When the results of the URA tender for the Dorset Road private housing site were announced on 9 October 2025, the real estate radar lit up. A consortium led by UOL, together with Singapore Land Group (SingLand) and Kheng Leong, submitted a top bid of $524.3 million, equivalent to $1,338 psf ppr, narrowly beating the second-highest offer by just 1 %.

That level of competition—nine bids in total—confirms that prime, city-fringe residential land is still very much in demand. Analysts had earlier expected bids in the S$1,000–S$1,400 psf ppr range, and this result landed at the upper end of that band.

What does this mean for the future development on Dorset Road? Below is an assessment of the reasons why the site is well positioned to attract buyers — and why the early signs suggest a high take-up once the project is launched (assuming the site is awarded to the consortium).

Site fundamentals: city-fringe with rare attributes

Strong connectivity and urban access

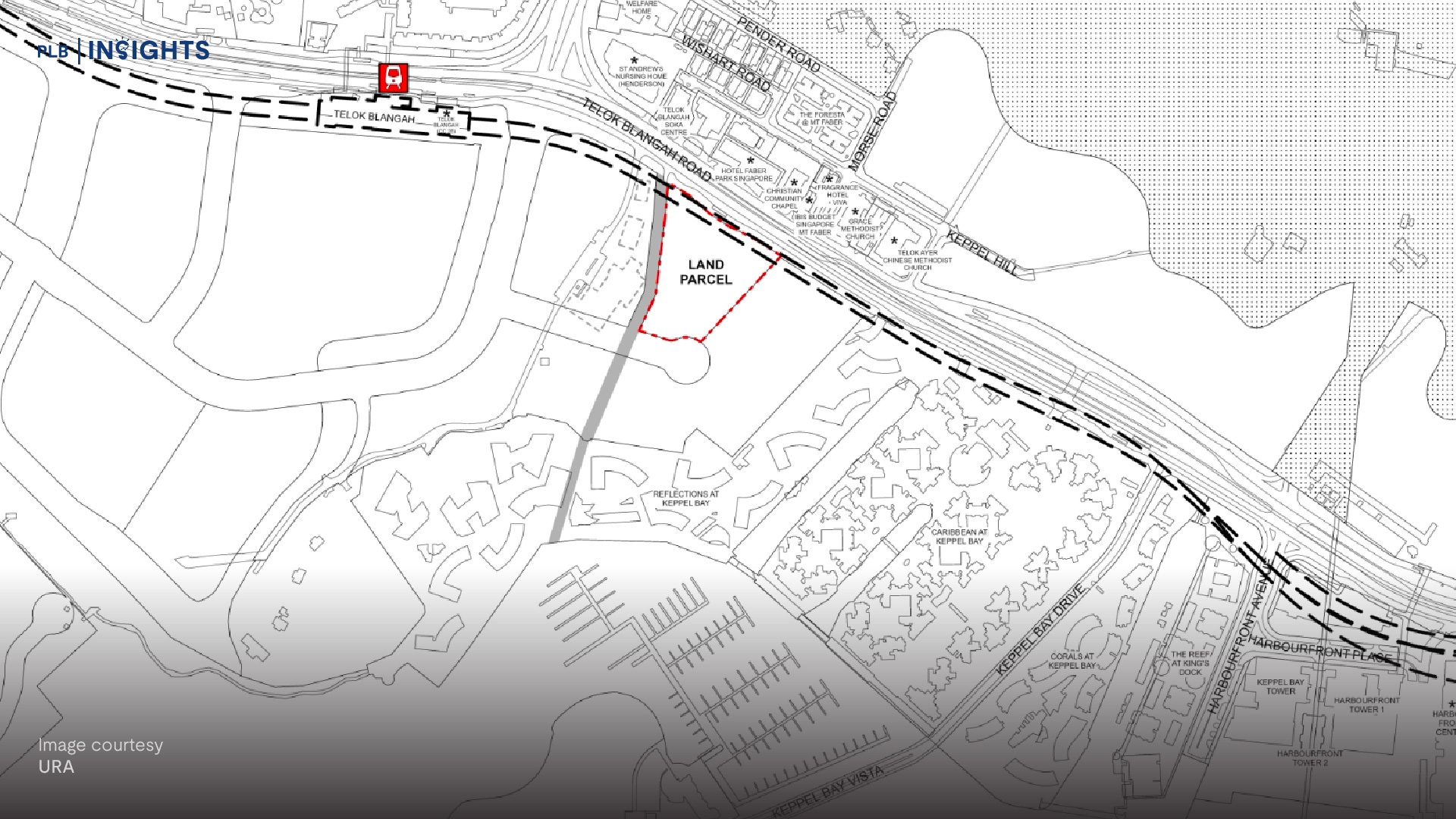

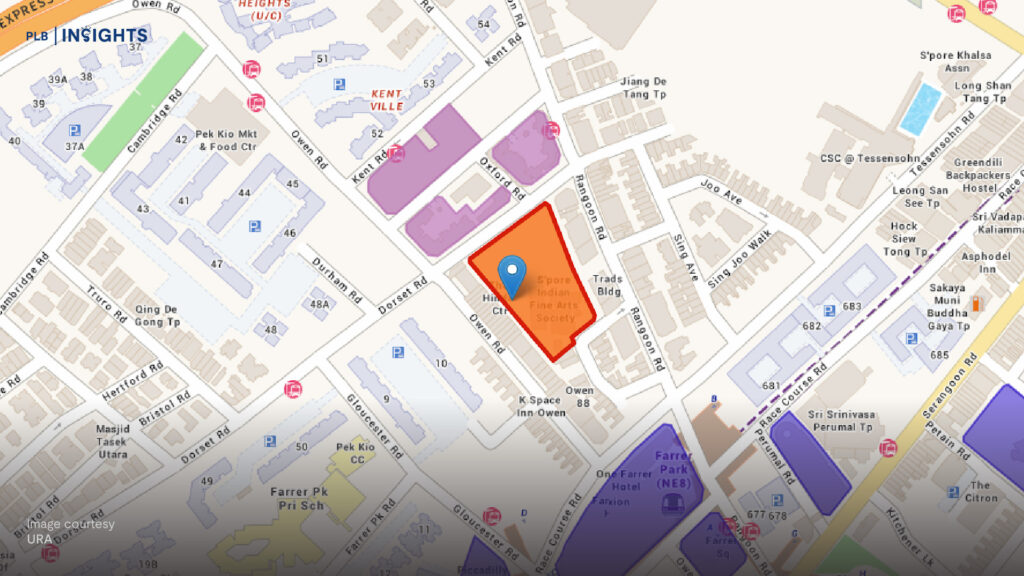

The Dorset Road plot sits within walking distance of Farrer Park MRT on the North-East Line (NEL). From there, residents can get to Little India in one stop and Dhoby Ghaut interchange in two, opening up connectivity to the North-South Line (NSL) and Circle Line (CCL). Road access is also favourable: nearby arteries such as Bukit Timah Road and the Central Expressway (CTE) allow relatively direct travel into the downtown core or toward the northern parts of Singapore.

In essence, the development could deliver a “best of both worlds” proposition: centrally connected and surrounded by a rich mix of urban amenities, yet slightly removed from the bustle of the Downtown Core. Observers have noted that among the confirmed 2025 GLS sites, Dorset Road stands out for straddling the fringe of the Core Central Region (CCR), offering city-fringe convenience and accessibility at a comparatively more attainable entry price than ultra-prime sites.

Mature amenities and lifestyle catchments

Beyond transport, the neighbourhood offers a rich amenity base. Within walking distance are everyday conveniences such as Pek Kio Market & Food Centre, legacy shophouse character, as well as retail draws like City Square Mall and Mustafa Centre. For recreation, parks and community spaces are not far off, and the Kallang Sports Hub lies within reach.

