In this article, we will be diving deep into the different types of interest rates that you should be looking out for when receiving a mortgage loan letter of offer. We have realised that home buyers are usually confused between a fixed interest rate package and a floating interest rate package.

We will outline the main differences between a fixed and floating interest rate, their respective advantages and disadvantages, and which packages will be more suitable for you in different circumstances.

Components of a Mortgage Loan Letter of Offer

1. Mortgage Interest Rate

Interest rate refers to the amount of money paid on top of the loaned amount as a “premium” for borrowing money from the bank.

2. Loan Amount

The Loan amount refers to the amount of money a party has borrowed from a lender and is obligated by law to repay it in full.

3. Tenure of Loan

The tenure of a loan refers to the period of the housing loan.

4. Lock-In Period

The lock-in period is the period of time when the tenure of a home loan in which repayment of the loan would result in penalty charges incurred to the borrower.

5. Maturity Date

The maturity date refers to the date on which the principal loan amount becomes due. In other words, the loan must be paid back in full by this date.

Fixed Interest Rate vs Floating Interest Rate

Fixed Interest Rate Package

Fixed Interest Rate mortgages have their interest rates pegged to the bank’s fixed deposit rates. The respective banks determine these rates and are not pegged to any market index (such as SIBOR or SORA).

Although typically higher than floating rates, this is the trade-off for having stability in interest rates as the mortgage will have a locked-in rate for the duration of the lock-in period, and will not change regardless of market conditions.

However, this would also mean you would be “locked into” the bank you are borrowing from and the interest rate you signed off on.

This brings us to the advantages and disadvantages of Fixed Interest Rate Packages.

