Industrial real estate investment has been gaining significant momentum among Singaporeans and savvy investors. Unlike residential assets, industrial properties can be purchased without incurring Additional Buyer’s Stamp Duty (ABSD), even when acquired as a second property. This regulatory flexibility, paired with capital accessibility and steady rental demand, positions industrial assets as an attractive alternative—especially for those who are already maxed out on residential holdings or are looking to diversify their portfolios strategically.

For investors seeking yield resilience, inflation hedging, and alternative asset exposure beyond residential constraints, the industrial segment stands out as a robust option.

What are industrial properties in Singapore?

Industrial properties in Singapore serve a broad array of sectors including manufacturing, logistics, e-commerce fulfilment, food processing, software development, and media production. These properties are governed by URA’s 60:40 rule, which mandates that 60% of the built-up area must be dedicated to core industrial activities, while the remaining 40% can be used for ancillary functions like offices, showrooms, and client-facing operations.

This regulatory flexibility significantly enhances the appeal of industrial properties for e-commerce fulfillment providers.

Companies like Beehive Fulfillment, a 3PL e-commerce fulfillment service provider in Singapore, utilise B1 industrial spaces to integrate warehousing, order processing, and administrative functions within a single facility. By co-locating these critical operations, Beehive Fulfillment optimises supply chain efficiency, reduces inter-site logistical costs, and accelerates order fulfillment cycles, all while adhering to URA’s 60:40 usage guideline.

Likewise, other hardware-focused tech firms and e-commerce brands leverage similar B1 spaces, such as those in Kallang or Tai Seng, to consolidate logistics, customer support, and office functions under one roof. And this drives productivity and lowers operational costs.

Classification Overview: B1 vs B2 Industrial

Industrial properties in Singapore are broadly classified into B1 and B2 categories, each catering to different operational intensities and tenant profiles.

B1 industrial properties are zoned for clean and light industrial activities that do not generate significant noise, vibration, or pollutants. They are often situated near residential estates and MRT stations, making them highly accessible and attractive to businesses such as software development firms, creative agencies, design consultancies, and media production companies.

These locations are ideal for tenants that require a blend of technical workspace and front-facing office functions. For instance, many digital agencies and e-commerce platforms operate from B1 facilities in areas like Tai Seng and Ubi, where they benefit from both logistical convenience and cost efficiency.

B2 industrial properties, on the other hand, are designated for heavier industrial use and are typically located in industrial parks such as Jurong Industrial Estate or Tuas. These properties accommodate businesses involved in manufacturing, engineering, automotive repairs, and metal works—activities that necessitate physical separation from residential and commercial areas due to the potential for environmental disturbance. B2 spaces generally have larger floor plates and are better equipped for high-power usage, heavy equipment, and vehicular movement.

Understanding the distinction between B1 and B2 is crucial for investors and end-users alike, as it impacts not only tenant mix and rental potential but also regulatory compliance and long-term asset suitability.

Strata-Titled Industrial Units: An Opportunity for Portfolio Expansion

Strata industrial units allow individual investors to acquire units within larger developments, analogous to owning a condo unit. With quantum often under S$1.2 million and financing available (albeit with slightly stricter LTV and higher cash outlay requirements), these assets are accessible to retail investors and SMEs looking to own rather than rent.

Such stratification allowed business owners and investors to acquire specific units for operational or rental purposes, offering liquidity, flexibility in ownership structure, and direct participation in prime commercial real estate markets.

Different Types of Leases for Industrial Properties

Industrial properties in Singapore are typically sold on leasehold terms, and the lease tenure plays a critical role in investment decision-making. The common tenures available are:

30-Year Leaseholds: Most new government land sales for industrial use are released on 30-year leases. This shift was implemented following a Ministry of Trade and Industry (MTI) announcement in 2012, where the Government reduced the maximum lease term for industrial sites under the Industrial Government Land Sales (IGLS) programme from 60 to 30 years.

This policy was aimed at enhancing land-use flexibility and making industrial properties more affordable to genuine industrialists. The shorter lease structure allows for more regular land redevelopment opportunities while lowering the upfront land cost for occupiers.

60-Year Leaseholds: Older industrial developments may come with 60-year leases, offering a more balanced horizon between affordability and asset longevity. Investors favour these for better resale value and longer holding periods.

Freehold Industrial Properties: Rare and typically transacted at a premium, freehold industrial assets are highly sought after due to their perpetual ownership structure. These are often legacy assets or exist in specific pockets of the city.

Investors are advised to assess remaining lease tenure critically, especially for resale and financing considerations. As a rule of thumb, the closer a property’s remaining lease approaches 30 years or below, the more restricted it becomes in terms of loan quantum and buyer pool.

