If you’re weighing a first step into freehold landed living, District 14’s inter-terraces deserve a close look. Anchored by mature, heritage-rich enclaves around Kembangan, Eunos and Paya Lebar, this segment combines practical layouts, family-friendly streets, and the most accessible quantum among D14’s landed types. Liquidity is healthy, supply is visible but not overwhelming, and everyday amenities are right on your doorstep—exactly the blend many upgraders prioritise today.

Where demand actually sits (and why it matters)

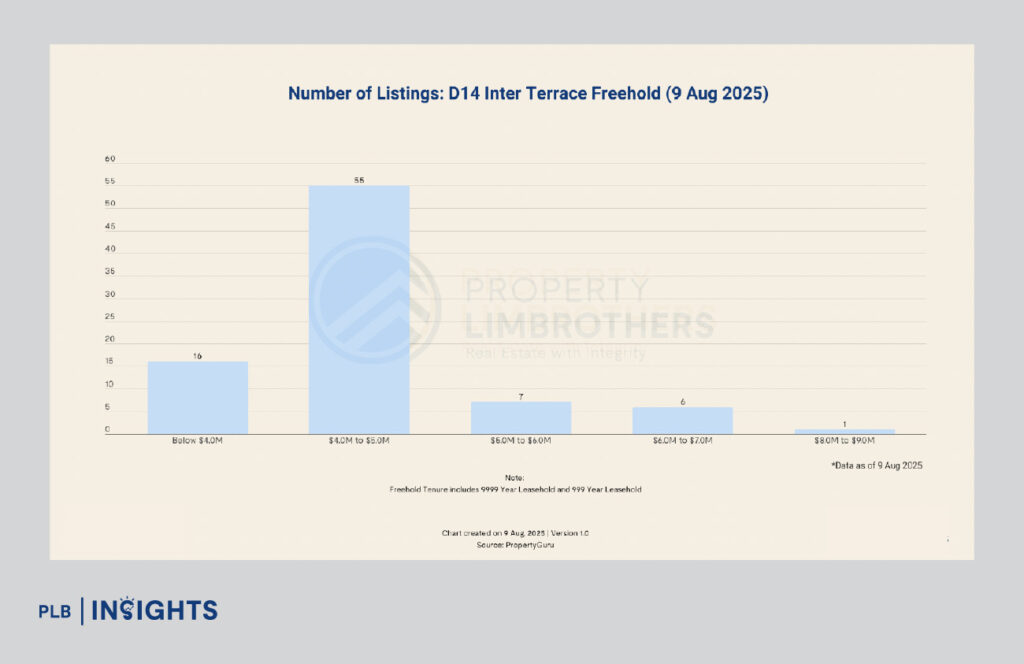

As at 9 August 2025, D14 recorded 77 active inter-terrace listings, with the market anchored firmly in the $4.0M–$5.0M band (55 listings)—the clear pricing sweet spot for freehold landed homes. A further 16 listings sit below $4.0M, while supply thins meaningfully above $5.0M (just 7 in $5–$6M, 6 in $6–$7M, and a single listing in $8–$9M). In other words: most options cluster at the practical, family-budget end of landed living.

Liquidity supports that picture. When you consider terraces as a whole (inter + corner), D14 shows a ~4.0-month absorption ratio based on 139 listings against 35 transactions over the past 12 months—quick enough to give sellers confidence, yet not so tight that buyers have to compromise on fundamentals. Inter-terrace inventory has also been steady-to-slightly higher year-on-year (about 80 listings in Sep 2024 vs ~85 in Aug 2025), which translates to real choice within the key price bands.

Why inter-terraces “fit” D14

Location & networks. Inter-terrace clusters in D14 are embedded in liveable street grids with direct links to Eunos (EW7), Kembangan (EW6) and Ubi (DT27) MRT stations, plus arterial roads like Changi Road and Sims Avenue—cutting journey friction for school runs and CBD commutes. The Paya Lebar commercial node adds weekday convenience and long-term decentralisation tailwinds, while park connectors and the eastern waterfront expand your leisure radius.

Schools & daily life. Access to Haig Girls’, Kong Hwa and Geylang Methodist (among others) is a key D14 draw. Layer on hawker icons, cafes along quieter lanes, and neighbourhood shops within walking distance, and the inter-terrace proposition becomes less about “entry ticket” and more about “everyday fit”.

