Are you outgrowing your BTO flat and thinking of upgrading to a condo? Is it even financially possible? It may not be as complicated as you think it is. However, to remain financially prudent, we would want to consider the numbers involved in selling and upgrading to a condo.

Before anything, are you eligible to sell your HDB?

For your existing HDB property, you will only be allowed to sell if the Minimum Occupation Period (MOP) has been completed. This rule implemented by HDB is to ensure that HDB’s primary purpose remains to provide affordable public housing instead of serving as an investment piece by preventing people from buying resale flats and reselling them for higher prices immediately.

The MOP is typically five years for most BTOs, DBSS and Resale flats. However, the exact MOP for different flat types bought under different schemes may differ. Should you still be uncertain, do check out the exact details pertaining to your specific circumstances over at the HDB Site.

Below we have listed a rough guide to the MOP for 2-room HDB flats and bigger:

Even if you are not yet eligible, it is always a good idea to plan ahead if your goal is to ultimately upgrade to a condo after the end of your MOP!

Sell First or Buy First?

Buying the condo first, or selling the HDB first have huge impacts on how you finance your new condominium significantly.

There could be instances where buying the condominium first would make more sense for you. For example, you may have already found a condo that fits your requirements and want to secure it before others do. Or maybe you do not want to go through the hassle of finding accommodations during the transition.

Whatever the case, the last thing we want on our hands is to have lost the intended unit because of waiting to sell the HDB first or selling first only to realise that there is nothing you intend to buy.

Should you be buying the condo first, you would be subjected to the terms for a second housing loan for your Loan-To-Value (LTV) and cash down payment.

You would also be liable for Additional Buyer’s Stamp Duty (ABSD). If you have contracted to sell your only apartment (HDB) before you execute the Acceptance to the Option to Purchase for the condominium, you do not need to pay ABSD. However, if you have not contracted to sell your apartment, your condominium purchase will be your second property on which you need to pay ABSD according to your specific circumstances.

Unlike private property, where it may be common to decouple to avoid ABSD, HDB decoupling has been restricted from 1st April 2016. Decoupling of HDBs is only allowed under specific situations — marriage, divorce, death of an owner, financial hardship, loss of citizenship and medical grounds.

The only workaround ABSD is if the initial purchase of the HDB was made under one party’s name, with the other party listed as an essential occupier. The couple can then purchase the condominium after fulfilling the MOP while not incurring ABSD as the essential occupier would be regarded as a 1st-time buyer.

Furthermore, since the essential occupier is not a borrower for the current HDB flat, they can be granted a higher loan quantum by the bank as the terms for a first housing loan for Loan-To-Value (LTV) of 75% would be applied.

The case would be more straightforward if you decide to sell your HDB first or have already done so. In which, there would be no ABSD, and you would be eligible for a higher loan quantum as you would qualify for the terms for “first housing loan” for your Loan-To-Value (LTV) and cash down payment.

So do I have enough to upgrade to a Private Condo?

Firstly we have to calculate the estimated sales proceeds from selling your HDB. To do that, we would need to find out the following components:

-

Estimated sale price of HDB

-

Outstanding mortgage loan

-

CPF utilised plus accrued interest

-

Legal fees

-

HDB Resalenet Fees

-

Property agent commission

1. Estimate Sale Price of HDB Flat

The sale price of your HDB can be estimated by referencing the HDB Resale Median Prices. Below we have included a table of Median Resale Prices for Registered Resale Applications (3rd Quarter of 2021)

(-) indicates no resale transactions in the quarter

Asterisks (” * “) refer to cases where less than 20 resale transactions in the quarter for the particular town and flat type. The median prices of these cases are not shown as they may not be representative

2. Outstanding Mortgage Loans

If you have taken a HDB housing loan, you can check your outstanding loan through My HDBPage by logging in using your SingPass.

You can take the following steps to check your outstanding loan:

Step 1: On the left dropdown menu, click on “My Flat” and select “Purchased Flat”

Step 2: Click on “Find out more” under “Financial Info”

Step 3: Check “Outstanding Balance” in “My Account Balance(s).” You will see your outstanding mortgage loan under “Outstanding Balance”.

If you took a bank loan when purchasing your HDB, do give your bank a call to find out your outstanding mortgage loan. A Bank loan would also require you to pay a prepayment penalty of about 1.5% of the amount borrowed if you’re still under a “Lock-In” period. This may or may not apply to you, so do check in with your banker.

3. CPF utilised plus accrued interest

Any CPF monies utilised for the purchase of your HDB will have to be returned with accrued interest back to your CPF account when you sell your HDB flat.

To check how much you have to return, head over to the CPF website.

You can take the following steps to check the CPF monies you have utilised:

Step 1: Hover over “my CPF”

Step 2: Click on “Home Ownership”

Step 3: You will be led to the following page, where you can check the “Total principal amount withdrawn” and “Total accrued interest.”

