When a $1.5 billion top bid lands in a heartland location, it deserves more than a headline glance.

The recent tender for the Hougang Central mixed-use site, which saw a CapitaLand–UOL–Singapore Land–Kheng Leong consortium emerge with a top bid of $1,179 psf ppr, was not just another government land sale (GLS) outcome. It was a revealing data point about how developers are pricing risk, demand, and long-term urban value in Singapore’s next phase of growth.

At first glance, the numbers appear bold. Analysts had expected bids in the $800 to $1,000 psf ppr range. Yet the winning bid came in well above that, implying potential home prices of $2,500 to $2,600 psf or higher — levels that would push Hougang into a new pricing territory.

But this outcome was not irrational exuberance. It was a calculated, strategic move that sheds light on how integrated developments, transport-anchored sites, and large suburban catchments are being re-rated by developers.

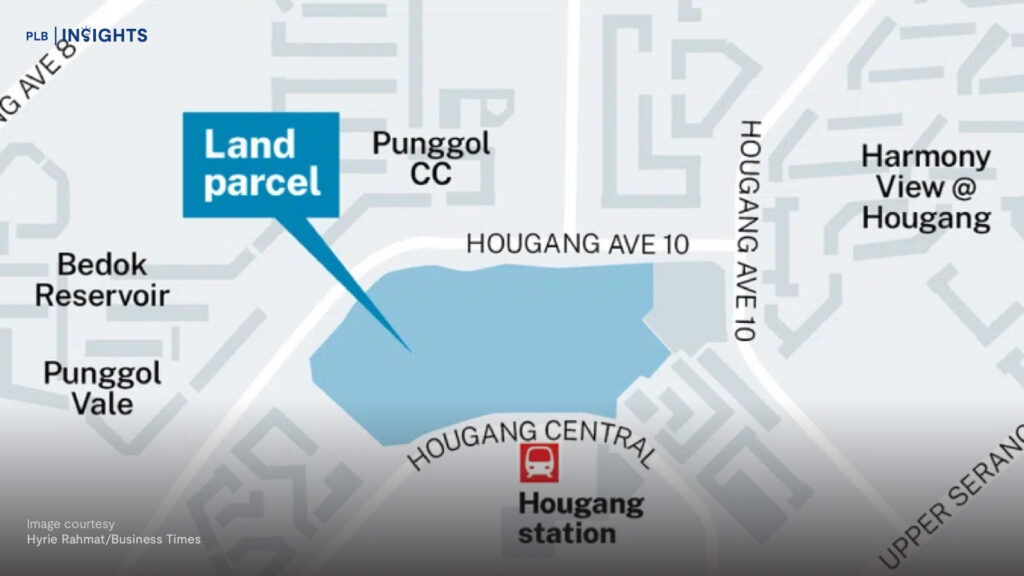

A Rare Integrated Opportunity in the North-East

The Hougang Central site is not a typical suburban parcel.

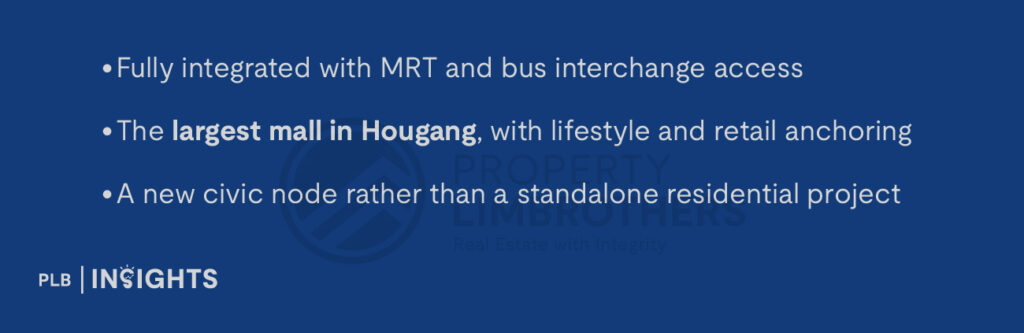

Spanning 4.7 hectares, it will house an integrated development with about 835 residential units and more than 430,000 sqft of commercial space, making it nearly twice the size of Hougang Mall. Crucially, part of the development will sit directly above Hougang MRT station on the North-East Line (NEL), with mandatory integration into a bus interchange.

