When it comes to landed homes in the East, few names carry as much weight as District 15 (D15). Encompassing Katong, Joo Chiat, and East Coast, it has long been regarded as the benchmark for prestige — a district where sea-view bungalows, heritage shophouses, and cafe enclaves shape its cultural fabric.

In last week’s series, we looked at how Districts 14 and 16 — often seen as the younger siblings — are quietly carving their own place in the market with their accessibility and liquidity. This week, we place District 14 side by side with District 15, to see how the challenger stacks up against the elder statesman of the East’s landed market.

This article examines how these two districts compare in terms of pricing, inventory, liquidity, and long-term growth, drawing on data from 2015–2025 YTD as well as recent inventory snapshots from August 2025 (D14) and September 2024 (D15). The picture that emerges is one of duality: D15 as the prestige benchmark, and D14 as the pragmatic alternative.

Location and Identity: The Benchmark vs The Challenger

District 15

D15’s identity is defined by its heritage and prestige. Landed enclaves here enjoy proximity to East Coast Park, established lifestyle hubs, and top schools such as Tao Nan, CHIJ Katong, and Victoria School. Its cultural depth — from Peranakan shophouses to a thriving cafe scene — makes it a perennial favourite among families and high-net-worth buyers seeking a blend of lifestyle and legacy.

District 14

D14, on the other hand, is positioned as a city-fringe contender. It combines the vibrancy of Geylang and Telok Kurau with the suburban charm of Kembangan and Eunos. Connectivity is its standout feature: Eunos and Kembangan MRT stations sit along the East-West Line, Ubi is on the Downtown Line, and major roads such as Sims Avenue and Changi Road provide seamless access to the CBD and Changi. Paya Lebar’s ongoing transformation into a decentralised commercial hub further strengthens D14’s long-term proposition.

In essence, D15 is about prestige and lifestyle heritage, while D14 is somewhat more about practicality and accessibility.

Market Fundamentals: Growth vs Resilience

District 14

From 2015 to 2025 YTD, landed homes in D14 recorded a compound annual growth rate (CAGR) of 4%, slightly below the OCR average of 5%. Semi-detached homes led growth with a CAGR of 4.8%, followed by detached at 4.3% and terraces at 3.2%. Between June 2024 and June 2025, D14 recorded 76 landed transactions, reflecting steady demand despite broader headwinds such as rising rates and cooling measures.

District 15

Over the same 2015 to 2025 YTD period, D15 outpaced D14 with a CAGR of 5.3%, driven largely by Detached and Inter-Terrace segments. Transaction volumes are significantly higher compared to D14, though liquidity varies sharply across categories — some segments move briskly, while others are weighed down by oversupply.

The Contrast: D15 has historically delivered stronger capital gains, but D14 demonstrates steady resilience and an affordability story that appeals to long-term holders.

Eight Years of Price Trends: How D14 and D15 Have Moved

Looking at the eight-year period between 2018 and 2025 YTD, both D14 and D15 show consistent appreciation across all landed segments — Detached, Semi-Detached, and Terrace homes. However, their trajectories differ in magnitude and pace.

