The Holland Link Government Land Sales (GLS) site attracted five competitive bids at tender close on 29 July 2025, with Sim Lian Group submitting the top bid of $368.37 million, equating to $1,432 psf per plot ratio (psf ppr). This was 22.2% above the next highest offer of $1,172 psf ppr by Wee Hur Holdings — a significant premium that signals Sim Lian’s bullish conviction on the site’s long-term value.

But, is this too expensive and will a cooling measure be rendered as a result of continuous rising prices? This is something we will look out in 3Q 2025 onwards.

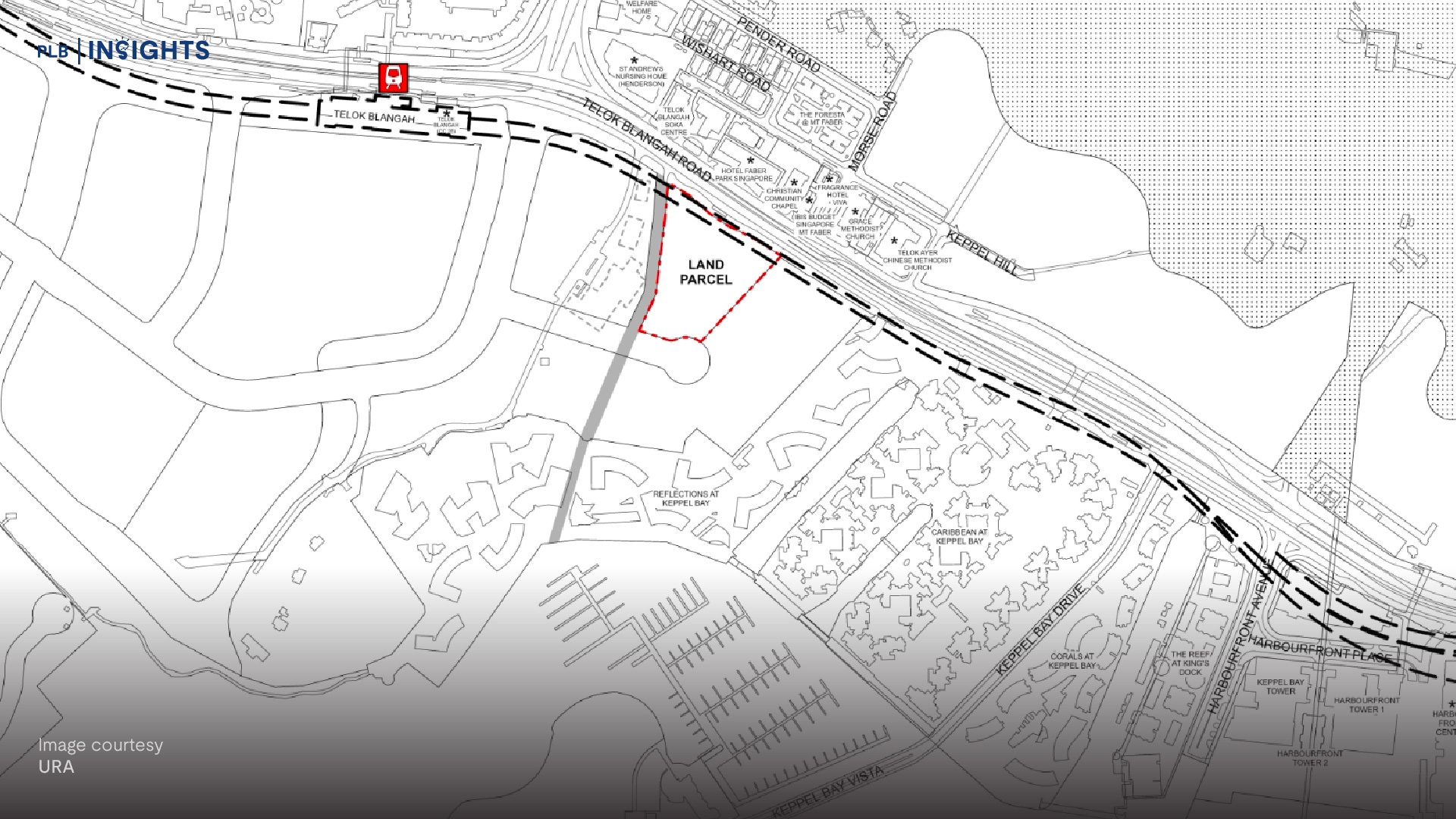

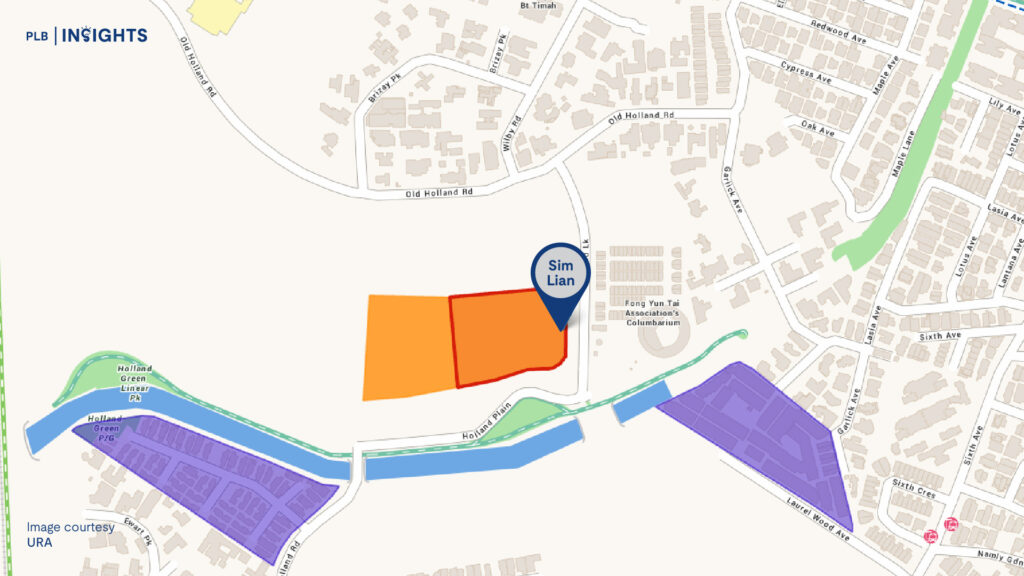

Site & Strategic Appeal

Located in District 10, the 99-year leasehold Holland Link site is nestled within the Core Central Region (CCR), spanning 185,141 sq ft with a GFA of 257,225 sq ft. It is expected to yield around 230 private residential units. Importantly, the site is situated within the 1km enrollment zone of Methodist Girls’ School (MGS) — a top-ranked primary school — a perennial driver of family-driven demand in the Bukit Timah area.

This GLS parcel is the first-mover opportunity in the upcoming Holland Plain precinct, an area poised for transformation with 8 GLS plots in total. This positions the winning developer to define the precinct’s pricing benchmark and brand perception.

Bidding Landscape & Sentiment Analysis

The wider-than-usual bid spread (56% from top to bottom) suggests a divergence in risk appetite among developers. While some developers priced in logistical limitations (e.g., MRT distance), Sim Lian appears to be pricing ahead based on the future potential of the Holland Plain precinct and likely infrastructure upgrades.

Macro Trends & Demand Drivers

CCR Confidence Returning

