Transaction sets new record of $6,197 psf for Singapore’s most prestigious landed homes.

Singapore — A Good Class Bungalow (GCB) in Singapore’s prestigious Tanglin Hill area has been sold for $93.9 million, setting a new price record of $6,197 per square foot (psf). The buyer is Ms Diona Teh Li Shian, daughter of the late Malaysian banking tycoon Mr Teh Hong Piow, founder of Public Bank.

This high-profile deal highlights continued strong demand for ultra-prime landed homes, particularly from well-established regional families with long-term ties to Singapore.

Prime Location, Rare Property Class

The property sits on a 15,150 sq ft freehold plot near Orchard Road and several foreign embassies—one of Singapore’s most desirable residential zones.

It is being developed by Meir Homes, which acquired the land in 2022 for $30 million, and is currently building a two-storey bungalow with a basement and a total built-up area of 2,756 sq m.

Luxury Features and Bespoke Design

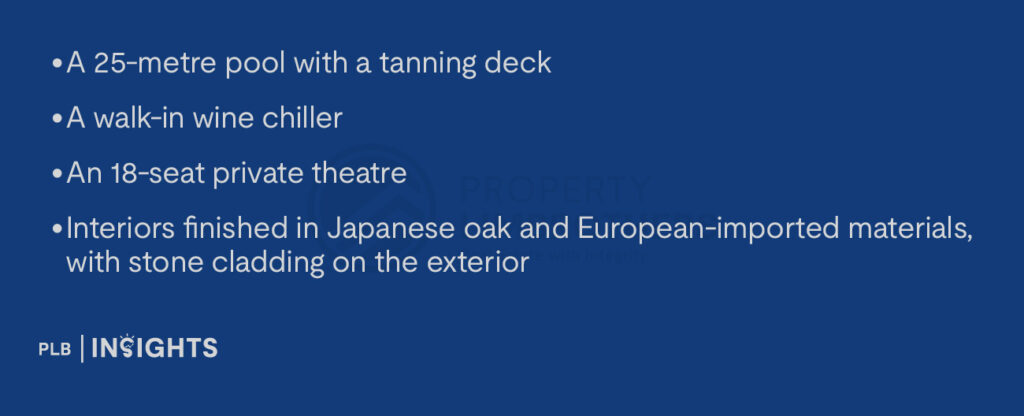

According to marketing materials, the upcoming home will feature:

The property is designed for high-end, multi-generational living—reflecting a growing trend among ultra-high-net-worth buyers seeking homes that combine prestige, privacy, and comfort.

GCBs: Limited Supply, Local Demand

GCBs represent the highest tier of landed housing in Singapore, with just ~2,800 units islandwide. Ownership is largely restricted to Singapore citizens, preserving exclusivity and supporting long-term asset value.

Family Legacy and Regional Wealth Anchoring

Ms Teh, a Singapore citizen, is one of four children of the late Mr Teh Hong Piow, who passed away in 2022. The Teh family still owns over 20% of Public Bank, now Malaysia’s second-largest lender by market value. Ms Teh has taken on a more visible role in the family’s affairs in recent years.

This transaction is not only a personal purchase but also part of a broader pattern: high-net-worth families anchoring wealth in Singapore through rare, legacy-grade real estate.