In Singapore’s planning context, such sites are rare, complex, and long-dated assets. They require strong balance sheets, integrated development expertise, and patience. This alone explains why only three bids were submitted — a turnout that some may misread as caution, but which in reality reflects high entry barriers rather than weak sentiment.

Large GLS plots above the $1 billion mark have historically drawn fewer bidders. Recent examples such as Chencharu Close and Zion Road Parcel A reinforce this trend. What matters more is who bids — and how decisively.

Why the Top Bid Matters More Than the Bid Count

The consortium comprises CapitaLand, UOL Group, Singapore Land, and Kheng Leong Company — all established players with extensive experience in large-scale mixed-use and transit-oriented developments.

This is significant for two reasons.

First, these developers are not known for speculative land banking. Their bids typically reflect disciplined underwriting based on long-term demand visibility, not short-term market sentiment.

Second, the same consortium had previously secured another mega integrated site in Tampines in 2023. That project, Parktown Residence, was launched in early 2025 and achieved over 87% sales at an average price of about $2,360 psf during its launch weekend.

The Hougang Central bid should therefore be viewed as an extension of a proven playbook, not an isolated gamble.

Pricing Expectations: Stretch or Structural Shift?

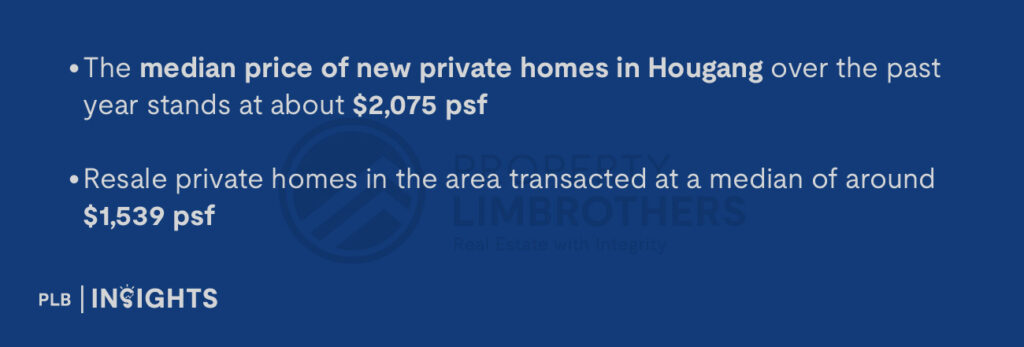

Based on the land rate of $1,179 psf ppr, analysts now expect average selling prices in the $2,500–$2,600 psf range.

To put this in context:

On paper, the gap looks wide. But markets do not price on historical medians alone — they price on product differentiation.

Hougang Central will be:

In this sense, comparisons with typical non-integrated projects in the planning area may be misleading. Buyers are not just paying for location, but for convenience density, time savings, and long-term urban relevance.

The Upgrader Math Still Works

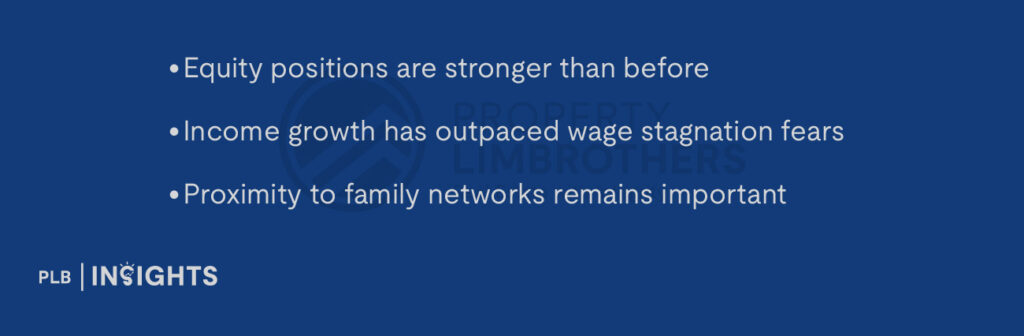

One of the more underappreciated drivers behind the Hougang Central bid lies in upgrader depth.

