There have been speculations about new cooling measures for the whole of 2022 as property prices and interest rates kept soaring. Now, they are finally here. As they say, be careful what you wish for. The current cooling measures are very targeted at making sure home buyers do not overextend themselves by taking up loans they cannot afford.

Based on the recent press coverage, Singapore is waking up to an unexpected surprise (as they usually do with all new cooling measures). Aspiring home buyers and upgraders are now scrambling to find out if they are affected by the new changes. Most importantly, they want to know if their plans are affected. The press release in this link covers all the changes that are announced by the government.

In this article, we will put out a quick FAQ for people who just want to know if they are affected by the new cooling measures and how. Subsequently, we will dive deeper into the changes in the TDSR situation and how this might affect the property market at large. We also explore the possibility of even more changes to the TDSR calculations in the future.

FAQ on the New Cooling Measures

Here is an FAQ for the new cooling measures that will take effect on 30 Sep 2022.

Am I affected by the new cooling measures?

- Singapore has just introduced new cooling measures with regards to TDSR, HDB LTV, and interest rate floor.

- If you have signed the Option to Purchase for your private property on or before 29 September 2022 you should not be affected.

- If there were no OTP, Sales & Purchase Agreements signed on or before 29 September 2022 should not be affected.

- For HDB, if your HLE application letter and Sale launch date (BTO & SOBF) were received on or before 29 September 2022 you should not be affected by the interest floor change.

A 15-month wait-out period for PPO and ex-PPO will be added for non-subsidised HDB resale flats with the exception of seniors aged 55 and above who want to downgrade to a 4-room or smaller flat for retirement. The 30 months waiting period for subsidised HDB flats will remain unchanged.

In addition, PPOs/ex-PPOs, regardless of age, with extenuating circumstances, e.g. financial difficulties, may approach HDB for assistance, and they will assess your situation on a case-by-case basis.

How am I affected by the Stress Test Medium Term Interest Rate and HDB Loan LTV changes?

- For those taking a bank loan, the TDSR remains at 55%.

- However, the stress test interest rate used to calculate Loan affordability for Residential Private Property will be raised by 0.5%, to a total of 4%.

- The stress test interest rate used to calculate Loan affordability for Commercial Property will be raised by 0.5%, to a total of 5%.

- For those buying an EC from a developer, the MSR remains at 30%.

- For those taking an HDB loan when buying an HDB, the MSR remains at 30%.

- However, the stress test interest rate for HDB Loans will be at 3%, up from the 2.6% previous interest rate. On top of this, LTV for HDB housing loans will be reduced from 85% to 80%.

For Private Residential Property Purchase

For those taking a bank loan for a private residential property,

Using an example to help you gauge the impact, we use the following assumptions.

Household income: $10,000.

Borrower’s Age: 35, Max 30 years tenure.

Under the current 55% TDSR rule, assuming you have no other loans, your total mortgage can only go up to the max. of $5,500 a month.

Previously under the 3.5% interest rate used for TDSR calculation, the Loan quantum was $1,224,822.

Now after the 0.5% raise to 4%, the Loan quantum is $1,152,037. This is around a 5.94% reduction in loan quantum. (Note: This % reduction varies with loan tenure, etc)

For HDB Residential Property Purchase

Change of HDB Loan Stress test Interest Rate from 2.6% to 3%

HDB Loan rates still remain at 0.1% + CPF OA rate = 2.6%

This example is for those buying a HDB or taking HDB loan,

Under the current 30% MSR rule,

Household income: $10,000.

Borrower’s Age: 35, Max 25 years tenure.

Previously under 2.6% interest rate used for MSR Calculation would mean an HDB LOAN quantum of ~$661K.

Now, after an increase to 3% interest rate used for MSR Calculation, this means HDB LOAN quantum of ~$632K.

This is around a 4.33% reduction in loan quantum. (Note: This % reduction varies with loan tenure, etc.)

