Penrith makes its debut as the first new condominium launch in Queenstown since Stirling Residences in 2018, and it may be the most anticipated in years. Backed by industry stalwarts GuocoLand and Hong Leong Holdings Limited, Penrith is set to preview in early October, bringing a rare high-rise residential offering to the heart of a mature and highly sought-after city-fringe estate.

Strategically located along Margaret Drive — just a 4-minute walk to Queenstown MRT — on a 102,498 sqft plot, Penrith comprises 462 units across two 40-storey towers. This launch arrives at a time when the supply pipeline in District 3 remains relatively tight, and buyer appetite for central but tranquil locations continues to grow.

With a land tenure of 99 years commencing from 4 November 2024, Penrith offers modern vertical living in a precinct deeply rooted in heritage, yet poised for rejuvenation. The project is expected to appeal to a diverse profile of owner-occupiers and investors, particularly those drawn to connectivity, lifestyle convenience, and long-term capital preservation.

*Preview for Penrith will begin on 4th Oct 2025, and set for booking 2 weeks later

In the sections ahead, we examine the key attributes of Penrith, providing a data-driven overview of its location, pricing, and market context. This article is presented in parallel with PLB’s New Launch Studio Review, offering a well-rounded perspective to assist prospective buyers and investors in making informed decisions.

Note: This article was written in September 2025 and does not reflect data and market conditions beyond.

Value Proposition: A Rare Site in a Coveted City-Fringe Neighbourhood

What makes Penrith especially notable is its prime location at Margaret Drive, a site that combines almost doorstep MRT access, rich heritage, and a wide range of amenities. With Queenstown MRT just 280 metres away, it stands among the rare few launches in recent memory to offer convenience within an established low-density enclave.

Penrith had a land bid price of $1,154.50 per square foot per plot ratio (psf ppr), awarded under the Government Land Sales (GLS) programme. This competitive acquisition cost — especially for a city-fringe site with MRT proximity — positions Penrith favourably against future launches in District 3, where land prices and development costs are expected to trend higher.

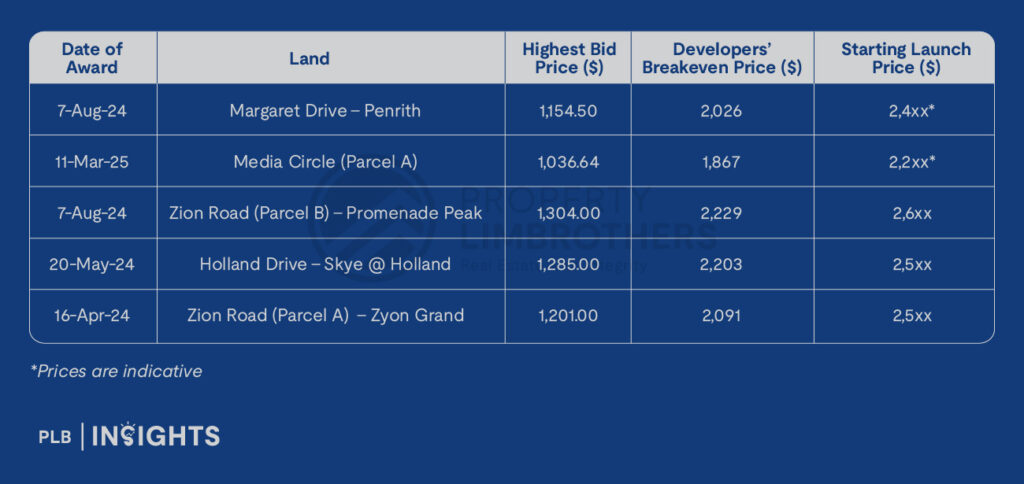

For comparisons, below shows a breakdown of the GLS bid in the RCR segment:

Secured prior to the more inflationary construction environment of late 2024 to 2025, the site’s lower entry cost may allow the developers to price the project more attractively, at likely an average of $2,4xx psf, while preserving healthy margins.

Although official launch prices have yet to be released, early market indicators point toward a compelling value proposition in the Queenstown–Alexandra submarket, particularly for buyers prioritising connectivity and long-term capital preservation.

Unit Mix & Configuration

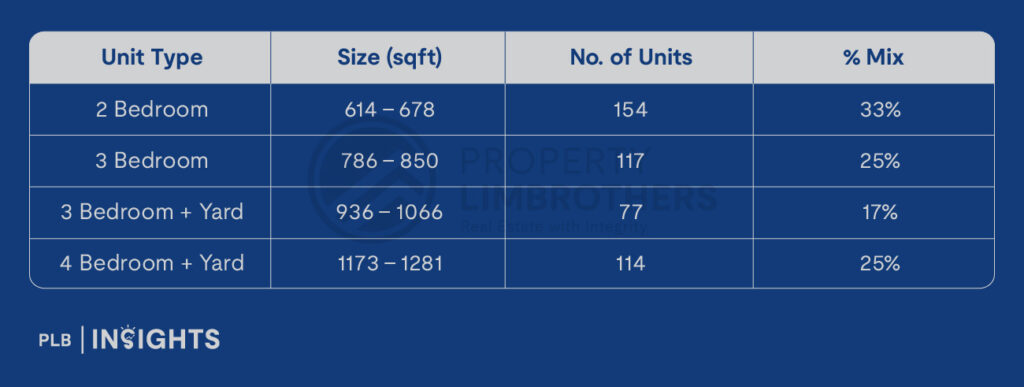

Penrith offers a balanced unit mix appealing to both families and investors:

