For owners of HDB flats and Executive Condominiums (EC), the Minimum Occupancy Period (MOP) is one of the big dates to be excited about. Once the MOP has been met, the HDB or EC can be sold on the open market. What’s next after you sell your home? Do you have a proper exit plan?

Most owners of HDBs or ECs might be tempted by the mouth-watering appreciation gains and look to make a sell decision before thinking elaborately about their next step. Are you going to buy another BTO, Resale HDB, EC? Or are you going to rent? Stay with your parents? Maybe venture into private property? What choice will you make?

This article will try to map out what might be the next step for you. Before you decide you hastily sell your HDB or EC, read this article to see which might be a better next step to take.

#1 Going for Round 2 (BTO or EC)

Feeling lucky? Some owners of HDBs and ECs might want to go for a second round. Perhaps a Prime Location Public Housing (PLH) BTO caught your eye? Or maybe you just like the new BTO or EC launches. Others might go for this option if they are not in a rush and don’t mind waiting a couple more years for another round of MOP capital gains. We have an article here that covers how capital gains look like for ECs after MOP.

The key thing to look out for when you are doing this is the timeline. You may only ballot for a new BTO or EC after the MOP is over. You may not do it during the MOP. Because of the balloting system, there is some uncertainty over whether you might get the project and unit that you want. This translates to a longer and potentially undefined waiting period before making your next property move. The plan for round 2 is all centred on the assumption that you get lucky with a favourable queue number for the next property.

Image courtesy Home & Decor Singapore

Once you get a good queue number and plan to commit to the decision, you need to know that:

-

Once you have booked the flat, you will have 4 months to signing the lease agreement (where the down payment is due)

-

If you intend to use the proceeds from the sale of your existing HDB or EC, you have a short runway to liquidate your home. We do not recommend this as BTO down payments are typically more affordable and the short timeline might be too risky.

-

-

After the lease agreement is signed you will have 3 to 5 years to wait before collecting the keys. Once the keys have been collected you will have 6 months to dispose of your previous property.

-

If you are not using the proceeds from your current HDB or EC sale for the down payment, you have plenty of time to dispose of the property.

-

-

ABSD will not apply since the government knows that your previous property will eventually have to be sold.

-

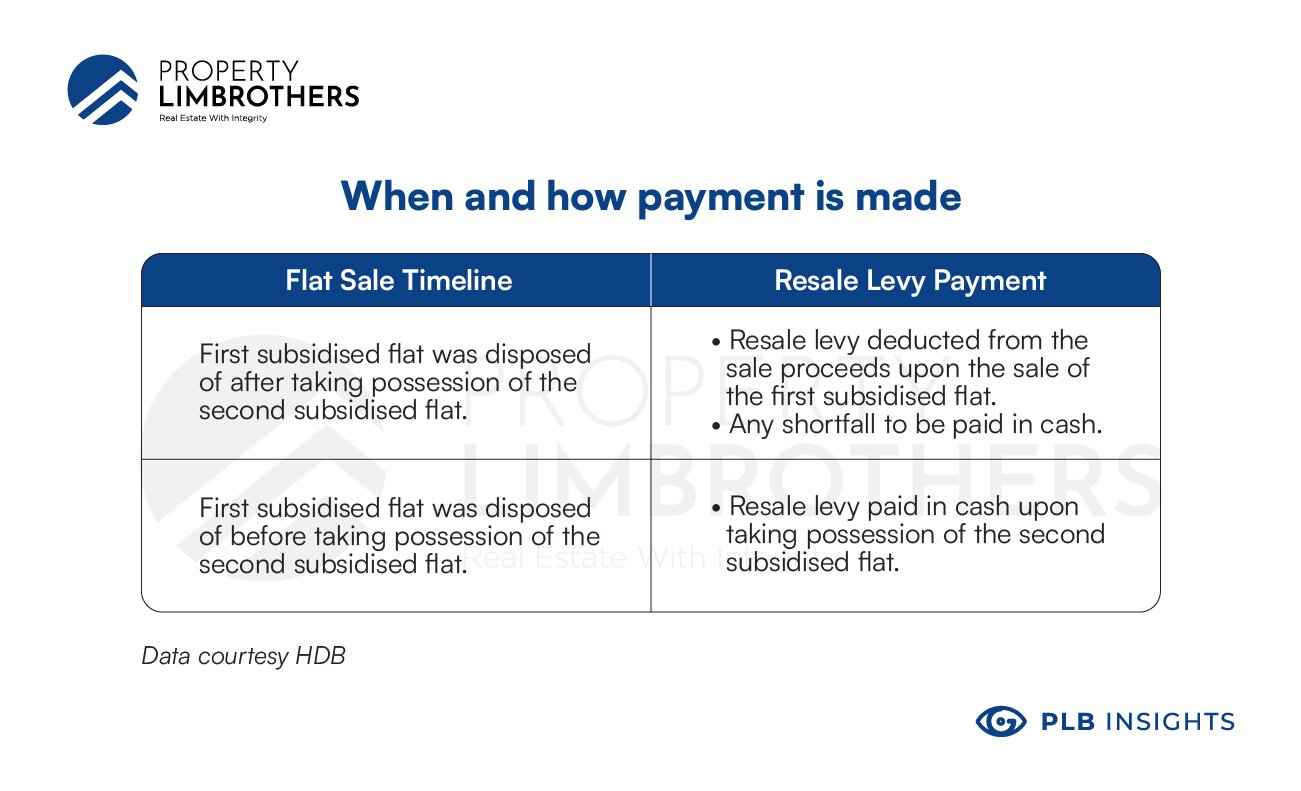

If you have taken grants for your previous HDB or EC purchase, a resale levy will be deducted from the proceeds of your sale.

