Evergrande. The largest private sector Real Estate Developer in China by sales. But it’s also the world’s most indebted developer. With total liabilities amounting to $300,000,000,000 ($300 Billion). Officially defaulting on their debts on 9 December 2021 and are prepared to enter a debt restructuring process as an alternative to bankruptcy.

This story isn’t just about Evergrande, but also the rippling effects it has had and will continue to have on the rest of the real estate sector. Not just in China, Not just in South-East Asia, but the world.

What exactly is going down in the Evergrande Crisis?

Image courtesy Getty Images

Have you ever missed a debt repayment? Individual debts are consequential enough as interests snowball and threaten personal security and asset ownership. But what happens when one of the world’s largest companies fail to make their repayments in time?

Founded by businessman Hui Ka Yan (once crowned Asia’s richest person) in 1996, Evergrande, through its aggressive borrowing from investors, expanded to become one of China’s largest companies. In a loosely regulated market, Evergrande Real Estate established itself across 280 cities in China, having more than 1,300 projects under their belt. Beyond their real estate arm, Evergrande also provides wealth management services and manufactures everything from food and drinks to electric cars. We were a little surprised to read that the company even dabbles in managing professional sports teams, having one of the country’s biggest football teams – Guangzhou FC, under their wing.

Even the best laid plans of mice and men often go awry – what less a plan that encompasses audacious borrowing from investors around the world? Failing to repay an $83.5 million interest payment in September 2021, the company narrowly escaped default by making the payment just as the 30-day grace period approached. A second overdue interest payment of $45 million was also made later in October, delaying what some may call the inevitable – Evergrande’s steady and catastrophic journey to the largest debt default by a company in Asia, realised in December 2021 after a failure to meet their interest payments.

Why is this important, much less relevant?

Further away from home, this Evergrande crisis could mean severe personal loss for individuals and families. Paying deposits for promised homes that now remain in precarious situations, the families who have bought in projects by Evergrande risk losing their initial deposits which could be devastating to one’s personal economy.

More critically, this default can have serious repercussions on firms that hold a relationship with Evergrande. Businesses that supply to Evergrande, including construction companies and material suppliers, now face the predicament of losing major projects, which could force them into bankruptcy.

The Evergrande crisis is drawing attention to the government’s intervention in other indebted companies. Apart from Evergrande, other Chinese developers have defaulted, divulging the fragility of China’s property sector.

-

Sunshine 100 China holdings defaulted on US$178.9 million (S$245 million) of debt and interest payments due Sunday (Dec 5)

Saliently, the default of such a huge company inevitably foreshadows a credit crunch in China, where banks and lenders who have interest repayments tied up with Evergrande struggle to sustain lending at previous rates. The reduction in lending activity or tightening of requirements for loans will result in slower growth for up and coming companies or companies who rely on these loans to operate.

The First Cracks in the Chinese Property Sector

Closer to home then, the collapse of the property sector in the world’s second biggest economy has, surely dampened the trust and confidence investors have in the Chinese Real Estate market at the moment.

Acknowledging this in mind, investors are scouring for the place to shift their focus over, but where to?

Based on PWC’s research on emerging trends in real estate in the Asia Pacific, Singapore ranks second in city investment prospects as it has successfully established itself a reputation for neutrality in an increasingly polarised world, drawing investments from world powers, from powers on opposite ends of the spectrum.

This is representative of past investor behaviour, especially during the Covid-19 pandemic. Valuing the Singapore government’s strong and fastidious response to Covid-19 and our reputation for being highly effective with low corruption, Singapore has gained international attention as a safe haven for property investment at the height of the pandemic. Faith in the Singapore economy to our gain in currency strength post-pandemic compared to our Asian counterparts helped foreign clients to remain undeterred despite high Additional Buyers’ Stamp Duty (ABSD) rates.

There are also other features of Singapore’s Real Estate Market that give confidence to foreign investors.

Singapore’s Real Estate Market Strengths

Singapore’s Governance

Singapore’s government is its worst kept secret as to why Singapore flourishes as a nation. The government has been monumental in the creation and growth of industries and business but what has it done for the development of our real estate market?

