Sky Eden @ Bedok will be the first project to be launched in Bedok in over 10 years, with the last project being Bedok Residences which launched in 2011.

The project will be developed at the site of the former mall Bedok Point, a 3-minute walk from Bedok MRT and bus interchange — providing a wealth of accessibility for future residents.

With Bedok being a mature estate, residents will have no lack of amenities and food places all around. Being a medium-sized development of 2 to 4-bedder type of units, Sky Eden @ Bedok is targeted towards families planning to purchase for own-stay in the heart of a mature estate.

Not to mention, with 12 commercial units on the ground floor, residents can expect to conveniently settle their daily necessities within the project’s compound.

Facts

Developer: Chempaka Development Pte Ltd

Architect: ADDP Architects LLP

District: 16

Address: 1 Bedok Central

Site Area: 4,136.6 sqm / 44,526 sqft

Tenure: 99 years from 05 January 2022

No. Of Residential Units: 158

No. Of Commercial Units: 12

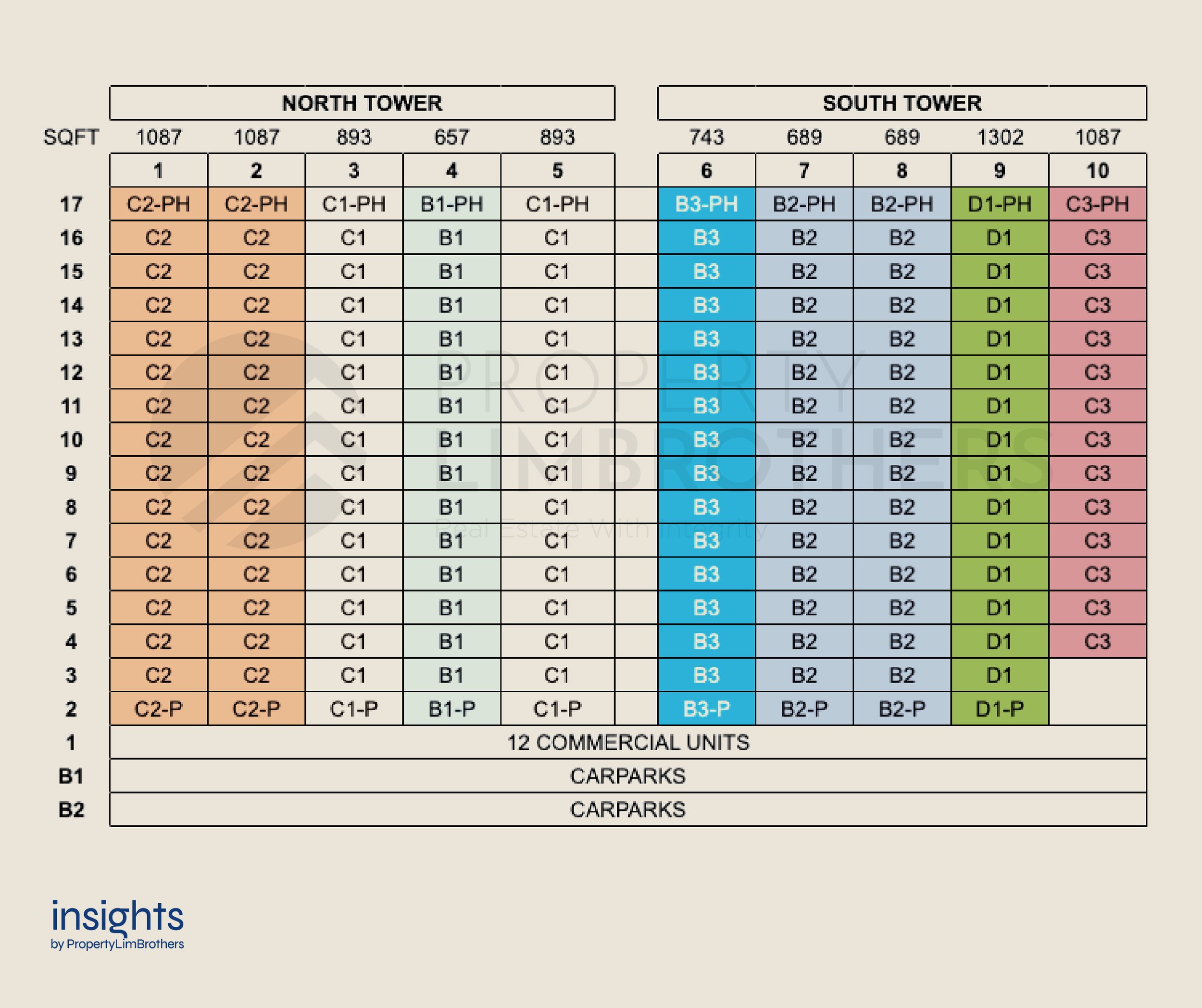

No. Of Blocks/Floors: 1 Block / 17 Storeys

Estimated TOP date: 30 June 2027

MOAT Analysis

Within the vicinity of Bedok MRT, the only private project available would be Bedok Residences. Hence we would be utilising our MOAT analysis tool to dissect the only project neighbour of Sky Eden @ Bedok.

Being an integrated development, Bedok Residences does come with a pricing premium. This naturally results in a lower scoring of the District Disparity Effect and Region Disparity Effect, which measures the project’s pricing relative to the district’s/region’s median pricing.

Analysing the trend of resale prices in Bedok planning area, the private property segment has grown at an annual rate of 32% from $990 psf to $1,309 psf — suggesting a level of pent-up demand for private properties within the area.

Recent transactions at Bedok Residences have been going between $1,4xx to $1,6xx psf. In comparison, prices at Sky Eden @ Bedok start from $1,9xx psf, which will put the project at the high end of the district/region’s pricing.

Considering the mixed-development nature of the project alongside the lack of private residential developments, the prices could very well be justified and absorbed by the area’s pent-up demand.

In terms of rental demand, Bedok Residences has a full score of “5”, indicating the strength of rental demand within the project, which is likely to be shared by Sky Eden @ Bedok as well.

