In an age of rising interest rates, stricter property regulations, and geopolitical uncertainty, ultra-luxury condominiums occupy a unique space in real estate. They are aspirational, exclusive, and often elusive—off-limits to the mass market and crafted for the world’s wealthiest. Yet even for the wealthy, questions arise: Are such properties still a safe and worthwhile investment in today’s climate? And what does the new launch of 21 Anderson, nestled in one of Singapore’s most prized enclaves, tell us about this segment?

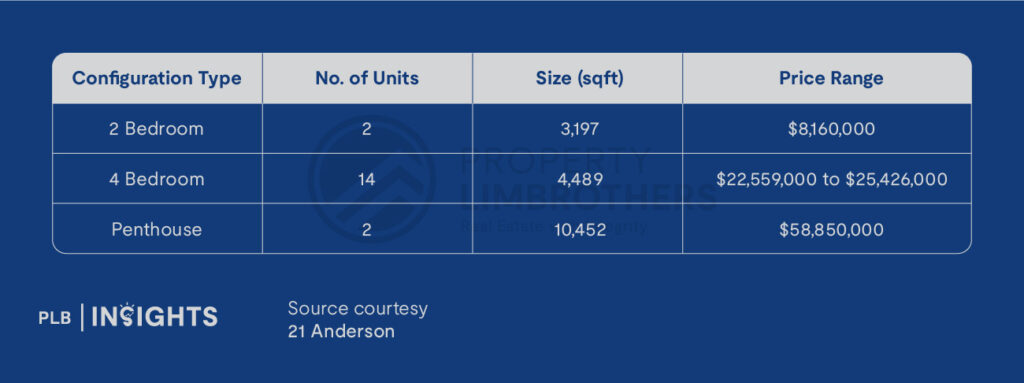

Launched by developer Kheng Leong in 2025, 21 Anderson is no ordinary luxury condominium. With a total of only 18 exclusive freehold units, including just two 2-bedders, fourteen 4-bedders, and two massive triplex penthouses, the project deliberately caters to a very small, discerning audience. Prices start from $8.16 million for a 3,197 sq ft two-bedroom unit and go all the way up to $58.85 million for a 10,452 sq ft penthouse.

But beyond the glossy marketing and breathtaking views, how does 21 Anderson hold up as an investment—and what can it tell us about the demand and outlook for ultra-luxury homes in Singapore?

