*This article was written in February 2023 and does not reflect data and market conditions beyond.

City Square Residences is a freehold condominium sitting directly across City Square Mall, which is integrated with Farrer Park MRT station, offering easy access to amenities and public transportation. With its city fringe location, the development caters to a range of lifestyles and is ideal for those seeking urban living with modern conveniences.

It was developed by City Developments Limited (CDL) and obtained TOP in 2009. Some of CDL’s most notable projects in recent years include Canninghill Piers, Sengkang Grand Residences with CapitaLand, and Piccadilly Grand with MCL Land.

In an area surrounded by shophouses, 99-year leasehold condominiums, and small boutique freehold apartments, City Square Residences stands out with 910 freehold units, making it an attractive development for investors and buyers looking for a rental or legacy property that will not be affected by lease decay.

Location Analysis

An important aspect of where City Square Residences is located is that it is the last plot of freehold land that is situated right beside a MRT station and a mall. It is just 88m away from the main entrance of City Square Mall, which is directly linked to Farrer Park MRT station by the basement level.

Farrer Park station, being two stops away from Dhoby Ghaut, means that City Square Residences is just a few minutes away from the city via public transportation. Dhoby Ghaut station is also an interchange for three different MRT networks – the North-South Line (NSL), North-East Line (NEL), and Circle Line (CCL). One stop from Farrer Park station is Chinatown station, where the Downtown Line (DTL) can be accessed, connecting to Bugis MRT and the East-West Line (EWL). This means that residents will have easy access to most of the MRT networks in Singapore, making the daily commute to work or school more convenient and seamless.

Those with an active lifestyle would appreciate the proximity to Jalan Besar Stadium and Swimming Complex. A short 7-minute walk separates residents from a nice workout at the pool or the tracks. City Square Residences also has a side gate that leads directly to a public park, where residents can take their daily evening strolls.

For parents with young children, there are two primary schools located within 1 km radius of City Square Residences – Farrer Park Primary and Stamford Primary. Those with older children would also appreciate the proximity of Northlight School and tertiary institutions such as School of the Arts (SOTA) Singapore and Singapore Management University (SMU).

Site Plan Analysis

The site of City Square Residences takes a squarish shape, with the guardhouse and entrance facing towards City Square Mall. The facilities are clustered towards the centre of the development, with the residential towers taking up linear profiles on opposite ends of the condo boundary. There are a total of 6 residential towers, all of which are named – Vista Tower (Block 2), Park Tower (Block 6), Boulevard Tower (Block 8), Promenade Tower (Block 10), Maxim Tower (Block 12), and Galleria Tower (Block 14). Vista and Park Towers have 28 storeys, Boulevard Tower has 29 storeys, and the remaining towers have 30 storeys each.

The units here have four different direction facings. The first facing overlooks the park towards Sturdee Residences, while the opposite will be facing towards the city view. The other two facings will be internal facing within the project and overlooking the condo facilities. One of the advantages of the internal facing units is that they do not get any road traffic noise, which is suitable for those who prefer a quieter environment.

One of the best qualities of condo projects with this kind of orientation is that the entire facility zone is elevated upwards. The entrance has two security posts for security clearance of vehicles as well as for visitors on foot, leading to a nice roundabout drop-off point. There is also a drop-off point at the basement level for rainy days. Other notable facilities include a bowling alley and a table games lounge with al fresco seating.

Price Analysis

Looking at the price trend over the past 5 years from Q4 2017 to Q4 2022, we see that there was some price volatility before 2020 as well as some fluctuation in the volume of transactions for the development. This could be attributed to the cooling measures introduced in July 2018 which saw a revision to the Additional Buyer’s Stamp Duty (ABSD) rates. In this round of cooling measures, Singaporeans buying a second residential property must pay 12% ABSD (up from the previous 7%), Singapore PRs must pay 15% (up from the previous 10%), and foreigners must pay 20% (up from the previous 15%). Furthermore, the Loan-to-Value (LTV) limit was reduced from 80% to 75%. This effectively cooled the red-hot property market at the time, deterring buyers and investors from snapping up properties. According to data from URA and EdgeProp, the quarter after the cooling measures were introduced saw a 37.8% decline in transactions.

