In a year still defined by high interest rates and tighter affordability checks, Singapore’s private new launch market has quietly delivered a very clear message: when product, location and pricing line up, buyers are still prepared to commit – and in many cases, commit fast.

We reviewed the top-selling 2025 launches by percentage of units sold, then layered in official launch and transaction data to understand how pricing contributed to these results. The pattern is consistent: projects that respected each micro-market’s “acceptable quantum” moved, even when headline psf numbers looked ambitious.

Below, we break down the 11 best performers of 2025 so far – and why they worked.

All data are as of 9 December 2025.

1. Aurelle Of Tampines EC – 100% Sold (760 / 760)

EC benchmark pricing, but still a heartland “value trade”

Aurelle Of Tampines is the defining EC story of 2025. The project sold all 760 units, with 90% taken up on launch weekend at an average price of about $1,766 psf, setting a new benchmark for the EC segment.

Launch pricing started from around $1.417 million for an 840 sq ft three-bedder, with larger five-bedroom units from roughly $2.26 million.

That put most family units squarely in the $1.5–$2.2 million range – high, but still recognisable for dual-income Tampines upgraders who are sitting on substantial HDB equity gains.

Crucially, Aurelle’s average $1,7xx psf sits roughly $600 psf below Parktown Residence’s integrated-condo average of about $2,360 psf down the road.

For buyers, that spread made the EC premium feel justified: they were paying a record price for an EC, but still enjoying a clear discount to the private integrated development that will anchor Tampines North.

Why it worked

2. Lentor Central Residences – 100% Sold (477 / 477)

Growth-node play at ~S$2,200 psf, with sub-$1m entry

Lentor Central Residences sold all 477 units, with around 93% snapped up at launch at an average price of roughly $2,200 psf.

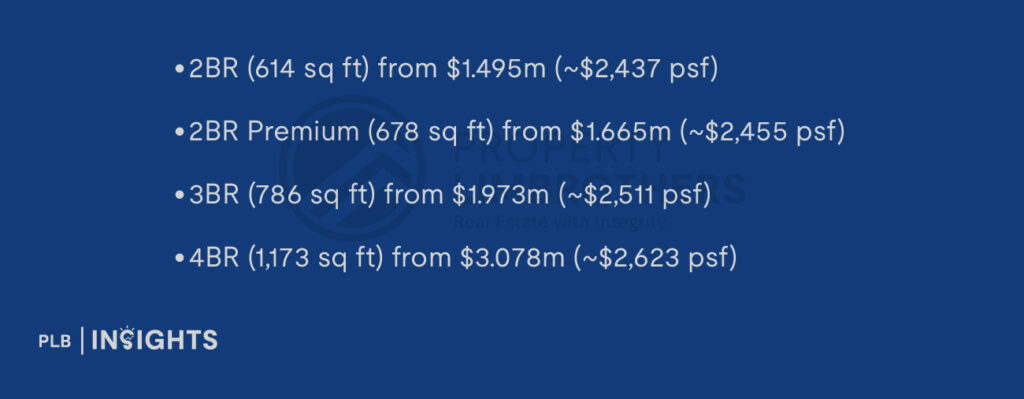

Prices start from:

- 1-Bedroom from about $975k (~$2,1xx psf)

- 2-Bedroom from about $1.38m (~$2,050 psf)

- 3-Bedroom from about $1.81m (~$1,984 psf)

- 4-Bedroom from about $2.37m (~$2,000 psf)

That pricing is notable for three reasons:

It undercuts some earlier OCR launches that pushed solidly into the low-$2,000s psf.

It offers sub-$1 million entry into a brand-new MRT-linked node – a psychological anchor for younger buyers.

It is supported by the lowest land price among the Lentor GLS plots, at about $982 psf ppr, giving the developer room to keep psf competitive.

Why it worked

3. Skye at Holland – ~99.5% Sold (663 / 666)

Skye at Holland, a luxury development in District 10, has sold 663 out of 666 units (~99.5%) as of December 2025, demonstrating that even in a challenging market, prime location, strong pricing, and high-quality offerings can still generate exceptional demand.

