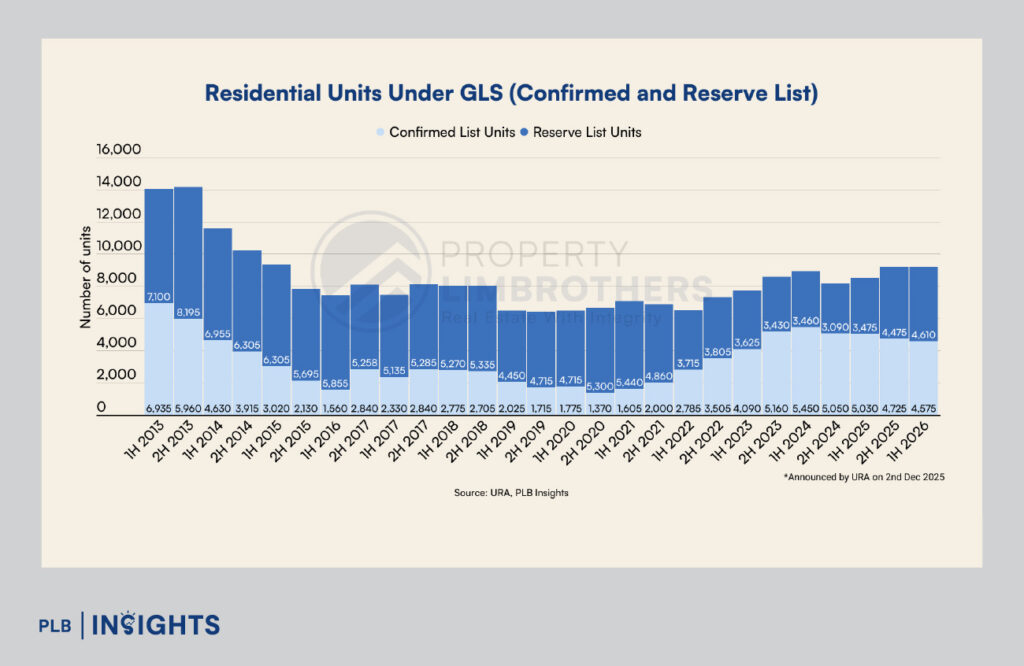

Singapore’s private housing market is set to enter 2026 with one of the largest land pipelines in over a decade, as the Government maintains a strong supply of development sites under the Government Land Sales (GLS) programme for the first half of the year. With 9,185 potential private residential units offered across Confirmed and Reserve lists, the message is clear: policymakers are intent on keeping the housing pipeline healthy, varied, and responsive to demand—without letting the market overheat.

A Deliberate Push to Meet Resilient Private Housing Demand

Despite a period of elevated interest rates, private home demand has remained surprisingly steady. Developers have cleared a significant amount of unsold stock over the past two years, and new launches in 2025 saw strong take-up in many locations.

Against this backdrop, the 1H2026 GLS programme includes 4,575 units on the Confirmed List, a figure that stands 43% above the pre-2024 average issuance. This is a deliberate move. By keeping the supply pipeline high, the Government aims to give developers the confidence to continue building while ensuring buyers face a stable, non-speculative market.

