Image courtesy: iStock

With the effects of 2020’s mayhem spilling over to this year alongside a multitude of new changes planned for properties in Singapore for 2021, property investments (which is already a pretty risky business on its own) is becoming an even bigger challenge for investors who now have to swim against the volatility tides of the property market.

Property investment isn’t a mindless gamble. Property investment is a major commitment that requires profound knowledge on the subject, prudent financial planning and some thoroughly calculated risks.

Let’s take a look at some of the expectations for 2021’s property market in Singapore that you should know about and discuss how you can minimise such risks in your property portfolio.

Potential expectations for 2021

Limited prospects for rental properties

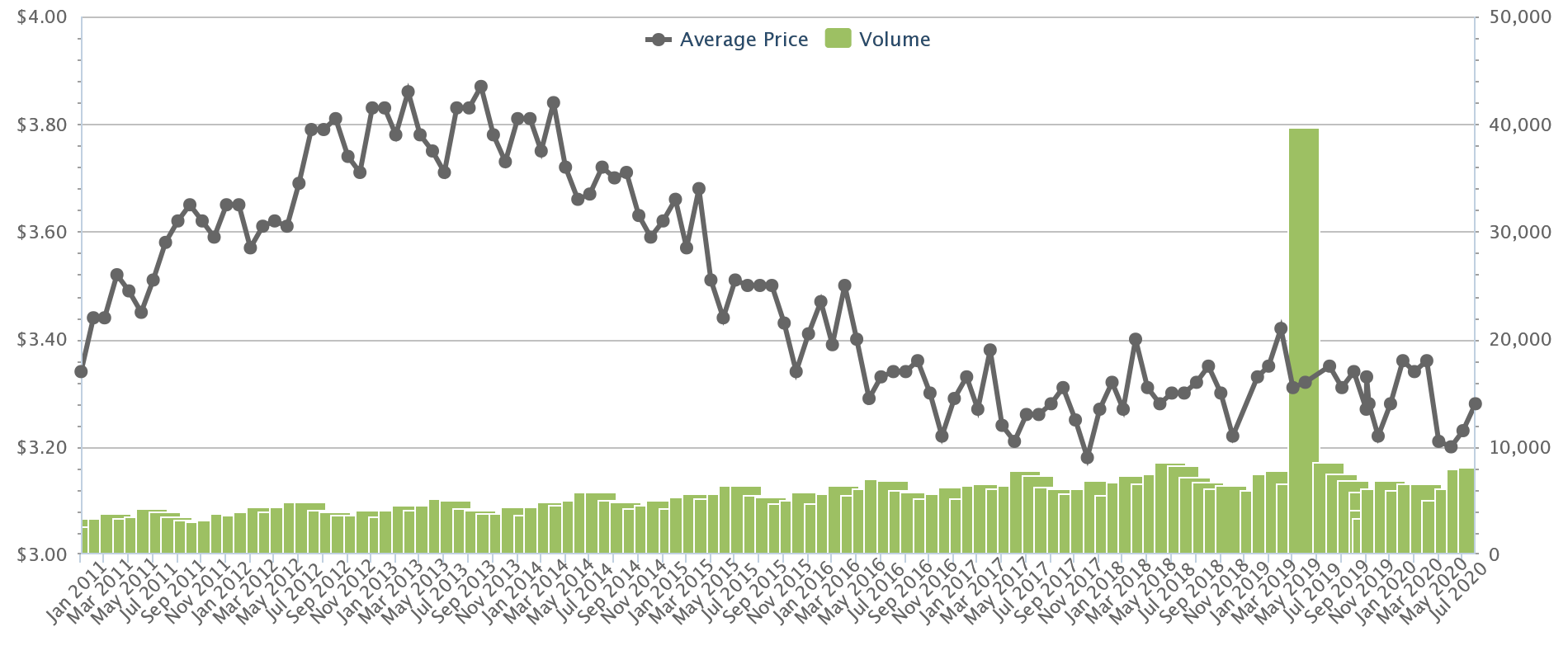

While demand for rental properties has shown no signs of abating, average rental rates in Singapore have continued to decline amid the pandemic; a far cry from the rental market’s peak back in 2013.