Average Price: ~$2,950 psf

Prices Start From:

Why It Worked:

1. Prime Location

Located in District 10, Skye at Holland benefits from being just minutes from Holland Village MRT, offering easy access to Orchard Road and the CBD. District 10 has not seen significant new launches in the past 6 years, making Skye at Holland a rare opportunity in this highly sought-after area.

3. Exclusive Facilities

Skye at Holland offers top-tier amenities such as a sky garden, rooftop lounge, and state-of-the-art gym, catering to buyers seeking a luxury lifestyle.

4. Developer’s Reputation

Backed by a well-known developer, buyers had confidence in the quality and long-term value of the development.

4. Otto Place EC – ~97.5% Sold (585 / 600)

Tengah EC that stayed firmly inside upgrader affordability

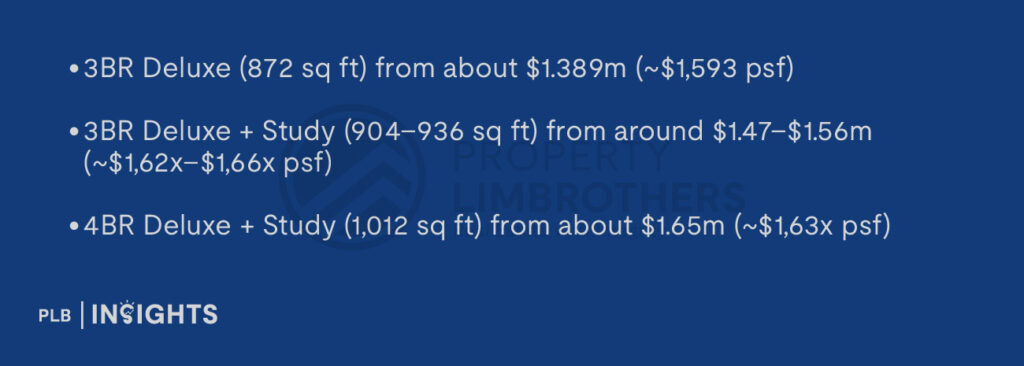

Otto Place, a new EC in Tengah, has effectively sold out, with about 97–98% of its 600 units taken up. Marketing and price-list data show launch prices for family-sized units roughly in this band:

Early sales average out $1,700 psf, which is high by historical EC standards, but still a clear step below new OCR private launches.

Why it worked

5. Penrith – ~97% Sold (448 / 462)

Queenstown city-fringe at ~S$2,800 psf – and still almost fully taken

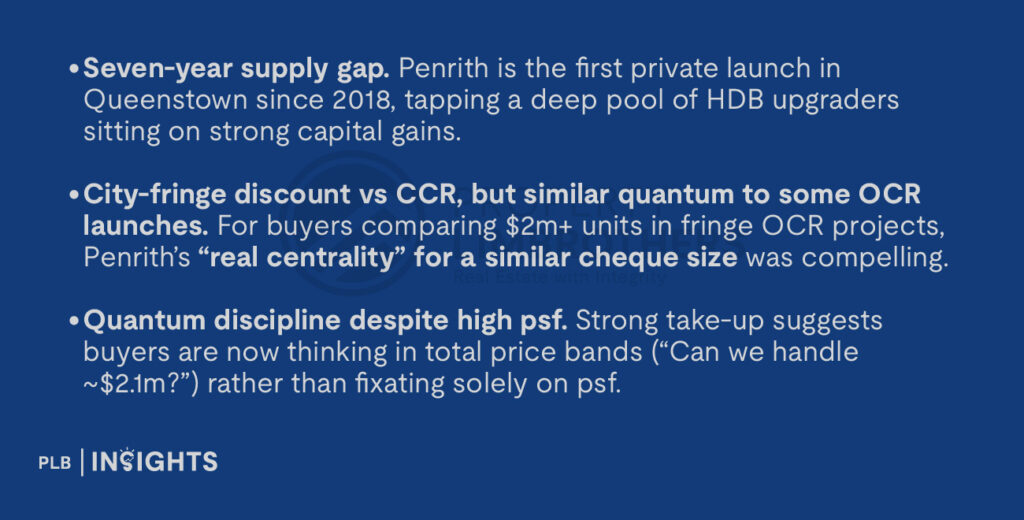

Penrith’s launch is one of the most striking events this year. The Margaret Drive project in Queenstown sold about 97% of its 462 units on launch weekend, at an average price of roughly $2,800 psf.