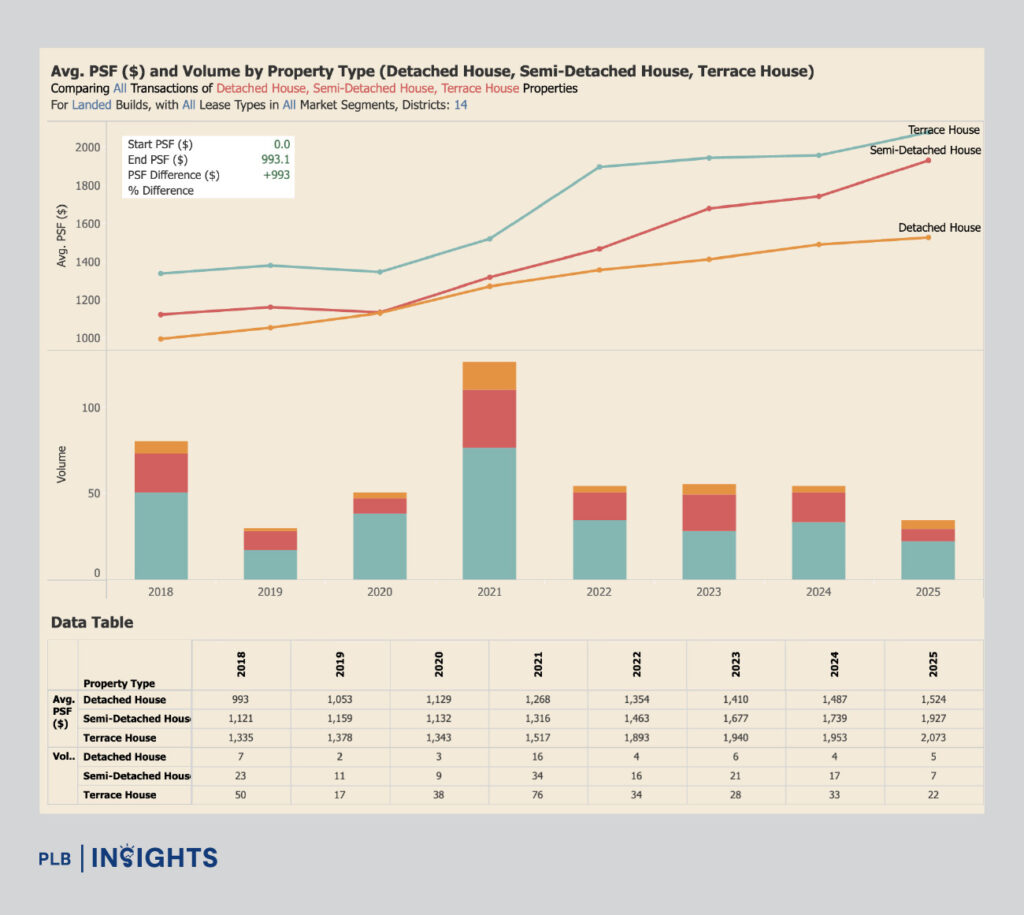

In District 14, Detached homes started at around $993 psf in 2018, steadily rising to $1,524 psf by 2025 YTD. Semi-Detached homes followed a stronger trajectory, climbing from $1,121 psf to $1,927 psf, while Terraces appreciated from $1,335 psf to $2,073 psf. Notably, all three property types saw their most pronounced jumps between 2020 and 2022, a period marked by surging demand amid low interest rates and a strong preference for larger spaces during the pandemic.