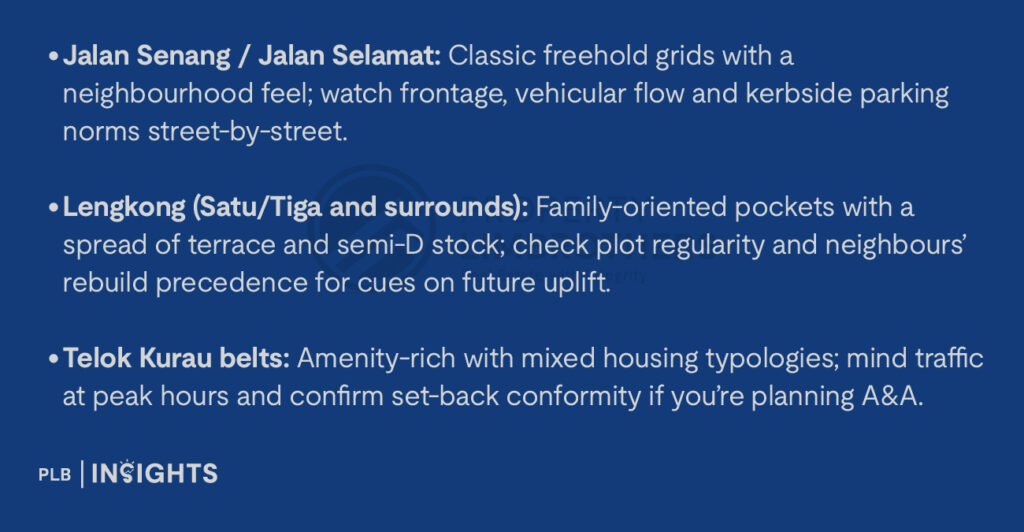

Freehold strength. D14’s landed stock is predominantly freehold, with tightly-held micro-pockets such as Jalan Senang, Jalan Selamat, the Lengkongs and Telok Kurau. In a country where landed homes are roughly 5% of total housing, structural scarcity underpins long-term stability—especially for the most “usable” format: inter-terraces.

How pricing maps to condition: the Cat 1–4 lens

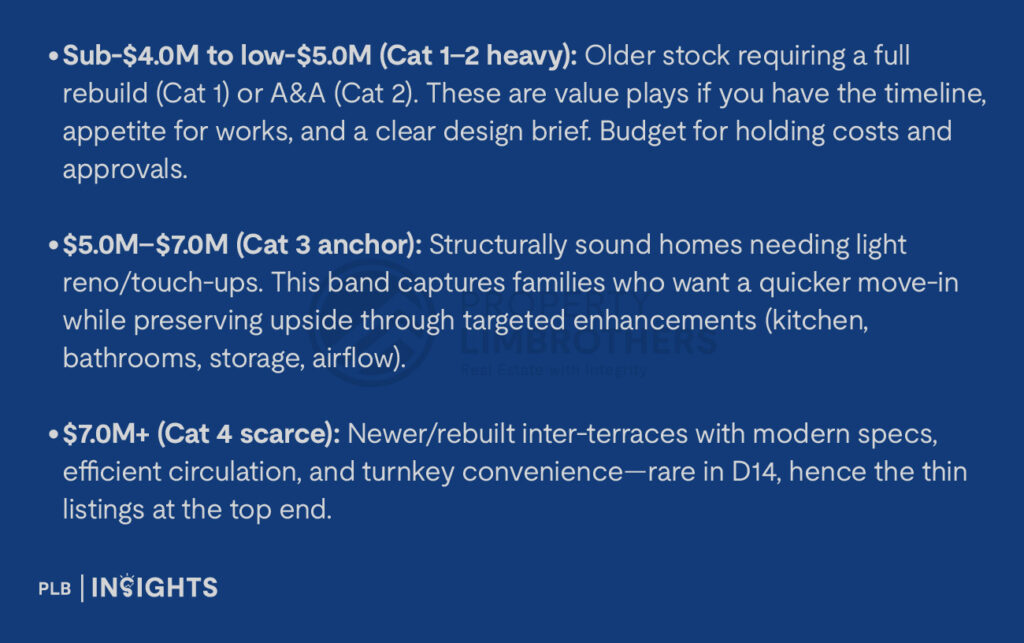

Use PLB’s Landed Framework (Cat 1–4) to read inter-terrace pricing quickly:

This mapping explains why most stock concentrates under $5.0M: buyers balance land ownership with manageable renovation scope, not wholesale redevelopment. It also explains the scarcity premium for rebuilt units—few trade hands, so the top of the market is thin by design.