Location Analysis

Central, Connected, and Established

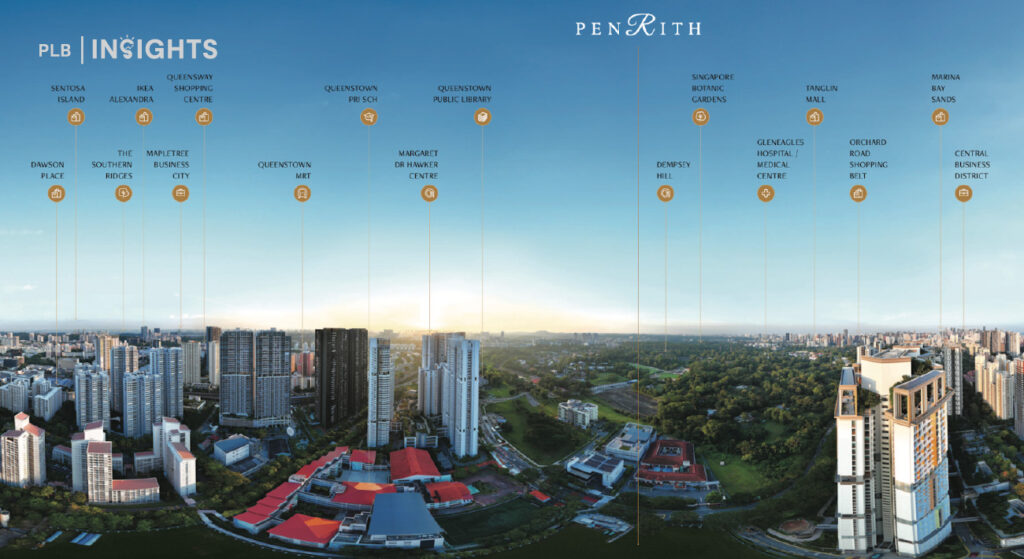

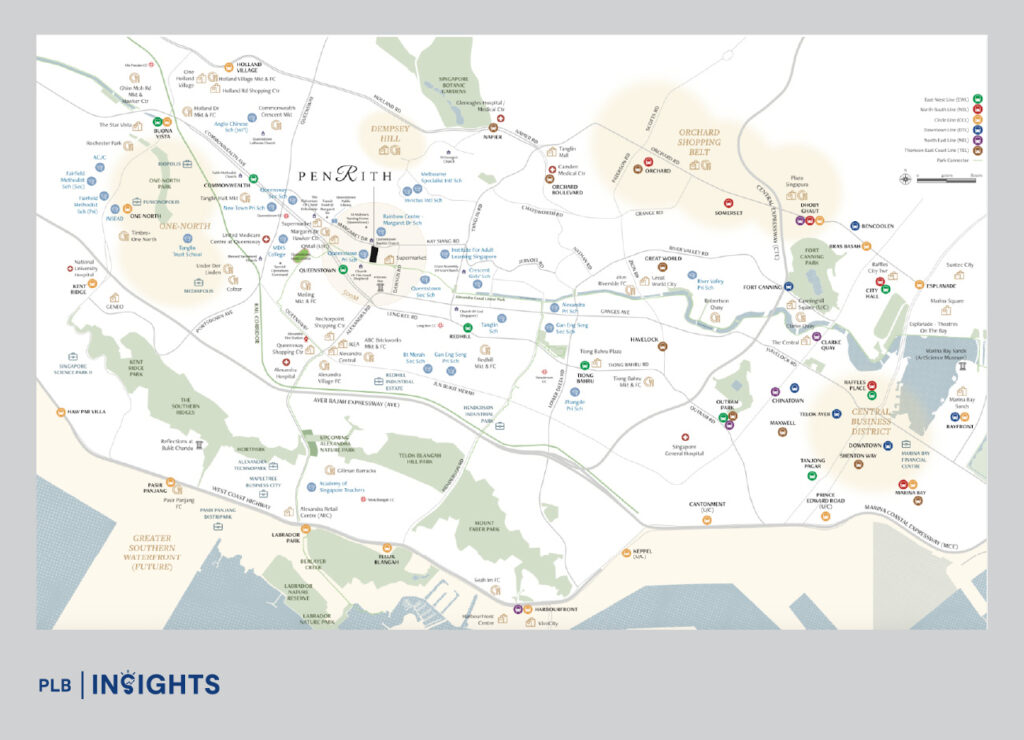

Penrith strikes a rare balance between central connectivity and established neighbourhood charm. Located in the heart of Queenstown, it offers residents swift access to both lifestyle amenities and business nodes.

- 4 mins walk to Queenstown MRT (East-West Line)

- 3 stops to Outram Interchange

- 5 stops to Raffles Place

- 6 stops to Marina Bay

For drivers, AYE, PIE, and CTE are easily accessible, enabling smooth island-wide connectivity. The development’s centrality also means it sits within a 15-minute drive to Orchard Road and the CBD, ensuring Penrith appeals strongly to professionals, investors, and expat families alike.

Upcoming Growth Catalysts

While Queenstown is already mature, the wider Greater Southern Waterfront (GSW) transformation and Rail Corridor enhancements add layers of long-term value. Residents at Penrith will enjoy first-mover advantage in a precinct primed for steady rejuvenation, amenity uplift, and land appreciation.

Amenity & Education Network

This strong educational catchment makes Penrith a standout option for parents navigating the MOE Phase 2C registration process, particularly in a location where proximity-based admission is highly competitive.