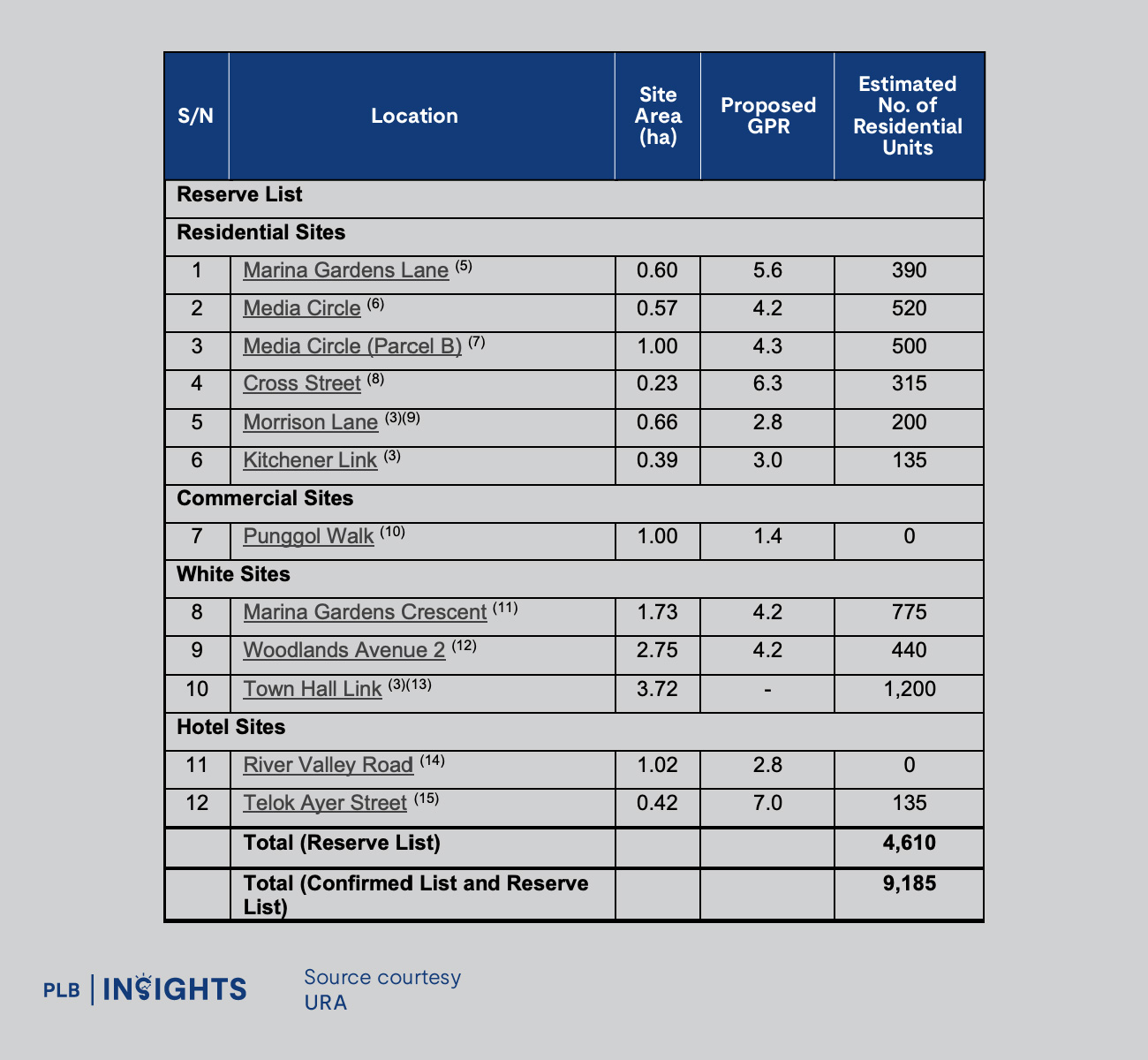

The Reserve List adds another 4,610 potential units, allowing developers flexibility—sites are activated only when a developer signals genuine interest with a minimum bid.

When combined with projects already in the pipeline, Singapore’s total private housing supply (including ECs) will rise to about 58,600 units, one of the highest in recent years.