Additionally, both projects are surrounded by a wealth of HDB projects — thus securing a perfect score of “5” for the Exit Audience factor.

The combination of these two factors (Rental Demand & Exit Audience) certainly presents Sky Eden @ Bedok as an attractive buying opportunity for both investors and homebuyers alike.

The last (but certainly not the least!) effect to touch upon would be the Volume Effect. With Bedok Residences having 583 residential units, this places the project at a healthy amount of units to create a healthy level of transactions per period — giving it a score of “3”.

As mentioned in one of our MOAT Analysis articles, the number of units in a project is crucial to determining the potential of price appreciation within that particular project.

Given that Sky Eden @ Bedok has less than a third of the number of residential units in comparison to Bedok Residences, we reckon that the transaction volume will be fairly lower, which will have an impact on the price action for future buyers of the property.

Map Graphic (Location Analysis)

Sky Eden @ Bedok is positioned in a very family-friendly location, surrounded by a whole host of amenities within the district for residents to enjoy — sports complexes, food markets, education institutions, healthcare facilities, etc.

With Bedok Integrated Transport Hub located just about a 3-minute walk away, Bedok MRT (East West Line) will take you to the city centre in approximately 15 minutes while the Bedok Bus Interchange — which has 28 operating bus services — will offer residents connectivity to various parts of Singapore

For drivers, Bedok is situated in between the Pan Island Expressway (PIE) and East Coast Parkway (ECP) expressway, with each expressway an estimated 5-minute drive away.

For parents with young children, the primary schools located within 1km of Sky Eden @ Bedok are as follows:

-

Bedok Green Primary School

-

Fengshan Primary School

-

Opera Estate Primary School

-

Red Swastika School

-

Yu Neng Primary School

Site Plan Analysis

From the first glance, we appreciate how the developers have strategically located the facilities towards the South of the development — closer towards the main road and MRT track — allowing for a decent setback for the residential units and therefore lesser noise for its residents.

Most stacks will be built in the North-South orientation, except stack 07 and 08 which are in the East-West fashion. However, referencing the site map, the balconies of these are facing East; therefore Sky Eden residents do not have to worry about facing the scorching afternoon sun.