Micro-neighbourhood notes (fast but useful)

Tip: Two adjacent inter-terraces on the same road can feel very different. Always verify orientation (morning vs afternoon sun), prevailing wind, and the real-world walk to MRT/food (not just as-the-crow-flies).

Buyer playbook: winning the short-list

Seller’s angle: positioning to clear inside four months

Risks & watchpoints (don’t skip these)

Performance context: steady, not speculative—and that’s fine

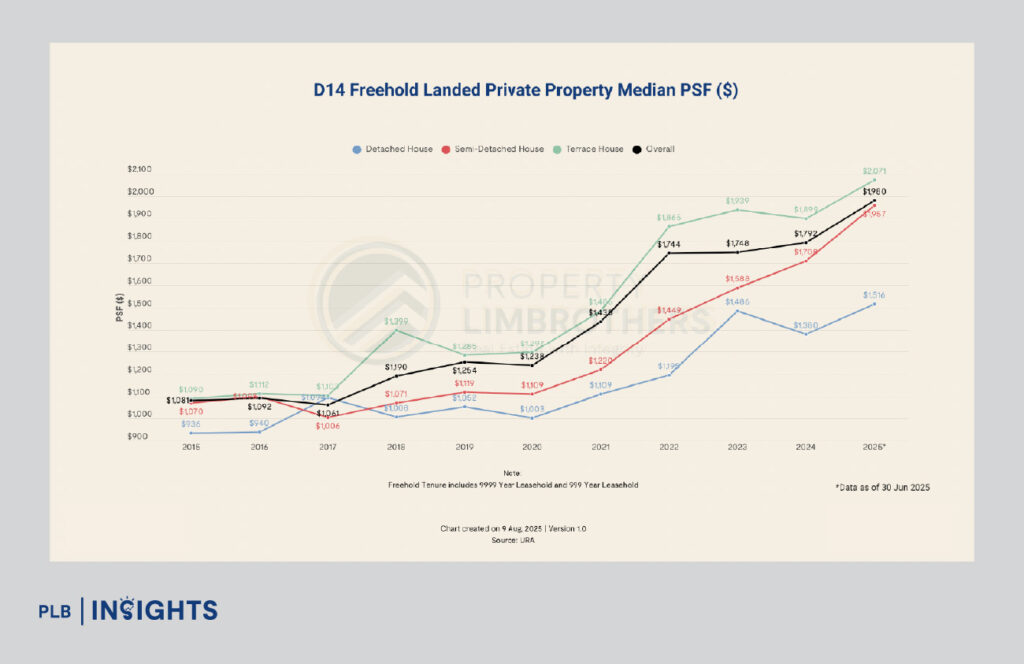

From 2015 to 2025 YTD, terrace homes in D14 clocked ~3.2% CAGR—a steady, utility-driven trajectory compared with semi-Ds and detached (which benefitted from larger plot scarcity). The district overall sits around 4.0% CAGR, with landed homes buoyed by tight supply and family demand. Across June 2024–June 2025, D14 recorded 76 landed transactions, reaffirming end-user momentum over speculation. In short: inter-terraces aren’t a “moonshot”; they’re a durable on-ramp to freehold landed living, with liveability and capital preservation doing the heavy lifting.

Outlook

Macro conditions have cooled exuberance but strengthened fundamentals. As inflation eases and policy steers the market toward owner-occupiers, D14’s inter-terrace segment is positioned to keep doing what it already does well: serve families who want land ownership, practical layouts, and rich amenity access—without the quantum leap into semi-D or detached territory. Persistent scarcity (landed ≈5% of stock), a deep $4.0M–$5.0M anchor, and an absorption profile around four months suggest stability with selective upside where condition, street and micro-location align.

Bottom Line

If your goal is to own land, live near daily needs and schools, and keep renovation/control in your hands, D14 inter-terraces are the most workable and liquid pathway to get there. Short-list with discipline, price condition (not just quantum), and buy the street as much as the house—you’ll feel the dividend every single day you live there.

Ready to explore D14’s most liveable inter-terrace options? Speak with our sales consultants today to find the right fit for your family.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.