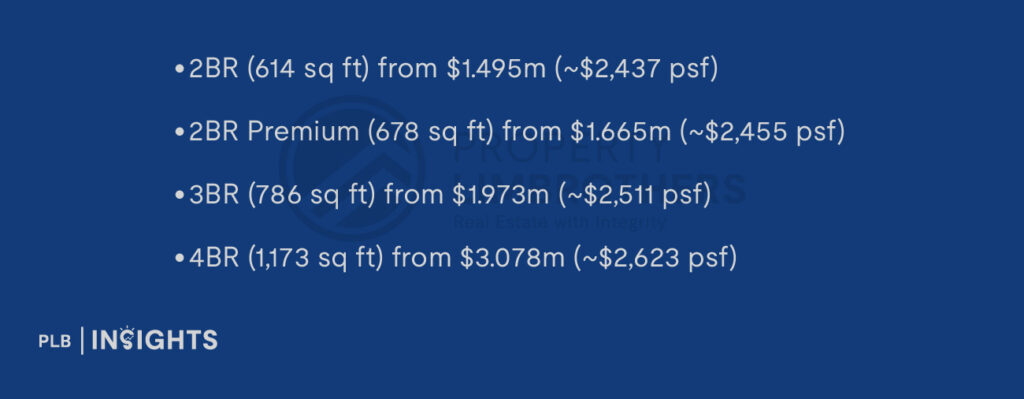

Prices start from:

While this sets Penrith above older Queenstown stock on a psf basis, we note that compact, efficient layouts kept most 2- and 3-bedroom quanta in the mid-$1.5–$2.3m range, with many 4-bedders under $3m.

Why it worked

6. Springleaf Residence – ~96.3% Sold (906 / 941)

Upper Thomson lifestyle at ~S$2,175–2,250 psf

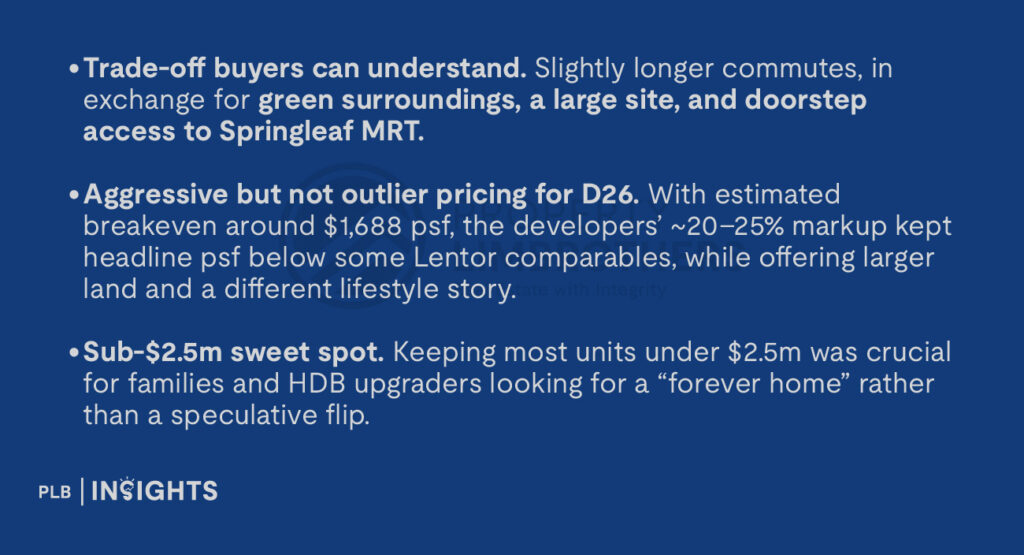

Springleaf Residence, the first major condo launch in a landed-heavy Upper Thomson belt, has sold over 96% of its 941 units. The average launch price was around $2,175 psf, with units starting from about $878,000 for a 388 sq ft one-bedder and the vast majority of units below $2.5m.