The project offers the standard range of condominium facilities — lap pool, kids area, gym, and common areas for party hosting.

However, a key feature that stands out is the presence of a sky garden on every floor. This is definitely a highlight in our opinion as it provides more than ample space for residents to unwind, relax, or mingle.

Distribution Table Graphic

Floor Plan Analysis — 2 Bedder

Target Demographics: Small Families

Size Range: 657 sqft ~ 904 sqft

No. Of Units: 64

Stack Location: 04, 06, 07, 08

Best Stack and Type: Stack 07/08, Type B2

Floor Plan Analysis — 3 Bedder

Target Demographics: Large Families

Size Range: 893 sqft ~ 1,302 sqft

No. Of Units: 78

Stack Location: 01, 02, 03, 05, 10

Best Stack and Type: Stack 03, Type C1

Floor Plan Analysis — 4 Bedder

Target Demographics: Large Families, Investors

Size Range: 1,302 sqft ~ 1,572 sqft

No. Of Units: 16

Stack Location: 09

Best Stack and Type: Stack 09, Type D1

Land Sales Graphic

Before Sky Eden @ Bedok, there was Bedok Point — the area’s former food haven.

Officially shutting down in early July 2022 due to a low footfall, Bedok Point has since been bought over by Frasers Property for $108 million to be redeveloped into Sky Eden @ Bedok.

This price tag is not inclusive of the differential premium and lease top-up that the developers have to pay and therefore the estimated breakeven psf ppr is expected to be higher.

As announced, the prices for the various units are as follows:

– 2 Bedder (657 sqft) — from $1.31m (approx. $1,994 psf)

– 3 Bedder (893 sqft) – from $1.73m (approx. $1,937 psf)

– 4 Bedder (1,302 sqft) — from $2.6m (approx. $1,997 psf)

With Sky Eden’s prices starting from $1,9xx PSF, this is far lower than the predicted $2,1xx PSF.

Now, you may be wondering if this pricing level is reasonable, especially in comparison to Bedok Residences, whose units have been transacting between the $1,4xx to $1,6xx psf range — bringing about a $300 ~ 500 psf differential.

Let’s analyse this by bringing about two points.

1. Bedok Residences will be 12 years old when Sky Eden attains TOP status

The gap in development age justifies the price differential.

Furthermore, when prices at Bedok Residences appreciate, this will allow buyers of Sky Eden to sell at a premium and maintain the price differential, since their development will be 12 years newer than its neighbouring project.

2. AMO Residences transacted at an average pricing of about $2,100 PSF

We have chosen AMO Residences as a direct comparison because both projects are located in the Outside Central Region (OCR), and both projects boast a nearby MRT station.

While AMO Residences may be located towards the centre of our little island, keep in mind that Sky Eden has the added advantage of a mixed development.

Sky Eden is also surrounded by a vast array of amenities, while the area around AMO Residences is comparatively underdeveloped. A caveat that comes with this benefit, however, is that Bedok residents will not observe much rejuvenation within the vicinity. They can, however, bank on nearby townships such as Paya Lebar and Bayshore for future growth potential.

Taking everything into account, in comparison to AMO Residences average transacted pricings of $2,100 psf, Sky Eden’s starting prices of $1,9xx psf definitely look attractive.

Hence, we reckon that the high demand of AMO Residences — which sold 98% on its launch day — could very well be replicated at Sky Eden’s launch as well.

Closing Comments

Overall, we believe that Sky Eden @ Bedok will be well absorbed by the market, given the lack of private residential developments within the area.

Although the price point is on the high-end for a mixed development in the OCR, the amenities and the convenience of its location does make up for it.

Our editor’s layout pick would be the 2 Bedroom Premium, Type B2 layout. As observed in AMO Residences, this two bedroom, two bathroom dumbbell-layout configuration is popular amongst buyers, and for good reason:

The unit offers two sizable bedrooms, a bathroom for each bedroom, no wasted walkway space, and a very comfortable living/dining area.

Because stacks 07 and 08 are mirrored layouts, the differences are minute — however, if you do have the luxury of choice, going for stack 08 would increase the perceived value due to the “huat” number.

Even if you’re not superstitious, your next buyer could very well be!