In a significant step to support young Singaporeans in achieving their home ownership goals earlier, the Housing and Development Board (HDB) will ease income assessment criteria for Build-To-Order (BTO) HDB flats, a move set to widen access to larger and better-located homes for newly forming households.

Announced on March 26 2025 by Minister for National Development Desmond Lee, the enhanced Deferred Income Assessment scheme will take effect from the upcoming July 2025 HDB BTO exercise. The new rule allows young couples—where just one party is a full-time student or serving National Service (NS)—to defer their income assessment to just before key collection, rather than during flat application.

This expands on the current framework, where both individuals must either be studying or serving NS full-time, or have completed their studies or NS within the past 12 months.

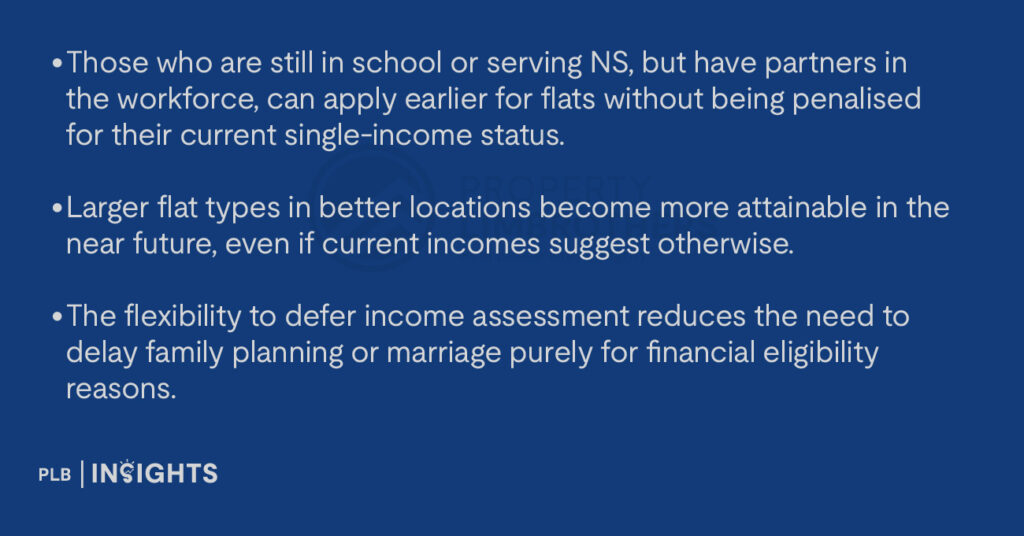

The policy tweak may seem subtle at first glance, but its implications are far-reaching. By delaying the income assessment, these couples can qualify for higher housing loans and grants at a later stage—when both partners are likely to be employed full-time and commanding higher combined incomes.

New HDB Rule Gives Young Couples a Head Start on Bigger BTO Flats

The move signals a shift towards greater flexibility in how the government supports housing aspirations, especially for young couples who are early in their careers. Traditionally, such couples often find themselves priced out of 4- or 5-room flats, especially in central or city-fringe locations, due to limited borrowing capacity based on current income levels.

Under the expanded scheme, a couple with a modest household income today can book their BTO unit early, and then assess their eligibility for housing loans and CPF grants closer to key collection—potentially three to four years later, when their financial standing has improved.

Minister Lee cited a scenario to illustrate the point: a couple where one party is still in school and the other is drawing a monthly income of $3,500 may previously only qualify for a three-room flat in an outlying area. With the new scheme, this same couple could qualify for a housing loan to support a four- or five-room unit, assuming their combined income reaches $7,500 closer to key collection.

This change is particularly significant in the context of Plus and Prime flats, which tend to be located nearer to transport nodes and the city centre. Such flats typically command higher prices and tighter resale restrictions, but are desirable for couples seeking long-term convenience and accessibility.

Greater Inclusivity Without Compromising Affordability

The deferred income assessment scheme was first launched to assist young couples who were not yet financially ready but wished to secure a home. This latest revision makes it more inclusive—opening doors for more varied life paths and timelines, while still upholding prudent financial planning.

Crucially, the change doesn’t lower the bar for affordability but shifts the timing of assessment to a more realistic point in the couple’s journey. This ensures that buyers are still borrowing within their means, just with a more forward-looking view of their income trajectory.

Moreover, the government has reiterated its commitment to maintaining affordability through the new BTO flat classification framework, which segments projects into Standard, Plus, and Prime categories. While Plus and Prime flats come with stricter Minimum Occupation Periods and resale conditions, they are also priced with market discounts and additional subsidies for eligible first-timers.

Growing Supply of Flats with Shorter Waiting Times

Coinciding with this policy shift, the government will also ramp up the supply of BTO flats with waiting times of under three years. Between 2025 and 2027, 12,000 such units are slated to launch—more than the total launched in the past five years combined.

This comes amidst efforts to bring the median BTO waiting time down to under four years, with 3,800 flats with shorter waiting times already planned for launch in 2025. Projects such as Sin Ming Residences in Bishan, and developments in Bukit Batok, Sengkang and Woodlands, reflect the growing availability of faster-turnaround options.

Shorter waiting times combined with more flexible income assessment offer a compelling value proposition for young couples who wish to settle down quickly and plan ahead for family formation.

Addressing Concerns Around Affordability and Resale Trends

Minister Lee also took the opportunity to address growing concerns about the affordability of public housing, particularly in light of recent news surrounding million-dollar HDB resale transactions.

He reaffirmed that BTO flats are deliberately priced below market value, with significant subsidies applied before grants are even factored in. Citing the February 2025 BTO exercise, he noted that four-room flats were generally priced between $350,000 and $650,000 depending on location—well within reach for most young couples with a few years of full-time work experience.

Furthermore, the Standard, Plus and Prime classification system serves to contain the “lottery effect” often associated with buying flats in prime locations, by ensuring resale conditions are aligned with the intention of owner-occupation rather than investment speculation.

These policy levers work in tandem to support a sustainable public housing ecosystem—where genuine home seekers are prioritised, and upward mobility is not dependent on securing windfall gains from resale appreciation.

What This Means for Buyers

With the new Deferred Income Assessment expansion, young couples can now approach their home-buying journey with more confidence and less compromise.

At the same time, couples must remain mindful that this is not a blank cheque. Loan eligibility and grant amounts are still assessed closer to key collection, which means financial discipline and long-term planning remain critical. But with the revised framework, couples have a longer runway to build up their earning power—without losing out on their preferred unit types or locations.

Looking Ahead

This is the latest in a series of targeted housing policies aimed at ensuring that public housing remains inclusive, affordable, and relevant to Singaporeans across life stages. By continuously refining schemes and frameworks, the government is sending a clear signal: housing policy will evolve in tandem with the aspirations of the next generation.

For now, the July 2025 BTO exercise will mark the first implementation of the new Deferred Income Assessment rules. And with a growing supply of shorter-wait flats coming onstream, young couples may find that there has never been a better time to take that first step toward home ownership—on their own terms.

Have questions about how this policy change could affect your home buying journey? Connect with our sales consultants for personalised advice and guidance tailored to your situation.