It is not new news that home prices have been rising.

According to the latest URA report, with respect to the previous quarter. prices of private residential properties in Singapore increased by 3.5% in the 2nd Quarter of 2022, as compared to only a 0.7% increase in the 1st Quarter of 2022.

HDB resale prices have also been climbing for nine consecutive quarters. In the latest data released by HDB, resale prices rose quicker at 2.8% in the 2nd Quarter of 2022, as compared with the 2.4% increase in the 1st Quarter of 2022.

Incidentally (or not), we are also experiencing high inflation. The Consumer Price Index (CPI) in Singapore has accelerated the most in July in more than 13 years.

So the question is, is there a correlation between Inflation and Property Prices? If there is, what would that mean for property prices in Singapore?

What is inflation and why is it bad?

Let’s first understand what inflation is and why a high inflationary environment is bad.

According to the IMF, inflation refers to how prices increase over a given period of time. An overall increase in price also means that every unit of money has declining purchasing power. For example, a cup of coffee may cost $0.25 in 1970 while the same cup would cost $2 in 2022.

While low inflation is a sign of a healthy economy, high inflation is not good news for any economy. There are three negative effects of uncontrolled high inflation. In short, when the cost of living becomes higher, what we used to be able to purchase easily may no longer be as affordable. If it is an essential item or service that we need, a higher cost would mean possibly digging into our savings to pay for it. Soon enough, consumers will prioritise their spending on what they absolutely need, which may lead to many non-essential businesses running the risk of closing down.

What causes inflation?

Primarily, inflation happens when there is either an increase in money supply by the monetary authorities or by devaluing currency through legal methods. Monetary authorities could also purchase government bonds from banks as a way to bring more money into the economy. Authorities typically use such measures to encourage spending and boost positive consumer sentiment so as to better the economy.

Inevitably, with more currency circulating in the economy, it loses its purchasing power and this drives inflation via three ways, namely Demand-Pull effect, Cost-Push effect and Built-in effect.

In a Demand-Pull scenario, people tend to spend more when they have more money. This drives up the demand for goods and services and soon the supply will not be able to catch up with the demand, causing prices to rise.

The Demand-Pull scenario inevitably leads to the Cost-Push effect. Prices rise, and people expect to be paid more in wages. As the cost of goods and services rises (due to wage rises or more expensive raw materials), manufacturing costs also go up as resources become more expensive. This leads to further rise in prices.

Soon enough, when people anticipate a higher cost of living due to rising prices, they would ask for higher wages. This in turn requires companies to charge more for their goods and services so as to pay higher wages.

In his latest speech in August, FED chair Jerome Powell mentioned how the restrictive policies also aim to better align supply and demand and prevent expectations of inflation to be deeply entrenched.

What’s the correlation between inflation and property prices (including how CPI is calculated)?

Let’s now take a look at the correlation between inflation and property prices.

How does inflation affect prices of goods and services, especially property prices? When supply is limited, inflation drives prices up, regardless of the goods. This is true for the property market as well. Quoting an analogy from Investopedia, if there are only 5 homes in the market, with $10 of currency in the market, then each home is worth $2 each. If there is more money in the system, for e.g. $20 of currency, consumers can now afford to pay more for the same home and each home is worth $4 now. A rising inflation pushes prices up only if there is only so much supply of goods in the market.

This correlation can be observed from past data. The graphs below show Singapore’s residential property price index (RPPI) and the Consumer Price Index (CPI) in Singapore over the last 10 years. The RPPI tracks how the transacted prices of residential property change over time. As for inflation, Singapore tracks the inflation rate using the CPI, which is the same as most countries. For the past 10 years, data shows the RPPI and CPI have been trending in tandem.

Thus, because of this correlation, real estate is a preferred asset class. Owning a piece of real estate in an inflationary environment preserves the capital because the real value of the property adjusts for inflation.

How do we calculate inflation?

To calculate inflation, a basket of goods and services that are commonly used by the residents or households in Singapore is first identified and given a certain weightage. These goods and services are updated every 5 years to stay relevant to consumption patterns. These costs are then tracked and compared monthly.

In the latest basket of goods and services in CPI (2014), there are 10 broad categories of goods and services, with housing and utilities occupying the largest weightage at 26.3%, thus affecting the CPI most. The price of housing services in the CPI does not include the purchase prices of new residential properties as they are considered to be capital goods.

