The global redistribution of wealth has intensified competition among key financial hubs in the Middle East and Asia—Dubai, Singapore, and Hong Kong—to attract high-net-worth individuals (HNWIs) and foreign capital. Amid this competition, Singapore has emerged as a favoured destination, underpinned by its macroeconomic stability, business-friendly policies, and politically neutral stance. These factors appeal to global investors seeking secure environments for wealth preservation and portfolio diversification. Knight Frank projects that Singapore accounts for 11% of all cross-border capital inflows into the Asia-Pacific region by the end of 2024, reflecting the city-state’s enduring appeal as a financial and investment hub.

Wealth Migration’s Influence on Real Estate Dynamics

Henley & Partners forecasts that approximately 128,000 millionaires will relocate globally in 2024, surpassing the 120,000 recorded in 2023. Singapore remains a key magnet for this wealth migration, driven by its exceptional infrastructure, top-tier education system, and reputation as a safe and stable haven for families and businesses alike.

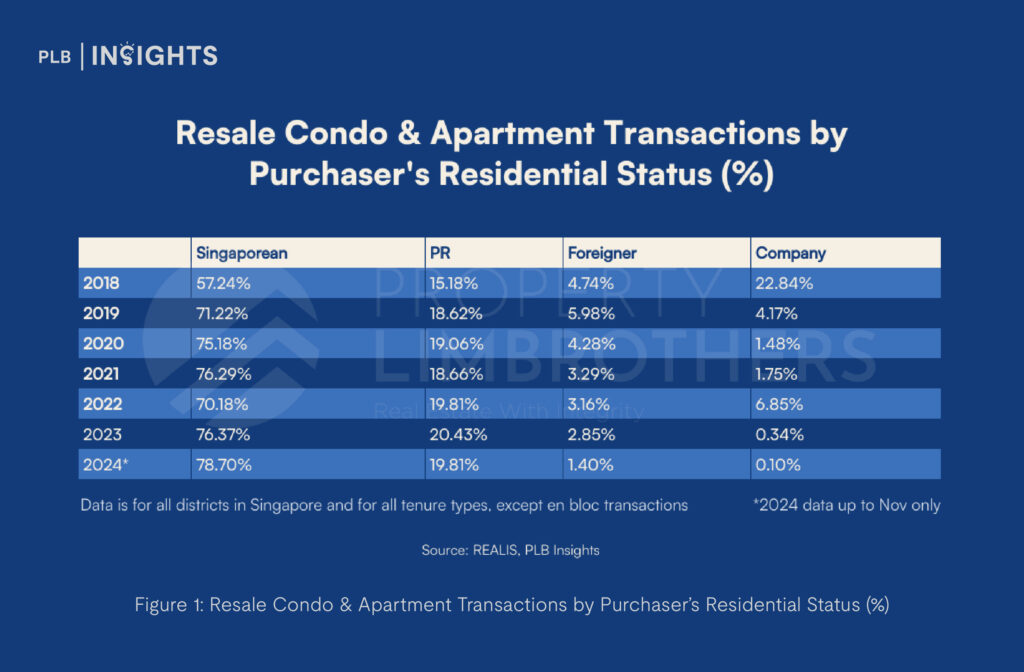

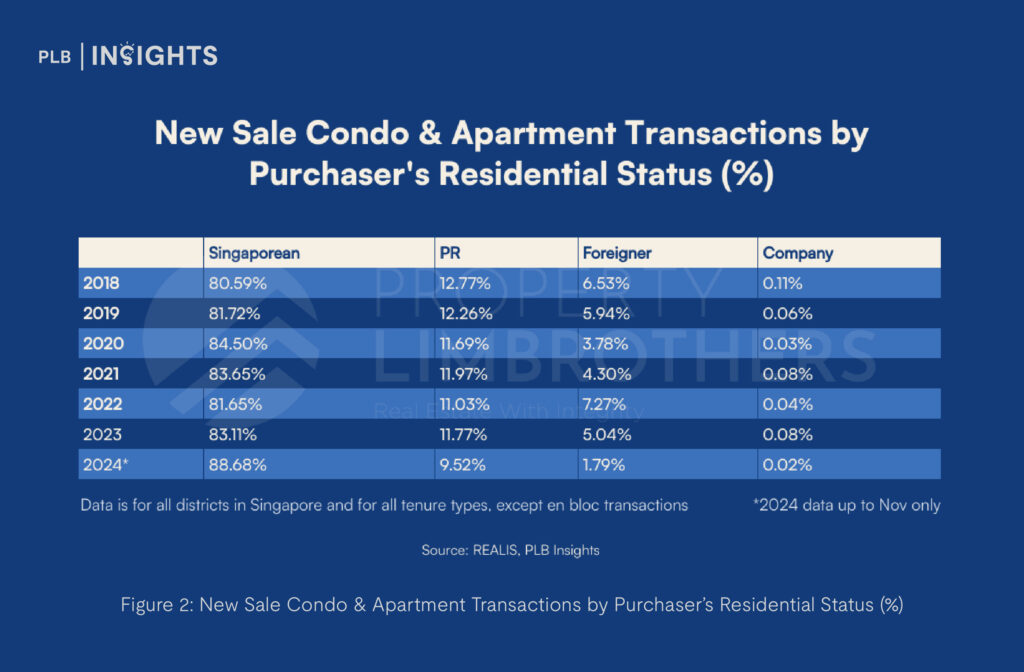

The Additional Buyer’s Stamp Duty (ABSD) increase for foreign buyers—from 30% to 60% in April 2023—was intended to cool speculative demand. Despite this, Singapore’s real estate market remains resilient. Data from the Urban Redevelopment Authority (URA) shows a decline in foreign buyer participation in the secondary market from 2.85% in 2023 to 1.40% in November 2024. This number is even lower for the new sale in the primary market, where foreign buyer participation fell from 5.04% in 2023 to 1.79% in November 2024.

However, industry experts argue that while the increased ABSD initially deterred some buyers, many wealthy investors still view Singapore as an unparalleled long-term investment hub, underscoring its appeal as a safe haven amid global uncertainties.

Trends in the Core Central Region (CCR)

The Core Central Region (CCR)—which includes prestigious districts like Orchard Road, Holland Village, and the Downtown Core—has experienced a mixed performance in 2024. Non-landed private home sales in the CCR were subdued, particularly in the new launch segment, as developers delayed projects amidst tepid market conditions. According to URA Realis data, only 248 new non-landed private homes were sold in the CCR during the first nine months of 2024. This figure positions the CCR on track for one of its lowest sales levels on record, with the last comparable low occurring in 1998 during the Asian financial crisis.

Despite this slowdown, prices in the CCR have shown resilience, albeit with slower growth. The URA’s Property Price Index reports that prices in the CCR rose by 1.9% in 2024, matching the growth rate recorded in 2023. Meanwhile, median prices reached record highs, with new non-landed homes averaging $3,246 per square foot (psf) and resale units averaging $2,103 psf as of September 2024.

Spillover Effects on RCR and OCR Markets

Although foreign buyers make up a smaller proportion of overall transactions, their impact on the broader market is undeniable. The demand for high-value properties in the CCR often creates ripple effects in the Rest of Central Region (RCR) and Outside Central Region (OCR). Investors and upgraders who are priced out of CCR properties may turn to these regions, fuelling demand and driving up prices.