Nearby Malls & Amenities:

For leisure and wellness, residents can access nearby Alexandra Canal Linear Park, the Rail Corridor, and Dempsey Hill, offering a rare blend of greenery and city access.

Sustainability and Green Living

Penrith distinguishes itself not only through location and lifestyle, but also through its strong commitment to environmental performance. The development is targeting the BCA Green Mark Platinum (Super Low Energy) certification — the highest tier under Singapore’s national sustainability rating system for buildings. This distinction will signal that Penrith has been designed with best-in-class energy efficiency, water conservation, and ecological integration in mind.

North, South, East, West Facings

For readers’ reference, this section provides a detailed overview of the different directional facings of Penrith — North, South, East, and West. These perspectives help prospective buyers better understand the immediate environment and long-term view potential of each orientation.

East-Facing Units: Dawson HDB

East-facing units at Penrith that front directly toward Dawson estate will face a mix of newer HDB developments, including the prominent SkyResidence @ Dawson and surrounding landscaped precincts. These views present a modern, high-density residential outlook, with green pockets such as the SkyTerrace gardens and linear parks weaving through the estate. While mid- to lower-floor units may experience some proximity to neighbouring blocks, upper-floor units will clear most built-up massing, offering broad urban vistas anchored by Dawson’s evolving skyline and curated greenery. This orientation receives consistent morning light, appealing to those who prefer sunlit interiors and dynamic city-facing views.

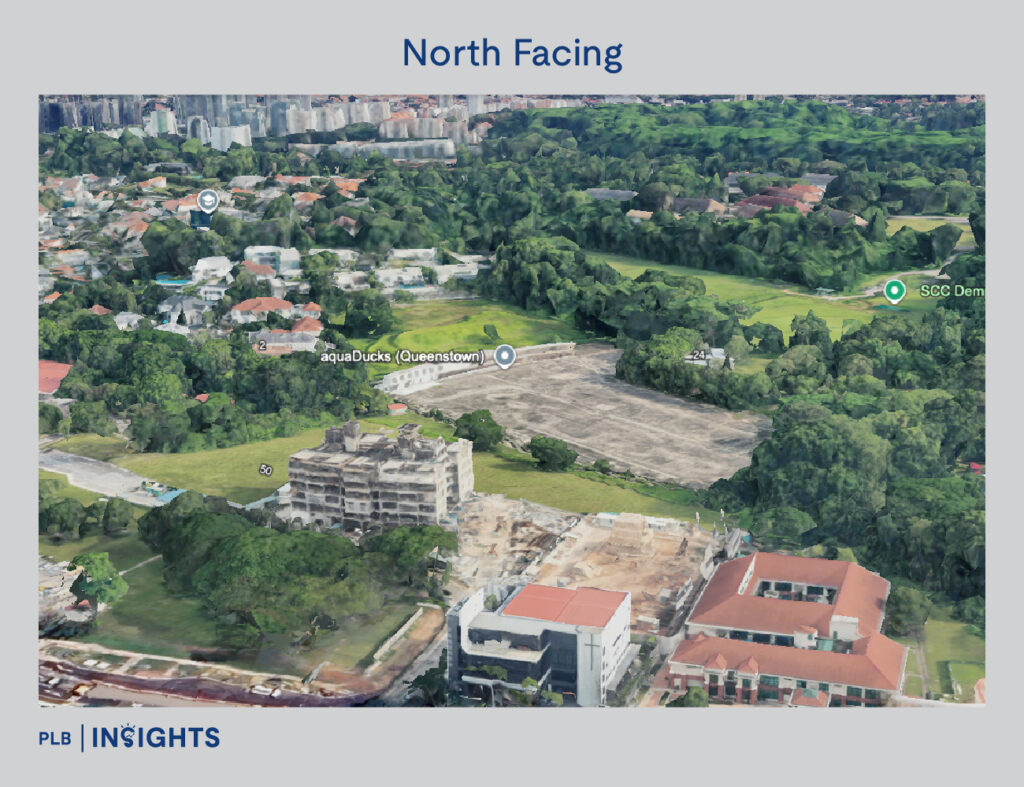

North-Facing Units: Landed Enclave

North-facing units at Penrith will enjoy a predominantly green, low-rise outlook over the landed housing enclave of Tanglin Halt and recreational grounds such as the SCC Demspey Field. With minimal high-rise obstruction, even mid-floor units are likely to benefit from unblocked views, generous sky exposure, and a cooler microclimate, as this orientation avoids direct sun throughout most of the day.

South-Facing Units: HDB Blocks

South-facing units at Penrith will primarily overlook the adjacent cluster of HDB blocks along the Alexandra and Dawson precincts, many of which rise above 20 storeys. While the immediate outlook may include some visual obstruction at mid to lower levels, higher-floor units are likely to clear the rooftops, offering broader views toward the southern skyline. This orientation receives steady afternoon light and may appeal to residents who prioritise natural illumination and consistent airflow.

West-Facing Units: Queenstown Primary

Some of Penrith’s stacks are oriented westward, offering open views over Queenstown Primary School and the surrounding low-rise enclave. While they receive stronger afternoon sun, this exposure lends a warm, ambient quality to the interiors during sunset hours.

