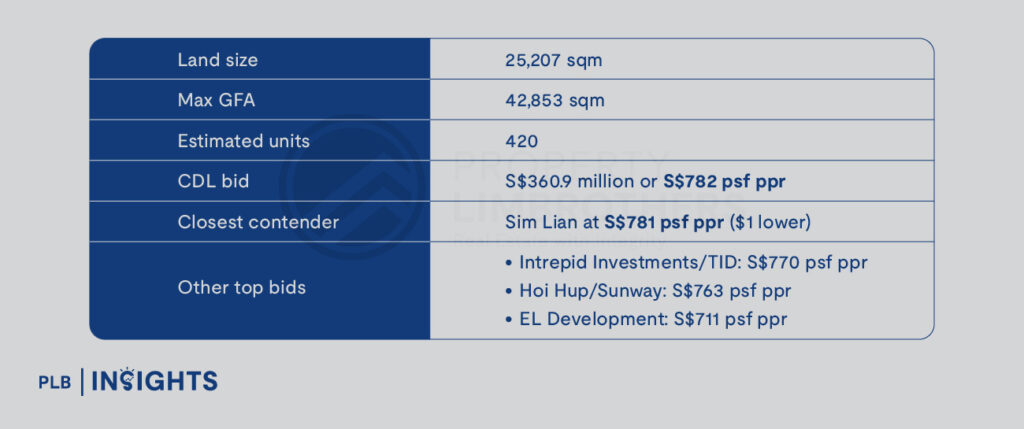

City Developments Ltd (CDL) has emerged as the top bidder for two Executive Condominium (EC) land parcels, setting a new benchmark land rate of S$782 psf per plot ratio (psf ppr) for the Woodlands Drive 17 site. This surpasses the previous record of S$768 psf ppr set by Sim Lian for a Tampines EC site in October 2024.

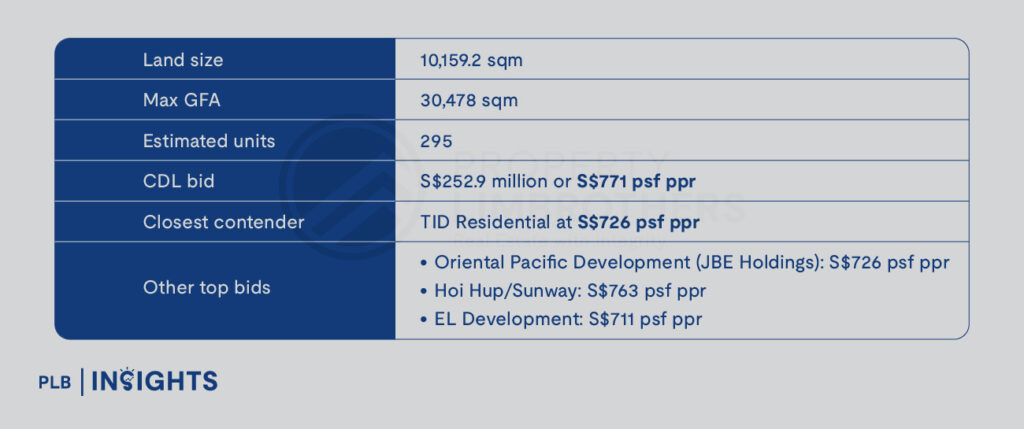

CDL also secured the Senja Close EC plot in Bukit Panjang with a bid of S$771 psf ppr, positioning itself as a dominant player in the upcoming EC supply pipeline with over 700 new units.

Woodlands Drive 17 (North Region)

Pricing Outlook:

Projected launch prices will be above S$1,800 psf, averaging S$1,900–S$2,000 psf, assuming a typical 20–25% developer margin based on historical trends.

Strategic Location Highlights:

Market Context:

This marks the first EC site in Woodlands since 2015, when Hao Yuan acquired a site at S$278 psf ppr. That project, Northwave EC, launched in 2016 at a median price of S$779 psf.

