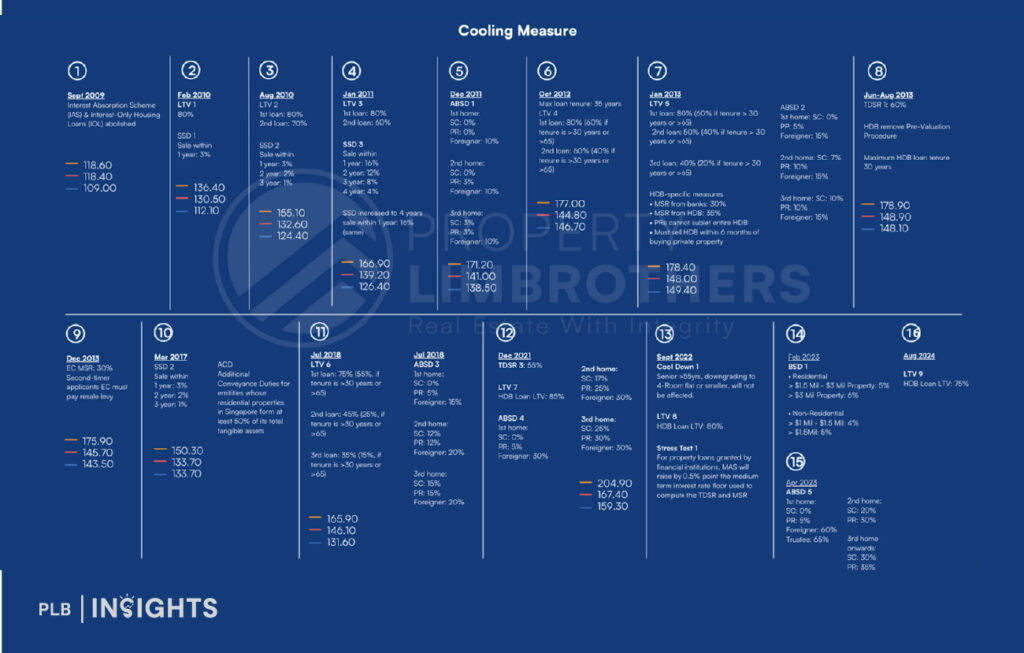

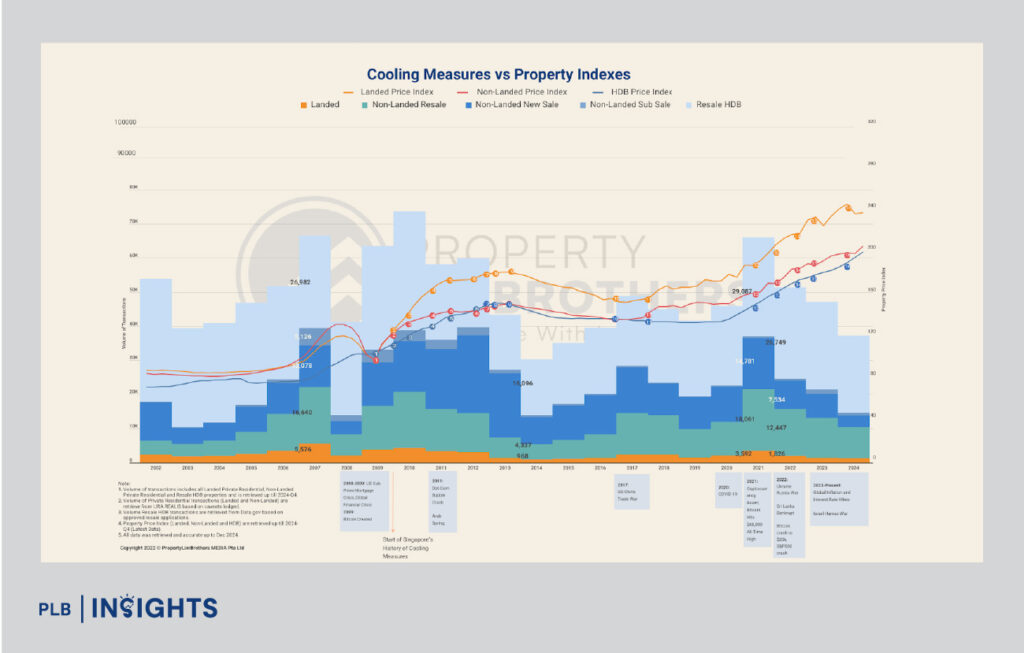

While external shocks such as tariffs and rising rates increase pressure on the property market, Singapore’s regulatory framework has introduced strong buffers in recent years after the Great Financial Crisis that happened in 2007.

A suite of cooling measures—ranging from ABSD and TDSR rules to SSD—has helped curb excessive speculation and maintain financial prudence among buyers. These macroprudential policies reduce systemic risk, limit overleveraging, and enhance long-term market stability.