It also one of the most competitively priced TEL-side launches in 2025 despite its greenery and MRT adjacency.

Why it worked

7. The Orie – ~94.1% Sold (731 / 777)

First Toa Payoh launch in 8 years, normalising mid-$2,000s psf in the central heartlands

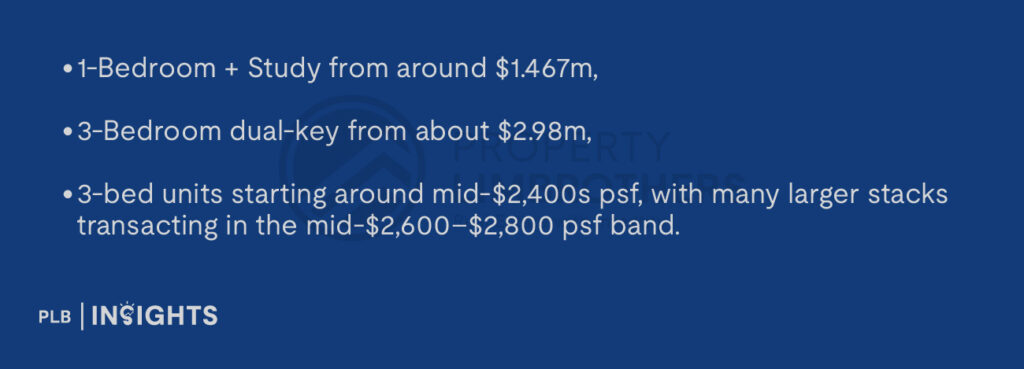

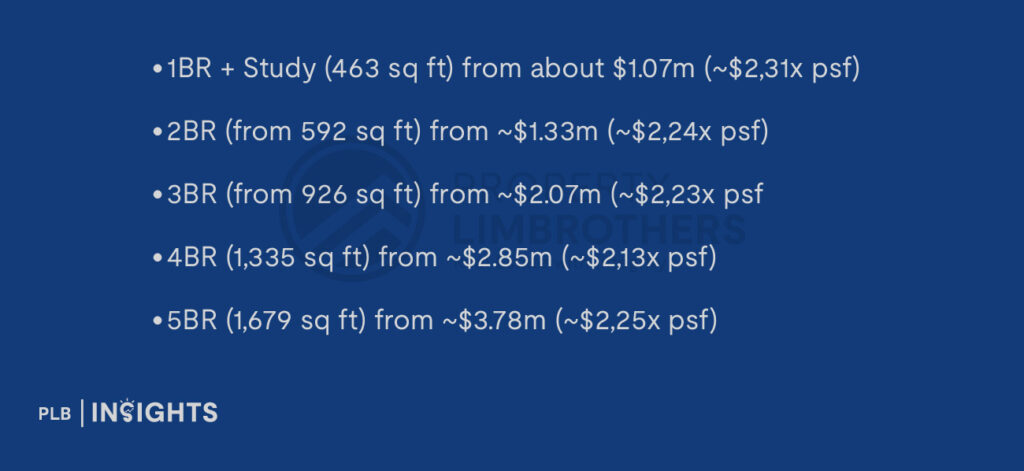

The Orie, at Lorong 1 Toa Payoh, has sold about 94% of its 777 units, making it one of the year’s strongest RCR performers. Current prices stand between $1.467m and about $4.0m, with psf in the ~$2,250–$2,870 range.