This dynamic has contributed to the narrowing price gap between the CCR and surrounding regions. From Q1 2020 to Q3 2024, non-landed home prices in the CCR rose by 15.1%, while RCR and OCR prices increased by 42.2% and 40.6%, respectively. This divergence highlights opportunities for buyers to capitalise on relatively undervalued CCR properties as the price gap narrows.

Balancing Growth with Stability

The Singapore government has adopted a cautious approach to managing its property market, with measures like the ABSD hike aimed at curbing speculative activity while maintaining long-term stability. Minister for National Development Desmond Lee has previously described these measures as “pre-emptive” and necessary to balance local and foreign investment demand.

While these measures have dampened foreign interest in the short term, they also reinforce Singapore’s reputation as a market that prioritises sustainable growth. The government’s proactive stance ensures that the property market remains accessible to locals while continuing to attract foreign capital that aligns with the city-state’s long-term vision.

Broader Economic Implications

Beyond the property market, the influx of foreign capital contributes significantly to Singapore’s broader economy. It supports sectors like retail, hospitality, and education, while enhancing demand for high-value services such as wealth management, legal consultancy, and financial advisory. Singapore’s position as a global wealth hub not only boosts its real estate market but also strengthens its status as a leading destination for expatriates, multinational corporations, and global investors.

Navigating Risks and Opportunities

Despite its strengths, Singapore’s real estate market must navigate challenges, including the potential for a major market correction. Such an event could disrupt financial stability and create ripple effects across the economy. For investors, staying informed about regulatory changes, market trends, and global economic conditions is paramount. Singapore’s ability to balance investor interest with market stability will remain pivotal in maintaining its reputation as a secure and thriving investment destination.

Conclusion: A Resilient Future

Singapore’s residential property market continues to evolve in response to global wealth trends and local regulatory measures. While recent cooling measures have tempered speculative activity, the city-state’s fundamentals remain strong. Its appeal as a safe, stable, and strategically located global hub ensures sustained interest from both local and international buyers.

As the redistribution of global wealth unfolds, Singapore stands out not only as a beneficiary but as a model of how to manage growth while preserving market stability. Investors and homebuyers who recognise these dynamics can seize opportunities in one of Asia’s most resilient and forward-looking real estate markets.

Stay Updated and Let’s Get In Touch

Stay connected with the real estate market. Questions? Do not hesitate to reach out to us!

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.