- Non-landed CCR home prices rose 3% in 2Q 2025, up from 0.8% in Q1.

- Notable new launches (Upperhouse @ Orchard Blvd, The Robertson Opus) have seen healthy take-up at ~$3,350 psf on average.

School Proximity as Anchor Demand

- The site is within close proximity to elite institutions like Methodist Girls’ School, Nanyang Girls’, Raffles Girls’ Primary, and Henry Park Primary — boosting family demand resilience.

Connectivity Growth Catalysts

- The upcoming King Albert Park MRT station (Cross Island Line) — slated for 2032 — is within a 10-minute walk, enhancing long-term accessibility.

Developers are likely pricing in mid-term upside from infrastructure completions and the scarcity of CCR land parcels with such low-density zoning, which makes for attractive boutique or family-centric concepts.

Forward-Looking Pricing Outlook

Sim Lian’s $1,432 psf ppr bid suggests potential launch prices in the range of $2,800 to $3,000 psf.

This remains competitive within the CCR, especially given the tight supply of freehold and low-density options in prime areas.

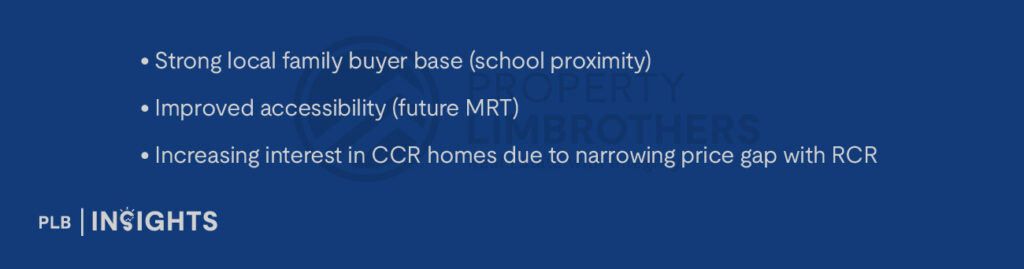

At $2,800 to $2,900 psf, future pricing would be supported by:

In Summary

Sim Lian’s winning bid reflects a bold, forward-leaning land strategy, potentially aimed at building a flagship CCR project within a precinct still in its infancy. With rising confidence in the prime segment and infrastructure-led growth on the horizon, Holland Link’s appeal appears well-founded.

So, keep an eye on Holland Plain’s broader development trajectory. The next land parcel in the area remains on the Reserve List, and early movers in this cluster could benefit from first-mover premium in a rising micro-market. This GLS outcome also serves as a barometer of growing optimism in Singapore’s CCR residential landscape.