Prices started climbing again towards the end of 2019, until the COVID-19 pandemic hit the property market hard at the start of 2020. Prices dipped 6% between Q1 and Q3 2020, with Q2 2020 recording zero transactions. That didn’t last long, however, as prices and transactions picked up after Q3 2020 and continued climbing for 8 consecutive quarters even as another round of cooling measures saw ABSD rates increasing again in December 2021. Between Q3 2020 and Q3 2022, there was an impressive 26% growth in average prices with a high volume of transactions peaking in Q4 2021 before the new ABSD rates kicked in.

With a lack of comparable freehold developments in the vicinity, we take a look at the nearest 99-year leasehold projects for price comparison.

One of last year’s hottest new launch projects, Piccadilly Grand, set a new benchmark psf of $2,150 for District 8 after achieving 77% sales on launch weekend. Being an integrated development with direct access to Farrer Park MRT station puts it in the same league as City Square Residences in terms of proximity to the MRT station. The high average prices translate to buyer confidence in the project as well as the potential of the location.

Right beside Farrer Park MRT as well, Uptown @ Farrer is a mixed development which just obtained TOP last year in 2022. An important thing to note: The transactions for Uptown @ Farrer recorded in the chart above are all from new sales, not resale transactions. As most of the owners are likely holding, there is no data for resale transactions yet. With the new sale transactions averaging between $1,600 to $1,900 psf, we predict that it will cross the $2,000 psf mark especially if SSD no longer applies for some owners.

Lastly, Citylights is an older development completed in 2007. The price trend is similar to that of City Square Residences, with prices trending upward since Q3 2020. It is currently averaging between $1,500 to $1,900 psf.

These 99-year leasehold projects have either crossed the $2,000 psf mark or are inching towards it, including Citylights, the oldest 99-year leasehold. And keeping in mind that City Square Residences is a freehold development currently averaging $1,600 to $2,000 psf, this means that there is definitely some disparity in prices and potential buyers or investors are in a very good position to hunt for undervalued units.

MOAT Analysis

This segment examines City Square Residences through the lenses of PLB’s MOAT Analysis. This analysis compares properties based on 10 key factors, providing a comprehensive and objective understanding of the property and determining its appeal to the general public in Singapore. To learn more about MOAT Analysis, you can refer to this article.

City Square Residences has a MOAT score of 62%. We take a closer look at some of the hits and misses. Being a freehold development, it naturally gets a perfect score for Bala’s Curve Effect. Other factors that returned with a score of 4-5 include Rental Demand and Quantum Effect, which comes as no surprise.

Its city fringe location makes it convenient for tenants to move around Singapore, and with all the amenities in the mature estate, City Square Residences will naturally observe a high volume of rental transactions. And with the nearby Piccadilly Grand already transacting past the $2,000 psf mark and Uptown @ Farrer projected to cross that mark after the SSD period, the current quantum that City Square Residences is going for is comparatively affordable. Not to mention the difference in tenure, which gives it an edge over its leasehold counterparts.

A bunch of factors came back with an average score of 3 out of 5 – MRT Effect, Parents’ Attraction Effect, Landsize Density, and Volume Effect.

Why did City Square Residences only score 3 out of 5 for MRT Effect despite being right opposite an MRT station? This might be because it got overshadowed by projects such as Piccadilly Grand which is integrated with Farrer Park MRT, as well as Uptown @ Farrer and The Citron Residences which has direct access to the station. Nevertheless, this is not a big concern given the actual proximity. Schools are not a major concern as well, given that there are two primary schools within a 1 km radius, and four more within the 2 km radius. As a freehold development with 910 units taking a limited plot of land, it is normal for the landsize density and volume effect score to be on the lower side as well.

And lastly, the factors that scored 1-2 out of 5 are Disparity Effect (Region and District) and Exit Audience. This signifies that there might be more affordable options within the region and district, but again, the freehold status of City Square Residences could justify the premium for rental and legacy play. Exit audience in our MOAT analysis refers to HDB upgraders within the vicinity, so a low exit audience score translates to a lack of HDB projects in the area to form this pool of HDB upgraders. However, in April last year, the government announced that Farrer Field Park will be redeveloped into a new public housing estate with 1,600 HDB flats and integrated with sports and recreational facilities. This means that this exit audience score will likely change in the next few years.

Unit Distribution

City Square Residences offers 1-Bedroom to 4-Bedroom types, with 3-Bedroom types (47%, 425 units) making up almost half of the unit offerings.