Perhaps of deeper appeal to families, the site lies within 1 km of several desirable schools: St. Joseph’s Institution Junior and Hong Wen School are both in that radius, while other nearby options include Farrer Park Primary, ACJC, Bendemeer Primary, among others. That adds a strong draw for owner-occupier demand, especially among families looking for convenience and certainty in school catchment.

Balanced scale and exclusivity

The size of the parcel — about 111,934 sq ft, yielding up to ~425–428 residential units under the consortium’s plans — is meaningful but not overly large. That size allows for full condominium facilities (pool, gym, landscaping, communal spaces) while retaining a degree of exclusivity and identity, avoiding the anonymity of mega-projects. Analysts have likened the scale to the nearby Piccadilly Grand project (407 units), which was well received by the market.

Moreover, the clustering of top bids (six of the nine bidders were within ~10 % of one another) suggests broad consensus on the site’s potential and a controlled perception of risk.

Track record of analogous projects

A useful comparator is Piccadilly Grand, the development on Northumberland Road (adjacent to Farrer Park MRT), which was awarded in 2021 and launched in 2022. That project sold 315 out of 407 units (77 %) in its first weekend, with average pricing of ~$2,150 psf at launch. Over time, it achieved full sell-out by end-2023. That strong performance underscores how well-located, mid-sized, city-fringe projects can resonate with buyers.

While the land cost for Dorset Road is materially higher, the proximity to Farrer Park MRT (rather than a walk-up connection) may temper premium, but the demand framework is there. CBRE and others have observed that despite economic uncertainties and pressure on construction costs, buyer confidence in quality new launches remains resilient.

Why we believe take-up could be strong

From the supply–demand perspective, several factors point to a favourable reception:

Tight supply and low unsold inventory

Singapore’s private residential market in 2025 is characterized by relatively low unsold stocks and modest overhang, which buttresses pricing resilience. CBRE projects a 3–4 % increase in private residential prices for the year. Developers buying land typically bank on that ongoing demand and limited competition in the immediate vicinity.

Buyer segmentation: owner-occupiers, upgraders, and mid-luxury demand

The project is unlikely to compete head-on with ultra-prime CCR launches, yet it provides a bridge for buyers who want more than typical RCR properties. Families, professionals, expatriates wanting central access (but without Orchard or Newton premiums) may find this a compelling option. The nearby schools, amenities, and connectivity anchor that appeal.

Psychological appeal of newness and facility features

Many buyers are drawn to fresh, modern homes with contemporary layouts, efficient designs, smart home features, and full condo amenities—not always offered in older stock or resale units. That new product premium often justifies a higher per-square-foot pricing in the buyers’ minds.

Limited good alternatives at similar scale and location

City-fringe GLS sites with this degree of maturity and MRT proximity are rare. The scarcity value of comparable options helps buffer competition and gives the project relative pricing power.

Momentum in the new launch market

Anecdotal evidence this year suggests renewed vigor in the primary market. According to PropNex, more than 7,900 new private homes (excluding ECs) had been sold as of 28 September 2025—already surpassing the annual totals for prior years. Developers may therefore be more willing to commit to land acquisitions, betting on sustained demand.

Given these factors, a well-executed marketing campaign, judicious pricing, and differentiated product offerings (layouts, views, amenities) could drive strong take-up at launch.

Pricing outlook: cautious optimism

It is still early days, and the site has not yet been awarded, so any price projection must be hedged with caveats. Still, based on the land cost and nearby comparables, analysts and market watchers have floated average selling price ranges in the $2,650 to $2,750 psf band.

If the developer leans into premium units (higher floors, views, corner layouts, penthouses) or garners excitement at launch, those might command further uplifts. The risk, of course, is that a miscalibrated pricing strategy could slow early release absorption, putting pressure on margins or requiring discounts or promotions.

