Singapore — According to flash estimates released by the Urban Redevelopment Authority (URA) on 1 April 2025, Singapore’s private residential property price index rose by 0.6% quarter-on-quarter (q-o-q) in Q1 2025. This marks a sharp deceleration from the 2.3% increase in Q4 2024, and is notably below the full-year growth of 3.9% in 2024.

Transaction volumes also contracted. Total private residential sales fell by 15% q-o-q, declining from 7,433 units in Q4 2024 to 6,299 units in Q1 2025 – a reflection of moderated market sentiment amid higher financing costs and increased supply expectations.

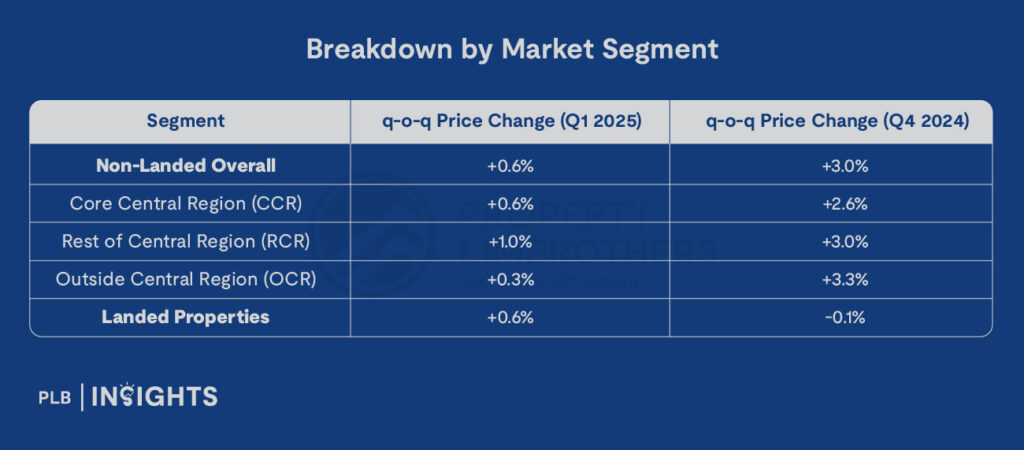

Breakdown by Market Segment

While all submarkets recorded positive price growth, the pace has clearly moderated across the board. The OCR, traditionally a demand stronghold due to affordability, posted the weakest growth at 0.3%, suggesting increasing price sensitivity among mass-market buyers.

Policy Commentary & Housing Supply Outlook

Minister for National Development Desmond Lee highlighted emerging signs of price moderation in both the public and private segments. HDB resale prices rose by 1.5% in Q1, down from 2.6% in Q4 2024, reflecting similar cooling trends.

To anchor price expectations and support genuine homebuyers, the government continues to prioritise supply expansion:

- The GLS (Government Land Sales) Confirmed List for H1 2025 will release 5,030 private residential units, closely mirroring the 5,050 units in H2 2024. This level remains ~60% higher than the average between 2021–2023.

- The EC segment will see robust expansion, with 1,000 EC units in H1 2025, and another 1,000 planned for H2, totalling 2,000 EC units for the year – nearly double the annual average supply from 2021–2023.

Market Implications

The easing in price momentum, coupled with declining transaction volumes, suggests a market entering a consolidation phase. Developers may adopt a more measured launch strategy moving forward, particularly in the OCR where affordability constraints are most acute. The elevated GLS pipeline and record EC supply will further serve to moderate upward pressure on prices, especially in the mid-tier and mass-market segments.

URA’s final statistics for Q1 2025 will be released on 25 April, providing deeper insight into project-level performance and buyer profiles.