Change of HDB Loan LTV from 85% to 80%

Assuming a 600K HDB flat,

Previously with LTV 85%, would mean a Loan quantum of up to 510K

Now with LTV of 80%, would mean a Loan quantum of up to 480K

*Subject to TDSR/MSR.

How does the wait-out period of 15 months for private residential property owners (PPOs) and ex-PPOs to buy a non-subsidised HDB resale flat impact me if I’m below 55 years old?

If you have sold your current private property or are in the midst of marketing your private property and are considering to relocate to an HDB, there may be changes in your Financials, Loan Affordability, Timeline for sale and next purchase, and options for your next place of residence, etc., due to the recent measures.

If you have any questions or concerns still unaddressed, you may contact us here. We can help advise on whether you are affected by the recent cooling measures and how you can adjust your property journey to appropriately navigate these tough macroeconomic conditions. We also have tools to help you find out the loan quantum you may be eligible for.

Impacts of the 2013 TDSR Introduction

The new cooling measures just introduced last night are not only targeting the private property market. It also aims to cool the public property market and make sure that they remain relatively affordable. These new changes are substantial, and we may start to observe the effects of a housing winter as the property market cools off in terms of volume. The rising interest rates will also continue to have a cooling effect.

Going back to 2013, how did the previous introduction of TDSR affect the total amount of loans that people can take up? In this initial introduction, the Total Debt Servicing Ratio of 60% was introduced. This curbed demand for housing heavily as financial institutions stepped up with the regulatory guidelines on the new rules.

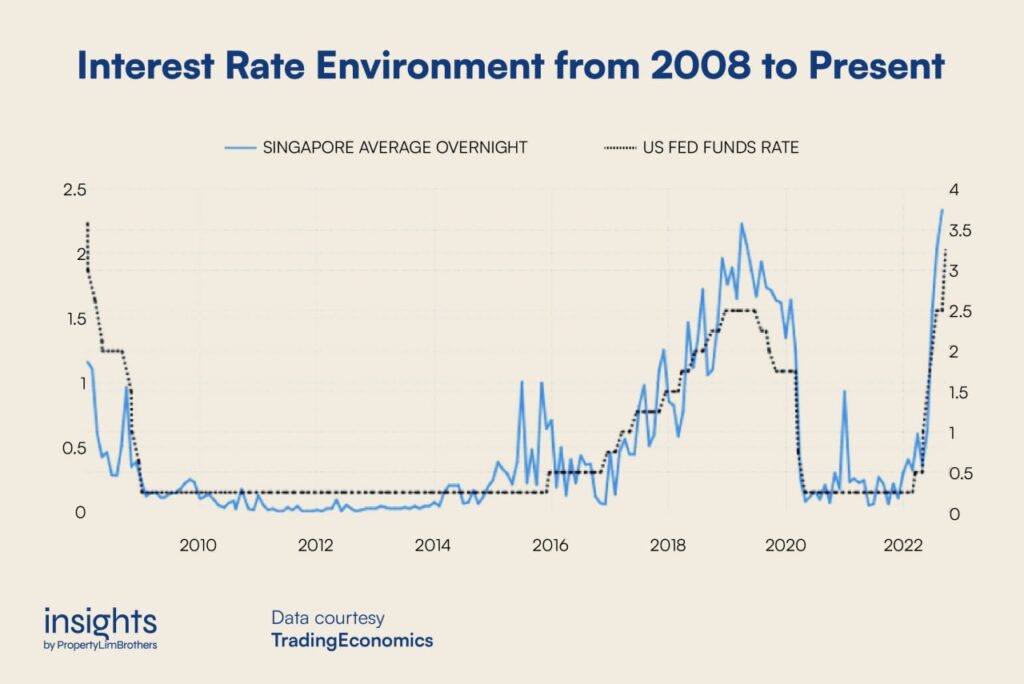

Historically, the period from 2013 onwards was after the recovery from the Global Financial Crisis in 2008. Over the course of the 5-year gap, financial institutions were recovering well and the stock market has more or less recovered.