Jurong Lake District Takes Centre Stage

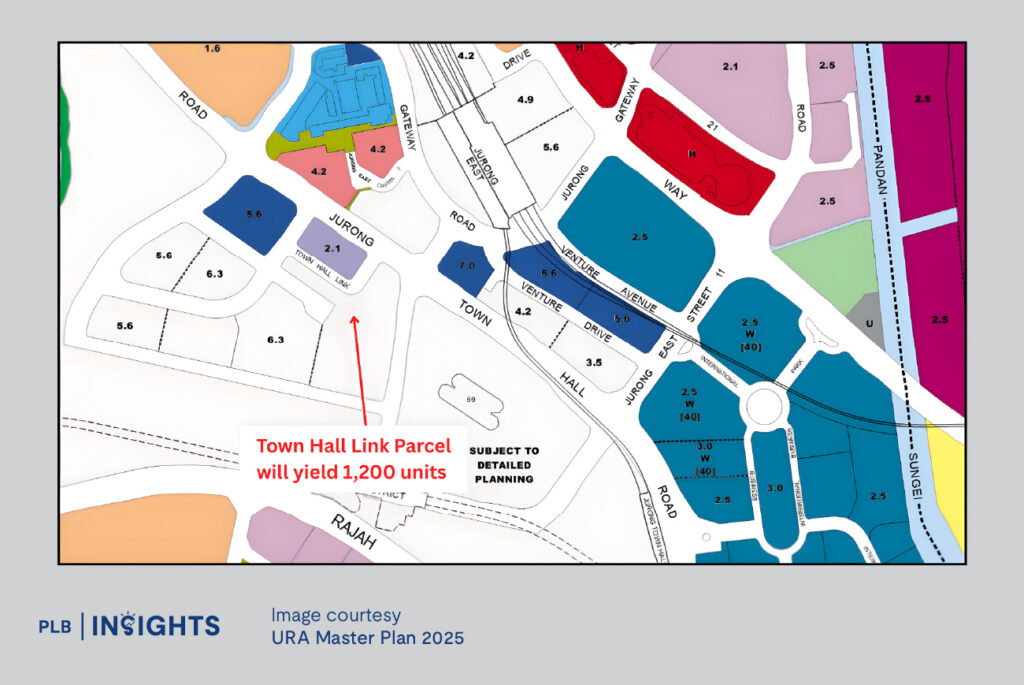

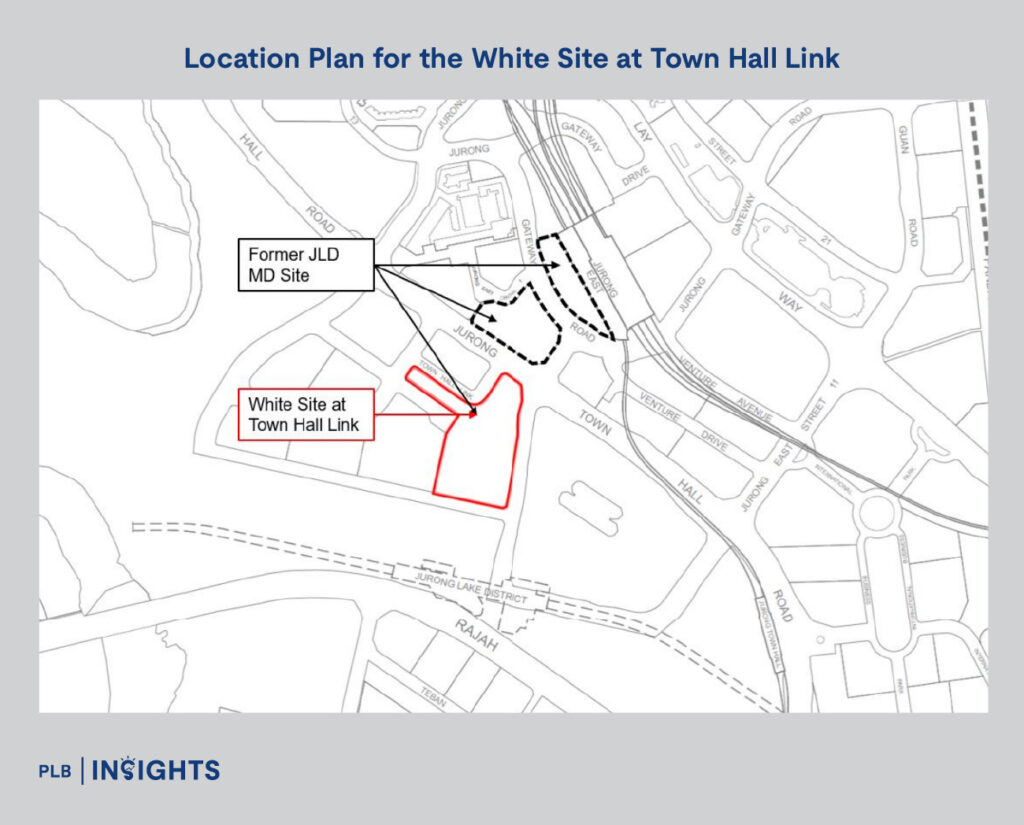

Perhaps the most significant move within this GLS tranche is the recalibrated approach to developing Jurong Lake District (JLD)—Singapore’s largest future business district outside the CBD.

Rather than releasing the massive 6.5-hectare Master Developer site in one go, the Government is splitting it into manageable pieces. The first parcel—a sizeable White site at Town Hall Link—will appear on the Reserve List, signaling flexibility but also giving developers room to prepare for a project of this scale.

This parcel alone can yield:

This is the type of integrated development capable of forming the nucleus of a new district—supported by major upcoming infrastructure such as the Jurong Region Line (2028) and Cross Island Line (2032).

Positioning the White site on the Reserve List instead of forcing a tender also reduces development risk. It gives builders time to digest planning requirements, while the Government concurrently works on key district-level infrastructure such as a District Cooling Plant and the Pneumatic Waste Conveyance System. Such upfront investments boost long-term sustainability and lower operating costs for future stakeholders.

More Commercial Supply, Ahead of Anticipated Business Demand

Beyond housing, the GLS announcement highlights Singapore’s ongoing commitment to building decentralised commercial nodes. Two commercial sites—Woodlands Avenue 2 and Punggol Walk—are carried forward to the 1H2026 Reserve List, giving developers optionality in expanding local office and retail supply.

The move aligns with broader trends: suburban hubs are increasingly popular among businesses seeking lower rents, better live-work-play integration, and proximity to growing residential clusters.

