Semi-detached homes have long held a unique appeal in Singapore’s landed property market, offering a harmonious blend of exclusivity, space, and value. District 28 (D28)—encompassing Seletar, Yio Chu Kang, and parts of Sengkang—stands out as a serene enclave filled with established landed estates like Seletar Hills Estate, Luxus Hills, and Nim Collection. However, as the market landscape evolves, prospective buyers eyeing semi-detached homes in D28 should tread carefully, particularly when it comes to potential “sandwich” pricing—a phenomenon where the quantum paid could overlap with higher asset classes or properties in prime districts, possibly limiting long-term capital appreciation.

This article dives deep into the dynamics of D28’s semi-detached segment, using key data insights on price trends, transaction volumes, inventory levels, and absorption ratios. More importantly, it highlights why astute buyers need to weigh their options, exploring not just D28 but also other prime districts such as D10, D11, and D15, before committing.

Semi-Detached Homes in D28: High Inventory, Strong Negotiation Power

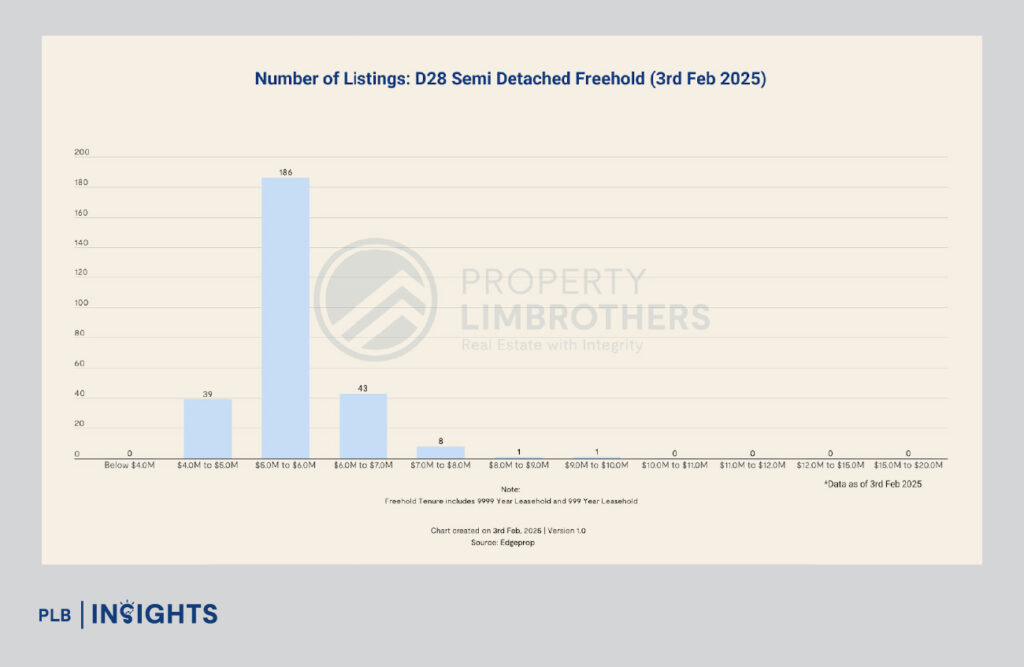

As of February 2025, D28 recorded a staggering 278 active listings for freehold semi-detached homes—making it the most supplied property type within the district. A significant majority of these listings, 67% (186 units), fall within the $5 million to $6 million price range, while 15% (43 units) are priced between $6 million and $7 million.

However, this abundance of supply signals more than just variety—it points to a classic buyer’s market. The current absorption ratio for semi-detached homes in D28 stands at 16.4 months, much longer compared to terrace homes’ 1.79 months. Simply put, it would take over a year on average to sell one semi-detached property under current conditions. This high absorption ratio reflects not only the influx of sellers but also a slowing demand relative to supply, giving buyers ample room to negotiate.

