The real estate market has always had its performance hinged on the turbulent market conditions, yet Singaporeans have rounds of cooling measures to rely on for a sense of regulation. Love it or hate it, in the recent release of our latest round of cooling measures Singaporeans were yet again presented with higher ABSD rates and tighter loan limits.

Introduction to cooling measures

Since its debut in 2009, multiple cooling measures such as the Seller’s Stamp Duty (SSD), Additional Buyer’s Stamp Duty (ABSD), Loan-to-Value (LTV), Total-Debt-Servicing-Ratio (TDSR), Mortgage-Servicing-Ratio (MSR), and Additional Conveyance Duties (ACD) have surfaced in the real estate market.

Cooling measures, continually and gradually introduced by the Singapore government, serve to regulate our real estate market. These measures have implications on homeowners and investors alike, and affect all Singaporeans, PRs and foreign buyers – though to varying extents. Whether the terms mentioned above lend themselves familiar to you, or fly over your head like a foreign language, as long as you are engaged in buying or selling a home in Singapore, these cooling measures will apply to you.

These measures encourage fiscal prudence and align Singaporean’s buying and selling behaviour to our economic fundamentals. In this article, we give a comprehensive breakdown on the history of Singapore’s cooling measures, and explain what it is they actually do and how these measures impact you.

Why are cooling measures important

Cooling measures are important because they respond and react to the housing market in Singapore, and encourage financial prudency in home purchase investments. They have significant implications on spending behaviour, and can influence market performance.

Cooling measures also have a salient impact on consumer behaviour as they deter against certain practises such as buying without sufficient cash, or short-term speculation of the housing market.

A comprehensive look at the 10 rounds of cooling measures

Sep 2009: Removal of Interest Absorption Scheme (IAS) and Interest-Only Housing Loans (IOL) for all private residential properties

Before the implementation of this cooling measure, the IAS and IOL allowed for buyers to purchase undeveloped properties with only a 10-20% down-payment until the project is completed. Since buyers are able to buy and sell these properties without heavy impact on their finances, these schemes encouraged property speculation in a buoyant market.

As a result of these initial measures, buyers were no longer able to easily buy and sell undeveloped property without first having significant capital on hand. This led to lower enthusiasm for private residential transactions, dampening the real estate market.

Feb 2010: Introduction of Seller Stamp Duty (SSD) and lowering of Loan-To-Value Ratio (LTV)

In response to the market heating up even after the 2009 cooling measures, the government introduced measures to tighten the credit supply to the housing market and promote financial prudence amongst buyers. This was a preemptive move to temper buyer sentiments before a financial bubble could form due to low interest rates and a positive outlook for economic recovery.

SSD of up to 3% of the sales price was introduced for all properties sold within the 1st year of purchase. The aim of SSD was to discourage short-term speculation that could distort underlying prices. Thus, long-term owners, or owner-occupiers are unaffected by it. On the other hand, investors who were looking to quickly flip properties for a profit had to reconsider the impact of the additional SSD eating into their profits.

LTV for all housing loans was lowered from 90% to 80%. The decision to lower LTV was done to send a clear signal to financial institutions to maintain their prudent lending standards to ensure a sustainable property market. As a result, buyers are now less able to borrow and hence take on less credit risk. Buyers who were initially looking to loan most of the value of the property now had to pay more out of pocket, effectively discouraging purchases of homes on credit.

Aug 2010: SSD expanded to include properties sold within the 3 years of purchase; LTV for second-housing loans onwards lowered from 80% to 70%

Due to a large 11% increase in private residential markets for the first half of 2010, the government viewed the market as very buoyant. Hence, there was a need to align the real estate market with the more moderate growth of the economy to ensure that an economic correction would not crash the real estate market. As before, the measures introduced were in line with improving financial prudency of both buyers and lenders such that credit risk was minimised.

SSD was expanded to include properties sold within the 3 years of purchase. However, the SSD gets progressively smaller the longer the property is held before selling.