Despite the financial and economic strength of the market, the introduction of TDSR cooling measures alongside a large GLS exercise in Singapore’s OCR region, eventually depressed property prices in Singapore for 3 to 4 years.

In addition to the story above, interest rates in Singapore and the U.S. during that time period were very low. These near-zero interest rates would have been beneficial for the housing market and stimulating demand, yet it remained depressed due to the TDSR regulations on the maximum loan home buyers could take up.

Among all the different cooling measures that were introduced, such as ABSD, SSD, and LTV, the most impactful cooling measure is arguably TDSR. The reason being that TDSR caps the loan quantum available to home buyers based on their incomes. And as we all know, property prices inflate much faster than wages. As a result, (private) properties are getting increasingly less affordable over time.

The TDSR inspires caution for buyers. Pushing them to make more prudent decisions in their finances. Avoiding pitfalls that may emerge from overleveraging, and the possibility of being unable to deal with huge changes under an economic or financial crisis.

Under the introduction of the TDSR rules during this period, overall residential property prices (including public, private, and landed) fell approximately 22% across a 4 year period. It eventually picked up in 2016 and 2017.

Diving deeper into how it affected individuals, this table shows the effects of the loan quantum that individuals could take up before and after the TDSR changes in 2013.

Impacts of the 2021 TDSR Reduction

The additional changes to the TDSR came in on 16 December 2021. This was coupled with more changes to the ABSD, and LTV for HDBs. Precise details can be found in the MOF press release here. Overall, this is a less drastic change than the slew of cooling measures from 2009-2013. Over time, the property market gets more acquainted with the idea of cooling measures and reacts less adversely to them as the market starts to anticipate regulatory changes.

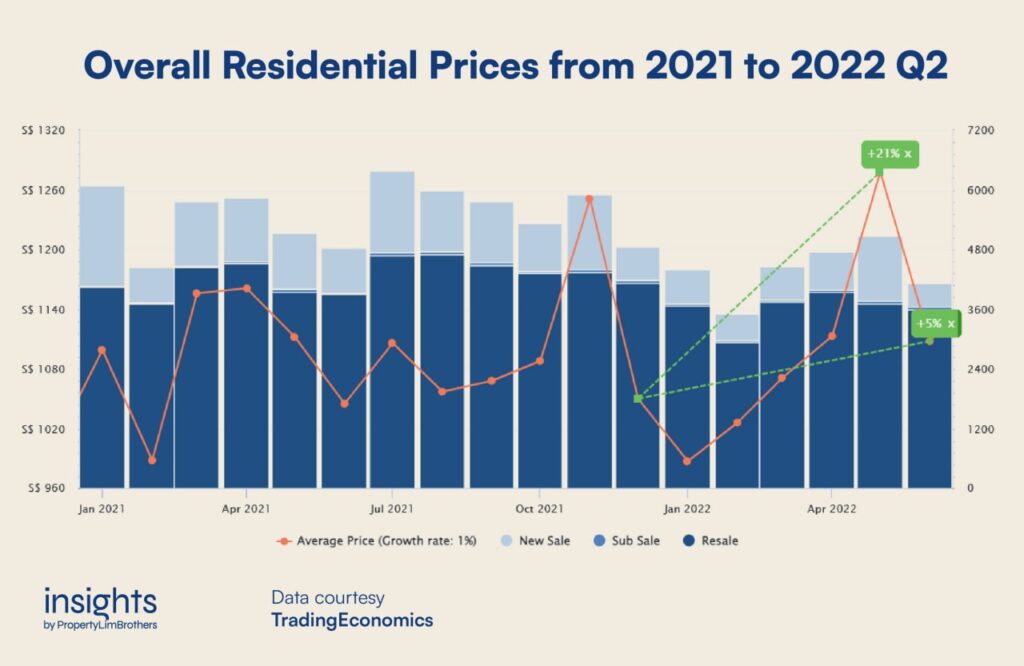

In the case of the changes to TDSR, it was lowered from 60% to 55%. While these changes to the TDSR, LTV, and ABSD should supposedly curb demand for housing, the home and rental prices continue to skyrocket upwards due to strong inflationary pressures. This was also before interest rates started to rise rapidly.