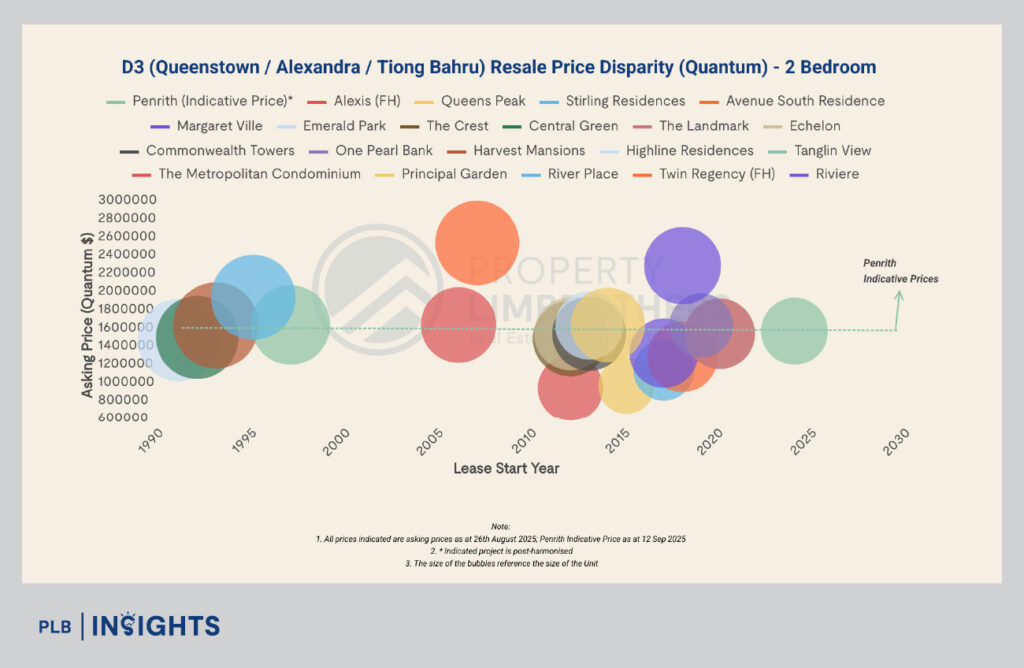

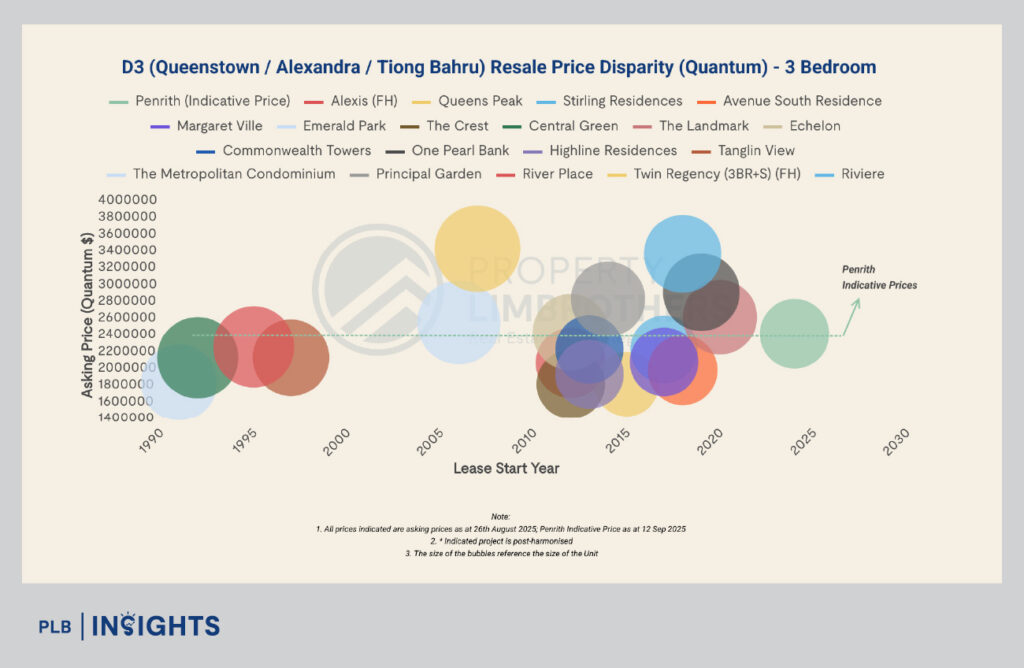

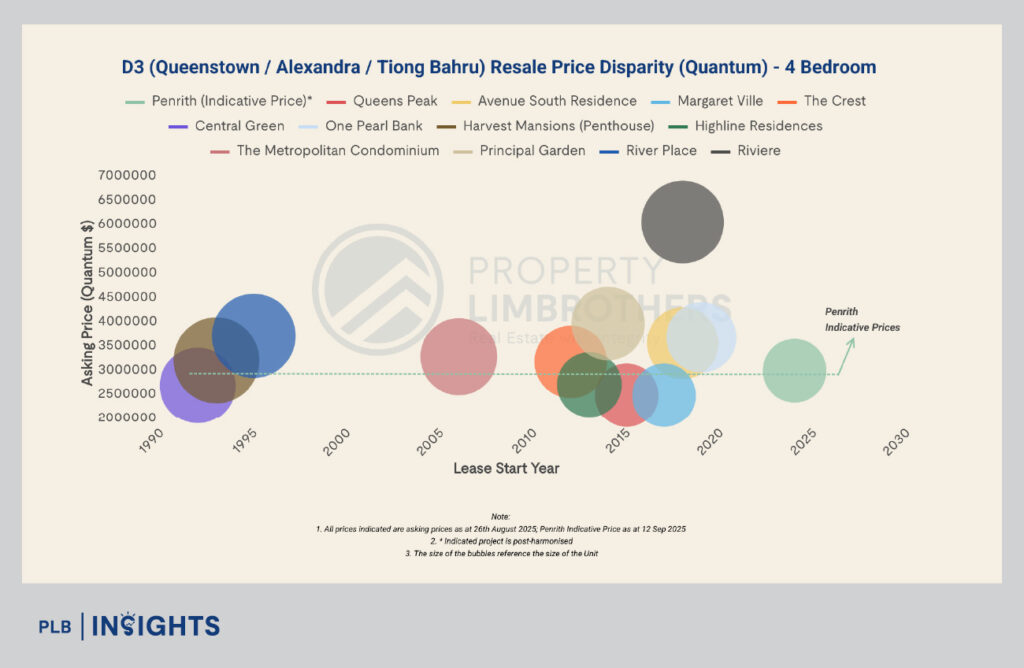

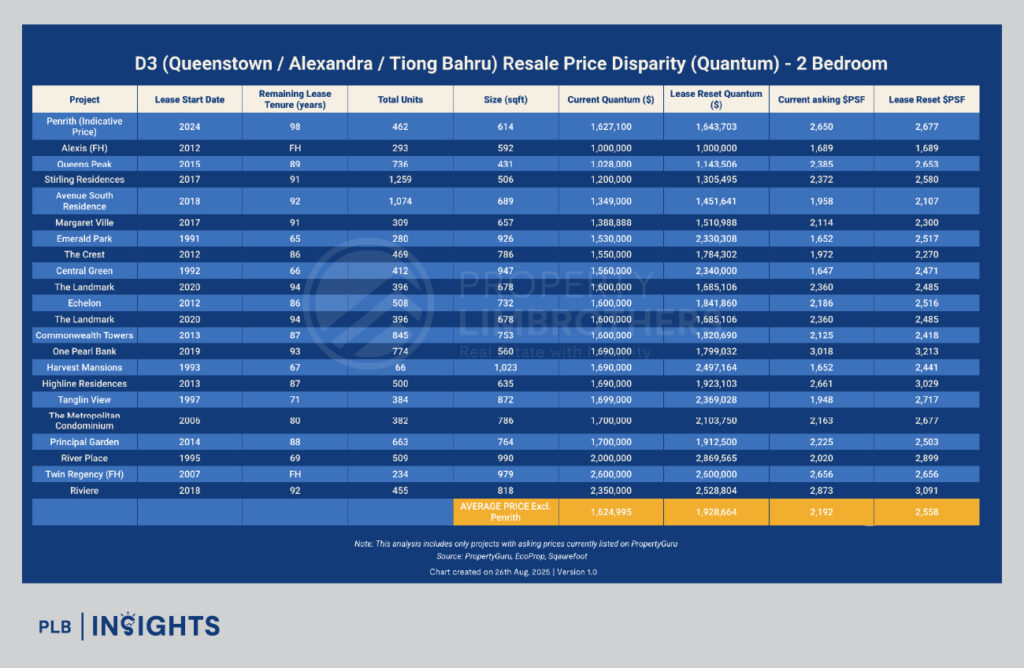

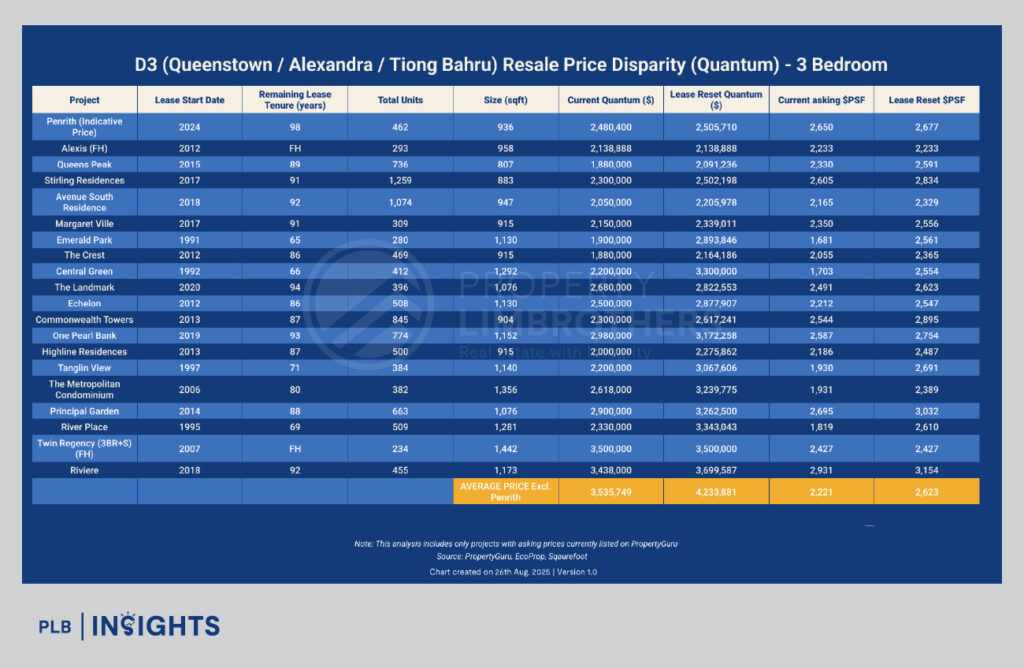

District 3 Pricing Disparities Analysis

This comparative framework provides buyers and investors with a clear view of relative affordability, value differentials, and possible entry strategies by unit type.

Note: At the point of writing in mid-July, official pricing for Penrith has not been released. For the purposes of this analysis, we have assumed a median pricing of $2,650 PSF based on market expectations.