With this progressive system, sellers are now even more motivated to hold for longer periods before selling as SSD can take away a significant share of profits from the sale of their property. As buyers and sellers hold property over a longer period, less transactions occur and real estate market prices face resistance against rising.

LTV for first-time borrowers remained at 80% while LTV for second-housing loans onwards was lowered from 80% to 70%.

Consequently, minimum cash down payment for second-time loans was increased from 5% to 10%.

This specific set of measures mean that buyers who are looking for asset progression after their first property now have to be more prudent in financing their subsequent propert(ies). Clearly, there is a trend towards limiting buying potential beyond an owner’s first property to promote equality in the market for first-timers. However, this comes at the cost of buyers who may have to consider other methods to finance their next home, or even look towards lower priced homes due to having less borrowing power.

Jan 2011: SSD holding period extended to 4 years from initial 3 years with increased rates; LTV for second-time loans onwards reduced from 70% to 60%

This time, coupled with an extension of SSD periods, the government also drastically readjusted the SSD rates to a whopping 16% (within the first year). This meant that selling a property within the first 2 years of buying it would incur a hefty penalty, even with the frothy market at the time, where prices had risen more than 10% in the year!

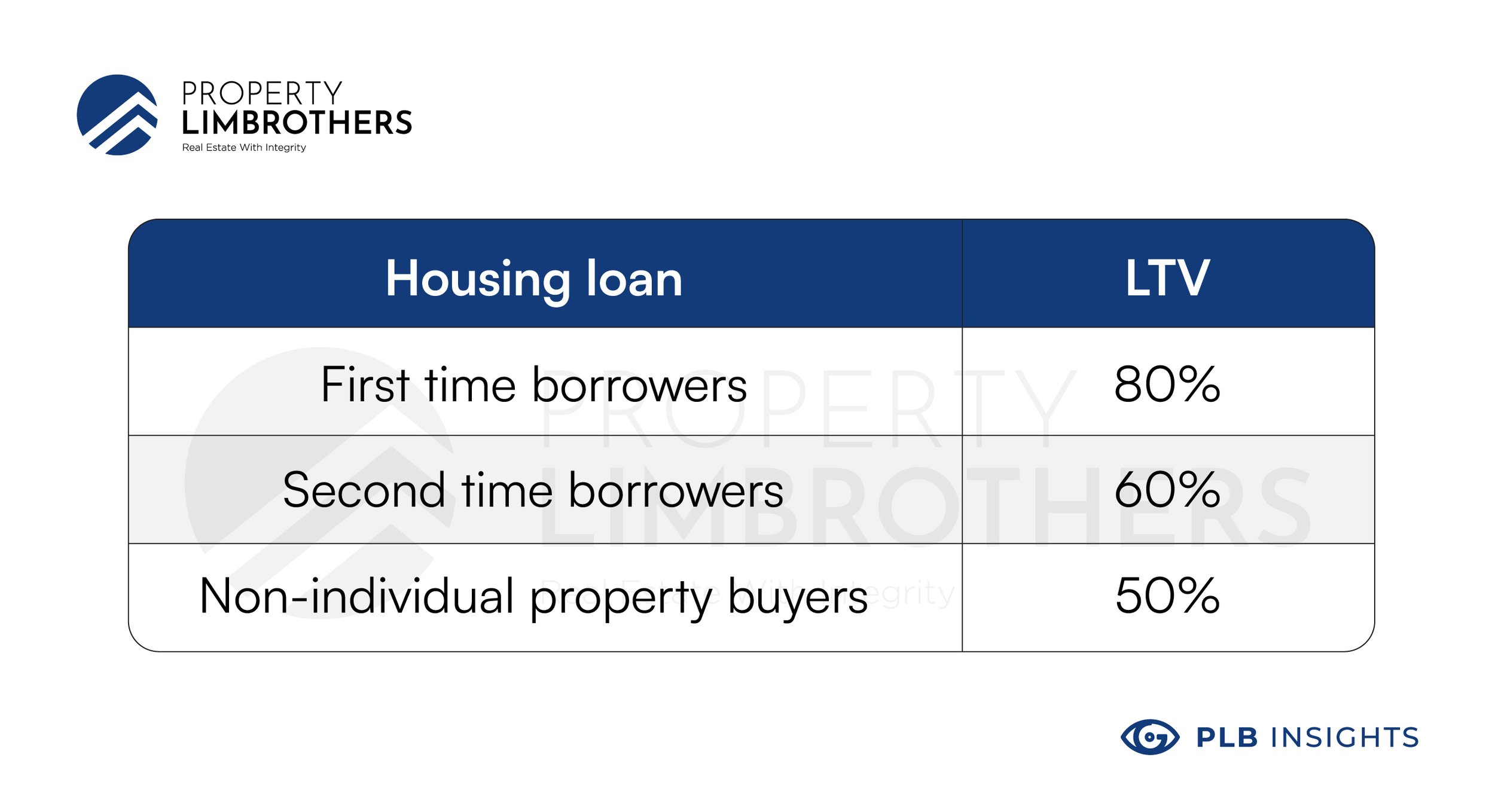

LTV for second-time loans onwards was again reduced from 70% to 60%, and LTV for all non-individual property buyers (for e.g. corporations, trusts and collective investments) was lowered to 50%.

Dec 2011: Additional Buyer’s Stamp Duty (ABSD) was introduced for Singapore Citizens and Permanent Residents

3% ABSD was applied to all:

-

SCs buying their 3rd or more property

-

PRs buying their 2nd or more property

10% ABSD was also applied to foreigners buying any property in Singapore.

If a purchase is made by multiple people, the highest (more severe) applicable rate is charged.

The ABSD measure is a flat rate that supplements the existing Buyer’s Stamp Duty which are already applied progressively on sales price (BSD – 1% on first $180,000, 2% on the next $180,000 and 3% for the remainder).

Oct 2012: Maximum duration of residential housing loans was capped at 35 years

Longer term loans were now disadvantaged with lower LTV across both first and second-time (or more) buyers.