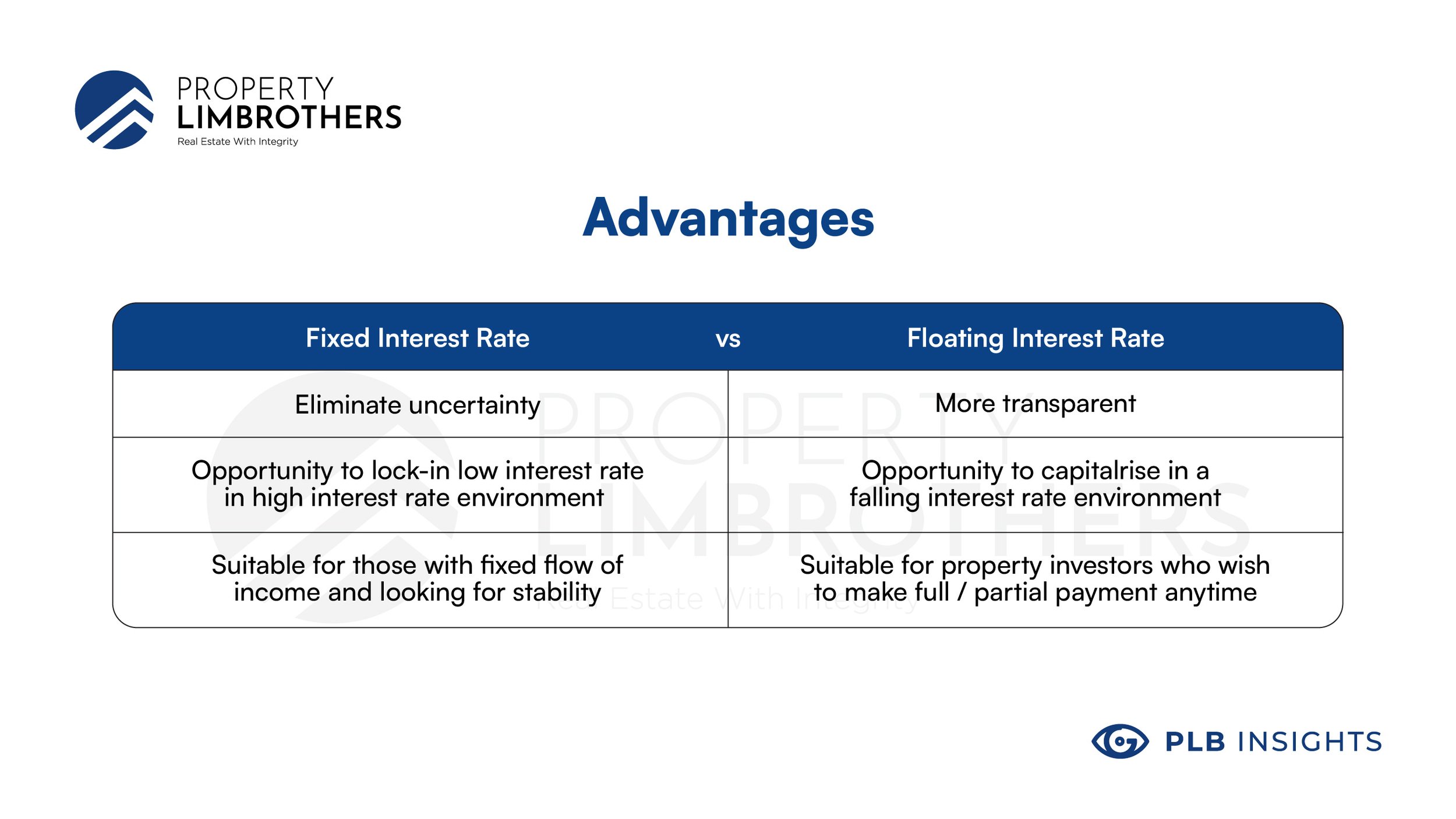

Advantages of Fixed Interest Rate Package

-

Elimination of Uncertainty

No matter how the interest rate environment were to change, you will be paying a fixed interest rate for the specified lock-in period of your loan.

-

Opportunity to Lock In Low-Interest Rate in a Rising Interest Rate Environment

Locking in on a low-interest rate benefits home buyers in a rising interest rate environment as you would be paying less interest than the market benchmark.

For example, if you were to sign a mortgage loan package with the bank at a 2.5% fixed interest rate for a lock-in period of 2 years. Even if market interest rates were to move much higher, hypothetically 2.8% or even 3%, you will remain paying only a 2.5% fixed interest rate. In other words, paying less on mortgage interest rates in a rising interest rate environment.

-

Suitable for those with a Fixed Flow of Income and Looking for Stability

A Fixed Interest Rate Package is more suited for those risk-averse and looking for stability in interest rates. As the name suggests, one subscribed to a Fixed Interest Package will not experience any fluctuation in interest rates.

Some home buyers previously subscribed to a floating interest rate switch to a fixed rate package so they can better plan and manage their long-term finances.

Disadvantages of Fixed Interest Rate Package

-

Slightly Higher Interest Rate

As mentioned earlier, rates are usually higher as you are made to pay a “premium” for that certainty in your monthly mortgage instalment.

-

Unable to make Partial Capital Repayment during Lock-In Period

Banks will usually put in a clause whereby borrowers cannot reduce any of the capital repayment for interest rates to be locked for the specified periods.

However, banks have been starting to offer more flexibility in allowing for partial repayment of capital in recent times. This is subjective to the bank and package you have subscribed for.

-

Lose Out in a Falling Interest Rate Environment

Locking in on interest rates is a double-edged sword as home buyers in a falling interest rate environment would end up paying more interest as compared to the market benchmark.

For example, if you were to sign a mortgage loan package with the bank at a 2.5% fixed interest rate for a lock-in period of 2 years. Even if market interest rates were to move much lower, hypothetically 2.3% or even 2%, you will remain paying only a 2.5% fixed interest rate. In other words, paying more on mortgage interest rates in a falling interest rate environment.

Floating Interest Rate Package

Floating Interest Rate mortgages have their interest rates pegged to a fluctuating index. The most common index rates are namely the SORA, SIBOR and SOR rates.

The Floating Interest Rate is usually determined as follows

The bank spread refers to the difference between the interest rate that a bank charges a borrower and the interest rate a bank pays a depositor; this is typically how banks earn a profit by borrowing money.

From 2021 onwards, banks have switched to Singapore Overnight Rate Average (SORA) as the new benchmark index to comply with Monetary Authority of Singapore (MAS) regulations. SIBOR and SOR mortgage loans will be a thing of the past.

SORA is a more resilient index as compared to SIBOR and SOR, which have allegedly been susceptible to manipulation.

SORA is determined by the volume-weighted average rate of borrowing transactions in unsecured overnight interbank SGD cash market in Singapore.

Most current Floating Interest Rate Packages are pegged to the SIBOR index. However, this would be phased out eventually by 2024. If you are currently subscribed to a SIBOR-pegged loan, you will eventually be switching to a SORA-pegged loan once your loan period ends.

Currently, one can mainly choose between a 1-month compounded SORA or a 3-month compounded SORA. This means that your interest rate will respectively fluctuate either monthly or quarterly.

Advantages of Floating interest Rate

-

More Transparent

-

Borrowers are able to source the information online. Information regarding SIBOR can be found on the Association of Singapore website.