Despite being a new launch, Penrith is not the most expensive project in District 3 — several resale developments are transacting at higher per square foot (psf) rates or absolute quantum, even after accounting for shorter lease tenure and older build.

For instance, One Pearl Bank (2019, 93-year lease remaining) is asking $3,018 psf for 2-bedroom units and $2,980,000 for a 3-bedroom, significantly above Penrith’s indicative $2,650 psf.

Similarly, Riviere (2018) — positioned at the fringe of Robertson Quay — sees 2-bedroom units at $2,873 psf and 4-bedroom units reaching $6.18 million, more than double Penrith’s 4BR quantum.

Even resale units at Commonwealth Towers and The Landmark are listed at $2,360–$2,544 psf, despite being older and less efficient in layout. This suggests that Penrith’s pricing sits within a competitive corridor, particularly when buyers consider tenure freshness, proximity to MRT, and future-facing facilities — making it a compelling option even in a tightly contested resale landscape.

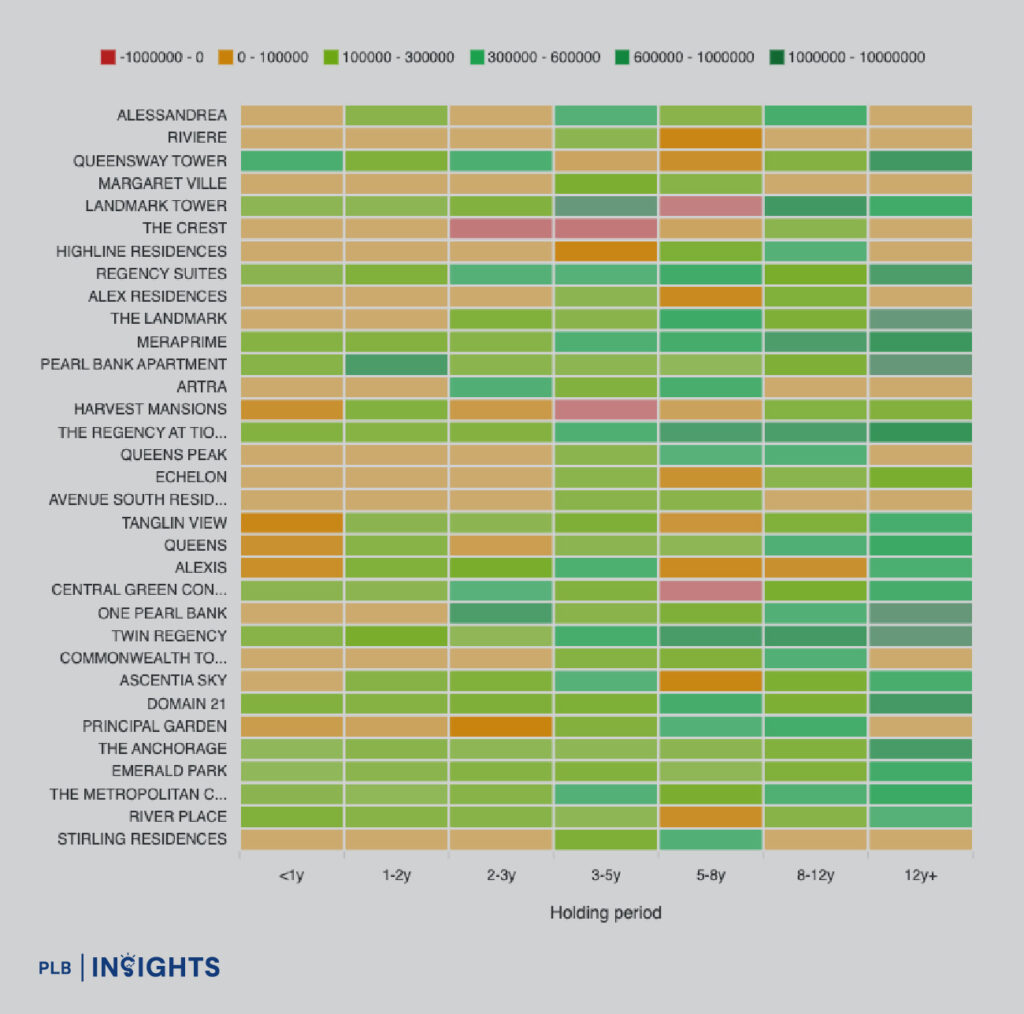

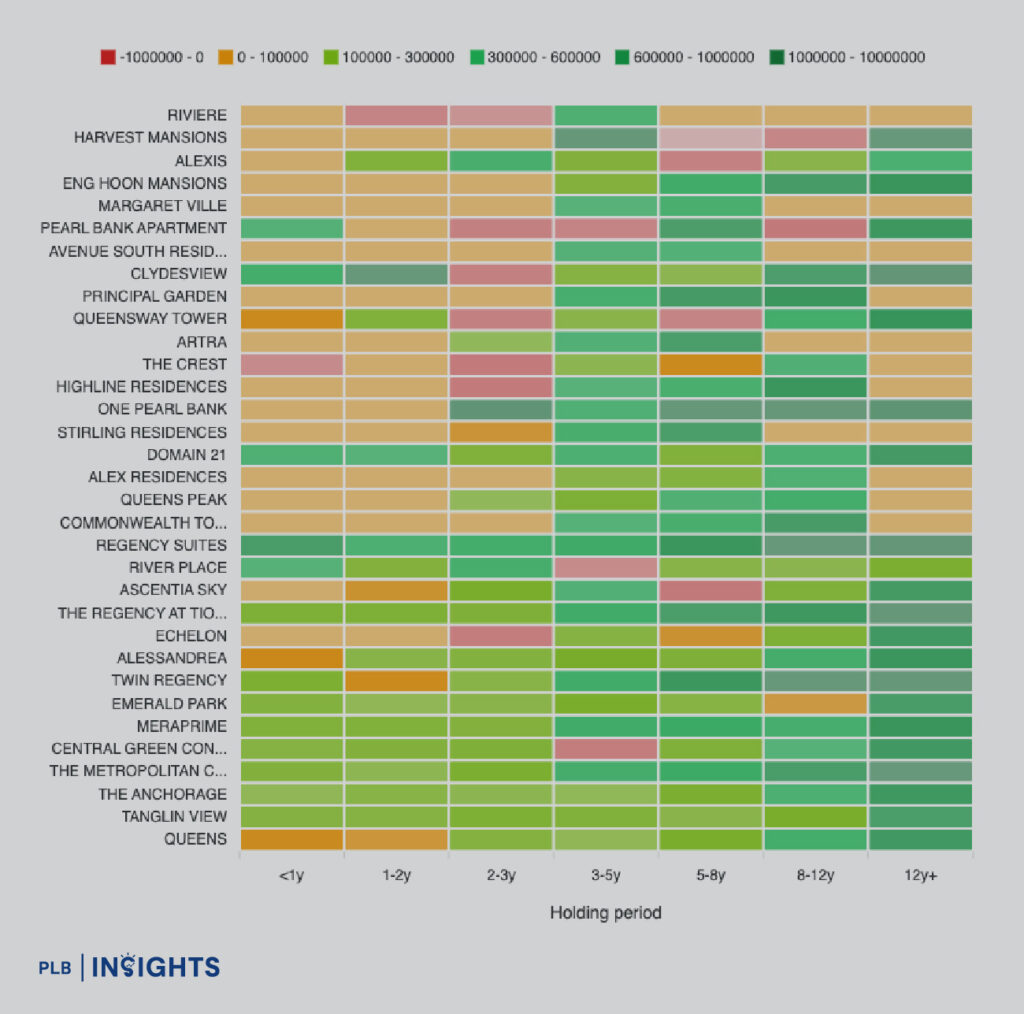

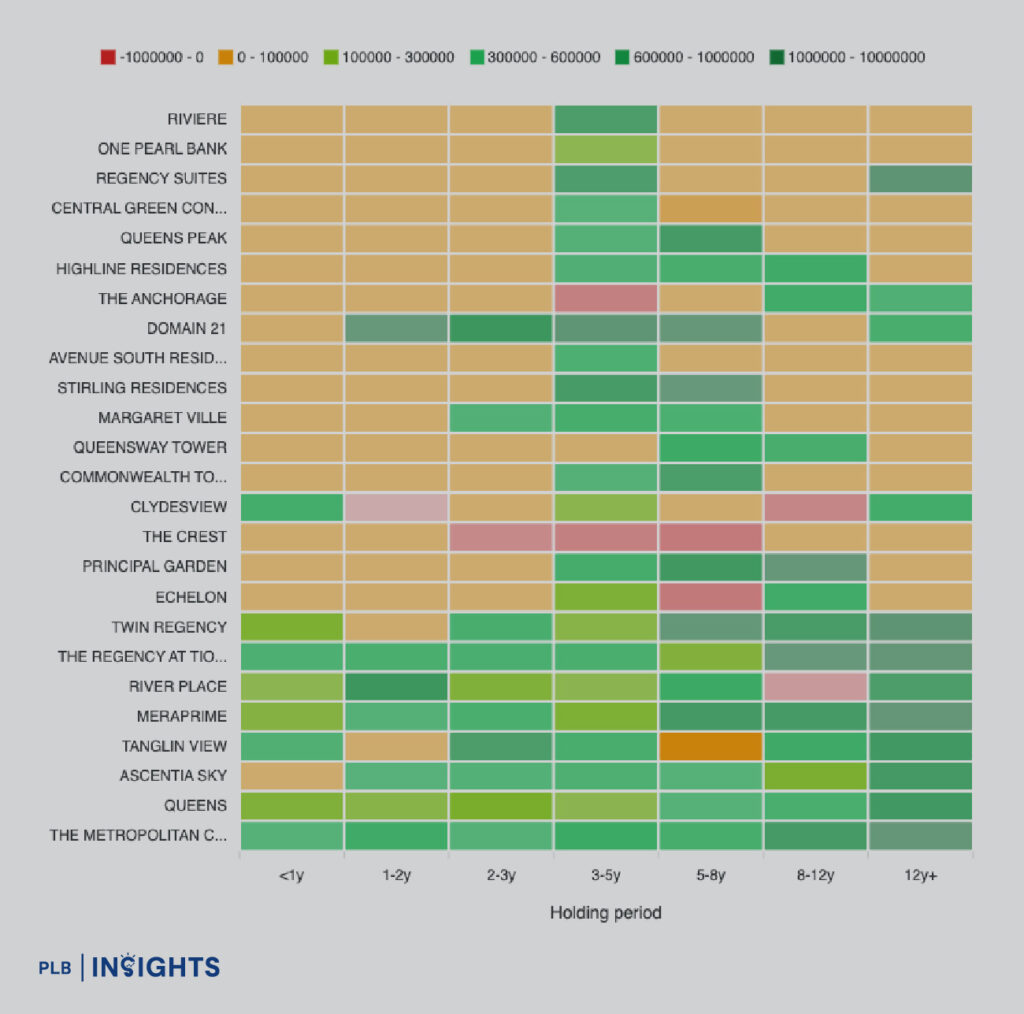

Average Profits for Condominium at District 3

We analysed the profitability of condos located at D3 from 2-bedroom to 4-bedroom. We found that larger units enjoy larger profits, and most of the units enjoy gains with gains exploded after 8 years of holding period.