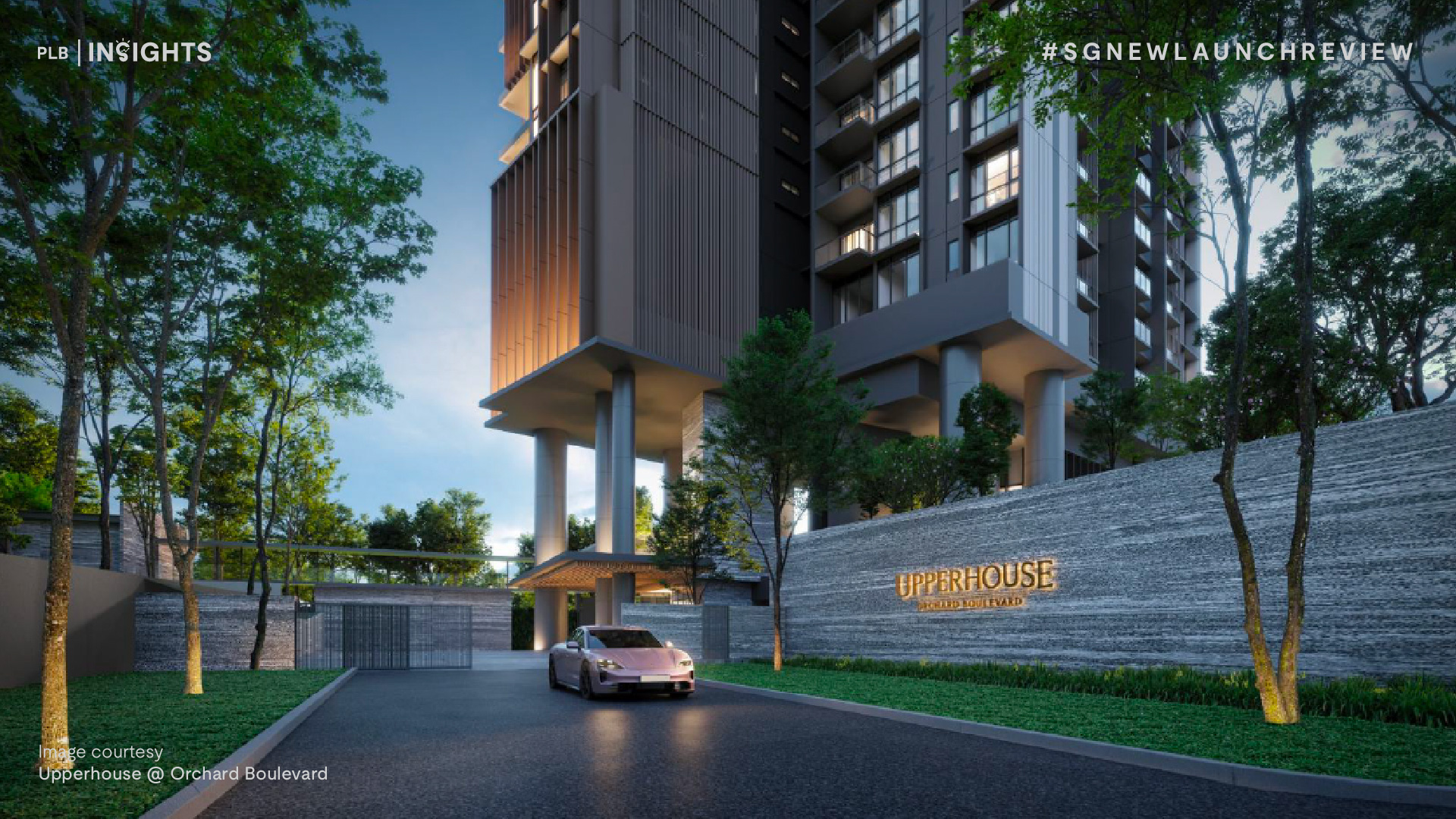

The Project: Ultra-Luxury by Design

Unlike mass-market condominiums or even high-end CCR launches with 100+ units, 21 Anderson is unapologetically low-density. The original development consisted of 34 units before Kheng Leong acquired it en bloc for $213 million in 2021. It was subsequently reconfigured into just 18 oversized residences, an extreme rarity in modern-day Singapore where developers usually try to maximise saleable units per site.

The unit mix reveals the intent:

Each home is more than just spacious—it’s palatial. The smallest 2-bedder here is larger than a typical landed terrace house. These units aren’t designed for flipping. They’re for legacy, privacy, and prestige.

From URA Realis data, at least two 4-bedroom units have already been sold, both crossing the $20 million mark and translating to psf prices in the $4,672 to $5,127 range. Several more have been reserved, hinting that despite a challenging global environment, there remains demand for rare, ultra-premium residences.

Proximity & Prestige: A Prime Address That Sells Itself

21 Anderson sits just off Orchard Road in the coveted Anderson Road–Tanglin area, often referred to as the diplomatic belt for its embassies, GCBs, and lush green surroundings. While peace and privacy dominate the immediate streetscape, world-class connectivity and conveniences are just minutes away.

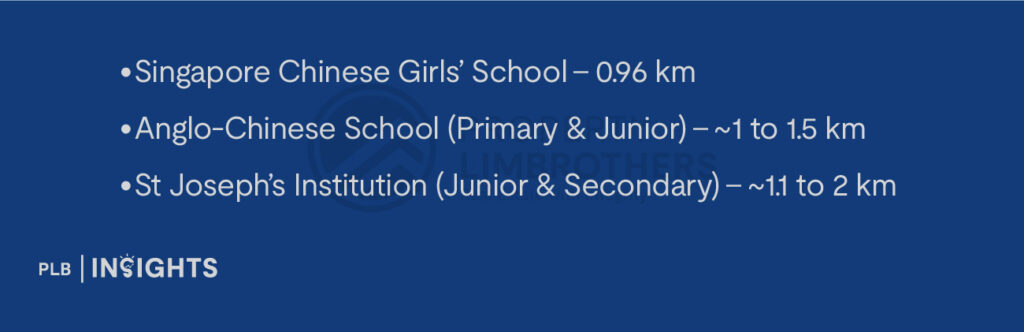

Nearby Schools:

For families, this proximity to elite educational institutions enhances long-term livability and resale value—especially important when catering to multi-generational wealth or foreign buyers with schooling needs.