Average rental rates and volume in Singapore between January 2011 and July 2020 for non-landed properties (above) and landed properties (below), courtesy: Squarefoot

As landlord of your rental property, you’ll need to constantly match up with the market’s average rates and revise your rental prices whenever necessary. This is because potential tenants are also constantly seeking out the best rental rates and they will most likely use the current market’s average as a benchmark for their budget range. If your rental rates remain unchanging even when the market dips to an all-time low, especially if your asking price is significantly higher than the average market rate, you’d definitely be losing potential tenants to other landlords who are mindful of market sentiments, offering way better deals in the market.

Image courtesy: TR Financial

With the surge in demand for rentals following the Malaysia-Singapore border lockdown, travel restrictions and circuit breaker in Singapore, you shouldn’t have too much of a problem finding tenants as long as you price your rental rates reasonably according to the market’s trend. But being a landlord also comes with responsibilities which you should keep in mind and these can require some extra expenses and attention, such as maintenance and repair fees for damaged parts of rental property whenever required.

As such with the average rental rates in Singapore still creeping by and unpredictable costs that can incur, it’s unlikely that you’ll be able to put out a high price on the market this year, limiting potential rental yields this year.

Image courtesy: The Real Deal

Property prices projected to keep rising

In 2021, around 25,000 HDB owners will be completing their MOP within the year and a significant number of homeowners will be placing their HDB flats on the resale market soon to upgrade or to make a profit. With the significant influx of resale flats in the market, prices are expected to dip due to a potential oversupply, but due to the difficulties of obtaining a BTO along with the financial downturn’s prompt for more prudent financial practices, a handful of new homeowners may consider purchasing a resale flat instead – which helps provide a substantial demand to meet the new supply of resale flats on the market. In fact, HDB resale prices surpassed mediocre expectations, rising by as much as 2.9% in the fourth quarter of 2020, making it the biggest quarterly hike in 9 years. Conclusively, we can expect this trend to continue into 2021.

Image courtesy: Financial Times

The cutback on Government Land Sales (GLS) in 2020 have driven developers to enbloc sales, once again signalling a potential return of the en bloc sales fever in 2021. But in recent years, Singapore has seen a huge influx of foreign developers, particularly from China; these Chinese developers have been snatching up some of the top properties in Singapore with record-breaking bids such as the Stirling Road plot deal sealed for more than $1 billion back in 2017.

Aside from higher bidding prices that developers require to secure areas for new developments, the government has also begun to increase Development Charges (DC) – a tax imposed on developers, likely in an attempt to cool the en bloc fevers.

You may wonder what this has anything to do with you and we hate to burst your bubble, but all of these changes will very likely have a direct impact on the market. This is because when developers have to pay more for their projects, they’re expected to transfer these costs to the buyers, either in the form of more exorbitant prices or smaller units. Ultimately, the overall price per square foot (PSF) is expected to rise significantly for future developments, which may also eventually set a higher benchmark for older developments.

Upcoming new launch “One Pearl Bank”, courtesy One Pearl Bank

Aside from these, the unwavering demand for new launches despite the decline in supply this year, as well as the new appreciation for bigger home spaces that landed properties have to offer, are just some of the other reasons for expected increases in property prices for 2021.

While the market rates are projected to keep rising, existing cooling measures such as the Additional Buyer’s Stamp Duty (ABSD) curbs the influx in demand for property in Singapore and maintains the property prices in Singapore so that they will remain reasonably affordable. There are ongoing discussions about new cooling measures that may happen in 2021. We have dissected the possibilities, so do check it out here.