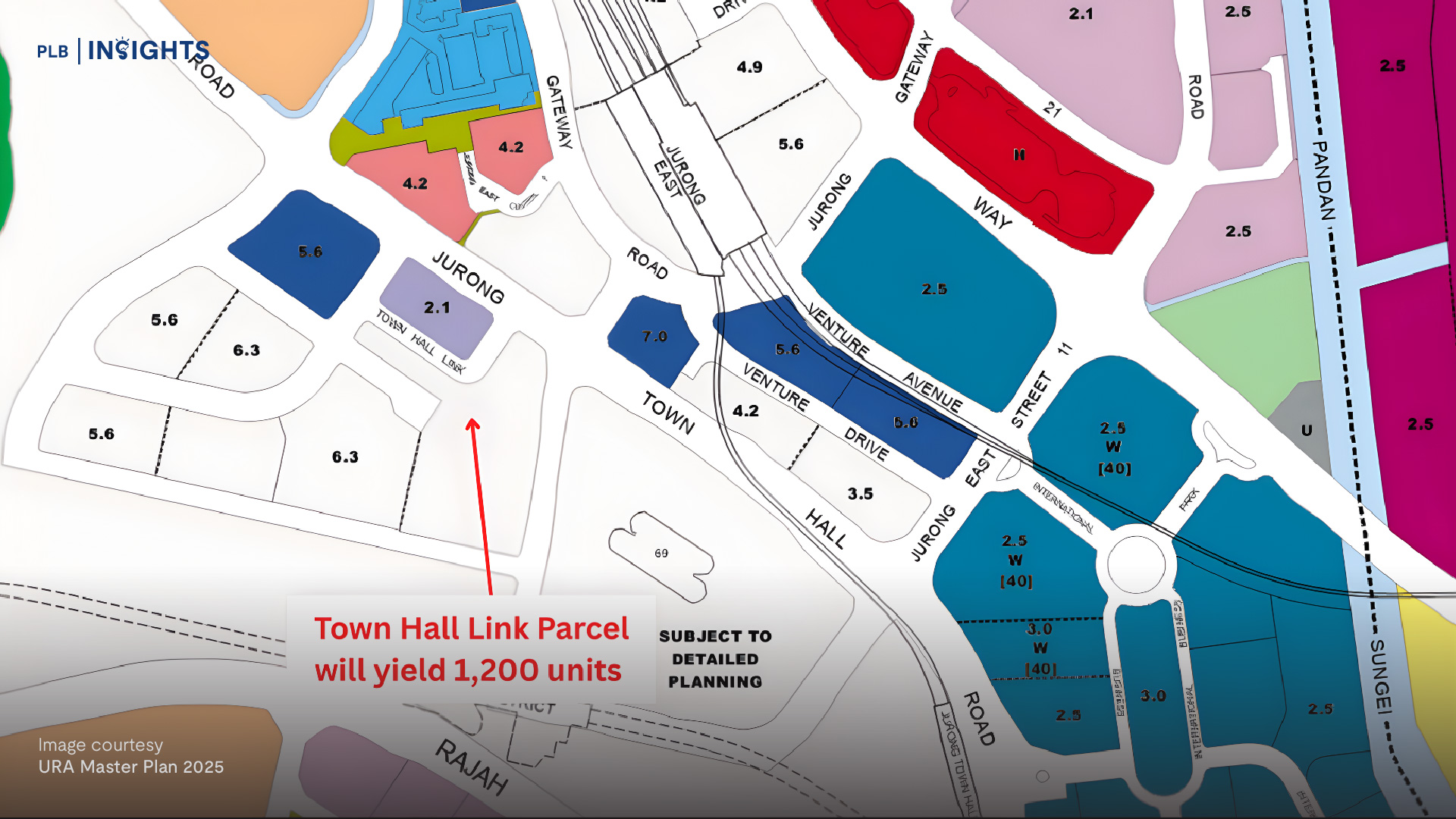

The URA Master Plan

Image courtesy URA

With the little red dot nation that we are, land is scarce and is a premium resource , hence to facilitate the needs of a growing and thriving metropolis, the Urban Redevelopment Authority (URA) of Singapore got down to business in ensuring that our land usage is maximised efficiently.

For the real estate investor, the URA Master Plan provides clues to the potential changes in Singapore’s urban landscape in the future. Using such information, investors gain the power of foresight in estimating future developments and hence plan their property purchase to ensure capital appreciation.