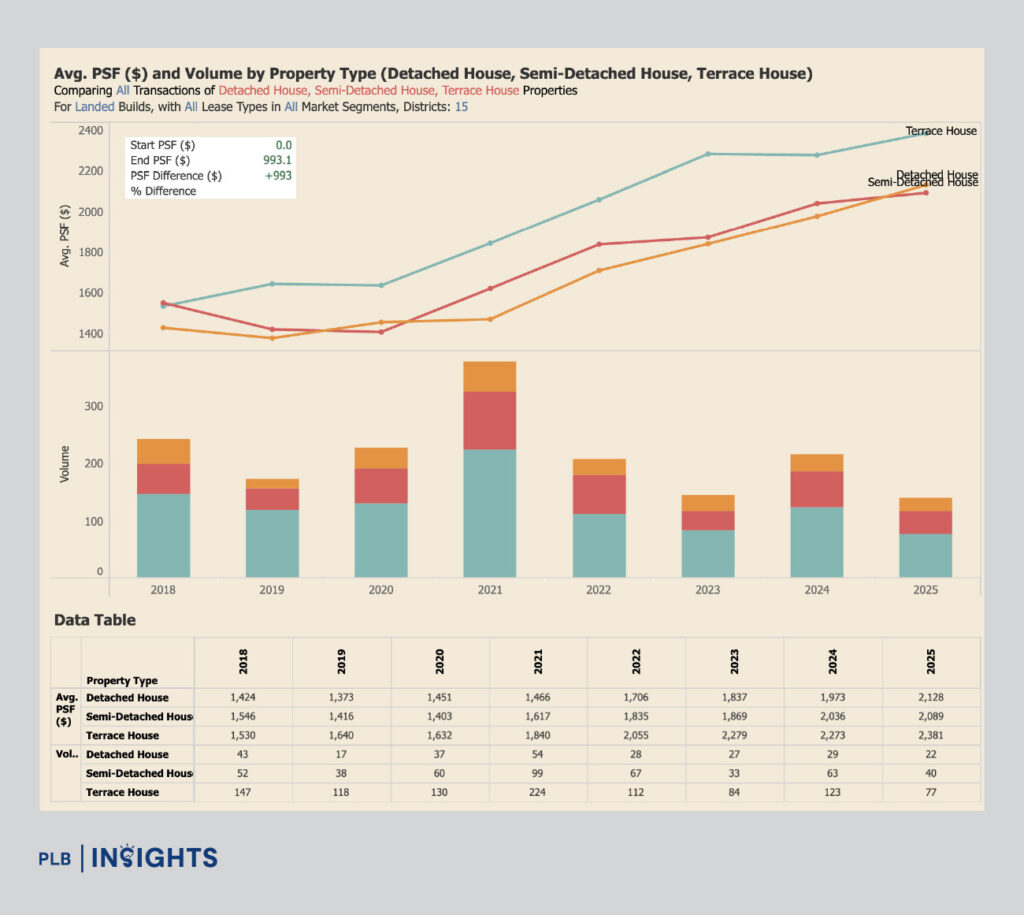

For District 15, Detached homes began higher at $1,424 psf in 2018, reaching $2,128 psf in 2025 YTD. Semi-Detached homes grew from $1,416 psf to $2,089 psf, while Terraces rose from $1,530 psf to $2,383 psf over the same period. While D15 maintains a clear PSF lead across every property type, the difference in growth percentage between the two districts is narrower than one might expect.

A closer look at the year-on-year movement reveals a shared inflection point in 2021, when both districts recorded their sharpest PSF price gains. D14’s Semi-D segment, for instance, leapt from $1,132 psf in 2020 to $1,316 psf in 2021, and continued its ascent through 2025. Similarly, D15’s Terraces surged from $1,632 psf in 2020 to $1,840 psf in 2021, a reflection of pent-up demand and limited new supply during that time.

Post-2022, prices in both districts have largely stabilised at these elevated levels, showing that the correction phase many anticipated has yet to materialise. D14’s year-on-year increments have moderated to low single digits since 2023, while D15’s prices have held firm — particularly in the Terrace segment, where demand remains resilient among both homeowners and investors.

The takeaway here is twofold: D15 continues to lead in absolute pricing due to its brand prestige and sea-adjacent enclaves, while D14 has shown equally consistent — and in some cases steeper — price progression from a lower base, underscoring its appeal as a more accessible yet steadily appreciating market.

Transaction Volume and Market Depth: A Tale of Scale and Stability

Price appreciation alone tells only part of the story. When viewed alongside transaction volumes, the contrast between D15’s market depth and D14’s measured liquidity becomes even clearer.

Between 2018 and 2025 YTD, D14 recorded 483 landed transactions across all property types, while D15 logged approximately 1,724 — more than three times as many. The difference isn’t surprising: D15’s land stock is significantly larger, and its reputation as a premium district attracts a wider range of buyers, from long-time residents upgrading within the area to new entrants seeking brand recognition and legacy value.