Hougang has close to 60,000 dwelling units, the vast majority of which are public housing. Recent resale data shows that 4- and 5-room HDB flats under 20 years old have reached median prices of approximately $675,000 and $830,000 respectively.

For a meaningful segment of these households:

An integrated private development within the same town becomes a natural step-up option, especially for buyers who prioritise convenience over moving further afield.

This upgrader pool does not need to absorb all 835 units at once. It only needs to provide steady, multi-year demand, which is exactly what large developers underwrite for.

Why Developers Are Willing to Play the Long Game

Large integrated developments are not designed for quick exits.

They are:

Market watchers have already noted that the retail component of Hougang Central could eventually be hived off into a commercial REIT, especially given the scarcity of yield-accretive suburban mall assets.

For a group that includes CapitaLand Integrated Commercial Trust, this optionality matters. Residential sales are only one part of the total return equation.

Reading the Three-Bid Outcome Correctly

Some may focus on the modest number of bids and infer caution. That interpretation would be incomplete.

As ERA Singapore CEO Marcus Chu pointed out, low bid counts for mega sites typically reflect strategic selectivity, not pessimism. Not every developer has the scale, balance sheet strength, or operational capability to deliver a complex civic-scale project.

Similarly, PropNex highlighted that GLS sites above $1 billion rarely attract large crowds — yet those that do attract bids often end up being market-defining projects.

In that sense, three committed bids may be healthier than ten tentative ones.

Hougang’s First New Launch Since 2019

Another important contextual factor is supply.

Hougang has not seen a new private residential launch since The Florence Residences in 2019. Over the past six years, demand has continued to build while supply has remained limited.

When new supply finally enters a mature town after a long gap, pricing tends to reset — not because of hype, but because replacement cost has risen and buyers recalibrate expectations.

Hougang Central will likely serve as a pricing anchor for future developments in the area, much like how earlier integrated projects did in other regional centres.

A Broader Signal for the GLS Programme

Zooming out, the Hougang Central outcome also speaks to the broader GLS landscape.

The H1 2026 GLS programme has limited integrated sites, with Bayshore Road standing out as the only confirmed parcel with a commercial component. This scarcity likely sharpened developer focus on Hougang Central as a timely and rare opportunity.

Rather than speculative bids, developers appear to be front-loading conviction into fewer, higher-quality sites — a trend consistent with rising construction costs, longer development timelines, and tighter capital discipline.

What This Means for Buyers and the Market

For buyers, the Hougang Central project will test price tolerance — but not in a vacuum. It will do so with:

For the market, the $1.5 billion bid reinforces a broader message: Singapore’s suburban nodes are no longer priced as peripheral, especially when they function as self-contained urban centres.

And for developers, the outcome confirms that scale, integration, and long-term relevance remain investable themes — even in a cautious environment.

Final Thoughts

The Hougang Central GLS tender was not just about a record land rate or headline-grabbing psf numbers.

It was about confidence with conditions — confidence rooted in infrastructure, demographics, and urban planning rather than short-term exuberance.

As Singapore continues to evolve towards decentralised, transit-anchored living, projects like Hougang Central are likely to become reference points, not anomalies.

And in that sense, the $1.5 billion bid may prove less surprising in hindsight than it seems today.

If you are considering how upcoming integrated developments like Hougang Central may shape pricing, demand, or upgrade opportunities, speak with our sales consultants for a clearer, data-led perspective tailored to your plans.