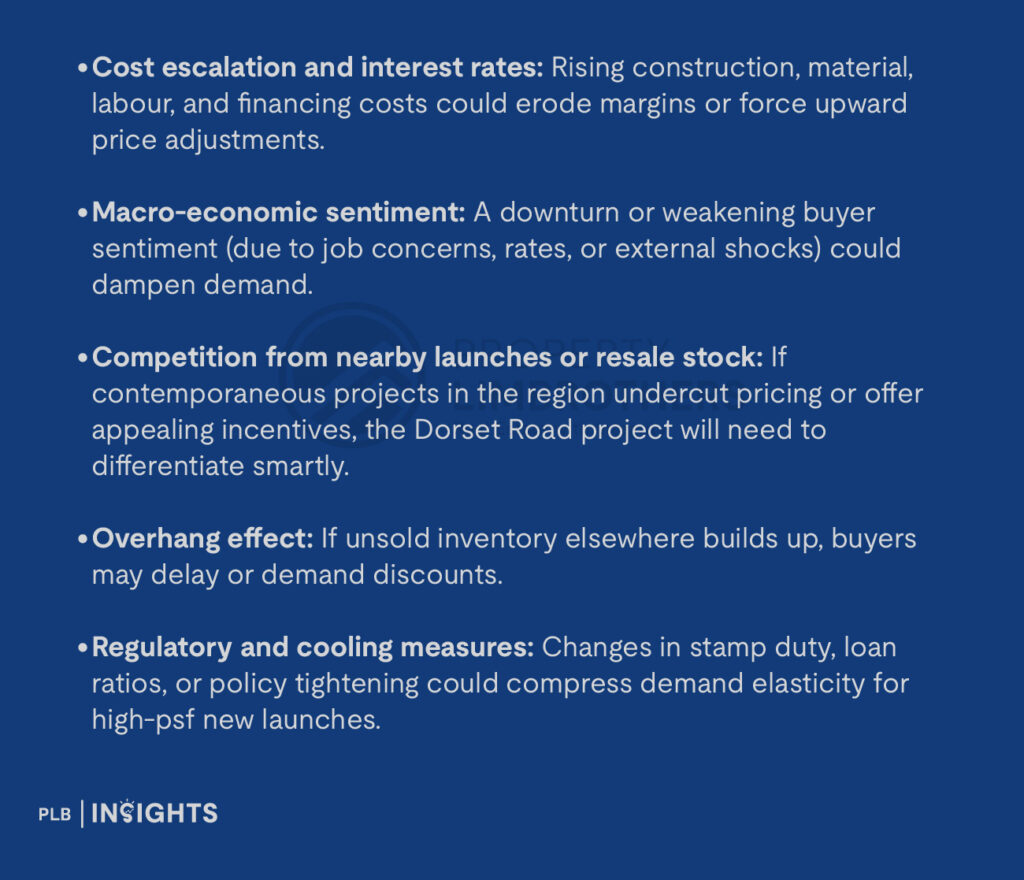

Risks and caveats

While the conditions look favourable, several risks must be borne in mind:

Nevertheless, many of these risks are common to all major GLS launches, and developers factor them in during bid deliberations.

Conclusion

The UOL-led consortium’s aggressive but measured bid for the Dorset Road site reflects confidence in both the fundamentals of the location and the underlying demand dynamics in Singapore’s central fringe. The project ticks many boxes: MRT proximity, school catchments, mature amenities, balanced scale, and an emotional appeal of a new, quality product in a well-connected enclave.

Assuming the site is awarded, a smart pricing strategy—perhaps starting in the ballpark of $2,500–S$2,600 psf (with room for premium over-launch pricing)—could position the new development for robust take-up, especially among owner-occupier and upgrader segments. Over time, the development could also act as a reference point for comparable city-fringe projects, influencing pricing trajectories in the RCR corridor.

The next decisive moments will be the tender award, followed by the development proposal, specs (unit mix, view corridors, facilities), and — critically — how the marketing and pricing at launch are executed. If those are done deftly, Dorset Road may well become one of the standout new launches of the cycle.

Want data-backed guidance on upcoming launches like Dorset Road? Get in touch with our sales consultants for an in-depth consultation.