Hospitality Pipeline Keeps Pace With Tourism Recovery

Tourism’s resurgence also finds expression in this GLS programme. Two hotel sites—River Valley Road and Telok Ayer Street—remain on the Reserve List, ready to be triggered should demand strengthen further. Singapore has seen record-breaking visitor numbers in 2024–2025, and developers may look toward hospitality investments as travel patterns stabilise.

A Balancing Act for a Stabilising Market

The overarching theme from the 1H2026 GLS programme is calibration. The Government is neither flooding the market nor withholding supply—it is keeping a steady hand as Singapore transitions toward a more stable interest rate environment and larger structural shifts, including decentralisation and mixed-use district development.

The high Confirmed List supply ensures that owner-occupier demand is catered for. The extensive Reserve List ensures developers have room to respond to market cycles. And the strategic focus on JLD underscores the long-term vision to grow a second CBD anchored by sustainability, connectivity, and integrated living.

As the housing market enters the next phase—likely shaped by interest rate cuts and continued economic growth—the 1H2026 GLS programme provides developers, investors, and homebuyers with something increasingly rare: predictability.

Our Take

The sustained ramp-up in GLS supply also sends a clear signal: policymakers are aiming to temper price pressures in a market where new launches have continued to see strong absorption in recent quarters.

By front-loading more land into the pipeline, the Government is creating room for developers to moderate future launch pricing and maintain market stability. While nothing has been announced, this calibrated increase in supply could indicate that further cooling measures remain an option should price momentum accelerate in 2026.