Prices:

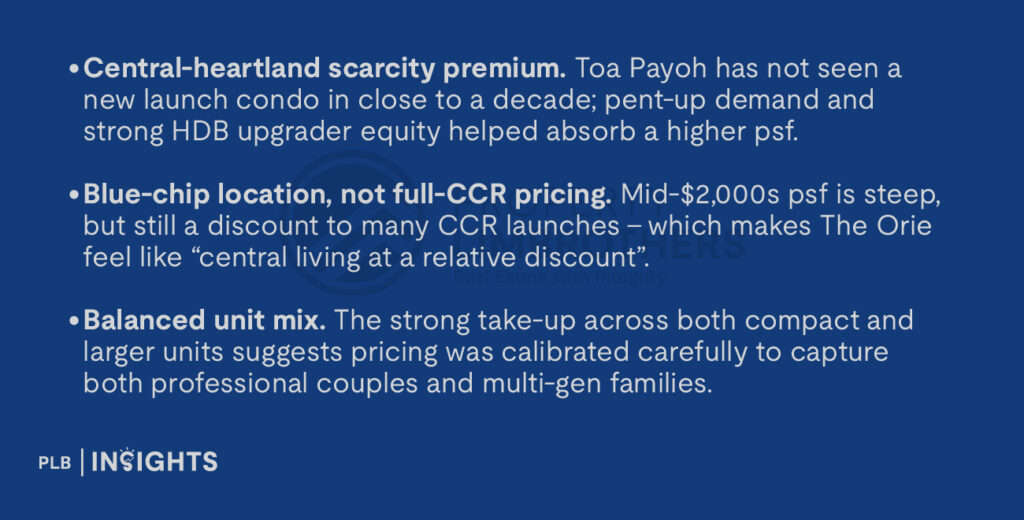

Why it worked

8. Parktown Residence – ~93.5% Sold (1,116 / 1,193)

Tampines North integrated at ~S$2,360 psf

Parktown Residence has moved around 1,116 out of 1,193 units, or about 93.5%, making it the standout mega integrated development of 2025. 1,041 units (87%) were sold on launch weekend at an average price of roughly $2,360 psf.

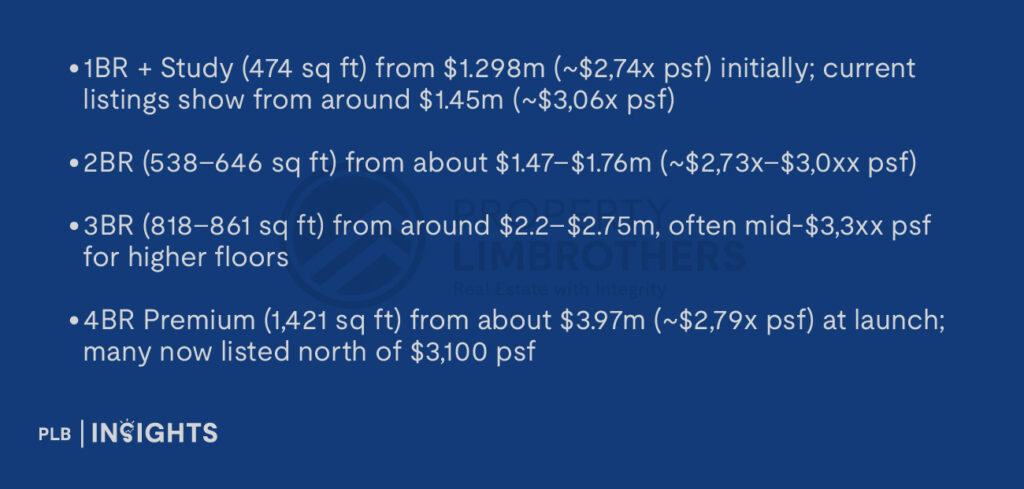

Prices:

Why it worked

9. River Green – ~92.2% Sold (483 / 524)

CCR River Valley at ~S$3,130 psf average – but from about $1.2m entry

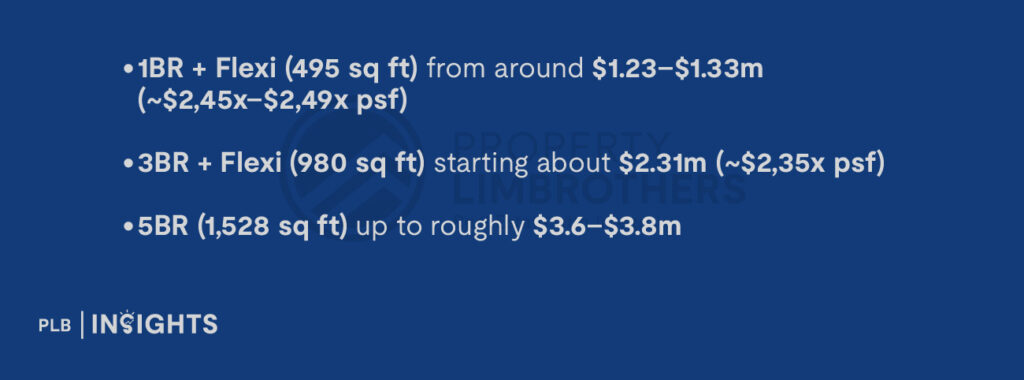

River Green, a single-tower project in River Valley, has sold about 92% of its 524 units.

Later price-list updates show psf in the $3,260–$3,640 range, with average achieved price of about $3,130 psf at around 88% sold on launch weekend.

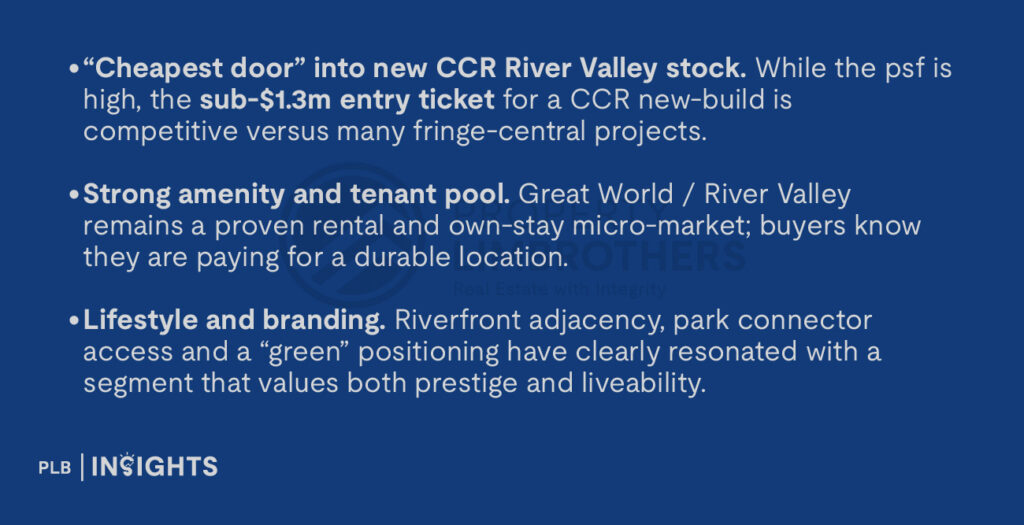

Why it worked

10. Bagnall Haus – ~87.8% Sold (101 / 115)

Freehold East Coast at ~S$2,450–2,500 psf

Bagnall Haus, a freehold boutique project on Upper East Coast Road, has sold about 88% of its 115 units. Average launch price was roughly $2,450 psf.

Price lists show:

Why it worked

11. Zyon Grand – ~86.7% Sold (612 / 706)

Integrated River Valley node at ~S$3,050 psf average

Zyon Grand, an integrated development at Zion Road with direct access to Havelock MRT (TEL), has sold around 612 of its 706 units (~86.7%), after an 84% launch-weekend take-up. The average selling price was about $3,050 psf.

Prices:

Why it worked

What 2025’s Top Launches Tell Us About Price, Product and Demand

Across these 10 projects, three pricing themes stand out very clearly.

Quantum beats psf in almost every segment

Whether it’s ECs like Aurelle and Otto, keeping family units in the $1.4–$1.9m band, City-fringe projects like Penrith and The Orie, calibrating 3- and 4-bedders around $2.1–$3.0m, or CCR launches like River Green and Zyon, offering sub-$1.3–$1.5m entry tickets for smaller units, buyers are clearly deciding based on total monthly repayments, not just psf headlines.