-

If you previously purchased a resale HDB or EC on the open market without grants, this will not apply.

-

You can see here that the timeline is rather messy, and timing is of the utmost importance in this exit plan. Since most Singaporeans like to bankroll new property purchases with the gains from the previous sales, the timeline might be very tight (4 months) to sell the property. If there are no good offers from buyers, this might lead to a less than ideal sales price for your property. Knowing this in advance and having a marketing and staging plan would definitely help reduce the lead time to selling your property on time.

For people who want to avoid potentially stressful situations with timing, it might be better to fund the down payment with cash or CPF. This way there will be a leeway of approximately 3 years and 10 months to sell your property. Plenty of time. Note, however, that you will need to have plans for your accommodations before your new BTO or EC is completed and ready to move in. With construction or renovation details, this might be for quite a long duration. If you plan on going for round 2, we wish you all the best for favourable ballot results!

#2 Resale HDB or EC

Image Courtesy DollarsAndSense.sg

For resale HDBs, the process is a lot simpler. There is no balloting involved, and the timeline is less complicated. Simply put, you have to dispose of your property within 6 months of receiving the keys to your new Resale flat. The key difference is that you do not have to pay the resale levy if you’re not taking any grants for your resale purchase.

The perks of this option is that there is less uncertainty as compared to BTOs or new EC launches. Since resale flats are already constructed, there is less uncertainty over construction delays. Furthermore, you may move in (hopefully) after your purchase is complete if there are no hiccups with the seller moving out.

The issue here is that if you choose to only sell your existing home after the collection of keys, you still have a tight timeline to work with. 6 months to sell your home might be a challenge if the market sentiments are bearish or faced with cooling measures. Nonetheless, this option acts as a good in-between affordable option for people who do not want to take their chances with a new BTO or EC and do not want to go for the private property option.

#3 Private Property

Image courtesy PropertyGuru

This option appeals to HDB or EC upgraders who do not wish to be hit by another round of MOP. Unlike the previous options, for private property the key limitation is the seller stamp duty (3 years). With this option being 2 years shorter than the 5 year MOP, there is a little more flexibility for investors looking to exit sooner in their property moves. Again, the 6 month timeline applies once you have exercised the option to purchase the private property whether it is a new launch or a resale private property. Remember that ABSD will apply if you are not able to sell your previous property in time.

The key perk of going into private property is that you may rent out the entire property immediately from purchase. A popular strategy that you would have heard of is decoupling: have 1 condo under each spouse’s name, one for ownstay and the other for rental income. Regardless of whether you are going for a new launch or resale, we strongly recommend a detailed study into your family’s personal financial situation.

While this option seems to be the least restrictive, it is also complex in the sense that it is difficult to make an optimised investment decision. Should you decouple in the first place? Can you afford to? Or should you focus on buying a bigger and more comfortable home (which will inevitably be more expensive)? Making the right decision seems harder for private property. There is less margin for error and the risks might be higher. There are more variables here in making the right decision and there should be sufficient analysis that shows your plan is resilient.

Image courtesy New Launch Properties

If you have even an ounce of doubt or uncertainty, you should spend more time to consider if you are making the right decisions. If you do decide to go with the decoupling strategy, make sure that you are not over-leveraged and taking on more debt than your family should. Just like how you shouldn’t max out your credit cards, you shouldn’t max out your TDSR. It will put you in a dangerous zone should either spouse lose their jobs or be unable to foot the mortgage (touch wood).

One way we recommend dealing with this issue is to make sure the private properties you pick have strong intrinsic value with good prospects to appreciate. Factors such as distance from MRT, schools, and other amenities would matter in helping the property act as a good store of value. At PropertyLimBrothers, we do an elaborate study using our MOAT analysis to give a rating on the property in question. Check out the article here and the video in this link.

Closing Thoughts

To summarise what we have discussed so far, here are the things you should look out for when you decide to sell your HDB or EC after MOP:

-

Note down the timeline of when you have to sell the property

-

Check if resale levy applies

-

Have proper accommodation plans to make sure you don’t end up without a place to live

-

If you intend to bankroll the down payment with your previous property, you will need to seek out alternative living arrangements while waiting for your new place

-

Watch out for potential delays in your plans to move in to your new place

-

Do a detailed analysis of your next property to make sure it has strong intrinsic value

If you need an expert opinion to help you out with your own situation, contact us here!