Importantly, during times of global crisis, investors often pivot toward less volatile and more tangible assets. Real estate—especially in politically stable, well-regulated markets like Singapore—is perceived as a hard asset and a relatively safe store of value.

The COVID-19 pandemic offers a compelling case study: despite an initial dip in Q2 2020, private residential prices quickly rebounded and even rose over 3% year-on-year by Q4 2020. Demand was driven by both local upgraders and long-term investors seeking safety amid uncertainty.

This behavioural trend suggests that during periods of heightened geopolitical or economic volatility, capital will shift towards residential property—not necessarily for short-term yield, but for capital preservation.

Pockets of Resilience: Singapore Home Prices Post-Crisis

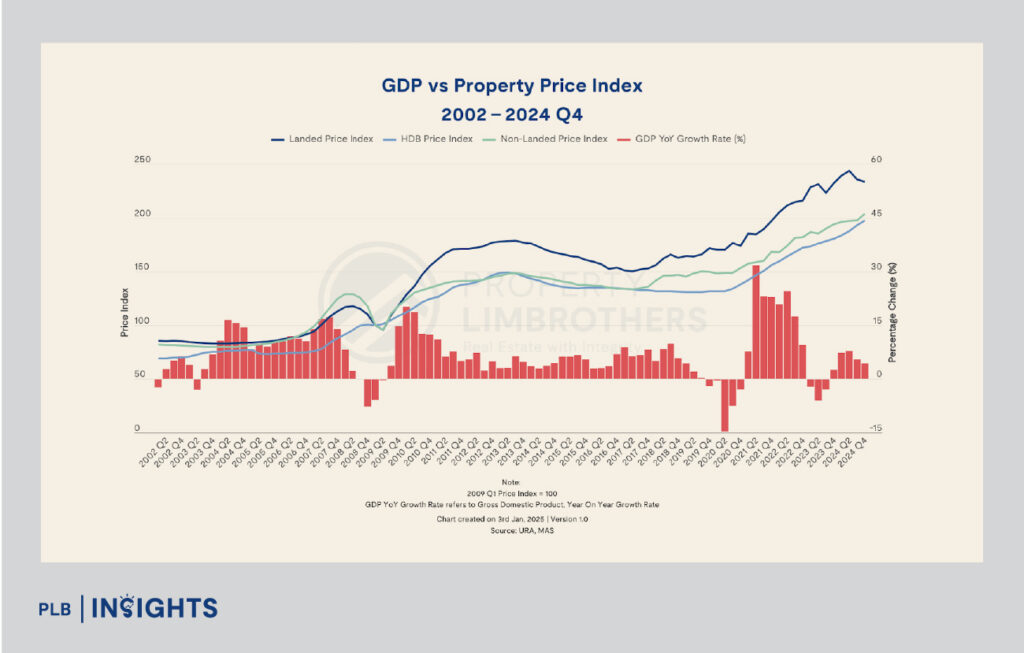

While downturns often trigger short-term price declines, Singapore’s housing market has shown a strong pattern of post-recession recovery and long-term appreciation. This has been especially evident in the wake of the COVID-19 pandemic.

In Q2 2020, during the height of pandemic-related uncertainty and lockdowns, the housing prices dipped slightly, according to the URA Property Price Index (PPI). However, prices rebounded sharply by Q4 2020, recording a 3.3% year-on-year increase. From then on, the market saw a sustained rally, with private home prices rising over 37% cumulatively between Q4 2020 and Q4 2024, based on URA’s PPI as seen in the chart above. Prices climbed steadily in 2021 and 2022 due to supply-side constraints and pent-up demand, before moderating slightly in late 2023 amid rising interest rates.

Prices remained resilient into early 2025, supported by structural underpinnings such as low unsold inventory and healthy household balance sheets. HDB resale prices also surged, increasing more than 43% from Q4 2020 to Q4 2024, driven by supply delays and demand spillover from the private segment.

This trend is not unique to COVID. Following the 2008 Global Financial Crisis, Singapore’s home prices fell sharply for three consecutive quarters but rebounded strongly by 2010. Prices increased by 37% from Q2 2009 to Q2 2010 even though it dipped by over 11% between 2007 and 2009 during the time of the Great Financial Crisis.

The recovery was mainly aided by monetary easing, government stimulus, and regional economic recovery.

The takeaway: recessions temporarily suppress prices, but Singapore’s structural fundamentals—limited land supply, strong governance, and prudent fiscal and monetary policy—create conditions for resilient long-term value. This recurring cycle of decline and recovery underlines real estate’s durability as an asset class, particularly when held through periods of macroeconomic stress.