Integrated and MRT-linked projects can push psf – but only with a clear story

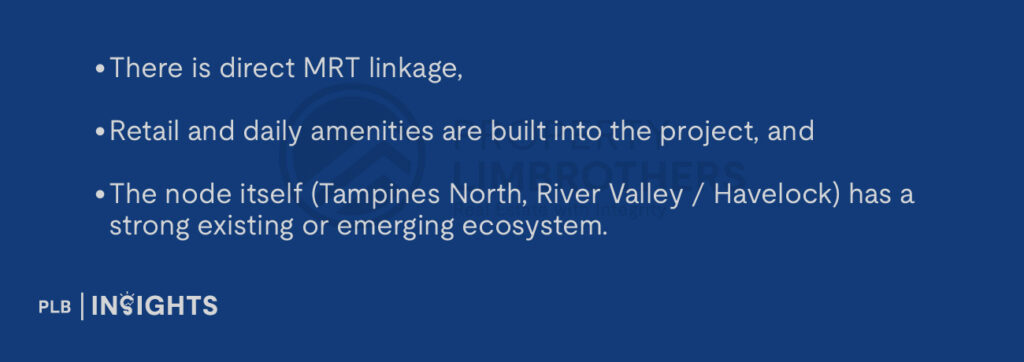

Parktown Residence and Zyon Grand show that the market will accept $2.3–$3.0k psf (and beyond) when:

In return, non-integrated projects in the same precinct – like Aurelle EC near Parktown and River Green near Great World – are being benchmarked directly against these integrated prices.

Micro-market benchmarks have shifted – unevenly

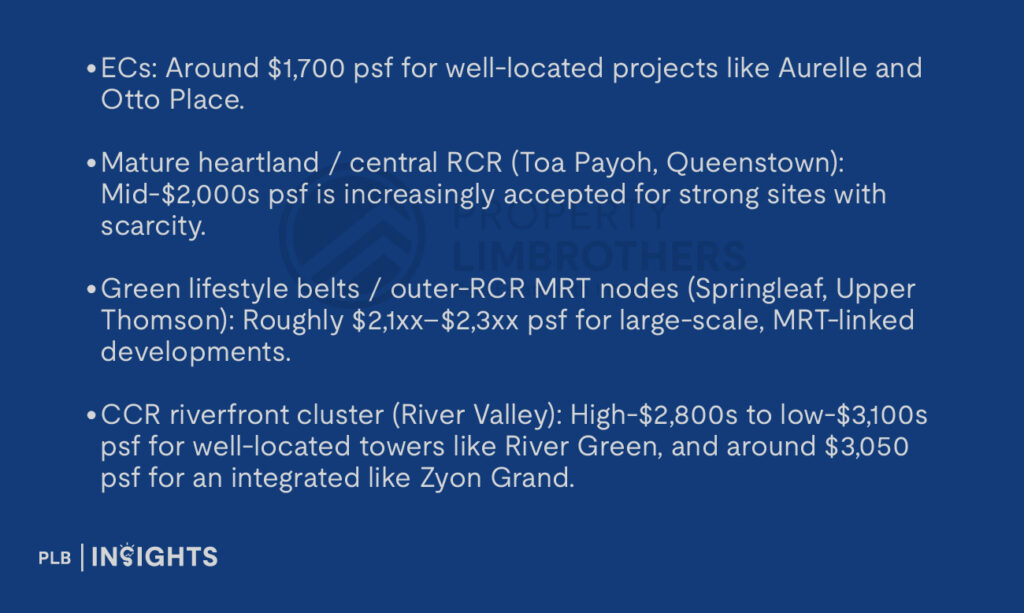

2025’s best-selling launches suggest that new normal bands are forming:

For developers, the implication is blunt: 2025 buyers are willing to pay up – but only when the psf and quantum are anchored by clear, defensible value in that specific micro-market.

For buyers and investors, these top performers provide a live price map. When a project sells above 90% in today’s environment, it is rarely because the market has gone irrational. More often, it is because location, product and pricing have been lined up with unusual precision – and the numbers above show exactly where that alignment tends to land.

Stay Updated and Let’s Get In Touch

Should you have any questions, do not hesitate to reach out to us!