Despite these cooling measures, property prices continued to rise unabated. Through 2022, prices faced near exponential growth. And is only starting to show signs of cooling, mainly from the influence of rising mortgage interest rates.

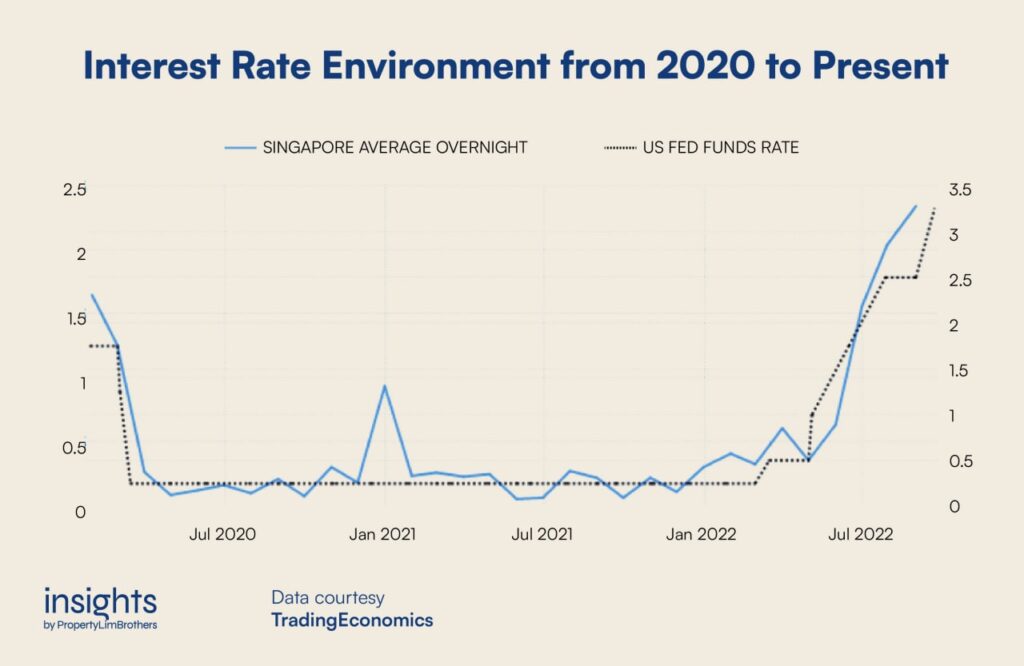

Seeing how property prices have risen throughout the year, so too has Singapore’s interest rates. When the 55% TDSR was introduced in December 2021, it was done so when interest rates were close to zero. With these 2021 and 2013 changes to the TDSR under low-interest rate environments, prices in the property market do not seem to correlate directly with the introduction of TDSR specific cooling measures.

Arguably, the impacts of the 2021 December cooling measures were muted due to the larger inflationary forces on the housing market. In other words, the direct Supply mechanics of the housing market might actually be more influential on home prices than the Cooling Measures themselves.

For instance, the large GLS through the 2010s and subsequently the housing shortage and construction delays throughout the 2020s more strongly impacted the price levels than Cooling Measures will.

The introduction of Cooling Measures affects the demand side of the property market. TDSR, LTV, and ABSD changes made in 2021 December were intended to curb demand. However, the higher prices we see today do not mean that the Cooling Measures were not working. In fact, the volume of transactions in the market has been steadily contracting. In other words, Cooling Measures might have a larger influence on the volume of transactions rather than the direct price movements per se.