Specifically LTV drops by 20% points if the loan duration:

-

is longer than 30 years, or

-

extends past 65 years of age of the buyer

The introduction of long-term loan differentiation was another major point as it changed how buyers financed their loans. In general, buyers would want to maximise their loan duration as it lowers the monthly repayments that eats into income which would otherwise be used for savings or other spending. Long-term loans allow buyers the flexibility to refinance their mortgage – for example to purchase other properties or to pay off their loans faster. By putting a cap on the maximum tenure and tying this to the age of the buyer(s), buyers are effectively limited to completing their property investing plans before 65 years of age.

Jan 2013: ABSD modified to incur heavier taxes; LTV rates tightened; minimum cash down payment for second-time loans and beyond again increased; HDB-specific measures that were introduced

ABSD was once again modified to incur heavier taxes on PRs, Foreigners, and everyone else who purchased beyond their first home. ABSD was raised by 5-7% points across the board, additionally, ABSD was imposed on PRs purchasing their first residential property and on SCs purchasing their second residential property.

Jan 2013 new ABSD rates:

LTV rates were also tightened for those borrowing beyond their first housing loan.

For second-time loans, LTV was reduced from 60% to 50%.

For third-time loans and beyond, LTV was reduced from 60% to 40%.

Jan 2013 new LTV rates:

The 20% points disadvantage for long-term loans continue to be applied across all LTV rates.

Lastly, minimum cash down payment for second-time loans and beyond was increased from 10% to 25%.

In response to rising competition for HDB flats, there were also HDB-specific measures that were introduced to reduce short-term, credit-heavy transactions by SCs and PRs.

Buyers looking to loan for HDB flats:

-

MSR provided by financial institutions capped at 30% of gross monthly income

-

MSR provided by HDB capped at 35% instead of 45% previously

PRs:

-

Will no longer be able to sublet the entire HDB flat.

-

Must sell their HDB within 6 months of buying a private home in Singapore.

June 2013: TDSR of 60% was introduced for all property loans that are granted by financial institutions

All financial institutions in Singapore will have to verify that the total debt (including non-housing loans) of a borrower is less than 60% of their total income before their loan can be approved. Due to the differing nature of loans and interest rates, MAS has a standardised method for calculating the TDSR.