With that, we are confident of the stability in terms of capital gains when buying into a D3 condo unit.

The heatmap below shows the profitability health for each bedroom type at project level. For further questions, feel free to reach out to us!

2-Bedroom Median Realised Profits:

3-Bedroom Median Realised Profits:

4-Bedroom Median Realised Profits:

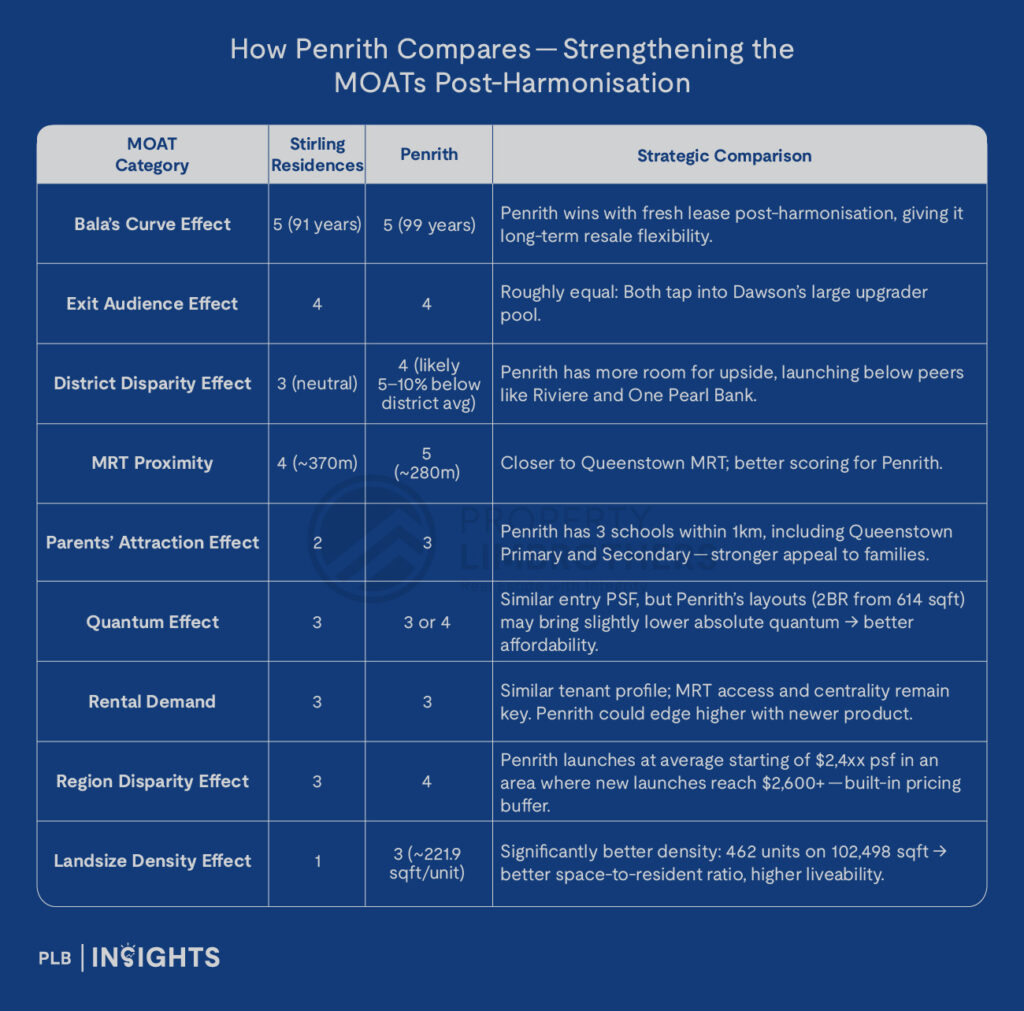

PLB MOAT Analysis

Due to lack of pricing and some info for Penrith at the point of writing, we will take Stirling Residences and use it as a benchmark comparison with Penrith.

MOAT Analysis Breakdown

Final MOAT Score for Stirling Residences: 68%

Key Insights: Penrith’s Competitive MOATs vs. Stirling Residences

Post-Harmonisation Advantage

Penrith is among the first launches post-land lease harmonisation, which means longer usable tenure and improved resale visibility — key for long-term investors.

Improved Density, Better Liveability

Penrith offers a much lower unit count (462 vs. 1,259) on comparable land, resulting in quieter living environments, better amenity access, and potentially lower maintenance wear.

Better MRT and School Proximity

While both are close to Queenstown MRT, Penrith edges ahead in both proximity and educational catchment — potentially attracting longer-stay families and resale buyers with children.

Pricing Corridor Favourability

At $2,4xx psf, Penrith undercuts nearby new launches like Riviere (~$2,873 psf) and One Pearl Bank (~$2,498 psf), while matching or slightly beating resale pricing at The Landmark or Avenue South — offering room for capital appreciation over the next cycle.

Stay Updated and Let’s Get In Touch

Our goal is to provide you with honest and transparent insights. Should you have any questions, do not hesitate to reach out to us!