What is your first step when you are looking for a place to buy? Some go for a specific location that they already have in mind. Staying close to family, workplace, or favourite neighbourhoods are a common way of taking the first step. But sooner or later, everyone has to take into consideration whether they can afford to own the place. If you are a buyer with foresight, you would also consider if future buyers would be able to afford your home.

Affordability, both in the present and the future, is a crucial consideration for property purchases. Affordable homes can help you with your finances, and is a form of living within your means. If the home remains affordable to future buyers, it would also help with the exit planning. In the MOAT Analysis, the quantum effect is the price sweet spot for Singaporean buyers. This quantum sweet spot is where most buyers are able to afford the property based on the income they are earning without being stretched in their finances.

In this article, we cover how the Quantum Effect in the MOAT Analysis can help you in your property buying journey. First, we will cover what the Quantum Effect is and why it matters. We will then give some examples of how it can help you with your property search and comparison with just a glance.

What is the Quantum Effect?

As we have briefly explained in the introduction, the Quantum Effect is the affordable sweet spot for property prices. This is not referring to the PSF price but rather the final Quantum price of the property. In order to buy any property, prospective buyers must have enough money saved up for the down payment and have enough income to be able to support a loan for the said property. The Quantum Effect looks at properties and gauges how deep the buyer’s pocket needs to be (savings) as well as how fast it can be filled (income).

For properties that fall within the sweet spot, there will be more prospective buyers that can afford it. If a large number of buyers are able to afford the property, the Quantum Effect score will be high. In addition to this, the MOAT Analysis looks at recent transactions to make sure that the Quantum Effect is reflective of the updated price trends.

In order to calculate the affordability of properties, we use the latest national median income provided by the government and calculate the affordable price for the property based on the TDSR requirements. To calibrate the higher property prices for properties in the Core Central Region (CCR), we base the calculations on an increment in median income.

To simplify the technical details, we estimate the sweet spot for property prices based on how much people earn in Singapore. This income-based estimation of demand is based on the fundamental understanding of the property decision process. Especially the financial constraints faced by buyers as property prices in Singapore continue to inflate.

Moving forward into the rest of 2022 and 2023, affordability of housing will become a more hotly discussed topic. High inflation in today’s context will price out many consumers from the properties of choice. As a result, more buyers will be focused on affordable options. Particularly those that have a good potential for price growth and ease of exit as well.

Why does the Quantum Effect Matter?

Does affordability matter that much in the property market? Yes. A large bulk of what makes the property market moves is based on the mass market. This group mainly entails a huge group of HDB Upgraders and Condo buyers, which is largely made up of the middle-income class living in Singapore. This group of buyers would still have to use a significant amount of their capital in property purchases (around 40% or more). Hence, affordability in terms of down payment and mortgage matters. These two factors of affordability are accounted for within the Quantum Effect.

As this middle income class which moves the market is also sensitive to price movements outside of the affordability range, demand and transaction volume will fall once a majority of buyers can no longer afford, or rather are no longer willing to buy at sky high prices. The Quantum Effect is important to the masses and for the market.

The Quantum Effect will be of growing importance in pricey and inflated markets that we see today. When affordable properties become increasingly more scarce, they will be more valuable and sought after by many buyers. While this might inevitably lead to higher prices for even the more affordable properties, it can also be interpreted as having a potential for growth in high inflation environments.

Property prices that fall within the Quantum Effect sweet spot are also important in generating a healthy volume of transactions for that development. Just as the growth potential might be decent for properties with a high Quantum Effect score, we expect a healthy volume performance as well. As the mass market supports the price movements in this market, we can expect a good take-up rate when an affordable property is also a good one. If there is a disparity, then it could be noteworthy to find out if the property has any downsides that you could have left out.

Ultimately, the Quantum Effect matters because it takes the income of the populace into account. As people’s livelihoods improve and Singapore gets wealthier over time, we can expect the property market to grow with it. However, we often find that the inflation of goods, services, and assets often outpaces that of income. The Quantum Effect brings buyers back to reality by giving them a quick check on whether the properties they have shortlisted are affordable to the general public.

How can we use the Quantum Effect in our Property Search?

Now that we know what Quantum Effect means and of the weight of its importance, we move on to how it plays a role in the property search process. Across our different articles on MOAT Analysis, we have mentioned several times on the true strength of this form of comparative analysis. The MOAT Analysis is a quick and efficient way for buyers to compare multiple properties on multiple different traits that are important to the property’s future value.

Quantum Effect helps with an affordability-led search process. It acts as a first-stage filtering for affordable properties that may provide an opportunity to find undervalued properties. When looking for a property, of course we do not just look at price. All the other factors act in conjunction to help us shortlist the project names that we are interested in. One way is to look at the Quantum Effect first to make sure that the properties you are looking for are within your reach.