Still, the patterns of activity in both districts mirror broader national cycles. The year 2021 stands out as the clear peak, with D14 seeing 126 transactions and D15 reaching 377 — the highest volumes of the eight-year window. The momentum was fuelled by pandemic-era shifts in lifestyle priorities and historically low borrowing costs. Since then, both districts have seen volumes normalise, with D14 averaging about 50 to 60 landed transactions per year, while D15 continues to hover around 150 to 200.

Breaking it down by property type, Terrace homes dominate activity in both markets. In D14, roughly 298 Terrace transactions occurred between 2018 and 2025 YTD, accounting for more than 60% of all landed sales. Semi-Detached homes made up 138 transactions, while Detached homes contributed 47. In D15, the split was similar in proportion but larger in absolute terms: 1,015 Terraces, 452 Semi-Ds, and 257 Detached deals during the same period.

Interestingly, despite the gap in total volume, both districts show parallel buyer behaviour. The surge of 2021 saw the bulk of transactions concentrated in the Terrace category — a clear indicator that affordability thresholds, not just address prestige, dictate momentum. D15’s Terraces, which were transacting around $1,840 psf in 2021, have since risen to $2,381 psf, while D14’s Terraces climbed from $1,517 psf to $2,073 psf in the same span.

Liquidity in D14’s Semi-D and Terrace segments remains healthy, as evidenced by steady transaction flow through 2023–2025 even amid higher interest rates. In contrast, D15’s high-value Detached and Semi-Detached segments are slower to move — not for lack of demand, but due to higher absolute price points, often in the $9M to $15M range, which naturally limits buyer depth.

Ultimately, the data paints a clear picture: D15 is broader and deeper, anchored by its size and prestige, while D14 is smaller but more nimble, with mid-tier landed segments demonstrating stronger turnover and sustained demand resilience.

What These Trends Mean for Buyers Today

The eight-year trends offer valuable cues for different buyer profiles navigating the East’s landed landscape.

For families entering the landed market, D14’s Terraces and Semi-Detached homes present an attractive entry point. Prices have appreciated steadily without the sharp volatility seen in some other districts, and average quantum remains within reach for upgraders from nearby condominiums. Moreover, proximity to both the CBD and Changi, coupled with the ongoing growth of Paya Lebar as a commercial hub, gives D14 a strong functional appeal that continues to support demand.

For those prioritising prestige and long-term legacy value, D15 remains unmatched. Its consistent PSF premiums reflect enduring desirability, especially in well-established enclaves like Katong, Frankel, and Siglap. Buyers here aren’t simply purchasing a home — they’re buying into a lifestyle and an identity. And as the district’s Detached and Semi-D markets become increasingly exclusive, D15’s landed homes continue to anchor themselves as generational assets.

From a market perspective, both districts exhibit resilience despite the tightening macro environment. Prices have not receded meaningfully since their 2021–2022 highs, underscoring the limited supply of landed properties in Singapore — a category that accounts for less than five percent of the national housing stock.

The real distinction now lies in positioning: D15 offers prestige at a premium, while D14 offers value with velocity — the latter delivering steady appreciation and liquidity at more attainable entry levels.

Conclusion

District 15 will likely remain the East’s benchmark for prestige, its reputation deeply entrenched by heritage and lifestyle. But District 14 is no longer just a fringe alternative. With consistent growth, resilient transaction activity, and approachable pricing, it offers a different pathway into landed living — one that is pragmatic, well-connected, and quietly compelling.

In the end, both districts share one critical truth: landed homes remain structurally scarce, making either choice a long-term asset class with enduring value. The real question is whether buyers prefer prestige at a premium (D15) or balance at a practical entry point (D14).

Whether you’re considering prestige in D15 or pragmatism in D14, our team is here to help you make the right move — contact our consultants today.

Thank you for reading, and stay tuned! For more detailed insights regarding the landed property market, join our Landed VIP Club and stay updated with the latest market trends and expert advice.