Bird’s Eye View on Profitability Analysis

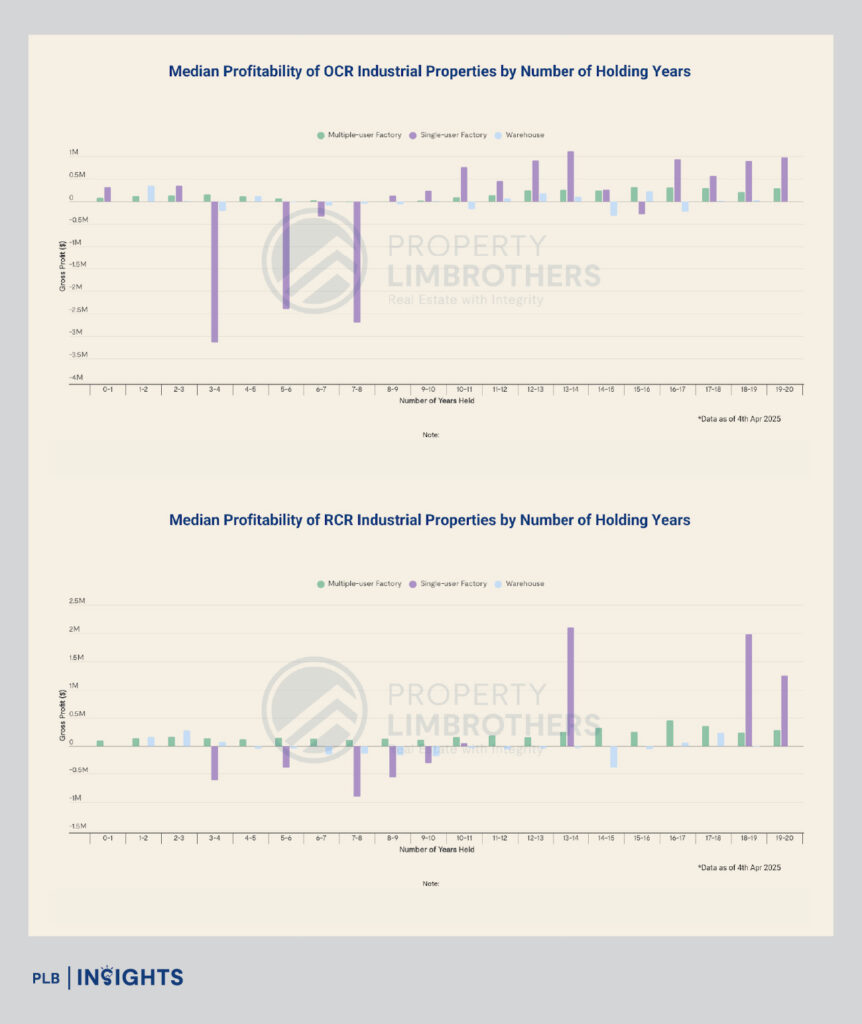

The chart highlights that profitability in OCR and RCR industrial property is not linearly linked to holding period, contrary to traditional expectations of capital appreciation over time.

Notably, certain shorter holding durations such as 3–4 and 5–6 years resulted in substantial losses, especially among Single-user Factories, where median losses exceeded $3.5 million in OCR. Even properties held for longer periods, including over 15 years, do not exhibit consistently superior returns, suggesting that the time held alone is not a reliable predictor of profitability.

Instead, external factors such as asset type, property cycles, policy changes, and macroeconomic conditions play a far more decisive role. Among the asset classes, Single-user Factories demonstrate the highest volatility, with returns ranging from extreme losses to the highest median profits.

In contrast, Multiple-user Factories and Warehouses exhibit more stable, albeit modest, performance, reinforcing that profitability is shaped by a confluence of variables—asset characteristics, economic cycles, and strategic timing—rather than holding duration alone.

Case for Timely Entry: Pandemic Purchases Outperform

The COVID-19 pandemic in 2020-2021 severely disrupted global economic activity, sparking uncertainty across asset classes. Singapore’s industrial real estate sector experienced a temporary pullback as businesses reassessed space requirements, supply chains stalled, and investment decisions were deferred. During this period, prices for strata-titled industrial units softened, and market sentiment weakened—creating a narrow but valuable window for contrarian investors.

Buyers who entered the industrial property market during this downturn—such as those who acquired units at Vertex or Midview City—benefited from attractive entry prices and minimal competition. As the economy rebounded in 2023-2024, driven by the resurgence of e-commerce, advanced manufacturing, and logistics activity, these early movers recorded robust capital gains over a short 3-year horizon. In some cases, price appreciation exceeded 20-25%, validating the principle that opportunity often lies in volatility.