Mortgage loan interest rates are expected to remain low

Image Courtesy: Forbes

In 2020 when the Federal Reserve of America announced that it would be cutting benchmark interest rates to zero and launching a massive quantitative easing (QE) program, these changes had a direct impact on the local SIBOR (Singapore Interbank Offered Rate) – commonly used to determine interest rates for bank loans in Singapore, which plummeted to a decade low of 0.25% shortly after. The Fed is also expected to hold the benchmark interest rates near zero till 2022, thus regulating SIBOR at low rates for the foreseeable future.

Several financial institutions are also expected to roll out SORA home loans by this year, after the Association of Banks in Singapore and the Singapore Foreign Exchange Market Committee (ABS-SFEMC) recommended the Singapore Overnight Rate Average (SORA) as the most suitable benchmark to fully replace the SGD Swap Offer Rate (SOR).

Comparative table for SOR, SORA and SIBOR in Singapore, courtesy Moneysmart.

To find out more about this, you may read their article here.

The introduction of SORA also targets to reform SIBOR which is set to be discontinued by 2024, thus shifting Singapore into a more SORA-centred interest rate market. It is probable that existing SIBOR loan packages will be converted to SORA loans eventually. The reason why SORA is seen as a favourable replacement for the current benchmarks is that notably, SORA tends to be a more stable and predictable choice than SIBOR, which may be more beneficial for property investors.

How can you effectively manage the risks?

The market is turbulent by nature as it’s constantly influenced by events around the world. Just as everything has its ups and downs, the property market has seen a fair share of downturns, but it really shouldn’t be any cause for alarm since the market runs in cycles and if it’s down now, it’ll only be a matter of time before it rises again.

Image courtesy: Risk.net

Stay grounded and be rational

We can draw some wise conclusions from the three types of financial investors, which does apply to property investors to a certain extent. We recommend you adopt the mentality of the Bullish investors — positive about the increase of market value over time and focus mainly on long-term investments. When the market goes bad, Bullish investors are the ones who are the least compelled to impulsively abandon their investments because they believe that the market will bounce back over time. Hence, they are instead likely to hold on to their property assets for the time being and only reconsider whether to sell it at a later time, hopefully when market prices have climbed back up. Although this type of investment techniques may require more time to see fruition and demands a stronger portfolio to tide over, it definitely carries lesser risks for investors as it avoids hasty decision making that could result in dire consequences.

In stark contrast to the Bullish investors, Bearish investors are pessimistic about market trends and usually think about short to medium term results. When markets begin to crash, Bearish investors would likely be the quickest to abandon their original investment plans and rush to sell their property assets. You also should avoid being like Piggish investors who disregard their original investment plan along the way out of greed for anticipated higher returns in the near future. These two other types of investors run higher risks of making poor decisions because it’s impossible to accurately predict the market’s uncertain trends; and in most cases these investors could leave the market with significant losses.

Image courtesy: Corporate Financial Institute

Have a solid plan and stick to it

Ultimately, it’s imperative that you have a well thought-out plan in mind for the long-term and stick to it while re-evaluating your strategies every now and then analysing the market’s recent trends.

You shouldn’t allow yourself to be easily swayed by headlines that speak of crashing markets because impulsive decisions that you’d make in a moment of panic will almost certainly lead to a loss most of the time; especially if you sell your property at a price that’s lower than its purchase price, instead of waiting for your property’s valuation to eventually recover.

Hedging

Hedging is a popular investment strategy that many advanced investors adopt to manage the unavoidable risks that come with any investment. Simply put, it’s a way of insuring or protecting yourself against a negative event’s impact on your property investments and finances.

One way you may choose to hedge your property investments is by diversifying the types of property in your investment plan. Just as the common adage “don’t put all your eggs in one basket”, if you are planning to buy your second or subsequent properties for investment, you should go for a variety of property (landed and non-landed property) and diversify your monetisation methods (buy and sell, or rental income) rather than just sticking to one.

Diversification: “Don’t put all your eggs in one basket”, courtesy Axiom Advisory.

For example, maybe you could decide that you want to only invest in landed properties because you think it’s a better option compared to non-landed properties. However, if the market demand or the average price of landed property drastically diminishes one day, then all your landed properties could cumulatively incur a loss simultaneously, which could put you in some serious financial rut.