As we focus on the graphs above, it is observed that the transacted prices of residential properties trend in tandem with the Consumer Price Index. This is unsurprising. A low-interest rate environment before 2021 has led to more spending and more liquidity in the market, which has led to increased prices of goods and services since consumers can now afford to spend more on the limited supply of houses.

Thus, as long as the supply of homes remains limited, Residential Property Prices correlate closely to CPI in Singapore.

Will prices of homes keep on rising in this environment?

In our opinion, prices of homes are likely to rise further due to the following reasons:

1. Inflation is likely to stay elevated in the short term.

Inflation today is caused by 2 reasons:

- Excess money in the system when monetary authorities increased the supply of money at the beginning stages of the pandemic to boost the economy.

- Supply of goods is unable to meet the strong demand. During the pandemic, demand for goods increased drastically. As the borders reopen, the supply for goods is unable to meet the increasing demand for goods and services. Coupled with supply chain limitations, lockdown in China and the increased energy prices (Ukraine-Russia war), these factors drive up costs.

Thus, experts expect prices and inflation to remain high for a couple of years until supply chains are able to cope with the demand and this may take a while, partly because bringing inflation down is not easy. FED Chair Jerome Powell reiterated on 26 Aug that FED’s goal is to bring inflation down to 2%. Just this year alone till July, the FEDs have already raised the interest rates four times in an effort to rein in the inflation rates. He mentioned in his latest speech in August that an “unusually large increase would be appropriate” in the upcoming September meeting, depending on the data and outlook. However, in efforts to bring down inflation, high-interest rates will hamper growth and soften the labour market. This would be painful for most households.

At some point, he expects the increase to slow down as policies tighten and take effect to better balance supply and demand.

It took the FED around 5 months to increase the interest rates. They will likely take an equal or even longer time to lower the interest rates cautiously as seen in 2019 – 2020 (see graph below). Thus inflation rates are unlikely to come down yet.

2. Supply of new homes unlikely to meet demand in the short term (Can supply meet demand?)

When the pandemic hit in 2020 and countries went into lockdown, most of the construction sector came to a halt for around 2 years. Even though the sector has started gaining traction slowly since 2021, the rate of resuming operations to pre-covid levels is hampered by rising costs of resources as supply chains struggle to keep up with demand. This was further exacerbated by global events such as the Russian-Ukraine war and China lockdowns that further put a strain on the supply chain. This meant that new homes now needed a longer time to complete and those who intended to buy would need to wait much longer. Those who can’t afford to wait will turn to ready resale units, driving up its demand and price.

Ever since Work From Home(WFH) became a norm and with a growing culture of a hybrid workplace model, Singaporeans continue to prefer bigger units for more space to work and live harmoniously. Ever since the 2000s, HDB flat types have reduced in size as the average household size reduces. This is the same for condominiums. Since the implementation of TDSR, developers have been building smaller units to make it affordable. Thus, buyers turn to the resale market in search of a bigger space, albeit older.

In addition, amidst the uncertain global economic outlook and turmoil, foreign demand for properties in Singapore continues to soar as they recognize Singapore as a safe haven to invest in.

However, in the short term, the supply is unlikely to keep up with the demand with the construction and supply chain delays. The current stock of new private homes is dwindling. According to URA, at the end of 2nd Quarter of 2022, there are 17,506 unsold private residential units and executive condominiums While the supply has gone up slightly from a low of 17,140 unsold units at the end of 3Q 2021, the supply is at one of the lowest levels in 4 years. On average, based on the take up rate from 2012-2021, we need about 10,750 new private residential units annually. The current new private housing stock would last for roughly about 1.5 years only.

