The northern region of Singapore is set for another major residential milestone with the launch of the second Executive Condominium (EC) site at Woodlands Drive 17 under the 2H2025 Government Land Sales (GLS) programme. Spanning 290,412 sqft and expected to yield about 560 units, the plot’s debut comes barely two months after the neighbouring site — also at Woodlands Drive 17 — was awarded to City Developments Limited (CDL) for a record $360.9 million ($782 psf ppr).

That earlier tender, which attracted five bidders, marked a clear vote of confidence in the long-term prospects of Woodlands. This second launch tests whether that momentum can continue — and whether developers will be willing to pay close to, or even match, that benchmark price amid a shifting housing landscape.

A New Benchmark and a Delicate Balancing Act

The earlier tender at Woodlands Drive 17, which set a record of $782 psf ppr, has effectively raised the benchmark for EC land in the area. Yet, developers are likely to tread carefully this round, knowing that an overly aggressive land bid could translate into higher launch prices and reduced affordability for potential buyers.

That balance — between confidence in Woodlands’ ongoing transformation and the affordability ceiling of the EC segment — will shape how the tender unfolds. EC buyers typically fall within a tightly regulated, price-sensitive bracket, given income and financing caps that constrain how high selling prices can go.

Market expectations point to four to six bids, with top offers anticipated in the $770 to $780 psf ppr range — broadly consistent with the previous plot. Overall, EC land bids have remained relatively stable, reflecting both developers’ cautious discipline and the segment’s steady, underlying demand.

Woodlands’ Transformation Gains Traction Under the Draft Master Plan 2025

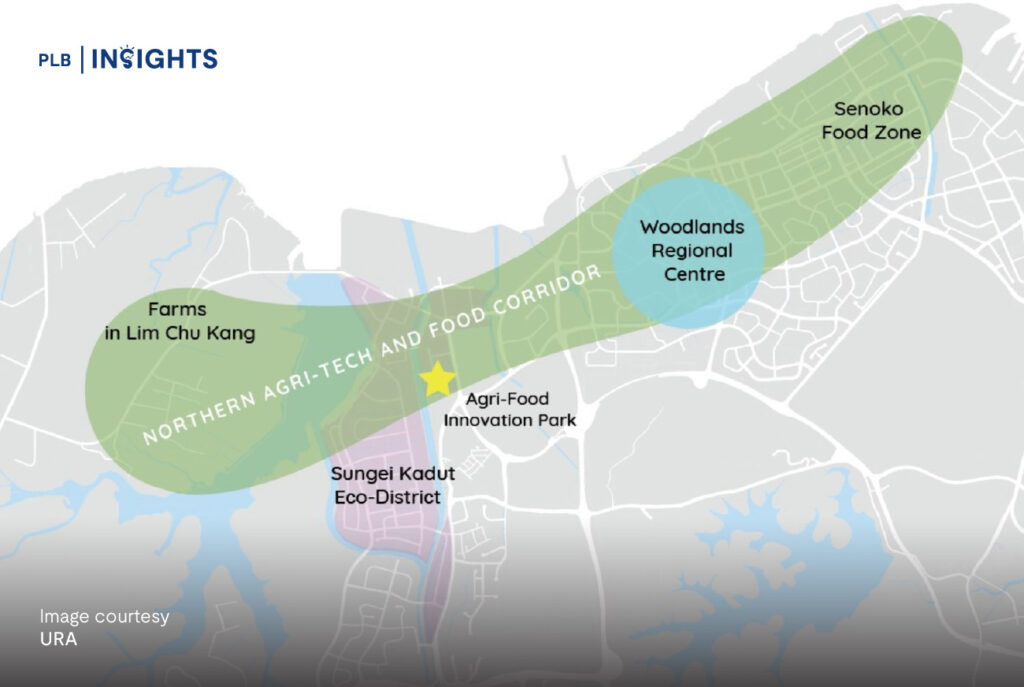

Despite this caution, there are several reasons developers continue to circle Woodlands. The area has evolved dramatically since its “too far north” label of a decade ago. Under the Draft Master Plan 2025, Woodlands is positioned as a regional growth hub — anchored by Woodlands Regional Centre, the Johor–Singapore Special Economic Zone (SEZ), and the upcoming RTS Link, scheduled for completion in 2026.

The new EC site sits just a short walk from Woodlands South MRT Station on the Thomson–East Coast Line (TEL), placing it one stop from Woodlands Regional Centre and two stops from the Johor–Singapore SEZ. This connectivity gives future residents a direct pipeline to emerging job clusters across the North and Central regions — a major plus for middle-income families eyeing a long-term home upgrade.

Families also benefit from the site’s proximity to Innova Primary School and Woodlands Ring Primary School, both within 1 km, supporting the area’s appeal as a self-sustaining residential enclave.