Make Love not War (Nation’s Neutrality)

Having been forced into independence by expulsion from the Federation of Malaysia, the newly independent Singapore was faced with several potentially existential threats. Singapore’s small size and close proximity to the much larger Malaysia and Indonesia threatened the existence of Singapore.

Thus from the early days of independence, Singapore positioned itself as the Switzerland of Asia – forming diplomatic ties with every nation who was willing to. Singapore today has been successful in balancing between its diplomatic ties and remains disciplined in its neutrality.

In not having to choose sides, Singapore has been able to benefit from both. As a result, Singapore has managed to steer clear of all wars, and have set up multiple bilateral and regional free trade agreements.

Regional powerhouse

With most multinational companies choosing Singapore as their Asian headquarters, Singapore accounts for more than half of Asia’s regional headquarters – 59% to be exact. It is no wonder why there is a large buyer’s and renter’s pool in Singapore, and not forgetting, that this is on top of growing demands from our growing population.

But why is Singapore a regional powerhouse? What is Singapore’s “secret power”?

Location, Location, Location

Image courtesy Singapore Company Incorporation

Singapore’s strategic location in the heart of Asia entices businesses to set up shop in Singapore to access the Asian region’s rapidly growing markets.

Not only is Singapore located only by a seven hour flight to all emerging Asian markets, Singapore is also a premier global hub port connected to 600 ports in over 120 countries as an added benefit of being located on the crossroads of the East-West sea trade.

Its opportune location thus makes Singapore one of the most ideal places for setting up a regional headquarters in Asia, or even for start ups looking to kickstart their growth.

Being engulfed in a shield by neighbouring countries, Singapore is safe from natural disasters which is definitely an added bonus for real estate investors as they do not need to worry about unpredictable weather events that may jeopardise their property.

Tax haven on Earth

Singapore corporate income tax stands at 17 percent, and is further lowered by the numerous incentives, tax breaks and tax exemptions put in place to entice more businesses to set up here in Singapore. Making Singapore the ninth largest tax haven in the world according to Tax Justice Network’s Corporate Tax Haven Index 2021.

The table below shows a comparison of taxes between countries in the Asia Pacific that listed high on city investment prospects.

It is worth noting that capital gains from the sale of a property in Singapore is not taxed in Singapore, benefitting investors as they get to keep all their capital appreciations.

Chapalang, Melting Pot of a Country

Image courtesy PSD

Chapalang? Say what? Chapalang is a colloquial term which means a culmination of various components, usually at random; originating from the Hokkien words 食飽人 (tsia̍h-pá-lâng).

But, Singapore’s multicultural and multi-religious country is by no means random, it is by design of the Singaporean identity. In the past, Singapore paid a huge price for segregation. Poor living conditions, soaring unemployment, and social unrest. Life in Singapore, as we know it, is disparately different from what our ancestors experienced 50-60 years ago.

Under the leadership of the late Mr. Lee, the newly formed government following Singapore’s independence was determined to eradicate segregation among our communities through building a multicultural and multi-religious community where all Singaporeans are equal before the law regardless of race, language or religion.

This melting pot culture simply can’t be found elsewhere, together with the peaceful harmony between culture, ethnicities and religion. It is truly a sight to behold. For foreigners living in Singapore, it’s almost like a home away from home.

That being said, Singapore is also one of the few countries where most are bilingual, making it easy for foreigners migrating here to communicate with the locals.

Closing Thoughts: The Little Red Dot

The Evergrande crisis has brought light to the importance of governance in supporting a healthy and flouring real estate market. Although many are affected by the litigation of the Chinese Real Estate market, hopefully this event will only stand to strengthen their market for the future.

However, this crisis may bring many foreign investors into Singapore, which stands as an extremely well positioned market in terms of having a strong governance backing the market.

For more information on what Foreigners can purchase in Singapore, read our article on “The Basics of Buying Real Estate in Singapore as a Foreigner. What properties am I eligible for?”.

To gain insight as to how Singapore has developed its real estate market over the years, read our article on “The History of Growth in Singapore’s Real Estate Market”.

This article is written in conjunction with our #InvestorsSeries on Youtube. We drop nuggets of wisdom for you to learn more about Singapore’s property market! From frequently asked questions to market analysis, we’ll take you through them all with the PropertyLimBrothers team.