The Price Growth Conundrum: Slower Appreciation vs. Supply Saturation

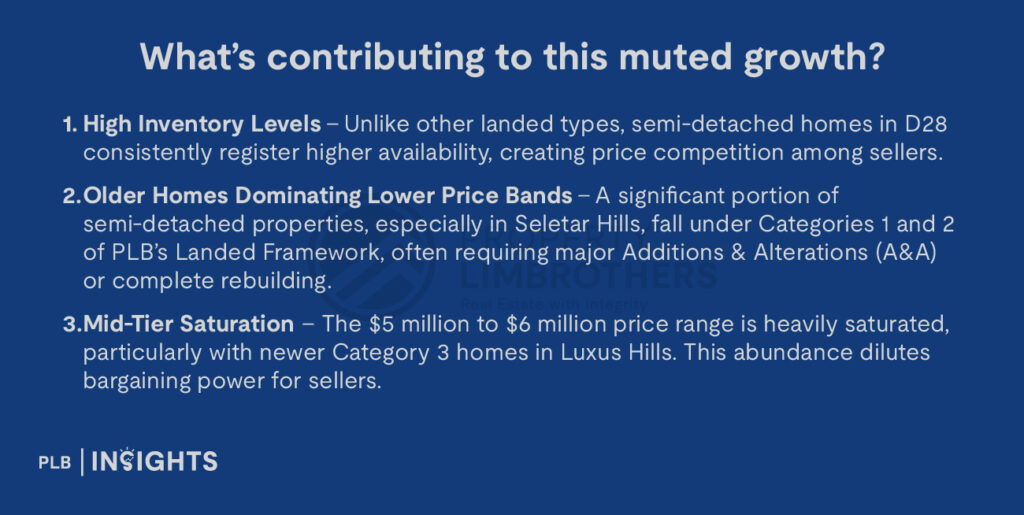

From 2015 to 2024, D28’s semi-detached segment recorded a Compound Annual Growth Rate (CAGR) of 2.4%, the slowest among D28’s landed property types. This is in stark contrast to terrace houses, which saw a 3.7% CAGR, and detached homes with a 3.1% CAGR over the same period.

While the district’s appeal remains intact, strong connectivity, and lifestyle offerings, price growth in D28’s semi-detached segment appears restrained compared to other districts.

PSF Surge: A Bright Spot or Mirage?

