The HDB resale market in Singapore has been a hotbed of activity, with its ever-evolving dynamics capturing the attention of homebuyers and analysts alike. At the heart of this market lies a fascinating interplay between supply and demand—where fewer flats reaching their Minimum Occupation Period (MOP) often lead to soaring resale prices.

But what does this mean for the future of the market? Will million-dollar flats become the norm rather than the exception? For context, these high-value transactions made up just 0.5% of all resale HDB sales over the past two years. Yet, with fewer almost-new flats entering the market in 2025, could these once-extraordinary transactions soon become a common reality?

In this article, we explore the correlation between MOP supply and HDB resale prices, highlight key projects reaching MOP that are poised to influence the market this year, and examine how shifting trends could reshape affordability and buyer behaviour.

Cyclical Trends in Newly MOP Flats and Their Impact on Resale Prices

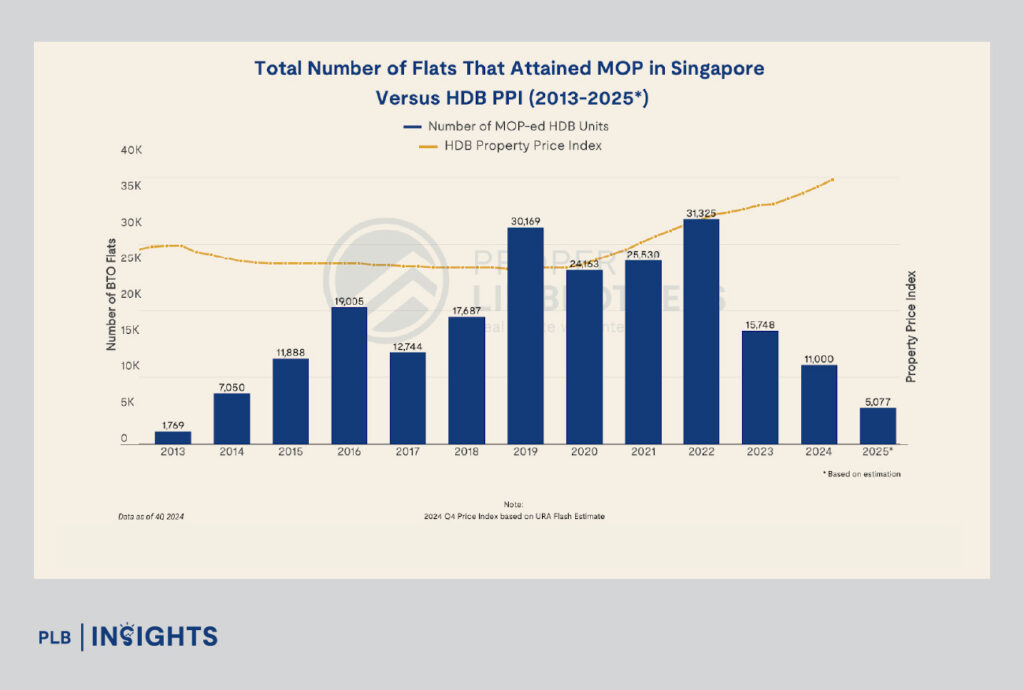

Figure 1: Total Number of Flats That Attained MOP in Singapore VS HDB PPI (2013-2025)

From 2013 to 2025, we observe cyclical variations in the number of MOP-ed flats, with peaks and troughs that directly influence the market. For instance, in 2019, the market witnessed a peak of 30,169 flats attaining MOP, coinciding with a steady but moderate increase in the HDB Property Price Index (PPI). Conversely, in 2023, despite a sharp dip in the number of MOP-ed flats to 15,748, the HDB PPI maintained its upward trajectory, reflecting heightened demand amidst constrained supply.

This year, an estimated 5,077 flats will reach MOP, significantly lower than the 11,000 flats last year. With a smaller pool of almost-new flats entering the resale market, we can reasonably expect further upward pressure on resale prices.

Adding to this demand are buyers who wish to avoid the long wait for BTO flats and the new HDB BTO Classification Framework, which comes with stringent rules for Plus and Prime flats. These include a longer MOP of 10 years instead of the usual 5 years (for Standard flats) and an income ceiling for resale buyers of these flats, which limits eligibility to households earning $14,000 or less. These restrictions make resale flats—especially those located in mature or central areas—more attractive to buyers seeking greater flexibility and immediate housing options.

Key Projects Set to Reach MOP in 2025: What to Expect

Recently-MOP resale flats are highly sought after for their long remaining lease and immediate availability compared to BTO flats. These qualities make them especially appealing to buyers who seek a balance between affordability and convenience, avoiding the long waiting times associated with new flats.

