The government will review the removal of the 15-month wait-out period for private homeowners looking to buy a non-subsidised HDB resale flat when resale prices ease.

Minister for National Development Chee Hong Tat said on Wednesday that the temporary measure—first introduced in September 2022—was aimed at cooling a heated resale market and may be lifted once conditions stabilise.

He mentioned that the restriction was put in place as a temporary measure precisely because there were concerns about higher resale flat prices during a media briefing after a visit to the Toa Payoh Ridge BTO project.

Recent data from HDB showed that resale flat prices rose by 1.6% in the first quarter of 2025—down from 2.6% in Q4 2024 and below the average quarterly increase of 2.3% last year. This marks the slowest rate of growth since Q1 2024.

Minister Chee attributed the price surge in previous years to a “supply and demand issue.” A total of 72,101 BTO flats were delayed during the COVID-19 period. As of March 8, all 75,800 affected units have now been completed.

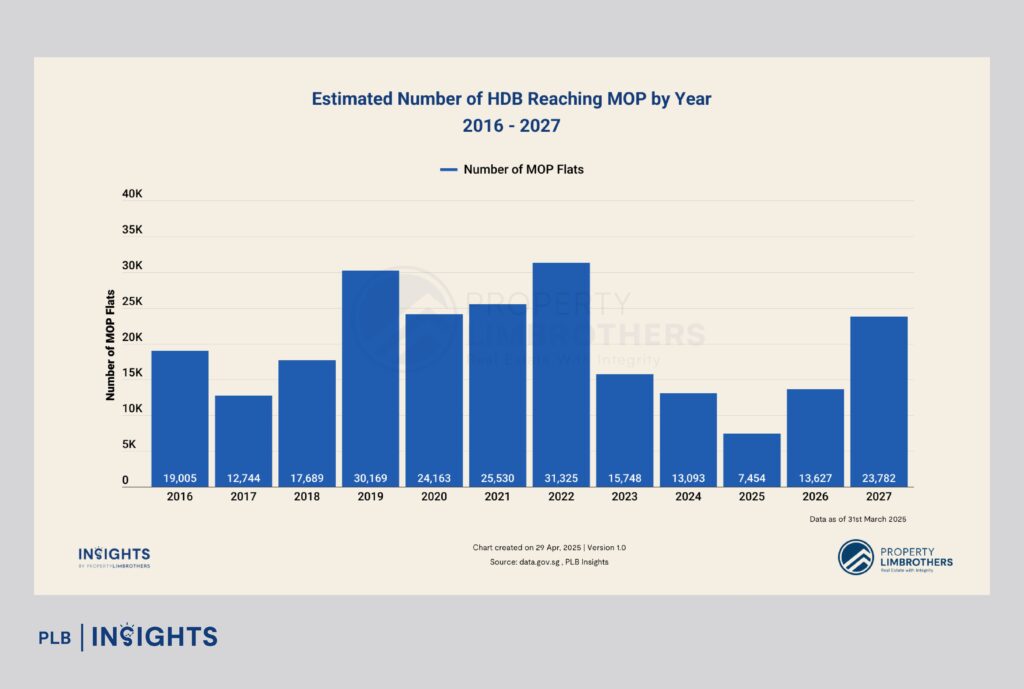

Looking ahead, Chee expects further market stabilisation as more flats reach their five-year Minimum Occupation Period (MOP) from 2026 onwards. Just 7,454 flats are expected to reach MOP in 2025—the lowest in over a decade—but that number will more than triple to 23,782 units by 2027.

The minister also highlighted that HDB is on track to deliver keys to 19,000 households in 2025. Over 50,000 new BTO flats are planned over the next three years, reinforcing the government’s long-term supply pipeline.

In addition, the Ministry of National Development (MND) will ramp up estate enhancements, especially for older towns. Toa Payoh will be among the first to undergo the new “silver upgrading” programme to enhance liveability for seniors.

Our View:

The easing resale price growth and rising MOP flat supply are strong signals that the market is entering a phase of normalisation. As shown in our “Estimated Number of HDB Reaching MOP” chart above, 2025 marks a trough in MOP supply, but 2026–2027 will see a sharp rebound in available resale stock—likely relieving some of the pressure driving price hikes.

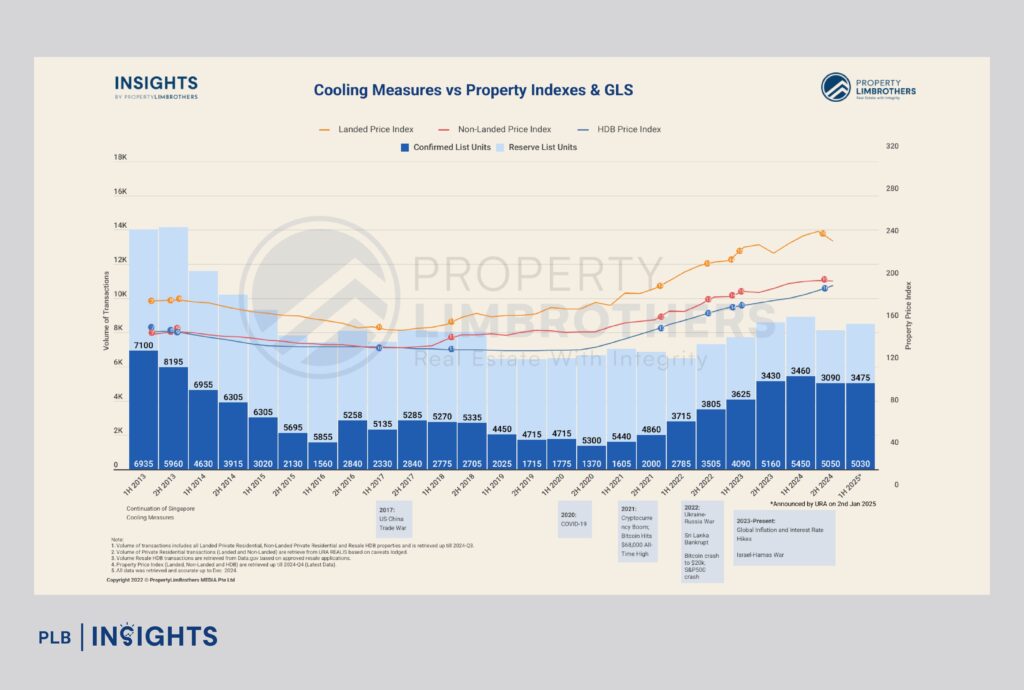

Additionally, while HDB prices have held firm amid external shocks, the trajectory is now plateauing, as seen in Figure 2 below. If this trend continues, the removal of the 15-month wait-out period could reactivate private downgraders into the market without distorting affordability.

In our view, the government’s move is both measured and timely, and we’ll be closely monitoring resale transaction volumes and median pricing shifts in the coming quarters.

Stay Updated and Let’s Get In Touch

Our goal is to provide you with real estate insights. Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.