You can refer to the table below to see how it impacts the loan quantum made available to home buyers after the 2021 and 2022 changes.

Will the new 2022 TDSR Stress Test Update wreck the Property Market?

As you can see from the table above, the 0.5% increase in the Medium-term interest rate used in the TDSR calculations will decrease the loan quantum available to home buyers by approximately 5.94%. Will this reduction in the loan quantum made available to home buyers wreck the property market? Probably not.

Looking back and comparing the 2013 TDSR and 2021 TDSR changes, the December 2021 lowered TDSR by 55% and reduced the loan quantum available to home buyers by approximately 8.33%. This was far greater than the impacts we will see from the more recent TDSR changes.

However, unlike the previous two iterations of TDSR changes, we are now experiencing much higher interest rates. The combination of these two factors might cool the demand side of the property market through the reduction of transactions in the market. The real effect on prices has yet to materialise. So whether it will impact prices in the property market has yet to be determined.

To sum up the new changes to TDSR, they are still considered as gradual changes. This new cooling measure is primarily to update the policy to the expected interest rates in the medium-term. Ultimately, it is to aid home buyers in making more prudent decisions in light of more turbulent financial times.

In addition to the changes to the bank loan side of the story, we have also prepared a table here for those who are going for an HDB loan for their upcoming BTO, SOBF, or resale HDB. We find that the maximum loan that can be taken has been reduced by approximately 5.04%. This is taking into account both the LTV changes to 80% and the Interest Rate floor of 3%.

Do note that for Executive Condominiums bought from developers, the stress test of 4% as per the TDSR used for private property applies. On top of this, the MSR limit of 30% also applies. In contrast, ECs bought from the open market do not have the MSR 30% limitation, but the stress test of 4% interest rate along with TDSR still applies.

This round of cooling measures brings about an incremental reduction in the amount of loan home buyers can take up. As a result, we might see the market participants opt for more affordable options. Buyers might start to look at options in the resale market (for both HDB and Private), thus the need to introduce a waiting period for resale HDB to prevent a spike in prices.

Furthermore, buyers may look to areas farther away from the city center that are more affordable options in addition to the resale criteria. Based on these two points, and the increasing interest rate environment, it would be best that buyers stay on their toes and go for the prudent choice of more affordable properties that are within their financial capabilities to maintain even if the interest rates continue to rise well above expectations.

The 15 months waiting period for PPOs and ex-PPOs might be the most shocking addition to this group of buyers. It basically makes one affordable option for housing out of reach for 15 months. This will be a substantial amount of rent if the seller ends up in a limbo period. As a result, these stranded sellers will need to look at affordable housing solutions in the form of OCR Resale Private Condos.

Will the TDSR Stress Test Get More Stressful? — Market Estimations of Terminal Rate