Alternatively, you can also use it as a way to gauge the ease of exit. If more people can afford to buy the property from you at a later date, it would be much easier to exit. This might be an important factor in your decision if you are looking for a short-medium term stay or if you are using this to find an investment property.

The Quantum Effect is also important in the MOAT Analysis to show you what you are paying for. Used together with the other components, you can see if the Quantum of the project is reasonable based on the other features of the property. If your property has a high Quantum Effect score in conjunction with other aspects of the MOAT Analysis, you may have found yourself some gold. On the contrary, if you see a low Quantum Effect score with not many other MOAT components reflecting a decent score, you may be looking at something overvalued.

This can be used to gauge the property’s value and whether or not you can afford it. Using the MOAT Analysis to filter for properties that fit your criteria on affordability and value will be a great way to save time and effort. Rather than spend hours on the internet browsing for properties that may or may not fit your criteria, the MOAT Analysis can filter them out with the click of a button.

Quantum Effect & Value — What are you paying for?

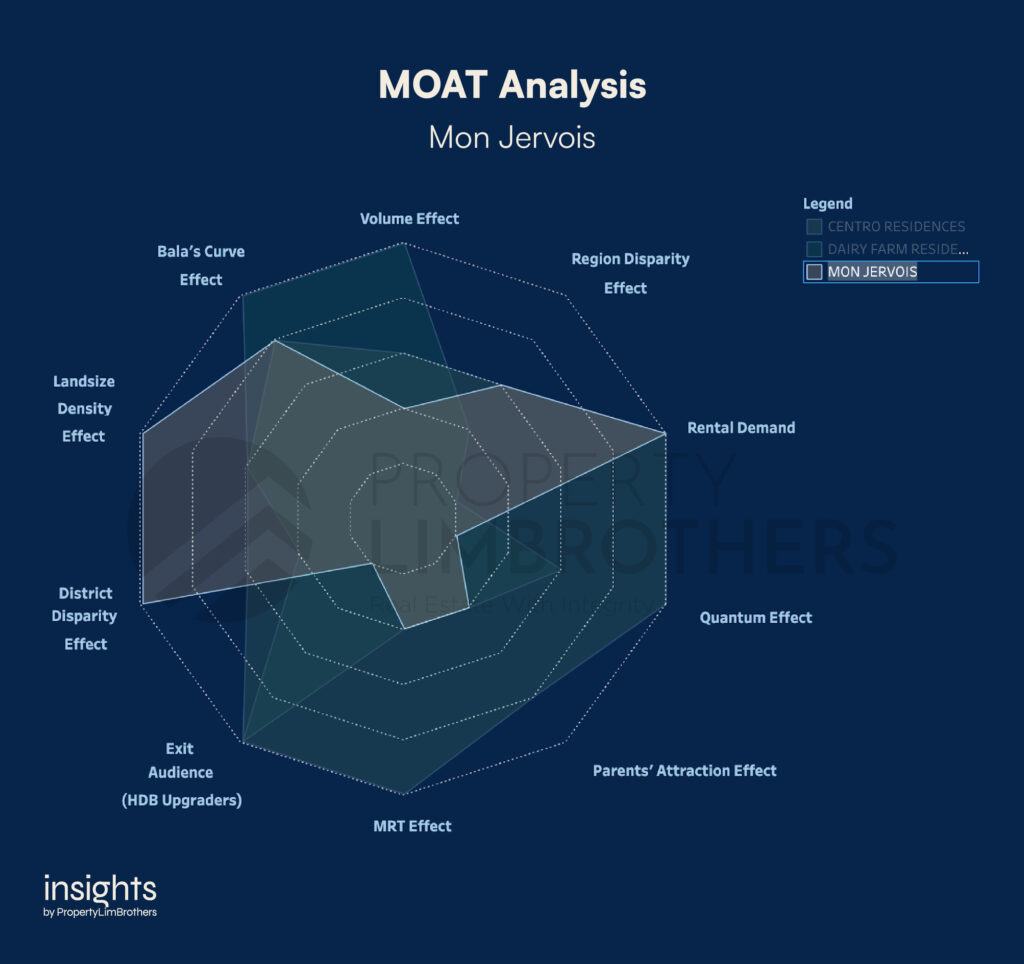

In this final section, we briefly compare three different properties using the MOAT Analysis to demonstrate how Quantum Effect can be used in conjunction with other MOAT factors to help to find properties that fit your criteria. This combination can show you what you’re paying for and gauge the rough affordability of the property. We will be comparing Mon Jervois, Dairy Farm Residences, and Centro Residences.

First up is Mon Jervois, a condominium in District 10, sporting 109 units. It was completed in 2016, with its 99-year lease starting in 2012. This condo is located within the CCR area. Even after applying a markup on income, the property is still considered relatively pricey. This is expected for properties within the CCR region.