The introduction of TDSR criteria for loan eligibility was another major milestone in the series of cooling measures. Since TDSR is calculated based on existing loan repayments, other measures such as LTV and loan tenure which affect the loan value now come into play. Any changes to these factors can drastically affect eligibility for a buyer to get a loan.

For example, a 45 year old buyer whose loan tenure is short (20 years instead of 35 years) because he wants to qualify for the higher LTV ratio (50% instead of 30%) will have to take on a greater monthly mortgage payment than if he had chosen a longer tenure. A higher mortgage payment causes TDSR to increase and potentially exceed 60%, causing them to not qualify for the loan. Thus, to satisfy the new TDSR requirement, the buyer is forced to extend his loan tenure (beyond 65 years) to get a lower monthly mortgage, but they now face the issue of a lower LTV (30%) and have to make up for the additional 20% of value without borrowing. With so many limitations due to interacting measures, it becomes harder for buyers of multiple properties to finance their loans.

Dec 2013: Measures were introduced to tighten the purchase of Executive Condominiums (ECs)

MSR capped at 30% of the borrower’s monthly income now applies to EC purchases. Second-time applicants looking to purchase directly from EC developers will have to pay a resale levy (similar to BTO)

EC application cancellation fees reduced from 20% to 5%.

Mar 2017: SSD holding period reduced; the rate for all tiers reduced

In response to a slower property market, the government reversed some measures.

SSD holding period was reduced to 3 years from 4 years previously. The rate for all tiers was reduced by a flat 4% points.

TDSR requirement was also removed for mortgage equity withdrawal loans where the LTV is less than 50%. This enabled more people to borrow against the value of their properties to obtain additional cash for retirement needs.

Jul 2018: LTV was reduced by 5% points across all categories for all housing loans

This last round of cooling measures targeted ABSD and LTV rates to regulate fast rising property prices.

LTV was reduced by 5% points across all categories for all housing loans granted by financial institutions.

Other than SCs or PRs purchasing their first property, ABSD was increased for all other individuals and entities.

-

Raise ABSD by 5%-points for all other individuals

-

Raise ABSD by 10%-points for entities

Dec 2021: Higher ABSD rates, tighter loan limits

First, the TDSR has been reduced from 60% to 55%, which means for every $10,000, Financial Institutions will assess $500 less towards the mortgage loan.

The difference of every $500 less is equivalent to roughly about $100K less in loan eligibility. This is based on TDSR Stress Interest of 3.5%, Loan Tenure 30 years for private properties.

Second, Singapore also saw a revision of HDB Loan LTV from 90% to 85%.

This results in the current LTV rates shown in the table below:

Most significantly, the ABSD on purchases of residential properties were also raised, quite significantly. This increase of 12 per cent to 17 per cent for citizens buying their second residential property, and 15 per cent to 25 per cent for those buying their third and subsequent properties, will likely deter many from buying additional residential properties.

The ABSD rate has also risen from 15 per cent to 25 per cent, for permanent residents buying their second residential property and from 15 per cent to 30 per cent if they are buying their third and subsequent properties.

This increase is also mirrored for foreigners and entities, including housing developers, to 30 per cent and 35 per cent respectively.

The following table shows the current rates for residential purchases:

Conclusion

Overall, we see that out of the 10 times the government introduced measures for the real estate market, 9 of them were aimed at tampering down the market while there was only 1 instance where the cooling measures were relaxed. These measures have also become more drastic as the years have gone by and it does not appear to be relaxing anytime soon. Amidst low interest rates, high demand for housing, and sky-high property prices, it was no surprise that new cooling measures were introduced so soon.

Nevertheless, it is important to recognise that cooling measures merely slow down the growth of real estate rather than reversing it, evident from ever rising property prices in Singapore, especially in a low interest environment.

So there you have it! A summary of the cooling measures thus far! If you are unsure of how these measures affect you, or simply want an expert opinion in your real estate affairs, feel free to reach out to us!