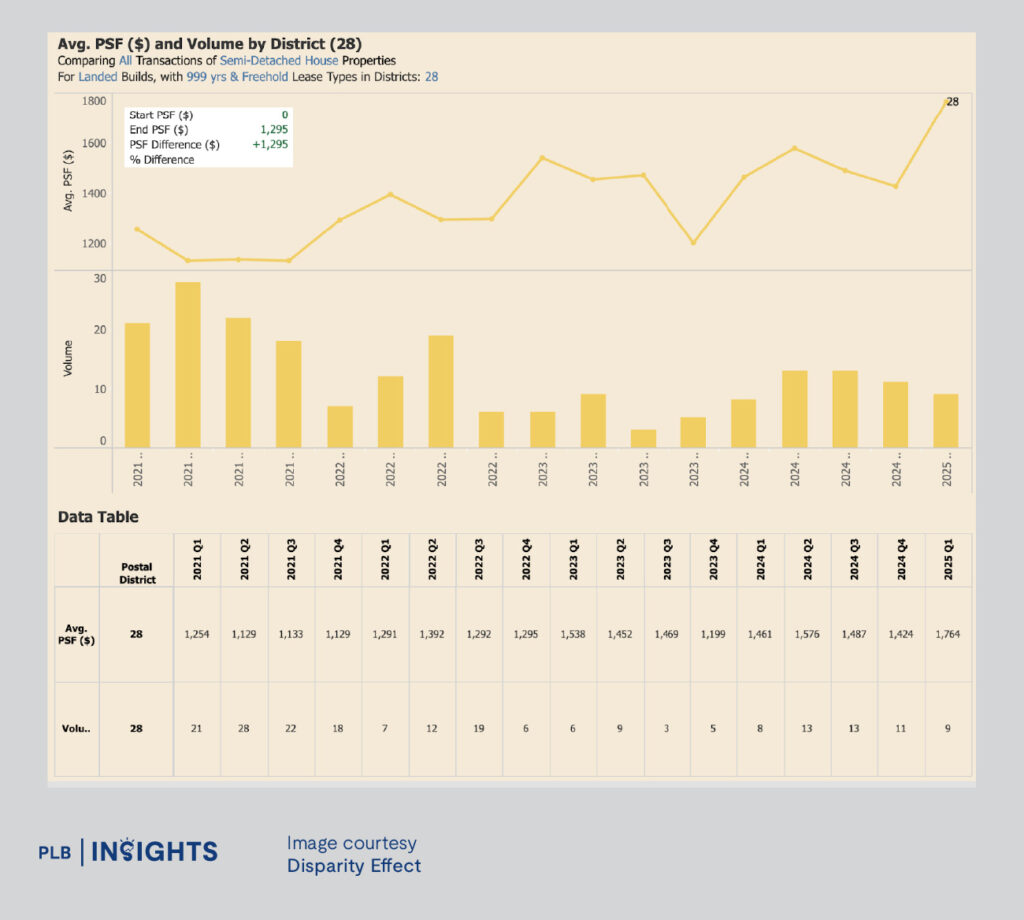

Interestingly, the average PSF for D28 semi-detached homes has seen a sharp rise, reaching $1,764 PSF in Q1 2025, up from $1,254 PSF in Q1 2021—a growth of approximately 41%. However, this headline figure may not tell the full story.

The surge in PSF is partly attributable to selective transactions of newer, well-finished semi-detached homes in premium enclaves like Luxus Hills. Yet, when juxtaposed with the influx of listings and slow absorption rates, this could reflect short-term market fluctuations rather than sustained, district-wide appreciation.

For discerning buyers, it is crucial to look beyond the PSF jump and analyse whether the quantum aligns with the intrinsic value, especially when long-term investment and wealth preservation are key goals.

Avoiding the “Sandwich” Price Dilemma: Key Considerations

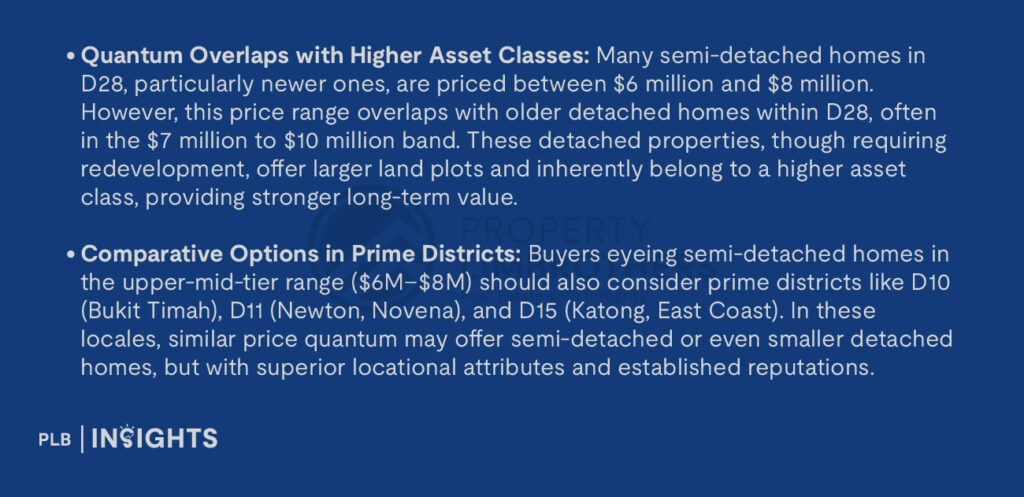

The biggest cautionary flag in D28’s semi-detached segment is the risk of falling into “sandwich” pricing territory. Here’s why:

Conclusion: A Balancing Act for Discerning Buyers

District 28’s semi-detached homes continue to offer families and buyers generous space, freehold tenure, and a tranquil suburban environment. Yet, today’s market presents both opportunities and potential pitfalls. While buyers enjoy greater negotiation power amidst rising inventory, it’s crucial not to fall into the trap of overcommitting at price levels that overlap with higher asset classes or homes in more prestigious districts.

For discerning buyers, the key lies in ensuring that the price quantum paid for a semi-detached home in D28 aligns with its long-term growth potential and market positioning. While pure landed homes in D28 offer spacious living, freehold tenure, and a tranquil environment, it’s equally important to weigh the quantum carefully—especially as prices inch closer to segments traditionally occupied by detached homes or premium properties in districts like D10, D11, and D15. Understanding this dynamic allows buyers to make well-informed decisions, whether capitalising on the attractive offerings within D28 or considering alternative options that may present stronger returns from a broader investment standpoint.

Navigating Singapore’s landed market requires a clear, data-backed strategy. Our team is here to guide you—whether it’s evaluating the right semi-detached home, comparing districts, or planning a long-term property investment strategy, we’re ready to assist.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.