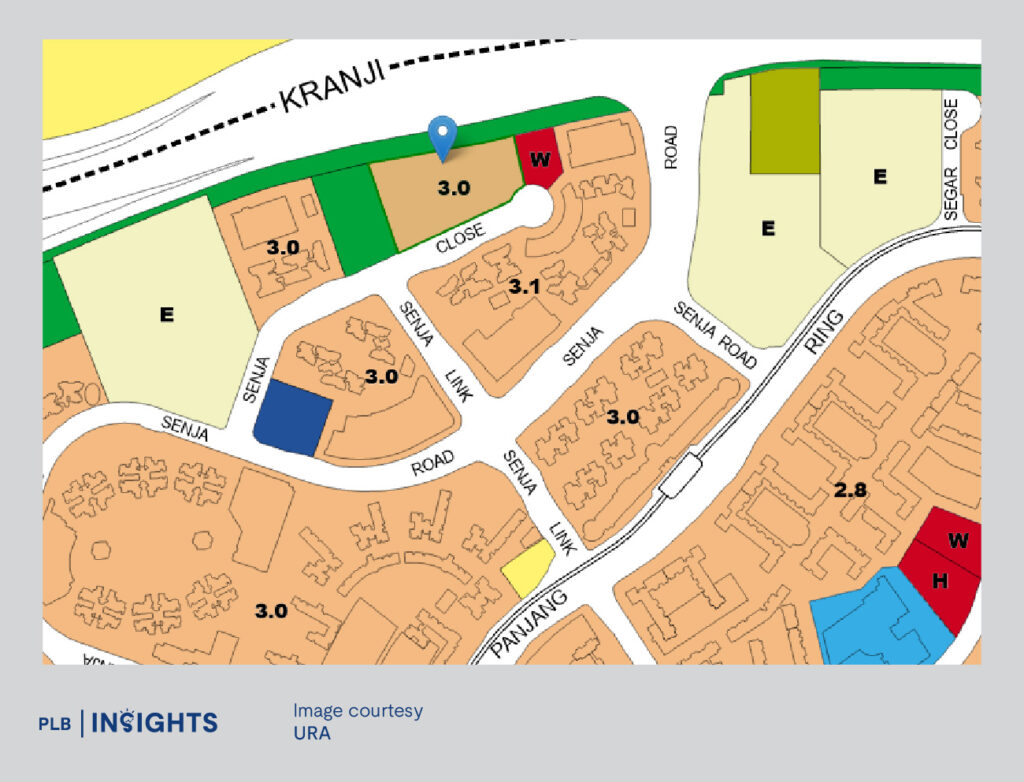

Senja Close (West Region – Bukit Panjang)

Pricing Outlook:

With an anticipated average launch price above S$1,800 psf, EC prices are expected to hit new highs.

Development Features:

Minimum 500 sq m early childhood development centre (up to 100 children), strategically located along Kranji Expressway.

Demographic Tailwinds:

Approximately 1,774 public housing flats in the Bukit Panjang area will meet MOP between 2022 and 2026, creating a strong upgrader pool.

Historical Reference:

CDL also acquired a nearby EC site in 2010 for S$271 psf ppr. The resulting project, Blossom Residences, launched in 2011 with a median price of S$704 psf.

Benchmarking Against Recent EC Tenders and Launches

Strategic Implications

Rising EC Land Costs: The upward trends in land bid prices—from S$603 psf ppr (Copen Grand, 2021) to S$782 psf ppr (Woodlands, 2025)—reflects both limited EC land supply and confidence in demand. But will push EC launch prices up.

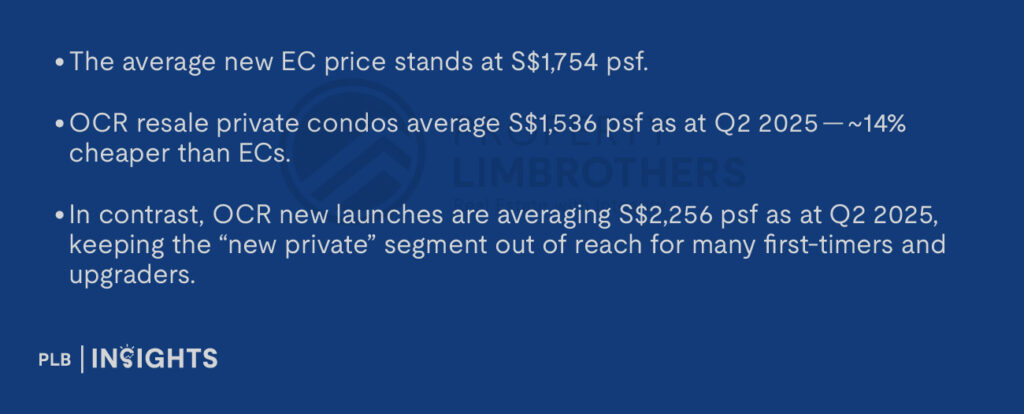

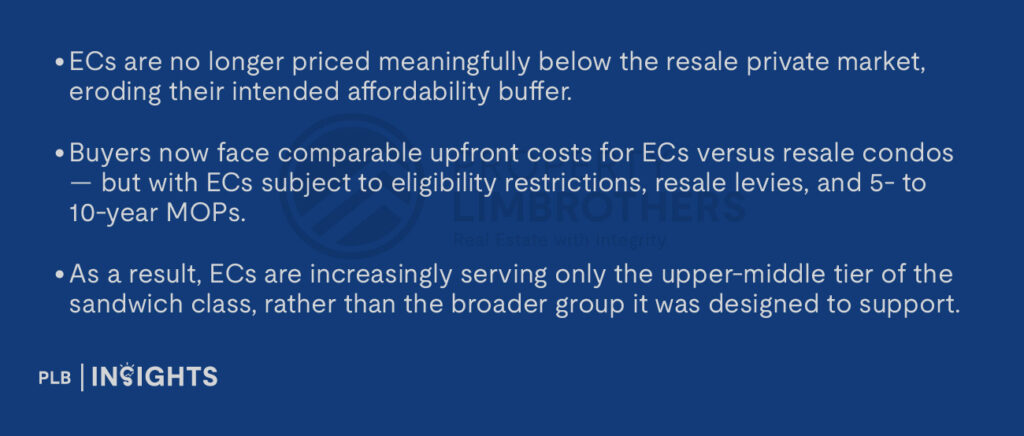

While Executive Condominiums (ECs) have historically served as an affordable stepping stone for the “sandwich class” — households that exceed BTO income ceilings but cannot comfortably afford private property — the pricing gap between ECs and OCR resale condos has significantly narrowed.

According to URA data, as of Q2 2025:

This convergence between EC and OCR resale pricing raises key concerns:

Policy Implication:

To preserve ECs as a viable housing option for the intended demographic, there may be a need to recalibrate land pricing, raise income ceilings, or introduce targeted subsidies — especially as land costs and launch prices continue to climb.