Last year’s transactions highlight this preference. Of the 1,071 million-dollar HDB resale flats sold, 336 were less than 10 years old, underscoring the strong demand for flats with longer leases. With only 5,077 flats expected to reach MOP in 2025, buyers are likely to face even stiffer competition for such units, potentially driving up price premiums further.

Among the HDB projects reaching their MOP this year, Alkaff CourtView in Bidadari and West Plains @ Bukit Batok stand out as the only developments with over 1,000 units each. These projects cater to distinct buyer demographics, given their contrasting locations and attributes.

Alkaff CourtView, part of the emerging Bidadari estate in Singapore’s central region, offers a modern residential environment with strong connectivity and a prime location. On the other hand, West Plains @ Bukit Batok is situated in a mature estate in the western region, providing access to established amenities and a more traditional neighborhood charm.

Another noteworthy project this year is Clementi Crest, located in a well-developed town renowned for its comprehensive amenities and educational institutions, making it a highly attractive option for prospective buyers.

Alkaff CourtView: Central and Convenient

One of this year’s standout projects, Alkaff CourtView in Bidadari, offers buyers an attractive proposition. Located in a central region and surrounded by amenities, it’s expected to command premium prices. Last year’s resale transactions in nearby Alkaff Vista set a precedent, with 5-room flats transacting for as high as $1.34 million. 4-room flats in the area also fetched impressive prices, with some units selling above $1.1 million.

Alkaff CourtView does not offer any 5-room flats, which may reduce its appeal to larger households. However, the demand for its 4-room units is expected to remain strong, particularly given its desirable location. This aligns with the broader trend where the limited supply of newly MOP flats, coupled with prime locations, drives prices upward—especially in years when fewer such flats enter the resale market.

West Plains @ Bukit Batok: A Budget-Friendly Alternative?

In contrast to Alkaff CourtView, West Plains @ Bukit Batok offers a more budget-friendly option, albeit with fewer nearby amenities and less centrality. While the projected resale prices for this project may be more accessible, the market segment it caters to is distinct. Buyers with modest budgets may find value here, but the demand for million-dollar transactions in this region remains limited compared to central locations like Bidadari or Clementi.

The limited price growth in Bukit Batok since 2021 (8.6%) compared to the west region average (29.2%) further illustrates the differing appeal of this project. While affordability may attract buyers, resale prices here are unlikely to match those of centrally located counterparts.

Clementi Crest: A Strong Contender

Clementi Crest stands out as an appealing option for families due to its proximity to reputable schools and a well-connected transportation network. The project is also surrounded by a plethora of amenities, making it an attractive proposition for prospective buyers. Last year, resale prices in Clementi exceeded those in Bukit Batok and the west region, with a 5-room flat in Clementi Avenue 3 transacting for $1.3 million.

Clementi Crest’s location in a mature town adds to its appeal, with buyers willing to pay a premium for its convenience and established infrastructure. The average resale price for flats in Clementi has consistently outperformed both regional and islandwide averages, reflecting the desirability of this location.

Supply and Demand Trends: A Broader Perspective

The broader market trends indicate that limited supply of MOP-ed flats can exert upward pressure on resale prices. The data from Figure 1 discussed above supports this hypothesis, as years with fewer flats attaining MOP, such as 2023 and 2025, tend to coincide with robust price growth in the HDB PPI.

This trend is anticipated to continue, based on the projected supply for 2025 and 2026, with approximately 9,400 flats expected to reach MOP in 2026, nearly doubling 2025’s number. If this projection materialises in 2026, buyers could have more choices, potentially easing the upward pressure on resale prices that is happening currently in certain towns. However, this also depends on other market factors, such as interest rates, government policies, and economic conditions.

Conclusion: A Market Shaped by Supply Constraints

The relationship between the supply of newly MOP flats and HDB resale prices highlights the critical role of market dynamics in shaping buyer behaviour. As highlighted, years with lower MOP supply often see stronger price growth, a trend likely to persist in 2025 given the sharp drop in MOP-ed flats compared to 2024.

Projects like Alkaff CourtView and Clementi Crest are expected to dominate buyer interest due to their desirable locations and attributes, while West Plains @ Bukit Batok caters to a different segment of the market. Overall, the demand for almost-new flats is expected to remain strong, driving prices upward in an already competitive market.

For prospective buyers, understanding these trends can help navigate the HDB resale market effectively, especially in years where limited supply could mean paying a premium for the right unit.

Ready to navigate the complexities of Singapore’s ever-evolving resale HDB market? Whether you’re looking for a flat with the perfect location, trying to secure your dream home amidst limited supply, or simply exploring your options, our team of experts is here to guide you. With personalised insights and professional advice tailored to your unique needs, we’ll help you make confident, informed decisions. Reach out to us today and take the first step toward finding a home that truly works for you!