A Decade-Long Wait for the Next EC in Woodlands

One of the most compelling tailwinds for this site is the sheer gap in EC supply within the Woodlands Planning Area. The last ECs launched here were in 2014 and 2015 — both now fully sold.

That decade-long absence means a large population of HDB upgraders has been underserved. More than 1,800 four- and five-room flats in Woodlands are expected to fulfil their Minimum Occupation Period (MOP) between 2026 and 2029, potentially releasing a wave of demand from families who prefer to stay in the same region.

For developers, that translates into an immediate, captive audience. An EC launch around 2028 to 2029 would coincide perfectly with this upgrader cycle.

Lessons from Norwood Grand’s Launch Momentum

While the Woodlands Drive 17 site will be an EC, recent market behaviour suggests that family-oriented projects with strong locational attributes continue to perform well — even outside the EC segment.

A case in point: Norwood Grand, a private condominium in the same planning area, achieved an 84% take-up rate during its launch weekend. Its performance underscores how Woodlands’ narrative has shifted — from a peripheral town to an emerging growth corridor backed by infrastructure, improved MRT connectivity, and cross-border economic activity.

For developers evaluating the new EC site, Norwood Grand’s reception demonstrates that buyers are no longer deterred by the “too far North” label. When the right mix of pricing, amenities, and accessibility is present, demand follows swiftly.

Price Expectations and Market Implications

With land bids for the second Woodlands Drive 17 EC site expected to settle around $770 to $780 psf ppr, overall pricing dynamics are likely to mirror recent tenders. This would place the project within a similar cost framework as other upcoming ECs, reinforcing its relative affordability for HDB upgraders.

For context, recent EC launches such as Lumina Grand in Bukit Batok and Altura EC have achieved strong responses despite average launch prices surpassing $1,450 psf, reflecting resilient demand in the segment even amid tighter household budgets and elevated interest rates.

This stable pricing corridor underscores the EC market’s continued role as a stepping stone for middle-income families seeking private-quality homes at more accessible price points. It also positions the Woodlands Drive 17 plots as a bridge between affordability and aspiration — a balance developers are likely to maintain to ensure broad buyer appeal.

Demand Outlook: Pent-Up, Predictable, and Supported by Policy

Demand fundamentals for ECs remain robust despite cautious market sentiment. The EC segment’s hybrid nature — private-quality housing at subsidised land cost — continues to resonate in an era of rising private-home prices and higher interest rates.

In Woodlands, pent-up demand is magnified by limited new launches and the neighbourhood’s improving transport spine. The completion of the RTS Link (2026) will further integrate Woodlands with Johor Bahru’s economy, adding cross-border vibrancy and positioning the area as Singapore’s northern gateway.

Additionally, as the government tightens new HDB classification and subsidy frameworks, more upgraders may gravitate toward ECs as the most attainable path to private ownership.

For Developers: Strategic Entry into the Northern Story

For developers, participation in this tender offers more than just a housing project — it’s a foothold in a regional growth story.

While the GLS programme’s pipeline for ECs has expanded to meet upgrader demand, sites with MRT adjacency and mature amenities remain scarce. Winning this Woodlands Drive 17 plot provides brand visibility in an area likely to see sustained transformation over the next decade.

Moreover, with both Woodlands Drive 17 plots likely to launch within close proximity and timeframe, healthy competition could drive design and amenity innovation, benefiting future homeowners.

The Bigger Picture: A North on the Rise

From an urban-planning perspective, the government’s move to release a second EC site so soon after CDL’s record bid signals its confidence in Woodlands’ growth trajectory. The town’s evolution into a self-contained regional centre — complete with commercial hubs, healthcare clusters, and international linkages — parallels what Jurong East achieved in the 2010s.

If the first site sets the pricing benchmark, the second will test market depth. Should the tender attract strong participation within the predicted $770 – $780 psf ppr range, it will reinforce the North’s emergence as a viable alternative to the West and Northeast corridors for new EC buyers.

The combination of limited EC supply, infrastructure upgrades, and proximity to cross-border growth nodes places Woodlands in a rare position — offering both affordability and forward potential.

Final Thoughts

The launch of the second Woodlands Drive 17 EC site marks more than just another entry in the GLS calendar. It represents a strategic inflection point for Singapore’s northern housing market — one where developer confidence, upgrader demand, and policy direction intersect.

With Norwood Grand’s 84% take-up reinforcing appetite for well-located northern projects, the Woodlands EC tender will be closely watched as a gauge of how far buyers’ and developers’ sentiment has matured.

If demand remains firm and bidding stays disciplined, this tender could further solidify Woodlands’ position as a key growth hub in the North — one defined by steady demand and enduring market resilience.

Interested to learn how this upcoming EC launch could fit into your home ownership or upgrading plans? Get in touch with our sales consultants here.