-

The Monetary Authority of Singapore(MAS) posts the SORA for a given business day in Singapore by 9 am the next business day on the MAS website and through third-party redistributors.

-

-

Opportunity to Capitalise in a Falling Interest Rate Environment

With the interest rate fluctuating according to the Interest Rate Environment, those signed to a floating interest rate package stand to gain in a falling interest rate environment as they would pay less interest on their principal loan amount.

-

Suitable for Property Investors who wish to make Full/Partial Payment Anytime

A floating interest rate package is suited for property investors looking to minimise the interest paid while waiting for their property to appreciate in price and sell it within a period of time.

Disadvantages of Floating interest Rate

-

Fluctuations in Loan Monthly Instalments

As the name suggests, the interest that you pay on your monthly instalments depends on the interest rate environment; as such, it is bound to fluctuate.

-

Higher Spread typically after 2-3 years.

Banks typically charge a higher spread as the number of years increases to gain a more significant profit; this would mean paying more interest as a home mortgage borrower.

-

Lose Out in a Rising Interest Rate Environment

And, of course, a rising interest rate environment would result in higher interest paid on floating interest rate packages.

Ways to Reduce Interest Paid on Mortgage Loans

1. Refinance Home Loan to a lower interest rate

By refinancing your home loan, you can get a lower interest rate and thus lower your monthly mortgage instalments and, therefore, overall break-even price.

Pro tip! Your refinancing window starts 4 months before your existing home loan renews. Banks often require a 3-month notice before you refinance and switch to another bank, hence it is important to know when your lock-in period will end in order to plan ahead and prepare for the refinancing process.

In the following example, we take a look at what would happen if you were to be able to refinance your mortgage interest rate from 2.5% to 1.6%.

For example,

As seen from the 2 graphs above, the Singapore Interbank Offered Rate (SIBOR), the benchmark interest rate for lending, has been falling in recent years. Thus by converting from a fixed interest rate to a floating interest rate (vice versa), one would be able to secure a loan with better interest rates.

A fixed interest rate package has its interest rate locked in for a certain period. Although it is more stable, the interest rate is slightly higher compared to a floating rate package.

Hence changing to a floating rate home loan which has its interest rate pegged to the SIBOR could benefit you in terms of paying less interest.

However, those tied to a floating rate may want to change to a fixed rate package to better plan and manage their long-term finances. Those who have also researched SIBOR rates can switch to a fixed rate if they expect the benchmark to inflate in the near future to lock in lower interest rates.

2. Shortening Home Loan Tenure

Suppose your financial status allows you to afford a higher monthly instalment. In that case, you could take advantage of it by taking a lower loan tenure, resulting in paying less interest on the mortgage.

For example,

To summarise, the idea of reducing your breakeven price follows the principle of lowering the amount of money spent on interest paid on mortgage loans.

Conclusion

Both fixed and floating interest rate packages have their individual merits and cons. Thus it would be best to deliberate which is the most suitable for your situation in terms of your objectives and the inflation rate environment.

Fixed interest rate packages, in essence, offer more stability and predictability when it comes to the amount you pay in interest. They are also beneficial in a rising interest rate environment by helping to lock in a low-interest rate. This could be especially useful now!

In major economies such as the USA and Europe, consumer prices are already growing at their fastest pace in decades.

With prolonged supply chain disruptions contributing to higher inflation this year and declining jobless rate on track to accelerate taper (unemployment rate in the US has fallen to 4.2% compared to 4.6% in October).

The Fed officials are making plans to accelerate the process of ending the pandemic-era stimulus program at their policy meeting on December 14th, taper bond-buying by March instead.

This tapering refers to the gradual slowing down of purchases of securities and bonds — a slowdown that, the Fed says, will begin at some point soon. This, in turn, will increase long-term inflation rates, ultimately affecting mortgage interest rates in Singapore. (If you would like to find out more about rising interest rates and debt among Singapore households, do head over to this article!)

On the other hand, Floating Interest Rate offers greater flexibility and transparency. They would also be beneficial in a falling interest rate environment as it would reflect in a smaller interest being paid on your mortgage!

Need more guidance? Feel free to reach out to our PropertyLimBrothers Buyers’ Consult team. Click here to contact us now!

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.

Interested in finding out whether to utilise your CPF for your down payment? We delve into that in our insights article here!

Curious to find out what factors you should consider when estimating an appropriate property’s monthly instalment? We delve into that in our insights article here!

To check out our Investors Series Season 1, click here! And for Investors Series Season 2, click here!