But what if alongside your existing landed property investments, you also decide to invest in non-landed properties, such as condominiums? Since the demand for landed properties has gone down, it’s more likely that the demand for specific property types in the market has shifted to non-landed properties instead. By investing in both types of property, you’re able to minimize the overall risk of loss in your property investment, since the profit of one may be enough to cover potential losses in the other.

Image courtesy: Realty Plus Magazine

When you buy your investment property, it’s also important to hedge against unforeseen circumstances that could cause damage to your property, such as fires, theft and physical damage. You’d definitely want to consider getting property insurance for your property investments. You might be hesitant to dish out this extra cost for insurance, but these problems could cost you a bomb depending on the severity of these problems, perhaps even more than the insurance itself – it’s always better to be safe than sorry!

Image courtesy: Seeking Alpha

Alternatively, you can also consider property derivatives such as the Real Estate Investment Trust (REITS). REITS will allow you to still make money from real estate without having to own or manage physical properties yourself. It’s a smaller commitment that offers good stability and higher liquidity, though it’s likely that the potential profits you may reap are more limited compared to actual property asset investments. Nonetheless it’s an option with promising prospects and if you think that buying a property asset in the turbulent market is an overly risky business that you don’t wish to partake in for now, then you could settle for REITs first while waiting for the market to hopefully re-stabilise in the next few years.

Aim only for “investment-grade property”

In this previous article for first-time property investors, we discussed what are some of the important factors that you should look out when comparing between different properties to pick out the best “investment-grade property” for yourself. This time, we’d like to focus a bit more on some of the prospective zones that have been set aside for housing development in Singapore in the near future, which could affect the valuation of property in the area and it’s something you should definitely take heed.

Illustration of future developments planned for Tengah, courtesy: HDB

Positive future developments near housing zones will most often result in the appreciation of property value within the vicinity, especially if the development value-adds to an area by offering new amenities or better convenience for residents in the area. Examples of value-added developments to look out for are such as new MRT stations, as well as recreational spaces such as parks and shopping centres. To find out more about other upcoming developments in Singapore, you may refer to URA’s comprehensive Master Plan here.

Dover Forest to be zoned for future housing developments, courtesy: Must Share News.

As most new major development plans are usually announced at random and rather abruptly, you can only anticipate prospective areas for development, invest, be patient, and hope that your prediction hits the jackpot. Usually, we recommend looking at older and untouched areas in Singapore that have not seen much change for a while. For example, Dover Forest is one of the latest zonings announced for future housing development – which has sparked quite a controversy online in defense of the preservation of green spaces in Singapore.

Old One Pearl Bank Apartments that has been sold in an en bloc and redeveloped, courtesy: Condominiums of Singapore.

In addition to the previous point, some investors have considered investing in older property because they have anticipated a possible en bloc in the near future, in hopes of claiming a good sum of compensation and other grants from the government. However, buying older properties does come with its own set of problems such as maintenance; plus its not guaranteed that your property will see an en bloc anytime soon – so you might end up stuck with an old property that can’t seal a deal for you on the market. It’s really a make or break deal for your investment, so think carefully about whether you’re prepared to take this risk.

There’s no such thing as “perfect timing”.

Image courtesy: Medium

Some investors are simply obsessed with picking the best time to buy or sell property, but there’s really no such thing as “perfect timing”– some opportunities are just better than the others. If you have sufficient capital to comfortably afford your investment property assets and if you can find a deal that you think is good for you, then just trust your gut and go for it.

The key is to be patient with your investments and avoid rushing into making hasty decisions for your property at all costs. You should always watch market trends closely by staying updated with global news and analysing the latest statistics so that you may try to foresee how some key events or trends could affect the real estate market; from the information you have obtained, you may be better prepared to make an informed decision.

If you would like some professional guidance on property investment, we have a team of dedicated and experienced professionals who can help you here at PropertyLimBrothers. We hope this article has been insightful and stay tuned for our next one!