This episode underscores the cyclical and resilient nature of industrial real estate. Investors who adopt a long-term, data-driven approach and act decisively during periods of market dislocation are better positioned to outperform over the investment cycle.

Cash Flow and Rental Yield: Realistic Outlook

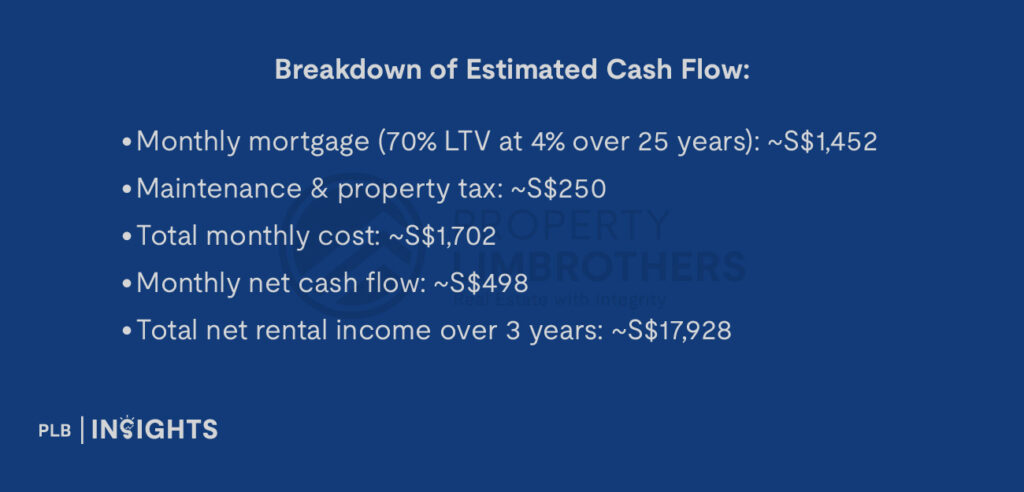

Understanding the cash flow and yield potential of industrial assets is key for any investor. Let’s take a real-world case study to examine performance in a high interest rate environment.

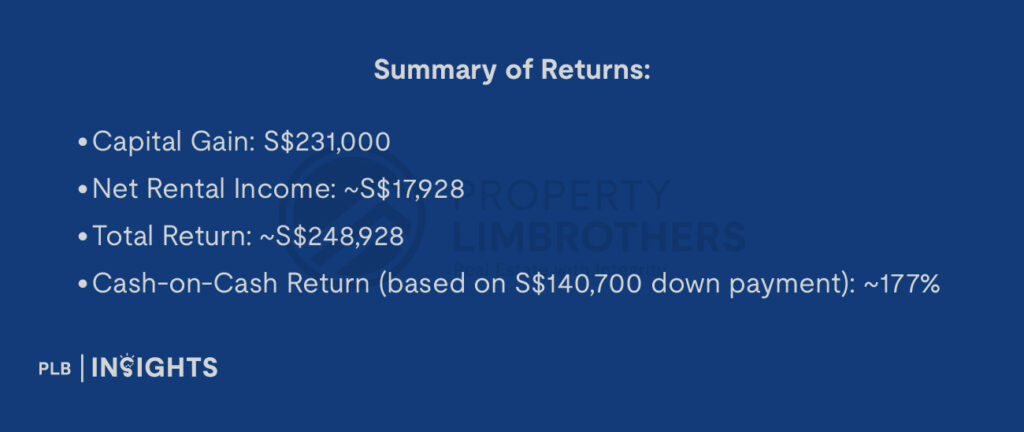

Case Study: 10 Ubi Crescent #02-XX

Purchased in 2021 for S$469,000 and sold in November 2024 for S$700,000, this B1 industrial unit delivered a substantial capital gain of S$231,000 in just under three years, based on URA Realis data. Assuming the unit was tenanted consistently at an approximate conservative monthly rent of S$2,200 (estimation based on market rate), yielding a total gross rental income of approximately S$79,200 over the holding period.

From this, we observe that low-quantum industrial properties can offer not just stable rental income, but also outsized capital appreciation when entry is at an opportune time. The gross rental yield, calculated at approximately 5.6%, is notably strong for a B1 unit—outperforming many residential rental yields in the same market window.