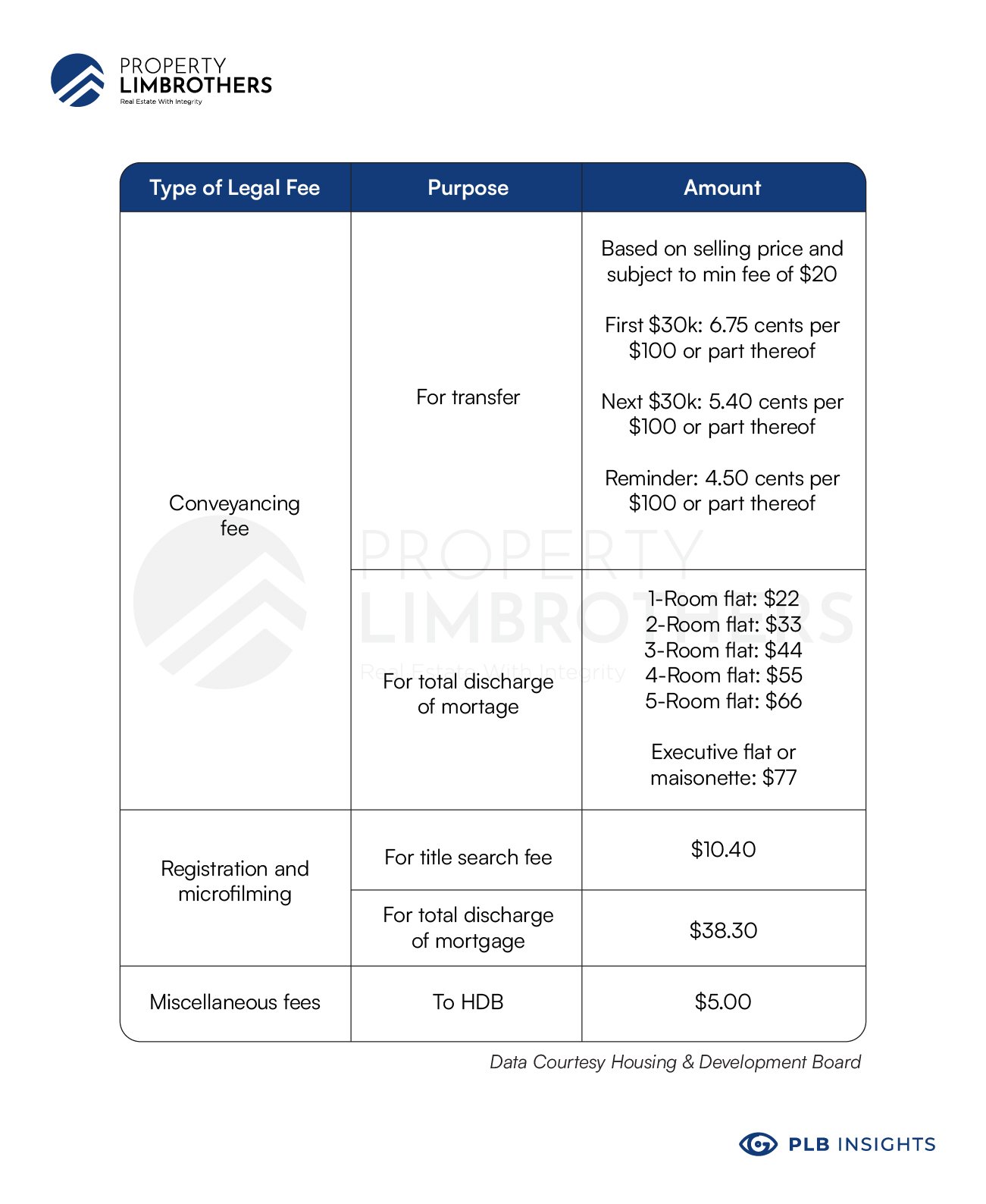

4. Legal Fees

If you choose to engage a HDB’s solicitor to act for you in the sale, you can get an estimate of the cost using HDB’s Legal Fees Enquiry service.

If you instead choose to engage your own solicitor, they will have to advise you on their fees, typically ranging anywhere from an estimated $2500 to $3000.

Below, we have listed the information on the breakdown of legal fees if HDB’s solicitor is acting for you.

5. HDB Resalenet Fee

Both the buyer and seller will each pay an administrative fee of $40 or $80, depending on the flat type.

6. Property Agent Commission

If you engage a property agent like us to expedite and facilitate your HDB flat selling process, there would be a commission payable, usually in the range of 2% to 3%.

Calculating the Estimate Cash Sales Proceed From Selling Your HDB Flat

To find out the actual amount pocketed from the sale of your HDB, you will have to deduct the CPF monies used as you would have to return it back to CPF.

Pro tip! You can use HDB’s Sale Proceeds Calculator to do the calculations for you.

Other Numbers to Take note of when selling your HDB and buying a Condo

1. Renovation Cost / Temporary Accommodation

Your reason for upgrading from a HDB to a condo could be to enjoy the better lifestyle associated with private condominiums. Hence it may be in your interest to also renovate before moving in.

However, do remember to factor in leeway for renovation delays and the cost of renovation. Additionally, the current shortage of manpower and supplies due to COVID-19, renovations may have to utilise local supplies and labour, which can have an inflationary effect on the costs.