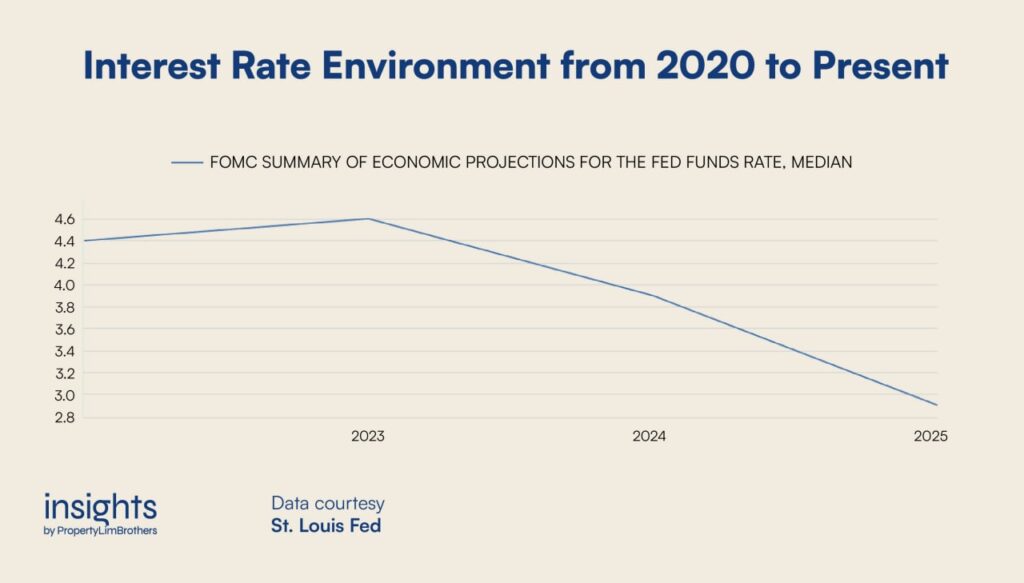

Speaking of interest rates, there is a possibility that more changes may be made to the Medium-term interest rates depending on the situation in the U.S. At the moment, the current Medium-term interest rate for TDSR calculation is 4%. We may see this number increase in the near future. So we have to brace ourselves.

You can read more about this situation in our Q2 report if you want in-depth coverage. Basically, if inflation remains persistently high, interest rates will continue to climb to counteract inflation. More importantly, how high will interest rates climb before they taper off? This level is called the Terminal Rate.

At the moment, the Terminal Rate stands at around 4.45% this is well above the Medium-term interest rate of 4%. Given the seemingly robust job market in the U.S. it is still possible for this terminal rate of 4.45% to continue rising. So long as inflation remains high and stubborn in the U.S., the world may face a period of prolonged high-interest rates.

Should this manifest, we should expect the TDSR Stress Test in Singapore to get more and more stressful over the next few quarters. This of course will depend on the interest rate decisions made by the U.S. FED, so it is best to keep an eye out for that.

The next few interest rate decisions will be critical as they might bring the Terminal Rate up and interest rates to catastrophically high levels. Here are the dates to watch: 1-2 November 2022, 13-14 December 2022, Late January 2023, and Mid-March 2023.

To say the least, if home buyers are worried about the current cooling measures and market conditions, it will probably get worse before it gets better. The wait-and-see approach may suffer from the risk of higher interest rates, and more adjustments to the TDSR stress test as the medium-term interest rates continue to rise.

Nonetheless, any further cooling measures and adjustments to the medium-term interest rates would likely be gradual. It would not immediately wreck the property market, nor are we likely to see a sudden drop in home prices. However, the added pressure from rising interest rates and cooling measures may see transactions in the property market in Singapore start to grow more silent. The time it takes to sell a home on the market may also take a longer time as buyers grow more cautious about the market conditions.

Closing Thoughts

To conclude, there is no need to panic. The cooling measures that were introduced on 30 September 2022 are gradual. In fact, they are bringing about a less severe change in the maximum loan quantum that buyers can take as compared to the 16 December 2021 cooling measure.

Home buyers in Singapore will need to brace themselves for the possibility of more cooling measures in the near future if property prices continue to climb despite lower volume. There is also a high chance of further increases in the Medium-term interest rate for TDSR calculation in the near future.

To make sure that buyers are prudent on their own, people considering buying a home should use a larger margin of safety while calculating what they can afford in properties. It is a great idea not to max out the loan you can take from the bank as that might put you and your family’s lifestyle at risk when interest rates go higher than expected.

It would be wise to consider right sizing and keep your mind open to other options for residences, such as resale options or less central OCR areas which are more affordable and comfortable to manage in stressful financial situations.

We will dedicate further articles to non-residential properties affected by these changes to interest rates. We will also cover how this might affect the public housing market in due course.

In the meantime, if you have any unanswered questions or doubts that you would like to clarify, please reach out to our experts here. Navigating this period of macroeconomic and geopolitical uncertainty will not be easy. But we promise to help you through thick and thin. Thank you for your support for PLB Insights.