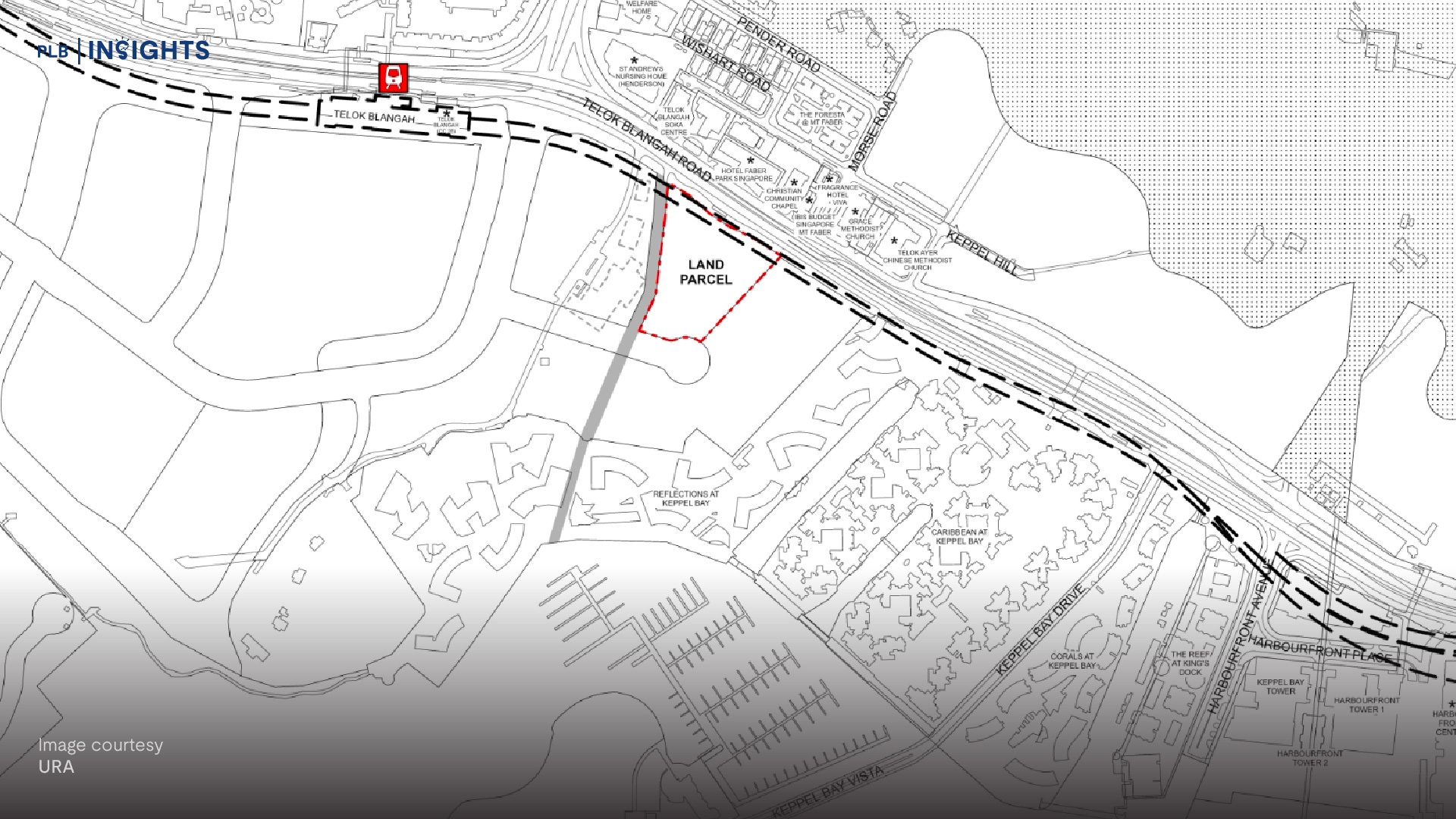

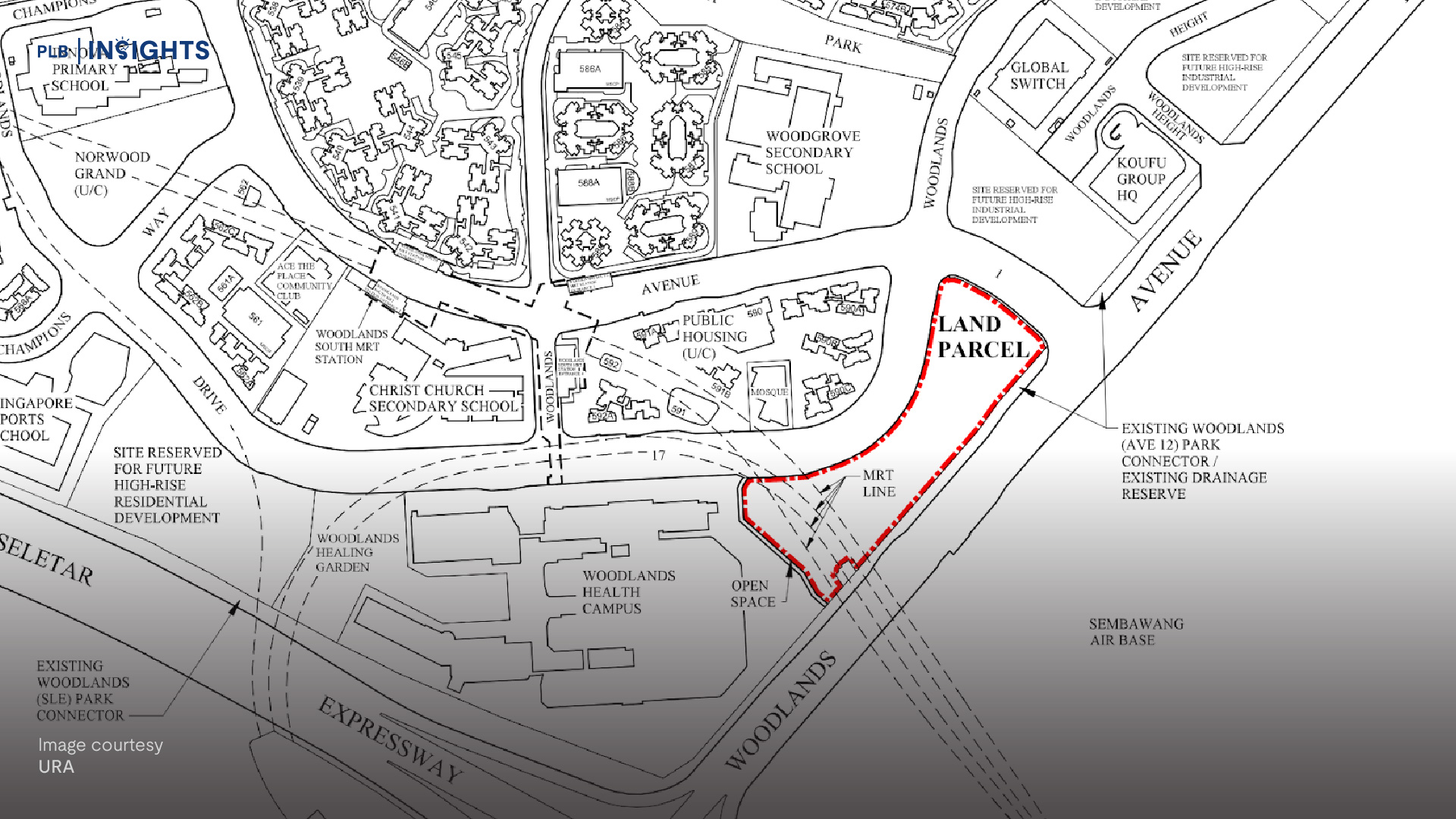

In response to the growing demand, MND has announced a potential supply of about 8000 units (including EC) from Government Land Sale Sites, Confirmed List sites and en-bloc sale sites. This will bring about an estimated 25,500 units available for sale at the end of the year or next year. The Housing Development Board also plans to increase the supply of new flats over the next 2 years, with plans to launch 23,000 flats per year in 2022 and 2023. They are prepared to launch 100,000 flats in total from 2021 to 2025.

While the construction sector continues to recover and until the completion of new housing units, the demand will likely outweigh the supply in the short term.

Conclusion

In summary, the real estate market today is right in the perfect storm of high inflation, high-interest rate, rising local and foreign demand and dwindling supply of new homes. This imbalance of supply and demand is mainly why we are witnessing the accelerating rate in home prices.

In the next 6 months to a year, resale prices are expected to rise further in tandem with demand. New condo prices will also continue to rise as it becomes more expensive to build with the rising cost of resources and manpower. The spillover effect into the rental market is expected to continue as we witness rental prices rising.

In the short to mid-term, we do expect the demand to be balanced out by the increased housing supply eventually as the construction sector recovers further and supply chain eases. Housing prices in certain sectors are also expected to consolidate.