The tradeoff between luxury and connectivity is that the price of the property would likely not be within the Quantum sweet spot that most buyers are looking for. On the flip side, that might not be the target audience that Mon Jervois is after in the first place.

Mon Jervois is likely targeting the more upscale, and wealthy upper-class market. Even though the Quantum Effect score is only at 1, it scores a 5 on Rental Demand, Landsize Density, and District Disparity. Among D10 condos, it is probably priced lower than the average price. It is spacious and has high demand for rentals.

Additional analysis shows that 31.7% of buyers are foreigners and 12.9% of buyers are PRs. Close to half of the buyers here are non-Singaporeans. This might mean that the target market might be more for expatriates with higher income levels.

This helps us to make a quick yet holistic idea of what the property offers, what is their intended audience, and whether or not they fit the bill when you’re a prospective buyer. Of course, if the property sparks your interest, you should do a deeper analysis of the history, price, and fundamentals of the project. Otherwise, you would have saved a lot of time filtering out properties you are not interested in, while not letting the good ones fall through the cracks.

The second property we are going to look at is Dairy Farm Residences. This time an OCR 460-unit apartment located in D23, Bukit Panjang. Though it is still an uncompleted leasehold project, the expected TOP date should be somewhere in 2024Q1. Its 99-year lease started in 2018, so it is a fresh property of the block, so to speak. The take-up rate after the launch was great, almost selling out as of the time of writing.

Dairy Farm Residences scores a 5 on Bala’s Curve Effect (due to its new launch status), Volume Effect, and Exit Audience. The project seems to appeal to HDB upgraders who, perhaps, enjoy staying in the Bukit Panjang area. Interestingly, it scores a 1 on District Disparity & a 2 on Region Disparity. This points to an above-average pricing compared to its peers in the area. Yet, this is sort of expected since new launch prices are considerably higher.

In this example, the Quantum Effect score is 3. It is a moderately affordable project according to median income levels in Singapore. Buyers of this project, past, present and future, should think about what they are paying for even if they can afford it. Just because you can afford a property doesn’t immediately mean you should buy it. It just means that there are fewer financial constraints to obtain that property.

Buyers should closely inspect the value proposition of that project and whether it offers you more value than nearby alternatives. In this case, Dairy Farm Residences has a very high unit distribution towards 701-800 sqft apartments (approximately 43.1% of all units). These smaller-sized apartments may contribute to the higher Quantum Effect score because of the lower overall size, and at the same time contribute to a higher average PSF of the project, bringing it above the district and region average.

The high volume of apartments of this size in the project could mean a lot of smaller family units, individuals, or investors prefer this location. At the same time, it could also mean that the competition to sell might be fiercer in the future when buyers of those unit sizes are looking to eventually upgrade their properties down the road.

Lastly, we look at Centro Residences. This OCR condominium near Ang Mo Kio MRT was completed in 2014, with its 99-year lease starting in 2007. This condominium is home to 329 units, most of which are between 801-1,000 sqft (55.1% of all units). This condo performs very well on the MOAT Analysis, with a 5 on Rental Demand, Quantum Effect, Exit Audience, and MRT Effect.

In other words, most of the units in Centro Residences are affordable to Singaporeans and it has a strong audience to sell to eventually. It is also very close to the MRT, giving it boosted value despite being affordable. There is also a high demand for rental. As this part of the OCR is relatively closer to the central regions than other properties further north.

The condo is well-rounded in the MOAT score. None of its other MOAT components falls below the score of 3 (Volume Effect, Region Disparity Effect, Landsize Density, District Disparity Effect). As compared to its peers in the district and region, Centro Residences is about average if not slightly higher. Its medium-size development is more on the smaller side, explaining the higher density in the living area and the lower volume.

These average scores can be interpreted as a good thing. Centro might offer HDB upgraders some value-for-money based on its locational advantages. Although not of an immediate concern, the decaying lease may be something that buyers want to look out for in the future.

Closing Thoughts

Looking at the different examples we have on the MOAT Analysis, Quantum Effect roughly tells us how affordable the property is. Coupled with a high Quantum Effect score, if the unit size distribution of the property is on the higher side, it is often a signal of lower overall price. The other components of the MOAT Analysis can also help you identify whether or not the property is a value-for-money purchase.

On the other hand, you will also be able to tell with greater certainty, the target audience of the properties you are shortlisting using the MOAT Analysis. This can help you save a lot of time in the search process and help you filter out for only the properties that you can afford and at the same time fit your personal criteria of what you are looking for in a home.

If you wish to find out more about our MOAT Analysis and how you can use it in your own personal property journey, contact us here. Our experts are trained in the MOAT Analysis and can assist you in finding the property that you want in the sea of options in Singapore.