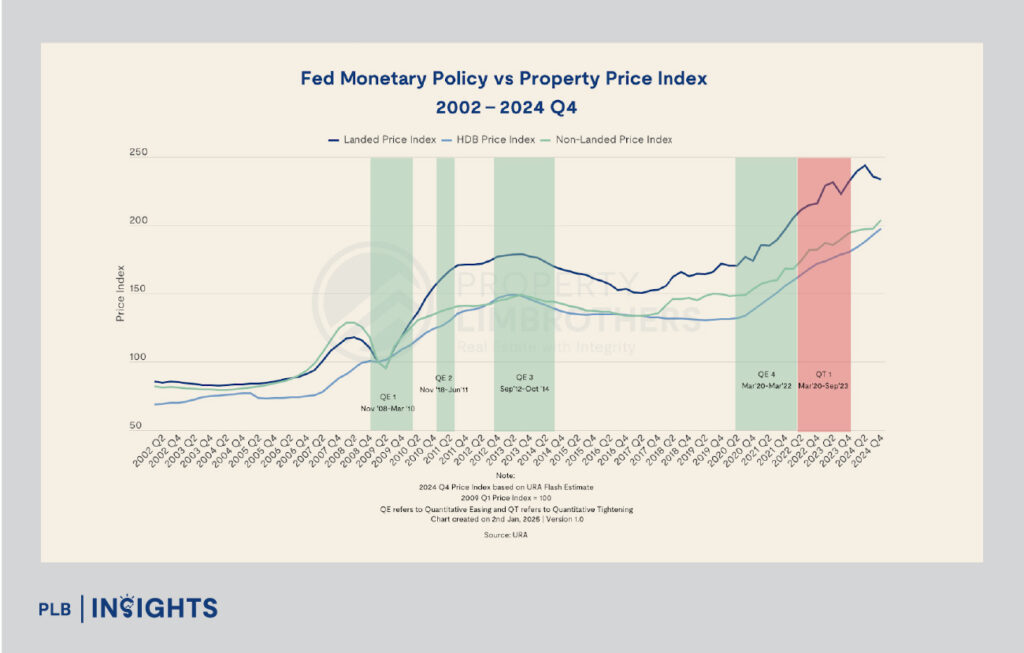

Mortgage Rate Trajectory and Housing Affordability

Mortgage rates in Singapore are closely tied to global interest rate cycles, particularly the U.S. Federal Reserve, due to Singapore’s exchange-rate-based monetary policy framework. While the Monetary Authority of Singapore (MAS) does not set benchmark interest rates, domestic borrowing costs—such as the SORA —tend to move in tandem with U.S. interest rate shifts.

As inflation rises and central banks maintain hawkish stances to anchor expectations, the risk of prolonged higher interest rates increases. If U.S. rates remain elevated or rise further due to imported inflation and geopolitical shocks, Singapore’s mortgage rates will likely remain elevated as well.

On the flip side, if inflation moderates more quickly than expected or if global growth deteriorates more sharply, central banks may adopt a more dovish stance. This could result in rate cuts or a more accommodative monetary posture that lowers borrowing costs and rejuvenates housing demand. Lower mortgage rates typically improve affordability and can spur both upgrader and investor activity, particularly in the mid-tier and core central regions where price sensitivity is lower and rental yields may be more attractive relative to financing costs. This is a dynamic we may observe in the coming months, especially if economic data points to a broader global slowdown that encourages central banks to adopt an expansionary monetary policy.

Conclusion: Real Estate Amid Global Disruption

Singapore’s housing market has long been seen as resilient—shielded by prudent fiscal management, strong institutions, and an educated investor base. And capital flight to real estate will likely be the case.

However, the evolving macroeconomic landscape suggests that resilience may now be tested in ways not seen since the early 2000s.

With global inflation proving sticky and geopolitical tensions disrupting trade, Singapore faces the compounded pressures of higher costs, tighter liquidity, and softening demand.

The property market, once buoyed by stimulus and confidence, is now constrained by structural headwinds—from weak global sentiment to rising construction and financing costs. Unlike past downturns where rapid monetary and fiscal responses cushioned the blow, today’s policymakers are more constrained. This limits the ability to stimulate recovery quickly or decisively.

Stagflation—once a theoretical risk—is now a central concern. Tariff wars, inflationary import costs, and fragmented supply chains are already feeding through to Singapore’s small, trade-dependent economy.

In the near term, the outlook is tilted to the downside:

Without a significant external catalyst—such as a coordinated global monetary pivot or major policy easing or the reversal of tariffs—Singapore’s property market will likely face a falling demand, translating to lower transaction volume. Owners will now hold onto their asset amid uncertainties.

In addition, the Singapore housing market may undergo a more prolonged correction period, marked by price consolidation and risk re-pricing across asset classes—just like it was like when recession hit in the past.

While the fundamentals of Singapore remain strong in the long term, the coming quarters will test the market’s resilience more than any cycle in recent times.

Stay Updated and Let’s Get In Touch

Our goal is to provide you in-depth analysis of the real estate market. Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.