The distribution is very even, with each unit type available in almost every residential tower – except Boulevard Tower with only 2-Bedders and 3-Bedders available, and Promenade Tower which has every unit type except 1-Bedders.

One thing we noticed is that the penthouse units here do not come with a different layout variation as many other developments do. Only the ground floor units are slightly different with an additional PES, and there are only 10 of such units. For Park Tower and Boulevard Tower, units only start from the second storey onwards.

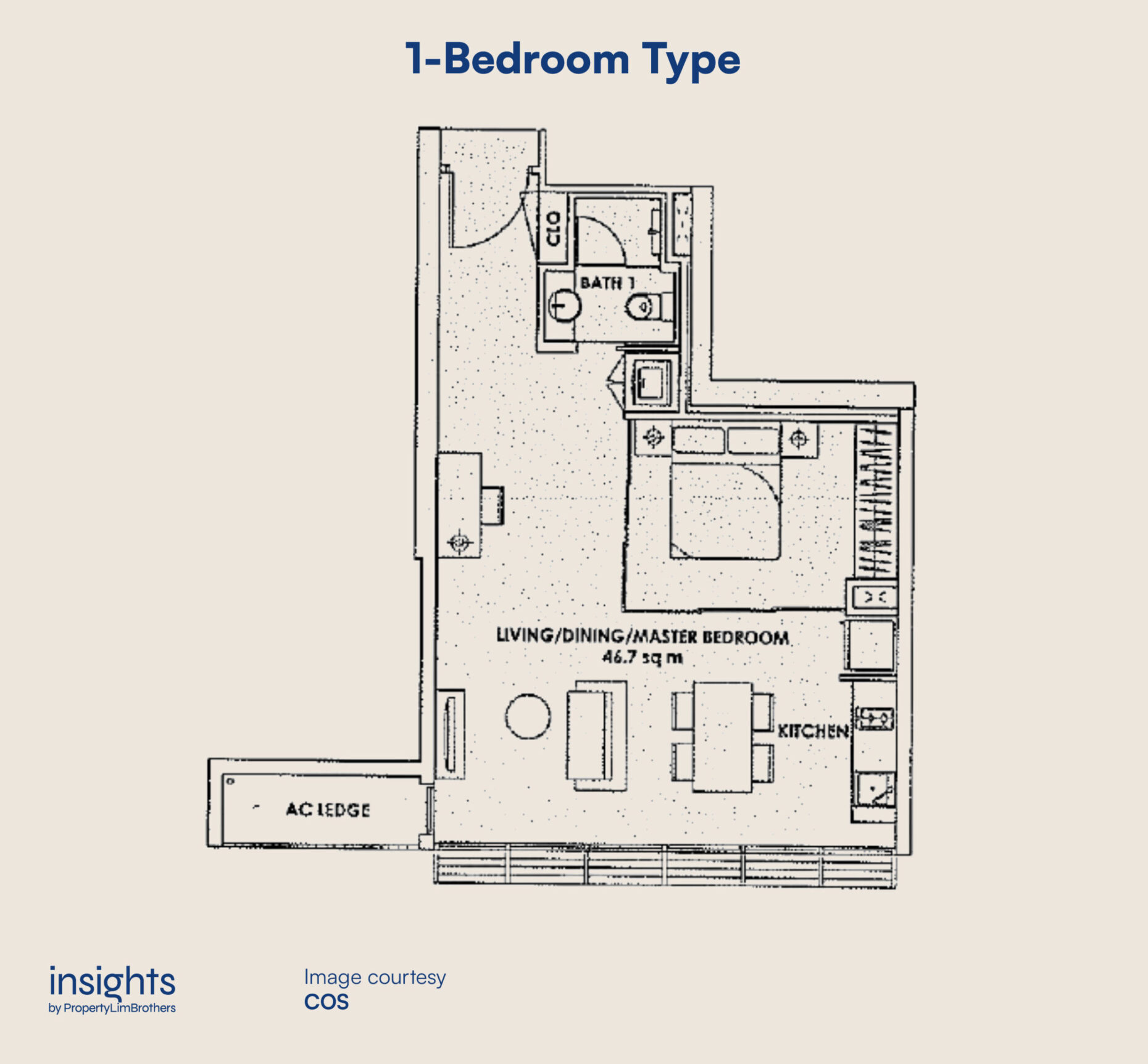

1-Bedroom Type

The 1-Bedroom types here only come with one standard layout that is 570 sqft in size, with two variations for ground floor units.