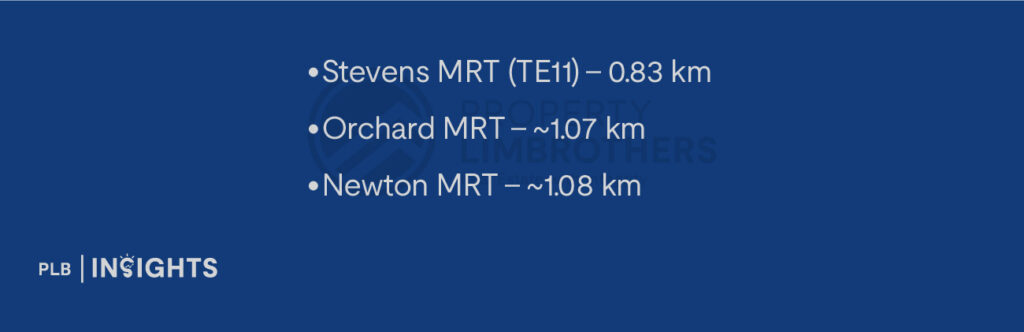

Connectivity:

Being near both the Downtown Line (DTL) and Thomson-East Coast Line (TEL) ensures easy access to the city core, the Central Business District (CBD), and Marina Bay. That said, most residents here will likely travel by private hire or personal chauffeur.

Lifestyle & Amenities:

In short, this is a location that needs no introduction. Its exclusivity is built into the land, not fabricated through marketing.

The Bigger Picture: What’s Happening to Ultra-Luxury Property Demand?

After the latest ABSD hike in April 2023—raising rates for foreigners to a hefty 60%—some feared the ultra-luxury condo market might stall. And indeed, transaction volume in the S$4,500 to S$5,600 psf range slowed, with only 13 such units sold in the past two years compared to 38 units in 2021–2022.

But sales aren’t entirely frozen.

In January 2025, a Park Nova penthouse was sold for $38.9 million ($6,593 psf). In May 2024, a 7,761 sq ft unit at Skywater Residences moved for $47.34 million ($6,100 psf)—a record for 99-year leasehold condos.

So what’s the key differentiator?

True scarcity. Projects like 21 Anderson—with freehold tenure, ultra-low density, and enormous unit sizes—offer a kind of real estate that cannot be mass-produced. As industry experts noted, ultra-luxury properties are increasingly seen not just as homes, but as “wealth preservation vehicles.”

Moreover, the rise in family offices and foreign UHNWIs relocating to Singapore under new talent and tax-friendly schemes is helping revive interest. As recently reported, Q1 2025 saw a 63.6% surge in luxury condo transactions, suggesting the segment may be bottoming out and recovering.

Is 21 Anderson a Good Investment?

Let’s reframe the question. Ultra-luxury condominiums are not meant for high-speed capital gains or quick rental yields. They serve a different purpose:

Potential Risks:

That said, for buyers who have the capital and patience, 21 Anderson is arguably in the same conversation as The Marq, Park Nova, and Boulevard 88—a blue-chip asset with timeless appeal.

Conclusion: A Symbol of Strength in a Cautious Market

21 Anderson is not for everyone—and it was never meant to be. With only 18 homes, the development is closer to a landed estate in exclusivity than it is to your typical condominium. Its location, architecture, and unit sizes cater to a rarefied audience, and its price tag reflects that.

While the broader market might see fluctuations, ultra-luxury condos like 21 Anderson continue to appeal to a select group of buyers who value privacy, scale, and permanence over price trends. They may not be liquid, but they are lasting—and in Singapore’s context, that makes them a powerful store of value.

In a world that’s increasingly volatile, real estate like this remains what it has always been: a sanctuary for wealth, and a statement of success.

If you’re exploring the possibility of owning a rare freehold ultra-luxury residence in one of Singapore’s most exclusive enclaves, 21 Anderson presents a distinctive opportunity worth considering. Whether for legacy planning, lifestyle, or long-term wealth preservation, our sales consultants are here to guide you through the finer details. Reach out to us today to begin your private consultation.