Many Singaporean families aspire to upgrade from their cosy HDB flats to private properties, with landed homes representing the pinnacle of such aspirations. However, the steep appreciation of private landed properties has posed an increasingly significant hurdle in recent years, given their exorbitant costs compared to HDB flats. While there’s a widespread belief that owners of private landed homes inherited their properties through generational wealth, it’s important to note that a significant proportion of buyers actually transitioned directly from HDB flats to private landed homes.

Between 2004 and 2013, nearly a third (23.3%) of all landed property transactions involved buyers who own a HDB flat, with the peak reaching 29.5% in 2009. In 2014, this trend persisted as 24.5% of landed homes were purchased by HDB flat owners, marking the second highest proportion in the past two decades. However, since then, there has been a gradual decline in the percentage of HDB upgraders transitioning to private landed homes, accounting for only 15.3% of the market share in 2023.

This article delves into the factors contributing to the decreasing number of HDB homeowners making the leap to private landed properties.

Drivers Behind the Rise in HDB Upgraders

When analysing the historical data, it becomes clear that the surge in HDB upgraders entering the private landed market was closely tied to a decline in landed home prices. Following the 2008 Global Financial Crisis, the price index for landed housing experienced a significant drop of 19.1% over the span of 12 months, from mid-2008 to mid-2009. It was during this period, in 2009, that the proportion of HDB upgraders in the landed housing market reached its peak.

Another compelling example highlighting the relationship between declining prices of landed properties and an increase in HDB upgraders can be observed in 2014. During this period, the price index for landed homes experienced a 5.4% contraction, largely attributed to various cooling measures announced in 2013. Interestingly, there was a slight uptick in the proportion of landed homes purchased by HDB upgraders, rising from 22.6% in 2013 to 24.5% in 2014. The decrease in the landed home price index in 2014 likely stemmed from public sentiment reacting to the introduction of measures such as the Additional Buyer’s Stamp Duty (ABSD) and Total Debt Servicing Ratio (TDSR).

Hurdles Confronting Prospective HDB Upgraders

Since 2014, the prices of private homes, whether landed or non-landed, have significantly outpaced the appreciation seen in HDB flats, presenting a significant challenge for HDB upgraders. Over the past decade (2013 to 2023), the prices of private landed homes increased by 31.7%, while private non-landed homes saw a growth of 31.6%. In comparison, the price index for HDB resale flats grew by only 23.7% during the same period.

Over a two decade period spanning from 2003 to 2023, the price escalation in various housing segments reveals notable discrepancies. Private non-landed housing witnessed a significant 143.1% increase, closely followed by HDB resale flats with a rise of 140.2%. In contrast, the prices of landed homes surged even higher, experiencing a remarkable 180.6% increase over the same timeframe.

When we compare the median prices of different property categories, it highlights the significant challenge for HDB upgraders. In 2013, the median price of a five-room HDB resale flat, the largest type built in recent decades, stood at $537,000. In contrast, the smallest type of landed property, a terrace house, had a median price of $2.68 million, already five times higher than the five-room flat. Fast forward to 2023, the median price of terrace houses increased by 34.3% to $3.6 million, while the median price of a five-room resale flat grew at a slower rate of 21% to $650,000. Consequently, the typical terrace house has become 5.54 times more expensive than the average five-room flat. The gap in absolute prices between terrace houses and five-room HDB flats widened from $2.14 million in 2013 to $2.95 million in 2023, a 37.7% increase, surpassing the 21% increase in the price of five-room flats over the same period.

Examining Preferred Locations and Types of Landed Homes Among HDB Upgraders

Terrace houses, the most common type of landed homes in Singapore, are often favoured by HDB upgraders due to their comparatively lower prices compared to semi-detached houses and detached houses (bungalows). Over the past decade, terrace houses accounted for 59% of all landed property transactions, while bungalows made up 12.3% and semi-detached houses comprised 28.7% of sales. In 2023, 71.2% of landed homes purchased by HDB residents were terrace houses, followed by semi-detached houses at 23.2% and bungalows at 5.6%.