What’s interesting about the layout is that the elongated foyer will lead to the bathroom and bedroom before reaching the living/dining room and kitchen. This is pretty rare as most layouts will see the kitchen placed next to the foyer rather than the opposite end of the main door. Because of this configuration, it might not be suitable for those who do heavy cooking due to the proximity of the master bedroom which is right next to the kitchen. There is also a designated area beside the living room to set up a small study.

2-Bedroom Types

For 2-Bedroom types, there are 3 different layout variations – B1, B2a, and B2b. There are very minor differences between the three, but the featured B2a layout which stands at 872 sqft comes with a slightly bigger kitchen/yard area and bedrooms. The squarish layout of these 2-Bedroom types makes it efficient with little wasted space.

An interesting thing we noticed about the layouts for the 2-Bedders here is that the master bathrooms are designed to fit a bathtub, which is a welcome addition for those that appreciate a good soak. The common bedroom is also big enough to fit a queen-sized bed, which is ideal to rent out for rental income to offset the monthly mortgage for young couples who do not have children yet.

3-Bedroom Types

There are 11 layouts for the 3-Bedroom types, with 3 variations for the ground floor units. This is not surprising since almost half the unit offerings are made up of 3-Bedroom units.

What we noticed about the 3-Bedroom layout is that it comes with a utility room, which is essentially the household shelter. All of them are placed in the middle of the unit, but it does not block the kitchen. In fact, it can only be accessed through the yard, meaning that those who prefer to have an open concept kitchen can still get it done without the utility room hindering – a very thoughtful design by the developers.

Most of the layouts also come with an elongated foyer, which offers some privacy to the owners as the living area is further away from the main door.

4-Bedroom Types

Coming to the 4-Bedroom types, they are very generously-sized, with the smallest layout coming in at 1,496 sqft. There are a total of 4 layouts for the 4-Bedders, with no variations as none of the 4-Bedrooms can be found on the ground floor. However, none of them come with the dumbbell layout that is often appreciated for 4-Bedders to promote multi-generational living.

The 4-Bedroom floor plans come with a designated dry kitchen area that has an open concept, with the wet kitchen and yard being enclosed next to it. And of course, it comes with a junior master with an ensuite bathroom. All of the bedrooms are also big enough to fit at least a queen-sized bed.

Future Growth Potential

With the government’s announcement of the redevelopment of Farrer Park Field into a new public housing estate, a fresh batch of 1,600 HDB flats will be injected into the immediate vicinity of City Square Residences. This means that there will be a new pool of exit audience (potential HDB upgraders) for the condominiums in this area.

The area will also be undergoing rejuvenation with a focus on fitness and recreational facilities, which will add on to the current plethora of amenities in the mature estate. This is likely to boost not just the quantum but also the rental demand for City Square Residences.

Given that the surrounding leasehold developments have already crossed the $2,000 psf mark or will soon cross it, there might be a disparity gap for potential buyers and investors to look into if they are interested in a freehold development in District 8.

In Summary

City Square Residences is the last freehold development that is located right next to an MRT station and mall. In an area surrounded by small boutique freehold properties, 99-year leasehold developments, and low-rise shophouses, it stands out with 910 units that will not be affected by lease decay.

With the upcoming rejuvenation and redevelopment of the Farrer Park micro location, coupled with the existing amenities in the area, City Square Residences is in a strong position and is likely to hold its value or appreciate further.

Let’s get in touch

Looking to buy, sell, or rent a unit here? Unsure of how it fits into your property portfolio? Let us help! Do contact us here and we will be glad to assist you or offer a second opinion.

Thank you for reading and following PLB. Stay tuned as we bring you more in-depth reviews of condo developments around Singapore.

Disclaimer: Information provided on this website is general in nature and does not constitute financial advice.

PropertyLimBrothers will endeavour to update the website as needed. However, information may change without notice and we do not guarantee the accuracy of information on the website, including information provided by third parties, at any particular time. Whilst every effort has been made to ensure that the information provided is accurate, individuals must not rely on this information to make a financial or investment decision. Before making any decision, we recommend you consult a financial planner or your bank to take into account your particular financial situation and individual needs. PropertyLimBrothers does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this website. Except insofar as any liability under statute cannot be excluded, PropertyLimBrothers, its employees do not accept any liability for any error or omission on this web site or for any resulting loss or damage suffered by the recipient or any other person.