Do factor in the estimated cost of temporary accommodation should you have already sold your HDB in the case of delays. And also, be prepared to pay more for renovations than initially budgeted.

Total Cost Involved in Purchasing a Condo

To find out if you can afford to upgrade to a condo, let us find out what is the total cost of purchasing a condo

The cost of purchasing a condo can be broken down into the following components:

-

Price of condo

-

Down payment

-

Buyer’s Stamp Duty

-

Additional Buyer’s Stamp Duty

-

Legal Fees

-

Property agent commission

Let’s skip the “Price of Condo” explanation, as it is pretty self-explanatory.

2. Down Payment

Following the flowchart below, we can get a rough understanding of the minimum cash down payment one has to make when purchasing a condo.

Do take note that:

-

The first 5% has to be paid fully in cash when you exercise your option to purchase

-

The other 20% can be paid using cash and/or CPF during the completion date. However, CPF Funds must be ready by 2-4 weeks before the actual completion date.

3. Buyer’s Stamp Duty

Buyer’s Stamp Duty (BSD) applies to all property purchases in Singapore. It is calculated based on the property’s purchase price or market value (whichever is higher). The table above shows the BSD rates according to the price range.

A more straightforward way to calculate is as follows:

Pro tip! You can use IRAS’s Stamp Duty Calculator to calculate the Buyer’s Stamp Duty that you have to pay on the condo you intend to purchase

4. Additional Buyer’s Stamp Duty

As mentioned earlier in the article, if you still own other residential properties, you will incur Additional Buyer’s Stamp Duty.

Do take note that if you have yet to find a buyer for your HDB flat, you would have to pay for the ABSD first, but you can get a refund if your flat is sold within six months.

5. Legal Fees

The legal fees incurred depend on the lawyer that you engage, but one can expect to spend anything up to $2500 to $3500 as a safe estimate.

6. Property Agent Commission

There are no fixed laws when it comes to property agent commission. However, the industry standard seems to run about 2% to 3% of the property purchase price.

For the purchase of Private Residential properties, the agent fee is typically covered by a co-broking fee with the Seller’s Agent or paid out by the Developer for new launch developments.

Calculating the upfront cost involved in purchasing a condo

If the cash proceeds (amount pocketed from the sale of HDB) can cover the cash and CPF required upfront, it would mean that you can technically afford the condo without any digging into your savings.

However, we would still need to consider the monthly mortgage instalment and whether it would be realistic and practical for you to afford it at your current financial standing. You can find out more about that in this article, “6 Factors to Consider for Your Property’s Monthly Instalment.”

Other things to take into consideration

Seller’s Stamp Duty

Most HDB flat owners would not have to pay the Seller’s Stamp Duty when they sell their flats as they would have met the minimum occupation period before they do so. However, those who have recently become the flat owners by way of transfer may be affected by it. You may check with IRAS to find out more about Seller’s Stamp Duty.

CPF Housing Withdrawal Limits

The total amount of CPF funds that you can you use to pay off your new condo depends on the Valuation Limit (VL) and withdrawal limit (WL)

For example,

For a condo purchase at $1.5million, which has been valued at $1.45 million

Valuation Limit (VL) = $1.45 million

(The VL is equal to the valuation of the property)

Withdrawal Limit (WL) = $1.45 million x 1.2 = $1.74 million.

To use your CPF savings beyond your VL, you would have to:

-

Meet the Basic Retirement Sum (BRS) in your Ordinary Account (OA) and Special Account (SA) if you’re below 55, or

-

Meet the BRS in your OA, SA and Retirement Account (RA)if you’re 55 and above

However, once you hit your withdrawal limit (WL), you will have to start paying in cash regardless of having met the BRS or not.

To better understand how much of your CPF you can utilise in your circumstances, do check out the CPF Housing Usage Calculator.

Negotiate your Option To Purchase

The typical length of Option To Purchase (OTP) is anywhere between 14 to 21 days. During this period is where you can exercise the option. However, failing to do so results in forgoing all or 25% of the Option fee for new launch developments.

In certain situations, the period of the OTP can be extended

-

For new launches, the OTP can be extended up to 12 weeks, provided permission has been granted from URA with the proof of sale of your current home.

-

For resale condos, the OTP can be negotiated between buyers and sellers

Your property agent can help negotiate the validity period of the OTP, which is done as part of the terms of the offer for the purchase of a property.

Conclusion

There are various costs involved in selling and buying a property that may not be so obvious. Hopefully, this article has given you a thorough understanding of the numbers to note if you are selling your HDB in order to upgrade to a condo.

If you are still in doubt or would like a professional to handle the selling and buying process, do drop us a message, and our consultants will be happy to help you along the process. We hope this article has provided you with some helpful information. Keep a lookout for our next bleubricks article by PLB coming soon. Until our next article, take care! For those interested in finding out more beyond the realms of HDBs or who would like to start planning for your property portfolio, you may contact our PropertyLimBrothers team! In the meantime, please do check out our very own portal, Bleubricks, which caters to all HDB buyers and sellers.