A Nuanced Landscape

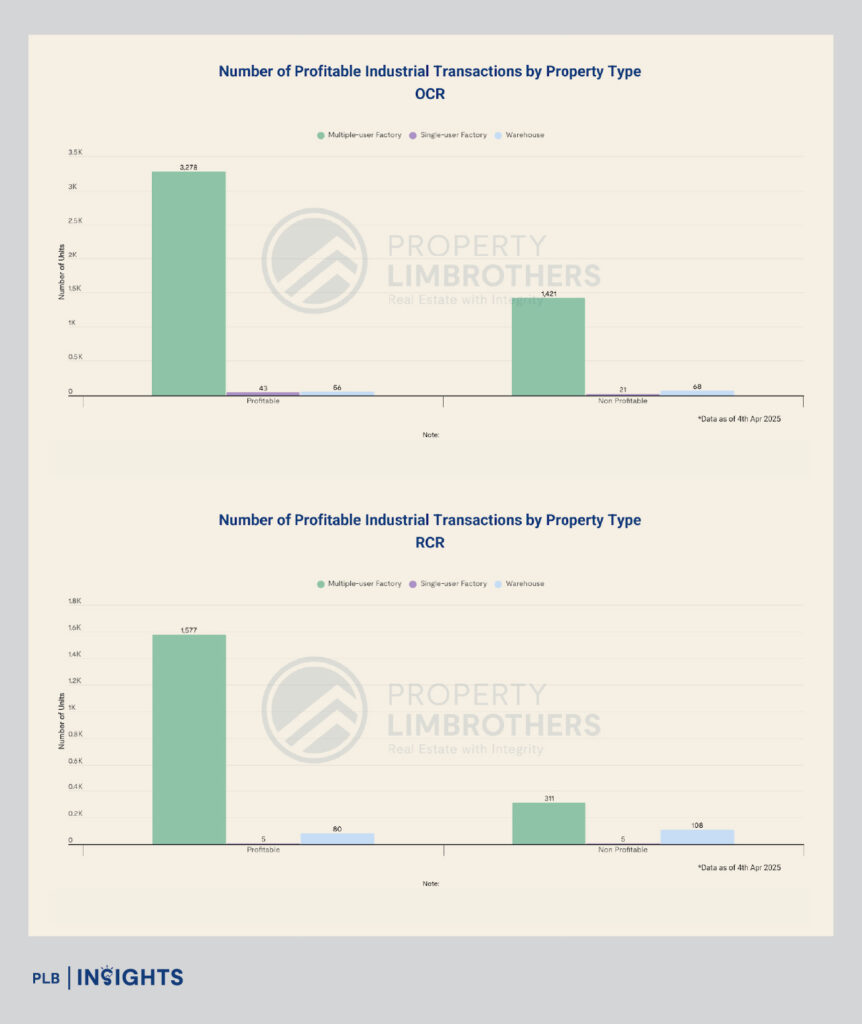

While industrial properties show greater variance in profitability compared to residential properties, opportunities still abound with strategic entry. Based on recent URA transaction data, industrial investments—especially in multiple-user factories—have generally performed well, but not universally.

When analysing by profit quantum, the majority of gains across both OCR and RCR fell within the S$100K–S$300K range. However, non-profitable sales still accounted for over 1,500 units in OCR and over 400 units in RCR, revealing the asymmetry in performance within the industrial segment.

These findings emphasise that success in industrial property investment is not guaranteed. Property cycles, asset selection, entry pricing, and holding strategy all contribute materially to investment outcomes. For investors, this data-driven nuance reinforces the need for due diligence, conservative financing, and strategic patience to optimise returns in the sector.

Who Should Consider Industrial Property in 2025?

The case for industrial investment in 2025 is particularly strong for select investor profiles. Below are three key groups that may stand to benefit the most:

1. Business Owners

- Ideal for entrepreneurs looking to convert rental liabilities into asset ownership.

- Provides flexibility to co-locate warehousing, operations, and admin functions in a single facility.

- Potential for subletting surplus space to generate secondary income.

2. Cash-Rich Investors with 2 Residential Properties

- Already maxed out on residential quota and subject to ABSD.

- Industrial offers a route to acquire another property without incurring additional stamp duties.

- Suitable for long-term asset diversification, with options to deleverage or refinance depending on rate cycles.

3. HDB Owners Seeking a Second Asset

- As decoupling is not permitted for HDB flats, owning a second residential property would incur ABSD.

- Industrial assets provide a workaround for wealth-building without disrupting existing home ownership.

- Cannot decouple from HDB.

- Industrial property becomes a viable investment alternative.

Strategic Outlook: 2025 and Beyond

Industrial property investment in Singapore is not without risk, but the segment’s long-term fundamentals remain solid. With the government investing in eco-districts, logistics hubs, and digital infrastructure, demand for industrial space will likely deepen.

For discerning investors willing to do the groundwork and analyse the market, industrial property offers a favourable combination of affordability, rental yield potential, and asset ownership.

Stay Updated and Let’s Get In Touch

Keen to explore specific projects, leasing trends, or entry opportunities? Reach out to our team for a detailed consultation tailored to your investment profile.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. While every effort has been made that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be executed, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this website or for any resulting loss or damage suffered by the recipient or any other person.