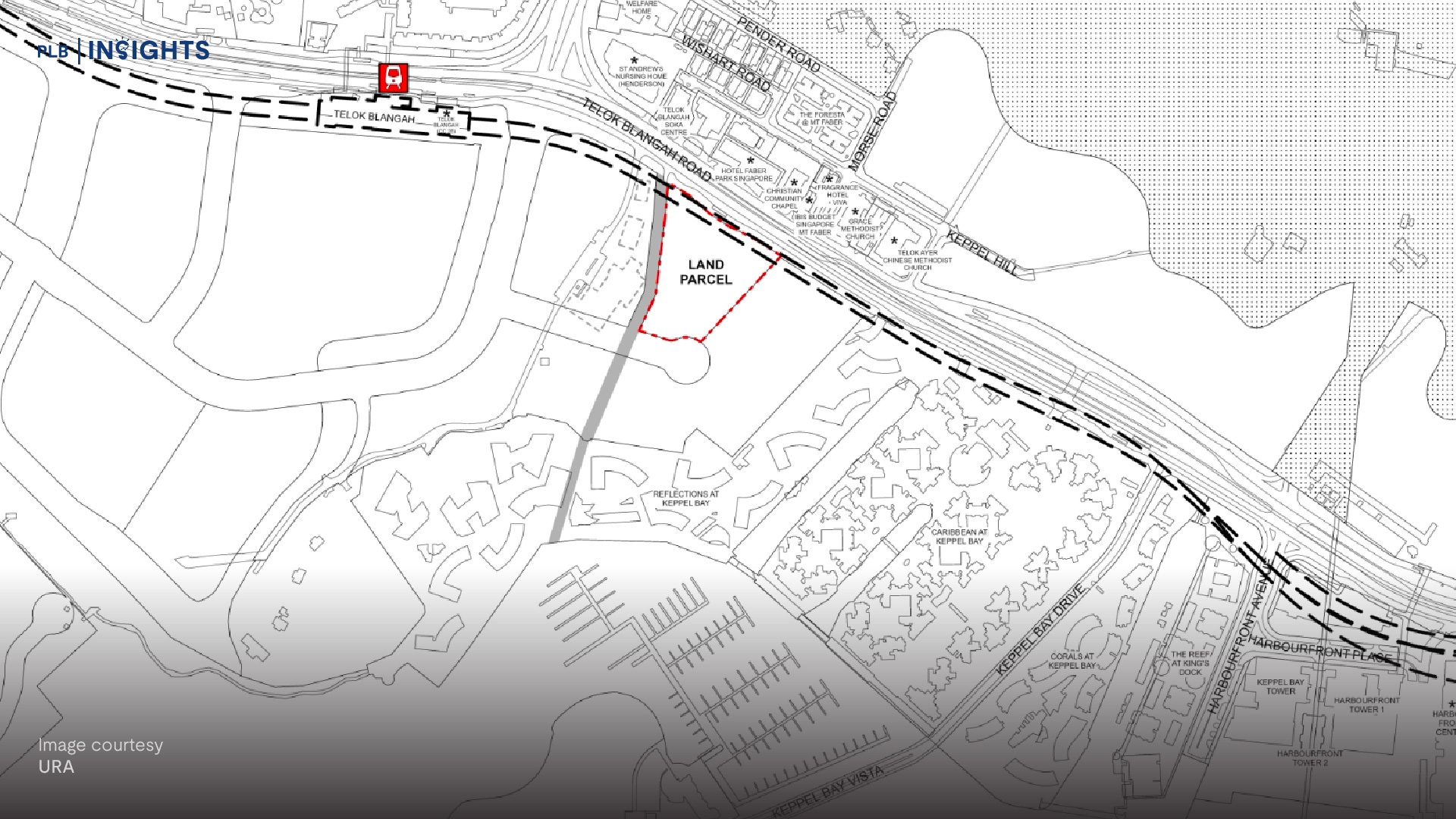

In terms of location preference, the Outside Central Region (OCR) appears to be the top choice for most HDB upgraders, with nearly eight out of ten houses purchased by HDB upgraders in 2023 located in suburban areas within the OCR. While some HDB upgraders have substantial financial resources, with 9.9% of buyers opting for properties in the Core Central Region (CCR) and 10.7% in the Rest of Central Region (RCR).

Prospects on the Horizon: Outlook for Aspiring HDB Upgraders

As Singapore experiences rapid urban development, land scarcity becomes increasingly pronounced. Consequently, recent trends in new property launches indicate a shrinking of unit sizes, be it a move by developers to make quantum more palatable for buyers or to optimise unit-to-land size ratio. This makes landed properties even more sought after and valuable. This trend sets off a domino effect, leading to a rapid escalation in the prices of landed homes and further widening the price gap compared to HDB flats.

Anticipating additional housing measures being introduced on top of existing ones to control property prices, especially for HDB homes, we anticipate a slowdown in the price growth of HDB resale flats. This poses a challenge for HDB residents aspiring to upgrade to private landed homes, as the increasing price disparity between landed properties and HDB flats means they’ll need a substantially larger financial commitment to enter the landed market after transitioning from their HDB flats.

Another significant factor expected to affect the dream of upgrading from an HDB to a landed property in the future is the implementation of rules governing Prime and Plus BTO flats, starting in the second half of 2024. In real estate, timing is crucial. The 10-year Minimum Occupation Period (MOP) and the clawback of subsidies upon resale, along with Loan-to-Value (LTV) cooling measures, will pose additional challenges for aspirants trying to align their life stages with their long-term goals. These measures will force them to allocate a higher financial investment. Moreover, since the maximum LTV is largely determined by the applicant’s age, it further exacerbates their financial burdens.

As the government continues to increase the supply of HDB flats, with an annual range of 18,000 to 23,000 units, the gap in pricing between HDB homes and landed properties is expected to widen further. Over the past decade, the annual average of newly completed landed housing units has been around 300. With land becoming more scarce in Singapore, this disparity in supply between the two housing categories is projected to grow even more pronounced.

In Summary

The journey of HDB owners aspiring to upgrade to landed properties in Singapore is marked by significant challenges and evolving dynamics in the real estate landscape. Despite the allure of transitioning from HDB flats to private landed homes, steep price differentials, coupled with changing market conditions, present formidable obstacles. However, though it is becoming increasingly difficult, with prudent financial planning and thorough long-term planning aligning with life-stages, upgrading to your dream landed home might not be a pipe dream.

Historical trends illustrate moments where economic downturns coincided with increased opportunities for HDB upgraders to enter the landed property market. However, recent years have seen a divergence in price growth between HDB flats and landed homes, making the transition increasingly daunting.

The preference for terrace houses among HDB upgraders, especially in suburban areas within the OCR, underscores the importance of affordability and location in housing decisions. Yet, even with deep pockets, navigating regulatory measures like the MOP and LTV ratios adds layers of complexity and financial strain.

Looking ahead, anticipated housing policies and the continued scarcity of land are poised to further widen the gap between HDB and landed property prices. As such, the dream of upgrading from an HDB to a landed property may become more elusive for many, necessitating careful planning and consideration of long-term goals amidst a dynamic housing market landscape.

If you are looking for guidance in your real estate journey, feel free to reach out to us. We will be glad to guide you through the process and offer a tailored consultation to help you reach an informed decision.

Thank you for reading and following PLB. Do stay tuned as we bring you more updates and insights on Singapore’s real estate market.